QUOTE(glitz2z @ Aug 3 2020, 10:01 AM)

Hi everyone,

Happy Monday!

Would need advise on the insurance plan quoted by an agent last week to me.

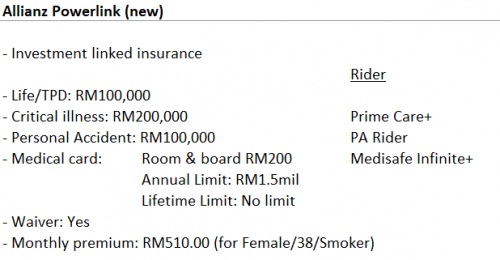

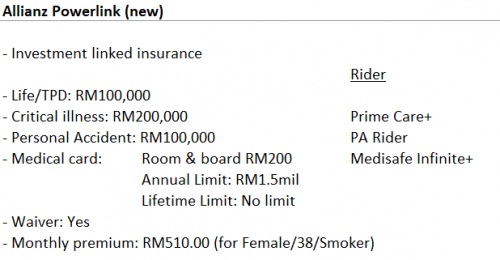

First concern: Was wondering if the monthly premium if too high for this ILP (anyone has similar package?) I know that standalone medical card and critical illness policies are definitely cheaper but I have done so much reading/checking and most independent websites recommend that Allianz Medisafe Infinite+ as one of the best choices for medical card but it's a rider type.

My focus right now is only to have better coverage for medical card and critical illness. I already have a few insurance that have higher payout for Life/TPD.

Another insurance agent from GE (a friend) mentioned that nowadays most insurance will always focus on selling ILP to customers for all-in-one package (since it's the trend) and of course, at the end of the day, it's the most commissions agents can get when selling ILP. He did quote me a similar package for GE to match the coverage by Allianz but the monthly premium is higher at RM575 and I need to top up / pay extra since I wanted early payout for critical care, whereas Allianz already have payout at all stages.

He did quote me a similar package for GE to match the coverage by Allianz but the monthly premium is higher at RM575 and I need to top up / pay extra since I wanted early payout for critical care, whereas Allianz already have payout at all stages.

Second concern: Allianz definitely have the holistic package but unsure how fast they process guarantee letters and claims.

Thank you!

A lot of times how fast a GL is issued is dependent on how fast the hospital replies the GL processing department for any inquiries, if required.Happy Monday!

Would need advise on the insurance plan quoted by an agent last week to me.

First concern: Was wondering if the monthly premium if too high for this ILP (anyone has similar package?) I know that standalone medical card and critical illness policies are definitely cheaper but I have done so much reading/checking and most independent websites recommend that Allianz Medisafe Infinite+ as one of the best choices for medical card but it's a rider type.

My focus right now is only to have better coverage for medical card and critical illness. I already have a few insurance that have higher payout for Life/TPD.

Another insurance agent from GE (a friend) mentioned that nowadays most insurance will always focus on selling ILP to customers for all-in-one package (since it's the trend) and of course, at the end of the day, it's the most commissions agents can get when selling ILP.

Second concern: Allianz definitely have the holistic package but unsure how fast they process guarantee letters and claims.

Thank you!

Otherwise I believe all insurance company have strict KPIs on timely GL approval, it’s only good business sense to do so.

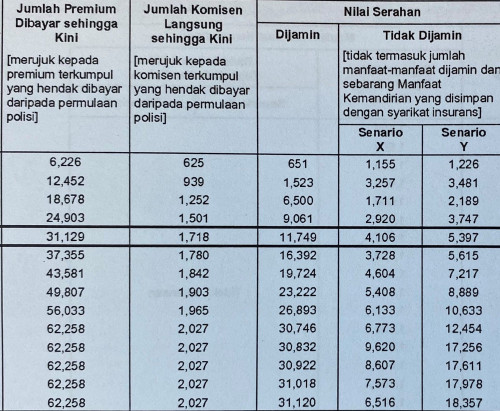

As for the premium quoted, I am not sure how the agent was able to quote you that premium as I am looking at my system and the lowest premium for that coverage is RM7368.

Best,

Jiansheng

Aug 3 2020, 11:08 AM

Aug 3 2020, 11:08 AM

Quote

Quote

0.1469sec

0.1469sec

0.73

0.73

7 queries

7 queries

GZIP Disabled

GZIP Disabled