QUOTE(Zwean @ Apr 16 2020, 02:27 PM)

At the end of the day it is dollars and cents matter, the rest is only good for blow water.This post has been edited by icemanfx: Apr 16 2020, 03:02 PM

Covid19 and MCO effect on properties, Q&A Session on the effects

|

|

Apr 16 2020, 03:02 PM Apr 16 2020, 03:02 PM

|

All Stars

21,458 posts Joined: Jul 2012 |

|

|

|

|

|

|

Apr 16 2020, 03:14 PM Apr 16 2020, 03:14 PM

Show posts by this member only | IPv6 | Post

#22

|

Senior Member

1,269 posts Joined: Dec 2019 |

QUOTE(icemanfx @ Apr 16 2020, 03:02 PM) Depends on how you measure the performance.If a property is cashflow positive and price is stagnant over 35 years (which is unlikely). You’ll end up with a fully paid off home. That being said, it’s grossly oversimplified to make a point that even if price were to remain stagnant. You’ll come up top. |

|

|

Apr 16 2020, 03:30 PM Apr 16 2020, 03:30 PM

|

All Stars

21,458 posts Joined: Jul 2012 |

QUOTE(Zwean @ Apr 16 2020, 03:14 PM) Depends on how you measure the performance. Cash flow positive for 35 years, realistic or not?If a property is cashflow positive and price is stagnant over 35 years (which is unlikely). You’ll end up with a fully paid off home. That being said, it’s grossly oversimplified to make a point that even if price were to remain stagnant. You’ll come up top. This post has been edited by icemanfx: Apr 16 2020, 03:33 PM |

|

|

Apr 16 2020, 03:34 PM Apr 16 2020, 03:34 PM

Show posts by this member only | IPv6 | Post

#24

|

Senior Member

1,269 posts Joined: Dec 2019 |

|

|

|

Apr 16 2020, 04:06 PM Apr 16 2020, 04:06 PM

|

All Stars

21,458 posts Joined: Jul 2012 |

|

|

|

Apr 16 2020, 04:08 PM Apr 16 2020, 04:08 PM

Show posts by this member only | IPv6 | Post

#26

|

Senior Member

1,269 posts Joined: Dec 2019 |

|

|

|

|

|

|

Apr 16 2020, 04:18 PM Apr 16 2020, 04:18 PM

|

All Stars

21,458 posts Joined: Jul 2012 |

|

|

|

Apr 16 2020, 04:28 PM Apr 16 2020, 04:28 PM

Show posts by this member only | IPv6 | Post

#28

|

Senior Member

1,269 posts Joined: Dec 2019 |

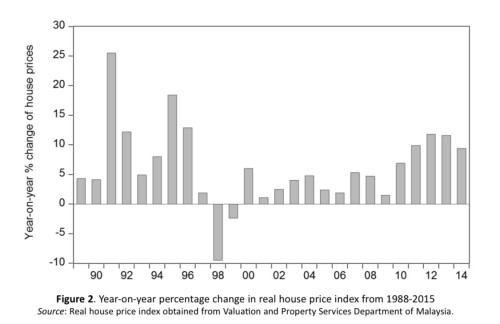

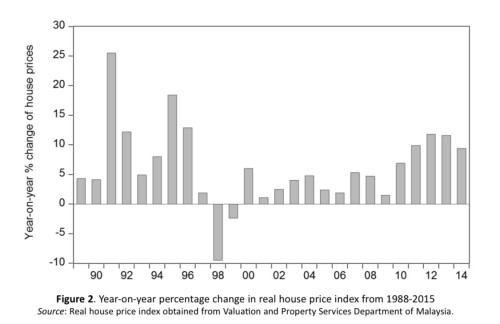

QUOTE(icemanfx @ Apr 16 2020, 04:18 PM) This is a new era no one has experienced before, poorperly price and rental will remain stagnant or drop for many years. No one has experienced before? Refer to below for the period leading up to AFC in the 90s. Let’s keep in mind that SEA is a developing region and GDP growth is stronger than many first world countries. Let’s also set aside the fact that the world production is shifting out of China. It’s okay, you can continue to stay hidden in your coconut and oyster shell. Inflation is real. |

|

|

Apr 16 2020, 05:15 PM Apr 16 2020, 05:15 PM

|

All Stars

21,458 posts Joined: Jul 2012 |

QUOTE(Zwean @ Apr 16 2020, 04:28 PM) No one has experienced before? Refer to below for the period leading up to AFC in the 90s. Every economic recession is different. this economic recession is world wide, worse and last longer than 1997 afc. some said this recession is like combination of 1918 spanish flu pandemic and 1929 great depression. if lockdown is earthquake, there will be tsunami. Let’s keep in mind that SEA is a developing region and GDP growth is stronger than many first world countries. Let’s also set aside the fact that the world production is shifting out of China. It’s okay, you can continue to stay hidden in your coconut and oyster shell. Inflation is real. factories shifting out china has been happening since u.s china trade war started, how many have moved to malaysia? sea gdp growth was largely depending on export and fdi. how much and at what price could they export? how many fdi will come to unproductive, overpriced and red taped country? |

|

|

Apr 16 2020, 05:20 PM Apr 16 2020, 05:20 PM

Show posts by this member only | IPv6 | Post

#30

|

Senior Member

1,269 posts Joined: Dec 2019 |

QUOTE(icemanfx @ Apr 16 2020, 05:15 PM) Every economic recession is different. this economic recession is world wide, worse and last longer than 1997 afc. some said this recession is like combination of 1918 spanish flu pandemic and 1929 great depression. if lockdown is earthquake, there will be tsunami. We shall see, let's revisit this in time.factories shifting out china has been happening since u.s china trade war started, how many have moved to malaysia? sea gdp growth was largely depending on export and fdi. how much and at what price could they export? how many fdi will come to unproductive, overpriced and red taped country? |

|

|

Apr 16 2020, 05:22 PM Apr 16 2020, 05:22 PM

Show posts by this member only | IPv6 | Post

#31

|

Junior Member

87 posts Joined: Mar 2020 |

IMF: Malaysia's GDP to grow 9% in 2021

|

|

|

Apr 16 2020, 05:32 PM Apr 16 2020, 05:32 PM

|

All Stars

21,458 posts Joined: Jul 2012 |

|

|

|

Apr 16 2020, 06:59 PM Apr 16 2020, 06:59 PM

Show posts by this member only | IPv6 | Post

#33

|

Senior Member

3,190 posts Joined: Dec 2017 |

|

|

|

|

|

|

Apr 16 2020, 09:36 PM Apr 16 2020, 09:36 PM

|

Senior Member

1,252 posts Joined: Jan 2012 |

|

|

|

Apr 18 2020, 12:43 PM Apr 18 2020, 12:43 PM

Show posts by this member only | IPv6 | Post

#35

|

Senior Member

2,867 posts Joined: Dec 2013 |

QUOTE(Pain4UrsinZ @ Apr 16 2020, 11:09 AM) yea i would like to know also, hopefully developer will pay LAD accordingly regardless of MCO. I agree that it's up to the Housing Ministry's discretion on a case-by-case basis. However, the Coronavirus/Covid-19 pandemic and the MCO that followed cannot be dismissed as just a mere excuse when almost all the business sectors are impacted, including the SMEs, just to keep it under check. Plus many people also got sick and many also died as a result of it.if housing minstry allow exemption they need to study the case carefully. Example, lakeville block C and D already made known to the buyer that VP will be delayed until JUNE, and this was notified in December few months before MCO. hopefully developer cannot use this as excuses want to deduct the LAD for MCO period. where to get the answer Even Sabah was under a lockdown as a result of the Lahad Datu terrorist attack many years ago and those suppliers/vendors there couldn't deliver the tractor parts to the company I used to work for in Sarawak for 2 weeks or more as a result of that. We had no choice but to wait as those parts aren't available in the latter state. Not to say that I'm okay with not paying the LAD when it's due to delays at the developer's end, but this is an unforeseen event that is out of anyone's control. This post has been edited by DesRed: Apr 18 2020, 12:47 PM |

|

|

Apr 18 2020, 01:31 PM Apr 18 2020, 01:31 PM

|

Junior Member

615 posts Joined: Feb 2018 |

|

|

|

Apr 18 2020, 01:37 PM Apr 18 2020, 01:37 PM

|

Senior Member

1,269 posts Joined: Dec 2019 |

|

|

|

Apr 18 2020, 01:39 PM Apr 18 2020, 01:39 PM

|

Junior Member

615 posts Joined: Feb 2018 |

|

|

|

Apr 18 2020, 01:48 PM Apr 18 2020, 01:48 PM

|

All Stars

21,458 posts Joined: Jul 2012 |

QUOTE(koja6049 @ Apr 18 2020, 01:39 PM) but that's too general statement. what about those who pay in cash. If one bought poorperly with cash and poorperly price stagnant still loss => FD interest.i see it more as an opportunity cost. money not used to buy property may be invested somewhere else, e.g. topglove company which is doing well now Most invested in poorperly because of access to leverage. This post has been edited by icemanfx: Apr 18 2020, 01:50 PM |

|

|

Apr 18 2020, 01:50 PM Apr 18 2020, 01:50 PM

|

Junior Member

615 posts Joined: Feb 2018 |

QUOTE(icemanfx @ Apr 18 2020, 01:48 PM) if you compare to fd, it's now only 2.65%... lawrencehl liked this post

|

| Change to: |  0.0234sec 0.0234sec

0.35 0.35

5 queries 5 queries

GZIP Disabled GZIP Disabled

Time is now: 22nd December 2025 - 07:12 PM |