Take note ya.

Attached file in below

Attached File(s)

tnc.pdf ( 114.89k )

Number of downloads: 48

tnc.pdf ( 114.89k )

Number of downloads: 48Malaysia ETF, FBMKLCI

|

|

Aug 5 2021, 11:23 PM Aug 5 2021, 11:23 PM

|

Junior Member

698 posts Joined: Jul 2018 |

Trade ETF got free touch n go pin RM100 + RM100 = RM200 (better use direct account) Take note ya. Attached file in below Attached File(s)  tnc.pdf ( 114.89k )

Number of downloads: 48

tnc.pdf ( 114.89k )

Number of downloads: 48 jojojoget liked this post

|

|

|

|

|

|

Aug 6 2021, 03:28 AM Aug 6 2021, 03:28 AM

|

Senior Member

6,427 posts Joined: Jan 2003 From: Autobiography!!! |

|

|

|

Aug 7 2021, 10:47 AM Aug 7 2021, 10:47 AM

|

Probation

13 posts Joined: Feb 2021 |

QUOTE(xander83 @ Aug 6 2021, 03:28 AM) Better off buying direct FANG as you would have quadruple or more including the splits which the ETFs has diluted the value Oh. It gets diluted? I thought the ETF buys into futures, which to track 2x the stock price / performance. |

|

|

Aug 7 2021, 12:14 PM Aug 7 2021, 12:14 PM

Show posts by this member only | IPv6 | Post

#124

|

Junior Member

76 posts Joined: Nov 2020 |

QUOTE(SQR @ Aug 7 2021, 10:47 AM) Oh. It gets diluted? I thought the ETF buys into futures, which to track 2x the stock price / performance. That's what I remember as well. However, if you hold it for the long term it won't be 2x anymore but less, 2x is only for short term returns. SQR liked this post

|

|

|

Aug 7 2021, 12:27 PM Aug 7 2021, 12:27 PM

|

Senior Member

4,503 posts Joined: Mar 2014 |

QUOTE(jojojoget @ Aug 7 2021, 12:14 PM) That's what I remember as well. However, if you hold it for the long term it won't be 2x anymore but less, 2x is only for short term returns. It will depend on market direction...It's 2x daily movement, so in uptrend market it will be more than 2x due to compunding over the time period. Similarly if downtrend, can be more than negative x2. Worse is highly volatile up n down market.. |

|

|

Aug 7 2021, 02:18 PM Aug 7 2021, 02:18 PM

|

Probation

13 posts Joined: Feb 2021 |

|

|

|

|

|

|

Aug 7 2021, 07:55 PM Aug 7 2021, 07:55 PM

|

Senior Member

6,427 posts Joined: Jan 2003 From: Autobiography!!! |

QUOTE(SQR @ Aug 7 2021, 10:47 AM) Oh. It gets diluted? I thought the ETF buys into futures, which to track 2x the stock price / performance. More into options than futures because faster liquidity2x because it is leverage or margin of the stock price movement vice Versa for inversely for opposite directions |

|

|

Aug 9 2021, 10:50 AM Aug 9 2021, 10:50 AM

Show posts by this member only | IPv6 | Post

#128

|

Junior Member

698 posts Joined: Jul 2018 |

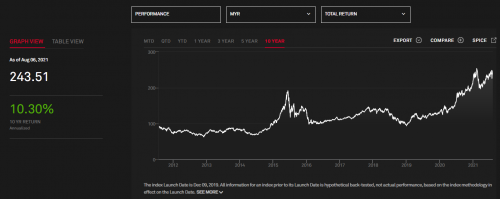

Market got new ETF China100-MYR recently, do not know good or not?

|

|

|

Aug 9 2021, 12:00 PM Aug 9 2021, 12:00 PM

Show posts by this member only | IPv6 | Post

#129

|

Junior Member

76 posts Joined: Nov 2020 |

QUOTE(edwin1002 @ Aug 9 2021, 10:50 AM) Have a look at the index performance, it's usually a good way to evaluate new ETFs. Analyze it in terms of past, present and future, understand how the index is constructed, how it used to perform, how it's performing now and what the potential is in the future. This post has been edited by jojojoget: Aug 9 2021, 12:07 PM Attached File(s)  fs_dow_jones_islamic_market_china_a_100_index_myr.pdf ( 485.13k )

Number of downloads: 16

fs_dow_jones_islamic_market_china_a_100_index_myr.pdf ( 485.13k )

Number of downloads: 16 |

|

|

Aug 9 2021, 02:24 PM Aug 9 2021, 02:24 PM

|

Senior Member

4,503 posts Joined: Mar 2014 |

This new ETF is by Value Partners, which is a HK based Fund manager listed on Hkex.

U might wonder why they set up in Malaysia? The Chairman n founder was Penang born Malaysian n they set up operations during PH time. This post has been edited by Cubalagi: Aug 9 2021, 02:25 PM |

|

|

Aug 15 2021, 09:49 AM Aug 15 2021, 09:49 AM

|

Probation

13 posts Joined: Feb 2021 |

QUOTE(xander83 @ Aug 7 2021, 07:55 PM) More into options than futures because faster liquidity Does this mean that they may not be investing based on what is mentioned in the Prospectus? Cause I noticed that they categorise these L&I ETFs as futures-based ETFs.2x because it is leverage or margin of the stock price movement vice Versa for inversely for opposite directions |

|

|

Aug 15 2021, 12:46 PM Aug 15 2021, 12:46 PM

|

Junior Member

76 posts Joined: Nov 2020 |

QUOTE(SQR @ Aug 15 2021, 09:49 AM) Does this mean that they may not be investing based on what is mentioned in the Prospectus? Cause I noticed that they categorise these L&I ETFs as futures-based ETFs. According to their NAV declaration it's futures contracts: https://www.bursamalaysia.com/market_inform...?ann_id=3182780 SQR liked this post

|

|

|

Aug 15 2021, 05:19 PM Aug 15 2021, 05:19 PM

|

Senior Member

6,427 posts Joined: Jan 2003 From: Autobiography!!! |

QUOTE(SQR @ Aug 15 2021, 09:49 AM) Does this mean that they may not be investing based on what is mentioned in the Prospectus? Cause I noticed that they categorise these L&I ETFs as futures-based ETFs. Most likely options with futures contracts pegged into itMeans they are buying and selling calls and put options with an expiry date |

|

|

|

|

|

Aug 15 2021, 06:11 PM Aug 15 2021, 06:11 PM

|

Senior Member

4,503 posts Joined: Mar 2014 |

QUOTE(xander83 @ Aug 15 2021, 05:19 PM) Most likely options with futures contracts pegged into it No options. Just futures contract..Means they are buying and selling calls and put options with an expiry date SQR liked this post

|

|

|

Aug 15 2021, 06:36 PM Aug 15 2021, 06:36 PM

Show posts by this member only | IPv6 | Post

#135

|

Senior Member

3,501 posts Joined: Jan 2003 |

--deleted--

This post has been edited by Medufsaid: Aug 15 2021, 06:45 PM |

|

|

Aug 15 2021, 10:21 PM Aug 15 2021, 10:21 PM

|

Probation

13 posts Joined: Feb 2021 |

QUOTE(jojojoget @ Aug 15 2021, 12:46 PM) According to their NAV declaration it's futures contracts: https://www.bursamalaysia.com/market_inform...?ann_id=3182780 Thanks! jojojoget liked this post

|

| Change to: |  0.0332sec 0.0332sec

1.62 1.62

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 23rd December 2025 - 11:46 PM |