QUOTE(_kilakila_ @ Dec 1 2020, 05:25 PM)

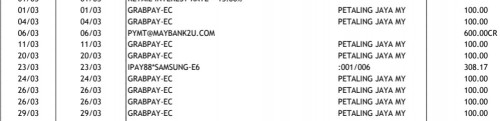

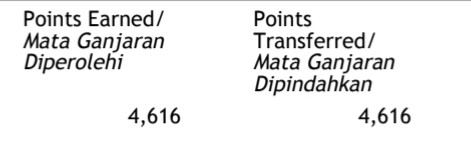

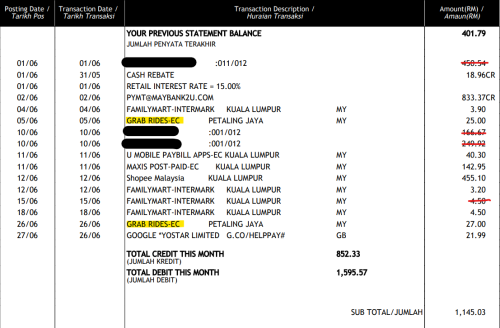

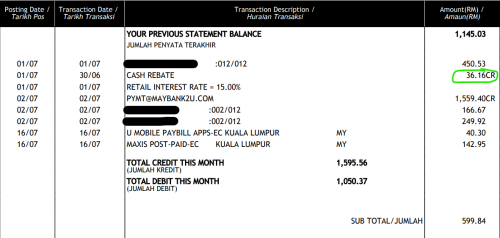

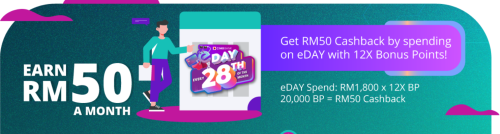

Just top up RM350 and get 7000 points with MBB Grab CC. Must join bonanza only can get. 8000 points equivalent to RM50.

https://www.grab.com/my/pay-deals/bank-card...anza-challenge/

Thanks bro for sharing this. https://www.grab.com/my/pay-deals/bank-card...anza-challenge/

Now just wondering after topping up RM350; on top of the promo 7000 Grab Points (GP), will we also be entitled for the x5 GP as well ?

Read the T&C and it does not mention that customer wont be entitle from its card benefit.

Hence potentially we will get 7000 (Promo Points) + 1750 (x5 GP) + 1050 (x3 Premum Grab Usage points) = 9800 Total GP

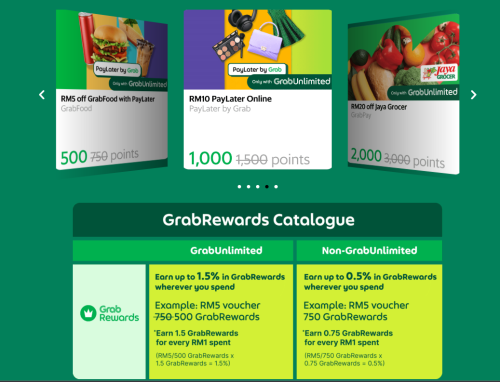

For normal Grab Rewards (without Points Back Campaign) , 800 GP equate to RM 5 Discount / 160 GP = RM 1 discount

Hence , from spending RM 350 we will get around RM61.25 worth of cash back value (17.5% rebate).

Correct me if am wrong guys

Dec 1 2020, 09:29 PM

Dec 1 2020, 09:29 PM

Quote

Quote

0.0881sec

0.0881sec

0.79

0.79

7 queries

7 queries

GZIP Disabled

GZIP Disabled