past 2 yrs is downtrend for property market.

i oso sold my landed house in rawang.... i think rugi at least 50k....

really hard to find buyer.

Regretted investment

Regretted investment

|

|

Jul 1 2020, 09:39 AM Jul 1 2020, 09:39 AM

Show posts by this member only | IPv6 | Post

#41

|

Senior Member

2,096 posts Joined: Oct 2007 |

past 2 yrs is downtrend for property market.

i oso sold my landed house in rawang.... i think rugi at least 50k.... really hard to find buyer. |

|

|

|

|

|

Jul 1 2020, 09:40 AM Jul 1 2020, 09:40 AM

|

Senior Member

1,176 posts Joined: May 2006 From: Memesia |

puchong not for humans live one

already say so many times yet still got ppl go buy LEL.. kek sial |

|

|

Jul 1 2020, 09:41 AM Jul 1 2020, 09:41 AM

|

Senior Member

3,632 posts Joined: Jul 2014 |

U still think nowadays can do flipping? =.=

Even buying landed and keep it for around 10 years waiting for it to appreciate also might not be a good idea anymore. |

|

|

Jul 1 2020, 09:41 AM Jul 1 2020, 09:41 AM

|

Junior Member

387 posts Joined: Jan 2008 |

since now no demand and price reduced, TS should buy extra units for good investment for future. Property price will shoot up next year....

|

|

|

Jul 1 2020, 09:42 AM Jul 1 2020, 09:42 AM

|

Junior Member

185 posts Joined: May 2009 |

QUOTE(hioniq @ Jul 1 2020, 08:55 AM) Bought new condo in puchong with 5% rebate, served loan 5 years average 2k / M plus maintenance. Now bad timing so wanna sell but the condo price depreciated. Damn, now already told some agents help to sell with loss, but till date no buyer at all and many units waiting for sell too... Habislah I... may i know where the actual location.........thanks |

|

|

Jul 1 2020, 09:42 AM Jul 1 2020, 09:42 AM

|

Senior Member

1,518 posts Joined: May 2008 |

QUOTE(Liamness @ Jul 1 2020, 09:37 AM) ?? you don't understand the property game.. Yes I don't understand the property game. But I am good at maths. Now you give figures, then only I can understand what you're trying to say. TS already been paying his outstanding loan for 5 years already.. if the condo was 500k, & he took a 450k loan, in 5 years, the loan outstanding balance is now 340k.. it is reducing.. around 5 years, you should look to refinance to lessen the monthly commitment.. That means TS takes up a fresh 340k loan on the outstanding balance for another 35 years.. So your monthly repayment will also be lesser.. That is how you can reduce your monthly commitment, meanwhile, rental prices generally hover around the same spot. So TS can take advantage of this by renting the unit out at market rate.. Which should definitely be more than his monthly loan repayment... Do you understand now?.. Unless you are buying the condo at 70% loan, no way you can fight TS monthly commitment after refinancing.. Because his loan is much more lesser than yours. This post has been edited by blanket84: Jul 1 2020, 09:43 AM |

|

|

|

|

|

Jul 1 2020, 09:47 AM Jul 1 2020, 09:47 AM

Show posts by this member only | IPv6 | Post

#47

|

Junior Member

368 posts Joined: Oct 2008 |

Punching which area?

|

|

|

Jul 1 2020, 09:47 AM Jul 1 2020, 09:47 AM

|

Senior Member

1,856 posts Joined: Dec 2008 From: In The HELL FIRE |

TS, can do charity let go at 50% discount to me ? you rich okay la can absorb, help poor ppl like me

This post has been edited by Pain4UrsinZ: Jul 1 2020, 09:48 AM |

|

|

Jul 1 2020, 09:49 AM Jul 1 2020, 09:49 AM

|

Junior Member

70 posts Joined: Apr 2019 |

Sell to me half, i pay cash

|

|

|

Jul 1 2020, 09:51 AM Jul 1 2020, 09:51 AM

|

Junior Member

789 posts Joined: Mar 2019 |

|

|

|

Jul 1 2020, 09:53 AM Jul 1 2020, 09:53 AM

|

Junior Member

925 posts Joined: Jul 2005 |

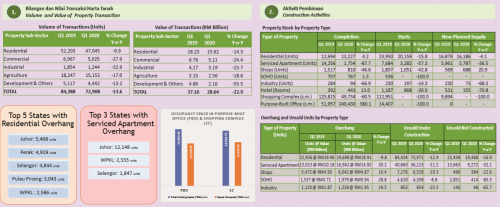

I doubt any banks would want to entertain refinancing right now (become prawnshop for the rakyat) or even giving fresh loans at this point in time is only towards really towards A-class borrowers. ( meaning you have to show a really healthy financial record). As for the property market... it doesn't look good from the below stats. Wait till Q2 or Q3 stats comes out and then the flippers will really be flipping themselves out of the water...  sheldonyong and asuka16 liked this post

|

|

|

Jul 1 2020, 09:58 AM Jul 1 2020, 09:58 AM

|

Junior Member

718 posts Joined: Oct 2008 |

QUOTE(hioniq @ Jul 1 2020, 08:55 AM) Bought new condo in puchong with 5% rebate, served loan 5 years average 2k / M plus maintenance. Now bad timing so wanna sell but the condo price depreciated. Damn, now already told some agents help to sell with loss, but till date no buyer at all and many units waiting for sell too... Habislah I... Not condo price depreciate, it's you bought highly mark up condo thinking of flip it up higher. Developer Con you |

|

|

Jul 1 2020, 10:00 AM Jul 1 2020, 10:00 AM

|

Senior Member

774 posts Joined: Jan 2003 From: Prontera's Inn |

|

|

|

|

|

|

Jul 1 2020, 10:05 AM Jul 1 2020, 10:05 AM

|

Senior Member

4,949 posts Joined: Jul 2010 |

QUOTE(blek @ Jul 1 2020, 09:58 AM) Not condo price depreciate, it's you bought highly mark up condo thinking of flip it up higher. Developer Con you Buyers are attracted to the low cash upfront when buying new units. They think can flip for easy money. They forgot subsale buyers need to fork out those miscellaneous fees and not many have the spare cash. |

|

|

Jul 1 2020, 10:10 AM Jul 1 2020, 10:10 AM

|

Senior Member

1,789 posts Joined: Aug 2009 |

Pucheong good for cheong. smallcrab liked this post

|

|

|

Jul 1 2020, 10:17 AM Jul 1 2020, 10:17 AM

Show posts by this member only | IPv6 | Post

#56

|

Senior Member

1,043 posts Joined: Feb 2012 |

ts tell the condo name la

|

|

|

Jul 1 2020, 10:21 AM Jul 1 2020, 10:21 AM

|

Junior Member

820 posts Joined: Aug 2006 |

QUOTE(hioniq @ Jul 1 2020, 09:17 AM) Believe or not up to you, is true story. Every year I have to pay cukai taksiran and fire insurance too. The first 5 years installment all gone into interest - average 1k interest per month so the principal not moving. So I already paid 60k interest to bank and now the condo has to sell at loss. I wanna release it so can have peace of mind at least less burden sad to hear this TS. |

|

|

Jul 1 2020, 10:22 AM Jul 1 2020, 10:22 AM

Show posts by this member only | IPv6 | Post

#58

|

Junior Member

464 posts Joined: Aug 2008 |

QUOTE(Marcion @ Jul 1 2020, 09:00 AM) Siapa suruh pergi invest condo, invest bangolo, double or semi double house better depending on rigth place. Sama je. If shit location nobody will buy alsoIf you say for "right price", obviously. If TS willing to sell his condo for RM100k, I'm pretty sure tomorrow he's gonna be bombarded by phone calls by agents and buyers lol |

|

|

Jul 1 2020, 10:24 AM Jul 1 2020, 10:24 AM

|

Junior Member

214 posts Joined: Jan 2019 |

QUOTE(ifourtos @ Jul 1 2020, 09:17 AM) short sighted They assumed Economic Crisis in which happened in cyclic nature:all rented owner think future market and country is stable for 30 years to break even their property investment like what most sheep doing. 1. 2008/2009 => Subprime 2. 2001 => 911 3. 1997/1998 => Asia Economic Crisis 4. 1987 => Sudden Stock crashes . . . 100. 1929 => The Great Depression Never exist & no one ever lost their jobs....including theirs. |

|

|

Jul 1 2020, 10:27 AM Jul 1 2020, 10:27 AM

|

Senior Member

3,506 posts Joined: Jan 2003 From: Lumpur |

/k can look at my thread regarding how my property is doing

https://forum.lowyat.net/index.php?showtopic=4987372&hl= |

| Change to: |  0.0238sec 0.0238sec

0.34 0.34

5 queries 5 queries

GZIP Disabled GZIP Disabled

Time is now: 28th November 2025 - 06:26 AM |