I summarised a few methods to obtain cash advance/flow by leveraging your credit a.k.a credit cards with lower interest rate.

Reason:

Traditional way to leverage your credit to obtain advance/flow can have very high interest rate

1. Credit card cash advancement/late payment can range from 9-21% p.a.

2. Personal loan interest rate can range from 4-18%

By using methods below, you can leverage your credit cards to obtain around 50days of cash flow to

1. Reduce flexi loan interest. eg: mortgage

2. Investment for higher return rate.

Bonus:

You can use cashback credit cards to further reduce the cash conversion loss or easy payment plan to extend the repayment period. (Some credit cards do offer 0% charges and 0% p.a. interest rate)

QUOTE

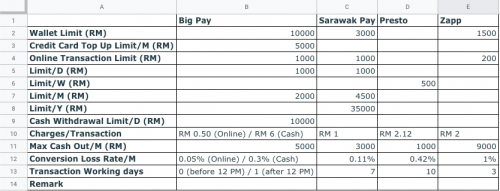

The policy/TnC is changing rapidly. The chart below is based on my best knowledge. Kindly let me know if there are any changes or you have other methods.

This post has been edited by LastIntel: May 10 2020, 08:26 PM

Mar 15 2020, 11:29 AM, updated 6y ago

Mar 15 2020, 11:29 AM, updated 6y ago

Quote

Quote

0.9838sec

0.9838sec

0.39

0.39

6 queries

6 queries

GZIP Disabled

GZIP Disabled