QUOTE(AHGS14 @ Apr 20 2020, 02:19 PM)

An interesting question to ask is how many of the launched and in progress projects will be completed, instead of being abandoned. I think it's common practise for developers to incorporate individual pte ltd company to undertake each project to insulate the holding company. The bigger companies may be worried about the damage to their reputation should they walk away from a loss making project. Many other SME developers may care less and simply declare bankruptcy for the project company as we have witnessed many past cases of abandoned projects during economic downturns. The banks will own the "project", land & whatever uncompleted buildings and lelong it out to new owner. If banks had disbursed partially loans taken up, would buyers end up owing the banks and need to repay the loans with interest but with no property, nothing to show?

Only if you know how many plc and big time developers are in talk on restructuring.

QUOTE(nexona88 @ Apr 20 2020, 02:34 PM)

Well that time very serious..

This time might be even worse 😣

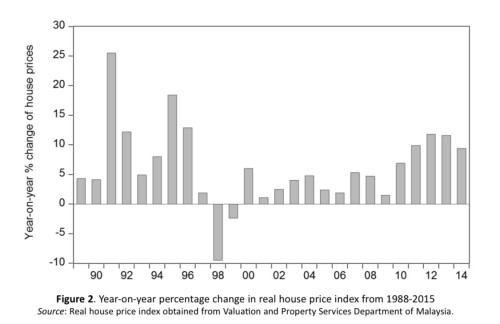

Yes, this recession will be worse and longer than AFC 97.

QUOTE(Zwean @ Apr 20 2020, 02:56 PM)

I'm not going to go into the intricacies to explain why a correction that deep will not happen.

To keep it simple, for asset price to fall that much the rental yield will have to fall significantly.

With no sharp excess supply pouring into the market it is simply not possible.

Unless COVID-20 appears and kills 90% of the world population.

Most if not all contractors, suppliers, service providers, etc to developer received multiple contra units. It is not at all surprised for them to offload at substantial cheaper price for cash flow.

If one knows where to look could find.

This post has been edited by icemanfx: Apr 20 2020, 03:23 PM

Apr 16 2020, 01:44 PM

Apr 16 2020, 01:44 PM

Quote

Quote

0.2172sec

0.2172sec

0.54

0.54

6 queries

6 queries

GZIP Disabled

GZIP Disabled