If the respective bank not reduce your instalment, actual is indirectly assist you to reduce more principal amount

Did you know how much you need to pay for interest cost each month again your monthly intalment !!!

If your loan tenure is 35 years, at the starting point, interest cost already cover by 78% of your instalment amount, which mean only 22% can reduce your principal amount

Of course interest cost will gradually decelerated & principal amount cover will be accelerated but need longer period of time

In calculation based on my above scenario, if your instalment is RM 2061 then interest cost already RM 1607 per month, only left RM 454 amount to reduce your principal

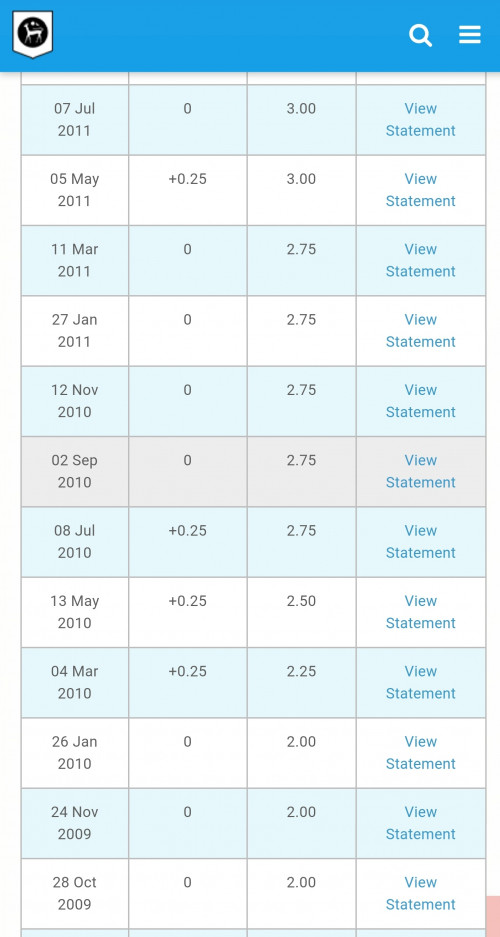

So you think if I take the loan right now, unfortunately 3 years down the road, BNM going to normalise the OPR, what happen to my instalment !!! What happen for my monthly interest cost !!!

**Wisely investment or purchase is right now priority

Mar 4 2020, 07:50 PM

Mar 4 2020, 07:50 PM

Quote

Quote

0.0239sec

0.0239sec

0.82

0.82

6 queries

6 queries

GZIP Disabled

GZIP Disabled