QUOTE(farizmalek @ Apr 24 2020, 05:33 AM)

Thank you for your feedback. Yes, the medical insurance each covered for self, wife and my dotter.

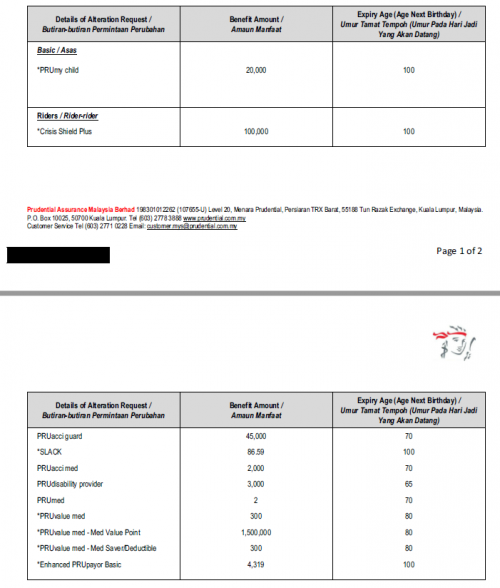

The purpose of my posting is whether our current medical insurance is sufficient. We bought it in 2014 and that was one of the best at that time. Now i am 44 and to change to a new and better one will be expensive. Beside that o have already have illness although not that serious.

As a back-up, my wife is Pegawai Kerajaan and I have GL for government hospital (From my wife). Plus my sister (adik) is a specialist in UITM Hospital, Selayang (not hospital selayang). Plus without the GL from my wife, i am still covered for life for free from the government because I already donated blood more than 50 times to National Blood Center.

In term of life saving, as a seaman before and also working overseas, currently I have cash: RM3,223,000 in my KWSP and ASNB. All my properties, land and cars were fully paid (No loans) and no credit card debt or personal loans.

I am still working.

My question is that, do i need to upgrade/change my medical insurance and also to get a life insurance from my condition above.

Sounds good for you.The purpose of my posting is whether our current medical insurance is sufficient. We bought it in 2014 and that was one of the best at that time. Now i am 44 and to change to a new and better one will be expensive. Beside that o have already have illness although not that serious.

As a back-up, my wife is Pegawai Kerajaan and I have GL for government hospital (From my wife). Plus my sister (adik) is a specialist in UITM Hospital, Selayang (not hospital selayang). Plus without the GL from my wife, i am still covered for life for free from the government because I already donated blood more than 50 times to National Blood Center.

In term of life saving, as a seaman before and also working overseas, currently I have cash: RM3,223,000 in my KWSP and ASNB. All my properties, land and cars were fully paid (No loans) and no credit card debt or personal loans.

I am still working.

My question is that, do i need to upgrade/change my medical insurance and also to get a life insurance from my condition above.

Will suggest you look into critical illness coverage. Also wealth & legacy planing.

Apr 24 2020, 02:22 PM

Apr 24 2020, 02:22 PM

Quote

Quote

0.1407sec

0.1407sec

0.78

0.78

7 queries

7 queries

GZIP Disabled

GZIP Disabled