QUOTE(justapawn @ Feb 18 2021, 11:41 PM)

Could you please elaborate the "market maker quality"? I am still very new in ETF, doing research about ETF at the moment. Even better if you could share some website for us to study. Thanks a lot ya.

This has been mentioned above.

Each ETF has a market maker appointed by the ETF fund manager. This market maker is an IB or a stockbroker. Their job is to provide liquidity by maintaining a buy and sell price.

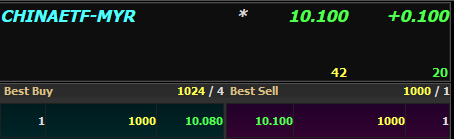

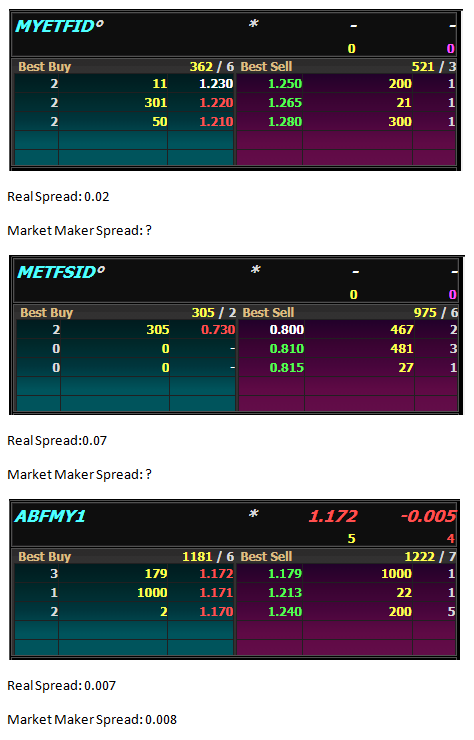

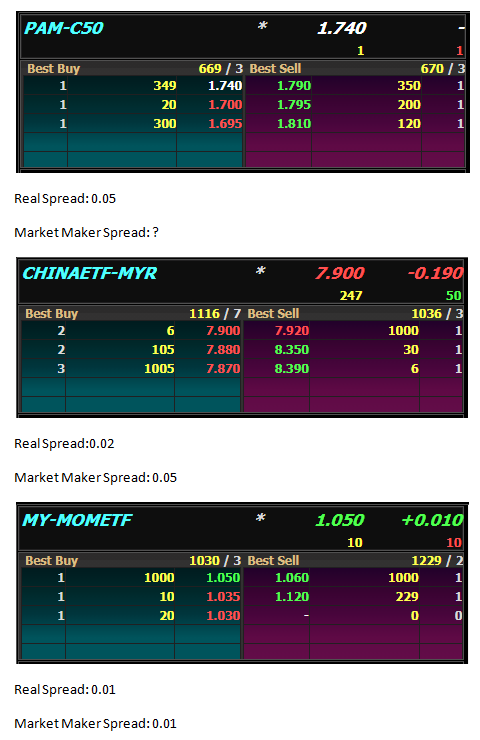

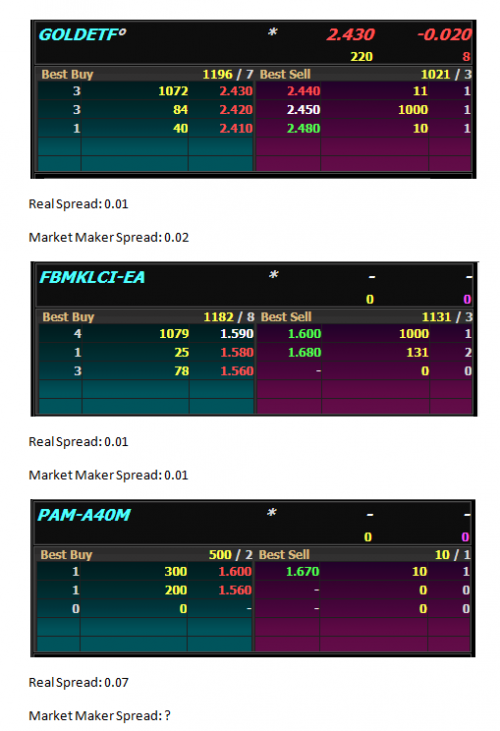

To determine how good, during market hours I watch for 1) how much units the MM put out on the bid and ask and (2) the spread between the buy and sell orders.

QUOTE(Hoshiyuu @ Feb 17 2021, 02:07 PM)

[/url]

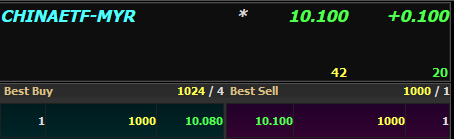

I borrow this pic from poster above. Can see here that the MM here put in 100k units at buy and sell. 1 unit is more than RM10, so it's more than RM1 million each side. For Malaysia standard this is good. For my use, it's good as I don't buy and sell more than RM1m.

The second thing to look for is the spread between buy and sell. Can see here buy is RM10.8 and sell is 10.10, its 2 sens. About 0.2%, which is Very Good.

The third, and this is an important technique, is to see the buy sell price and compare it to the ETF iNAV.

What is iNAV?

Normal Mutual Fund has only one valuation called NAV which is calculated at end of day. NAV is the value of each unit of the Mutual Fund. It doesn't matter if u buy a mutual fund in the morning or in the afternoon. So let's say a Bull day where an index jumps 5% in a day. For a normal mutual fund, u will have to buy at the 5% higher price.

However, for ETF u can buy in the morning and potentially get the 5% gain. But how do you know the valuation of the ETF in during the day?

An ETF has an end of day NAV like mutual fund, BUT it also has a "live" NAV during the day. This is called iNAV which is the valuation of the unit intraday. You want to buy as close to the iNAV as possible.

Where to find iNAV data?

In Malaysia, iNAV is called iOPV by bursa. Bursa is quite nice that it provides this iOPV data in one place. U can find it at their bursamarketplace site.

https://www.bursamarketplace.com/mkt/themarket/etfLook at the second last column to the right.

These are the 3 things I look at before I click an order. All 3 are not constant, so must be checked.

So I noticed this Monday got people buy this Chinaetf. Hong Kong was closed on Monday. MM not obliged to market make when the primary market for the ETF is closed. Those investors who buy were buying way above iNAV. The selling ones got windfall.

This post has been edited by Cubalagi: Feb 19 2021, 09:14 AM

Feb 17 2021, 03:08 PM

Feb 17 2021, 03:08 PM

Quote

Quote [/url]

[/url]

0.0291sec

0.0291sec

0.15

0.15

7 queries

7 queries

GZIP Disabled

GZIP Disabled