A whopping 1.9 million out of 9.6 million residential units purchased in Malaysia are unoccupied, according to numbers released by the statistics department in June, raising questions about the housing situation in the country amid the scramble to find affordable homes.

Department director-general Mohd Uzir Mahidin said the data was collected in the 2020 population and housing census, and showed a steep increase from the 700,000 units registered as unoccupied just 10 years before in 2010.

In Pahang, 18% of homes purchased are not fully occupied while in Melaka, the numbers are even higher at 30%.

Speaking at a press conference, Uzir had attributed the situation in part to homeowners using such houses as temporary accommodation or homestays. In other cases, he said, the owners might possess a house in a particular area but work elsewhere.

A similar trend has been ongoing in the US, where one out of every 10 homes is unoccupied – equivalent to about 16 million units.

This is one of the highest figures in the world, followed by Japan (eight million), Brazil (7.9 million) and France (three million), according to the Organisation for Economic Co-operation and Development.

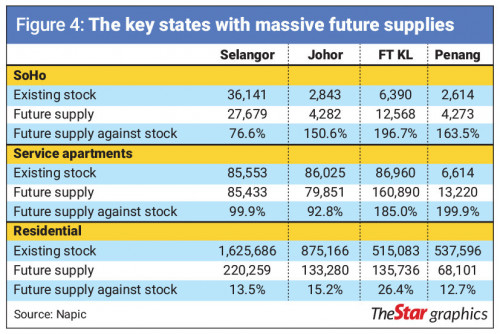

Property expert Cha-Ly Koh said cities in Malaysia appeared to have been built without data or a comprehensive understanding of conditions.

"A key metric that we track is the over and undersupply of housing in Malaysian cities," Koh, the CEO of a property data company in Petaling Jaya, said.

"The areas with oversupply naturally translate to vacancies."

Speaking to MalaysiaNow, Koh said that unoccupied homes were the result of two main issues, namely the use of houses as a commodity and policies that are not based on real data, coupled with the situation in the real estate market.

Rosli Said of Universiti Malaya's architecture faculty said those who invest in real estate might do so in the belief that such assets will not depreciate in value.

But he said this would also depend on the type of house as well as its location.

"The data issued by the statistics department includes the units that are located in areas with low levels of economic activity," he said.

"This leads to a lack of demand for these units. This is one of the factors leading to vacancies in houses offered for rent."

About 59% of rental demand comes from the private sector with the rest attributed to civil servants.

According to Rosli, tenants from the private sector gravitate towards areas with economic activity while government employees do not depend on location.

If this trend continues, he said, only houses for rent in areas with economic activity will remain in demand while the number of unoccupied units in other locations will increase.

At 76.9%, Malaysia's home ownership rate is one of the highest in the region.

Nevertheless, owning a home is also considered difficult and unaffordable.

"If housing is treated as a commodity, whether it shelters a family or not becomes a secondary concern," Koh said.

"That's why you hear stories of discriminatory landlords who would rather leave their units vacant than rent them out to families who need them."

Describing this as an artificial shortage, she said the government was taking the easiest route by simply building more houses.

She said this was why government policy usually asked developers to cross-subsidise the construction of affordable housing, or increase the density of housing projects.

However, units bought for housing are allowed to remain unoccupied for the accumulation of wealth, she added.

"The government KPI may have been met but the shelter pressure has not been relieved," Koh said.

"This cycle repeats itself to the point that it has risen to the 1.9 million vacant homes reported by the statistics department."

Rosli meanwhile said the country might witness a housing crisis as tenants are increasingly unable to afford homes while investors cannot make repayments to financial institutions if the units that they buy, especially wholesale, fail to obtain the expected rent.

At the moment, he said, there was no appropriate act to deal with the problem of speculation despite the constant changes to the real estate profit tax.

"Appropriate measures should be enforced by limiting the purchase of affordable units, for example to five units," he said.

He said local authorities could also help resolve the issue by limiting the rental period of "rent to own" homes to five years.

The "rent to own" scheme was introduced several years ago to allow prospective buyers to test out a particular piece of property by renting it before deciding whether to buy it once the scheme ends.

Under this scheme, no advance payments are required.

Rosli suggested that advance payments be included in the monthly rent in the form of an annuity for the first five years.

"This way, the buyers will not be burdened because they will continue to own the house at the same rental payments as the first five years," he said.

Koh meanwhile said that increasing the property supply would not resolve much.

Even though there are already 1.9 million unoccupied units, she said, it is difficult for first-time buyers to purchase these units from the original owners as they would need six to seven times the amount of cash compared to buying a unit in a new project.

"Instead of supplying more housing to the market, the government could simply effect some changes to the rules and unlock these 1.9 million units to those looking to purchase a home," she said.

"Young people should not be encouraged to buy new housing projects," she added. "Older or existing housing projects are better located, anyway."

https://www.msn.com/en-my/news/national/the...52UH?li=BBr8Mk9

Apr 15 2020, 09:21 AM

Apr 15 2020, 09:21 AM

Quote

Quote

0.1760sec

0.1760sec

0.65

0.65

5 queries

5 queries

GZIP Disabled

GZIP Disabled