Im not working in banking, so im not sure what’s really the threshold to trigger DD analyst.

However, the way banks looking at it is cumulative deposits and cumulative withdrawal in one calendar year.

Let’s say the threshold is 150k for a saving acc, So if u have cumulative deposits within a month breached 150k, that’s a trigger point, im not sure what’s the actual threshold, but definitely below than 450k based on my knowledge.

They don’t bother (especially new hires analyst) to find the relationship maybe the 30k u deposit is recycle money, meaning to and from scb/ocbc 30k, they will contact u. Experience analyst will look at pattern, investigate further and close the case themselves.

Again, at end of the day, IT IS NOT ILLEGAL, and u may do so, in my very limited knowledge of banking, as i get to ‘oversee’ only not a banker nor DD analyst, just expect noobies DD analyst to call u.

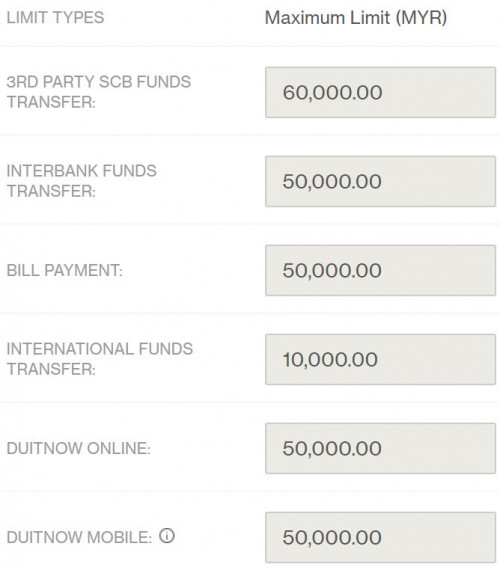

Bu doing so, u can earn 2.75% on the 30k and say 60k from scb if u have net cash of 60k only. Untung 2.75% la on 30k.

Again, dont get me wrong. I am not against it, just giving friendly reminder. Please proceed just that expect analyst to email/call u. Unless the analyst also malas, instead simply email/call client, they go do further tracing, then should be fine

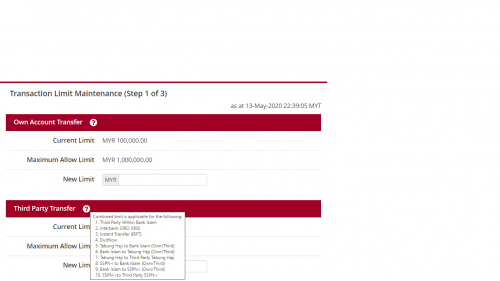

Thanks for giving me an idea but I was not even thinking of transfering to and from ocbc/scb, it is just a 1 off thing. SSPN>OCBC360>PSA>EPF(end-of month). Didnt calculate but I think can earn only a few RM only lah, hehehe.

May 12 2020, 11:36 PM

May 12 2020, 11:36 PM

Quote

Quote

0.0668sec

0.0668sec

0.78

0.78

7 queries

7 queries

GZIP Disabled

GZIP Disabled