QUOTE(dwRK @ Dec 10 2021, 09:53 PM)

I see. Thanks.Wise (Transferwise) Malaysia Discussion, v1.0

Wise (Transferwise) Malaysia Discussion, v1.0

|

|

Dec 11 2021, 07:39 AM Dec 11 2021, 07:39 AM

Return to original view | IPv6 | Post

#21

|

All Stars

24,428 posts Joined: Feb 2011 |

|

|

|

|

|

|

Dec 16 2021, 11:58 PM Dec 16 2021, 11:58 PM

Return to original view | IPv6 | Post

#22

|

All Stars

24,428 posts Joined: Feb 2011 |

QUOTE(kart @ Dec 14 2021, 07:05 PM) Fees for Wise Visa Prepaid Card: https://wise.com/my/multi-currency-account/...account-pricing So, is it true that most Wise users here have no issue paying RM 13.70, to get Wise Visa Prepaid Card? QUOTE(dwRK @ Dec 14 2021, 07:18 PM) I am willing to spend RM13.70 /year and give it to wise especially the part where I get access to a multicurrency account. What do I get if I paid RM13/year to Malaysian banks? Nothing.Trust me. The wise multicurrency account is a game changer for those receiving USD. I have been receiving free USD every year for almost 5 years form shopback sites in US and I couldn't be more pelaee with it. So kart just cough up the money. It's cheap. This post has been edited by Ramjade: Dec 16 2021, 11:58 PM |

|

|

Dec 17 2021, 01:33 AM Dec 17 2021, 01:33 AM

Return to original view | IPv6 | Post

#23

|

All Stars

24,428 posts Joined: Feb 2011 |

|

|

|

Dec 17 2021, 07:34 AM Dec 17 2021, 07:34 AM

Return to original view | IPv6 | Post

#24

|

All Stars

24,428 posts Joined: Feb 2011 |

|

|

|

Dec 21 2021, 07:03 PM Dec 21 2021, 07:03 PM

Return to original view | IPv6 | Post

#25

|

All Stars

24,428 posts Joined: Feb 2011 |

|

|

|

Jan 24 2022, 12:42 PM Jan 24 2022, 12:42 PM

Return to original view | Post

#26

|

All Stars

24,428 posts Joined: Feb 2011 |

|

|

|

|

|

|

Jan 24 2022, 01:08 PM Jan 24 2022, 01:08 PM

Return to original view | IPv6 | Post

#27

|

All Stars

24,428 posts Joined: Feb 2011 |

|

|

|

Mar 25 2022, 05:33 PM Mar 25 2022, 05:33 PM

Return to original view | Post

#28

|

All Stars

24,428 posts Joined: Feb 2011 |

|

|

|

Mar 25 2022, 06:01 PM Mar 25 2022, 06:01 PM

Return to original view | Post

#29

|

All Stars

24,428 posts Joined: Feb 2011 |

|

|

|

May 28 2022, 09:29 AM May 28 2022, 09:29 AM

Return to original view | IPv6 | Post

#30

|

All Stars

24,428 posts Joined: Feb 2011 |

Guys who got better Forex rate? Bigpay or TransferWise card?

|

|

|

May 30 2022, 10:11 AM May 30 2022, 10:11 AM

Return to original view | IPv6 | Post

#31

|

All Stars

24,428 posts Joined: Feb 2011 |

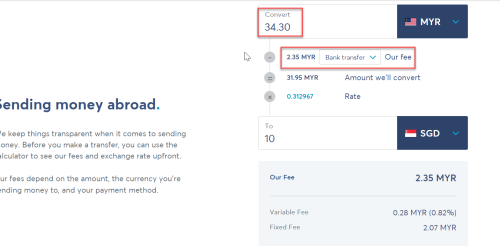

QUOTE(Davidtcf @ May 30 2022, 09:20 AM) after this CIMB MY direct transfer to SG is cheaper? No more fees for transferring: Don't look at fees. It's just marketing.Notice via CIMB app:  Using Wise sending SGD to CIMB SG (calculator):  Tested same amount using CIMB MY to SG:  Key in say MYR1k and see who give you the most SGD for your rm1k. That's how you know who's chepaer. Test it out. You don't need to transfer. There maybe no fees, but the exchange rate is markup. Come back to same thing. Trust me. That's why I never get caught by no fees marketing. |

|

|

May 30 2022, 10:41 AM May 30 2022, 10:41 AM

Return to original view | IPv6 | Post

#32

|

All Stars

24,428 posts Joined: Feb 2011 |

QUOTE(Davidtcf @ May 30 2022, 10:29 AM) Well you know. The only banks that's cheap is UOB but still expensive Vs wise Vs Sunway money.Sunway money have always offer the best rate. That's why I always use them. No one even come close to sunway money rates. |

|

|

May 30 2022, 11:24 AM May 30 2022, 11:24 AM

Return to original view | IPv6 | Post

#33

|

All Stars

24,428 posts Joined: Feb 2011 |

QUOTE(Davidtcf @ May 30 2022, 11:00 AM) I don't send money straight to ibkr. I send to sg bank account then deposit SGD into ibkr. Davidtcf liked this post

|

|

|

|

|

|

Jun 5 2022, 03:40 PM Jun 5 2022, 03:40 PM

Return to original view | Post

#34

|

All Stars

24,428 posts Joined: Feb 2011 |

QUOTE(Mr Gray @ Jun 5 2022, 03:38 PM) Pretty much unusable in so many shops in Malaysia. How's Mae and OCBC debit card Vs bigpay exchange rate? Which have the best rate?I'd rather use MAE Card/OCBC debit card/bigpay. All zero markup, accepted everywhere I've tested so far. Kind of hard for me to accept banks do not hike up exchange rate for overseas spend. Thank you. Btw long time didn't see you around in the forum. |

|

|

Jul 30 2022, 11:34 AM Jul 30 2022, 11:34 AM

Return to original view | IPv6 | Post

#35

|

All Stars

24,428 posts Joined: Feb 2011 |

QUOTE(ziling60 @ Jul 30 2022, 10:19 AM) Is it possible for someone in malaysia to receive money via wise from a bank account in overseas without much hassle for a big amount transfer? is there any BNM regulation that prohibit certain limit on money transfer electronically to be received in malaysia? i tried to find online but only can find someting about physical cash transaction limit of RM25k but nothing else about electronic transfer like Wise.. You can received money through wise. But if you want to store money you need the multicurrency account. Wise on it's own cannot store money. Even their multicurrency account can store only rm20k.would you guys recommend using direct wise transfer or through its multicurrency account? Of course depend on how big is your amount. Your receiving bank will likely question you about source of money (which you need to give) or else money will never be released to you. |

|

|

Aug 11 2022, 09:36 AM Aug 11 2022, 09:36 AM

Return to original view | IPv6 | Post

#36

|

All Stars

24,428 posts Joined: Feb 2011 |

QUOTE(Akaashi @ Aug 11 2022, 09:15 AM) Noob question here for all sifu 1. Wise for Malaysian is a joke. We are only allowed to keep max rm20k while there is no such restrictions for foreign currency account.1. What is the difference between opening a foreign currency account vs offshore account? E.g if I want to diverse my savings to SGD, which option is better? 2. Heard about this Wise account, anyone here using it? is it safe compare to banks in terms of security ? Thanks in advance. Go open a sg bank account directly. You can use wise for transfering the money (RM to SGD). 2. Yes. I am using it. I use it to transfer USD from my USD cashback website to my sg bank account. No issue. There are some people who wise close down account and refund the money. No reasons given but I suspect the person couldnt provide proof of where the money coming from. I have been in wise for like 5 years no issue.. Post here. This is a spot for all TransferWise. Akaashi liked this post

|

|

|

Aug 11 2022, 01:12 PM Aug 11 2022, 01:12 PM

Return to original view | IPv6 | Post

#37

|

All Stars

24,428 posts Joined: Feb 2011 |

QUOTE(ziling60 @ Aug 11 2022, 01:08 PM) If I want to transfer money from from overseas, lets say from SG bank acc to MY bank acc directly via wise, do I need to submit any declaration or application to BNM beforehand for certain limit? Is there any limit imposed for declaration purpose? Shoulder be no issue to send money back to Malaysia. I have always been sending money out of Malaysia. So can't really help you.If it is just a normal bank procedures to ask questions etc before releasing money to me, I have no problem on that as all money received are legitimate. But I am afraid of the BNM requirement and do not want to do anything that is ignorant of regulations or Act. This post has been edited by Ramjade: Aug 11 2022, 01:12 PM |

|

|

Aug 11 2022, 01:31 PM Aug 11 2022, 01:31 PM

Return to original view | IPv6 | Post

#38

|

All Stars

24,428 posts Joined: Feb 2011 |

QUOTE(ziling60 @ Aug 11 2022, 01:17 PM) oh haha do you just keep all of your money in SGD now and have not revert back? I don't hold SGD. SGD is good currency but sg stock market is a lousy place to grow your weslth. Only banks and reits. Not much quality companies there. I converted all my SGD into USD and invest them.you must be smiling wide with the exchange rate today. This post has been edited by Ramjade: Aug 11 2022, 02:14 PM |

|

|

Sep 11 2022, 09:53 AM Sep 11 2022, 09:53 AM

Return to original view | IPv6 | Post

#39

|

All Stars

24,428 posts Joined: Feb 2011 |

QUOTE(TOS @ Sep 10 2022, 10:52 PM) You do not need to worry about submit applications etc for inward remittance to Malaysia. Transfer money into Malaysia usually they won't ask question. (They would more than welcome it, especially now! By the way, based on your SG-> MY example, it's most likely Wise will deal with this AML stuffs before releasing the money to your MY bank account. Just make sure you prepare proof of source of fund if Wise asks. Prepare bank account statements for the past 3 months, for example, if Wise wants to check transaction source/frequency etc. They will email you if they want to know about the necessary documents. I recently had trouble with paying uni tuition fees in HK with Instarem too. They withheld the fund for a few days and required bank account statements to release the money. I rarely use Instarem, so probably the large amount alerted them, but if you transfer a few ks often between your own bank accounts, it shouldn't be an issue with Wise/Instarem. QUOTE(ziling60 @ Sep 10 2022, 10:57 PM) How abt ard 20k sgd? Do u think that will trigger any alarm at bnm or malaysia side? Wise confirm will ask tonnes of ques too i suppose? Avoid instarem. Bloody expensive rates. Not worth using them at all now. Been years since I use them. And they can only function MYR -> currency.QUOTE(acbc @ Sep 11 2022, 09:49 AM) If I want to receive USD 20K from a bank to my Wise USD account possible? Already created the virtual USD account. I only need to share the account details under Outside the US right? If you are Malaysian, you can only hold rm30k in your account. So for usd20k, you need to clear the rm20k before more money can be deposited. If I am not wrong. |

|

|

Sep 11 2022, 10:54 AM Sep 11 2022, 10:54 AM

Return to original view | IPv6 | Post

#40

|

All Stars

24,428 posts Joined: Feb 2011 |

|

| Change to: |  0.0381sec 0.0381sec

0.56 0.56

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 19th December 2025 - 01:41 PM |