I have a business trip to Europe soon, so I've just gotten my Wise card, paid RM13.70 and looks like it will be delivered to me in 10 working days.

...but I'm still trying to understand how the borderless account works...

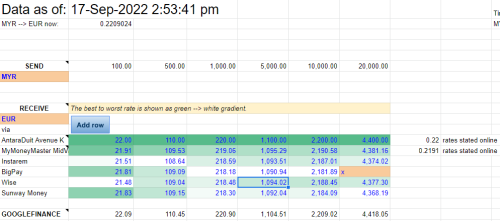

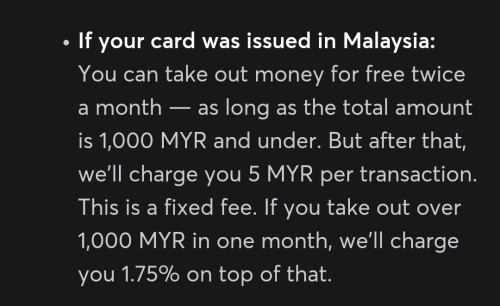

Now I also compared several rates, and to my surprise, the cash option is way cheaper, assuming the advertised rates on their websites are true and without surcharge:

Another point to note is that Wise has the shittiest rate if it's a small amount (100 or below). So here are my questions, assuming the same rate holds:

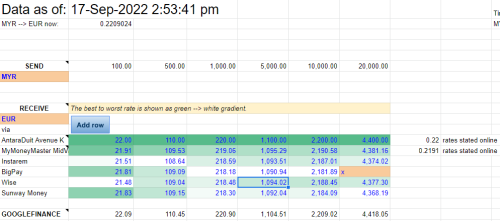

1. What if I deposit into my EUR account at one go, and then I swipe Wise card when in Europe? Please confirm my example:

- load 218 EUR (pay slightly less than RM1000)

- swiped 10 transactions with Wise card, each at 21.48 EUR > my EUR account is now left with 3.2 EUR

2. What if I deposit into my MYR account, and do the same? Please confirm example:

- load RM 1000

- swiped 10 transactions with Wise card, each at 21.48 EUR > my MYR account is deducted RM 100 each, resulting in 0 money left.

If my examples are correct, then I'm planning to load my EUR account before travelling, then I have the freedom to either swipe my card directly, or just ATM to get some cash if I don't have enough.

Now another follow up question: suppose I have excess EUR after the trip - will I be allowed to deposit to my IBKR broker via this EUR account? Note: I also see that it is possible to get IBAN/SWIFT code or something if I deposited some money first... does that give me a proper "bank account number" that the IBKR can flag as an account I own, rather than 3rd party?

1. Convert how much you think you will need in Europe. Then just swipe. Card is widely accepted in Europe.

Midvalley money changer rates are one of the best.

You can transfer to IBKR but it's not proper as it's not under your name. If you are planning to transfer just get ready to answer IBKR inquiries say 6-7months later.

but I don't need the Wise debit card. Is there anything that could be paid using Wise from the app? Like TNG eWallet?

but I don't need the Wise debit card. Is there anything that could be paid using Wise from the app? Like TNG eWallet?

Sep 17 2022, 08:04 AM

Sep 17 2022, 08:04 AM

Quote

Quote

0.0908sec

0.0908sec

0.90

0.90

7 queries

7 queries

GZIP Disabled

GZIP Disabled