Outline ·

[ Standard ] ·

Linear+

Banking Privilege$aver by Standard Chartered, up to 4.75%, Seems like so few people talk about it

|

tadashi987

|

Feb 23 2020, 06:09 PM Feb 23 2020, 06:09 PM

|

|

QUOTE(David_Yang @ Feb 23 2020, 11:14 AM) The pure number is indeed meaningless. You need to compare the interest of a CASA or FD with the OPR rate. And you need to compare the performance of unit trusts that invest in stocks with the corresponding index. A unit trust that only loses 10% when the corresponding market loses 15% is a great performer. A unit trust that gains 15% when the market is 20% up is bad. yep That's the concept of benchmark of each financial product |

|

|

|

|

|

SUSyklooi

|

Feb 23 2020, 06:35 PM Feb 23 2020, 06:35 PM

|

|

Maybe off topic....

But talking about benchmark....

Not sure abt others... But as for me, I compared the fund performance against its peers of similar mandate, I don't really looked into whether the fund met its stated to follow benchmark.

A fund may mets its targeted benchmark but when compared against its peers of similar mandate... Where does it stand among them? How is the return?. How is the risk reward ratio? What is the expense ratio?

|

|

|

|

|

|

GrumpyNooby

|

Feb 23 2020, 09:11 PM Feb 23 2020, 09:11 PM

|

|

Wow ... the best thing about SC ATM/Debit card is PIN change no need to be done at ATM machine! Just do like credit card.

|

|

|

|

|

|

Darkcloudz

|

Feb 26 2020, 11:29 AM Feb 26 2020, 11:29 AM

|

|

hi guys, may i know how much i need to deposit in order to open a saving account with STD CHRT? rm250?

|

|

|

|

|

|

digimon09

|

Feb 26 2020, 11:33 AM Feb 26 2020, 11:33 AM

|

|

QUOTE(Darkcloudz @ Feb 26 2020, 11:29 AM) hi guys, may i know how much i need to deposit in order to open a saving account with STD CHRT? rm250? If you already have their credit card, no need to deposit. But to get their 4% interest rate, need to deposit min 3k and 1k cc spending. |

|

|

|

|

|

GrumpyNooby

|

Feb 26 2020, 11:33 AM Feb 26 2020, 11:33 AM

|

|

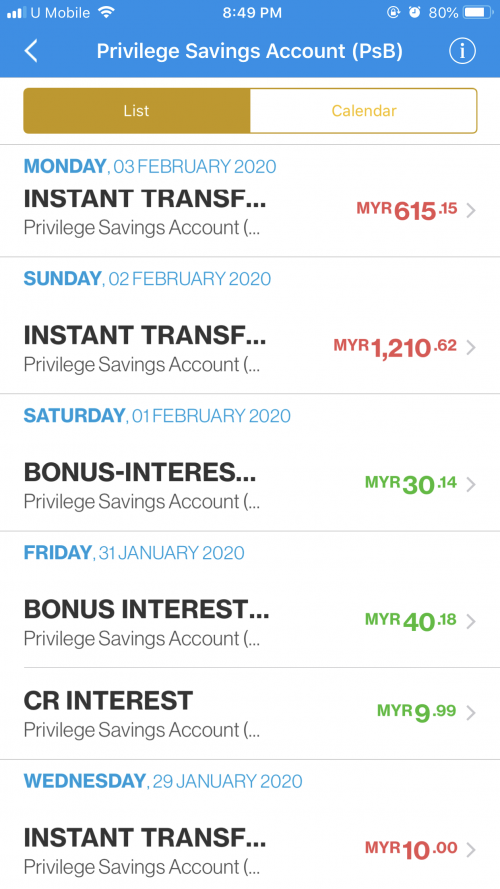

QUOTE(Darkcloudz @ Feb 26 2020, 11:29 AM) hi guys, may i know how much i need to deposit in order to open a saving account with STD CHRT? rm250? I opened it with RM 0. I did an instant interbank fund transfer once the account is activated and viewable in SC Web/App, This post has been edited by GrumpyNooby: Feb 26 2020, 11:34 AM |

|

|

|

|

|

Darkcloudz

|

Feb 26 2020, 11:42 AM Feb 26 2020, 11:42 AM

|

|

i just need a basic saving account for payroll purpose. still some bank may require a min deposit right?

|

|

|

|

|

|

GrumpyNooby

|

Feb 26 2020, 11:44 AM Feb 26 2020, 11:44 AM

|

|

QUOTE(Darkcloudz @ Feb 26 2020, 11:42 AM) i just need a basic saving account for payroll purpose. still some bank may require a min deposit right? Yes. BSA needs RM 20. Some accounts need higher. Some banks may hide BSA too. This post has been edited by GrumpyNooby: Feb 26 2020, 11:44 AM |

|

|

|

|

|

Darkcloudz

|

Feb 26 2020, 11:51 AM Feb 26 2020, 11:51 AM

|

|

QUOTE(GrumpyNooby @ Feb 26 2020, 11:44 AM) Yes. BSA needs RM 20. Some accounts need higher. Some banks may hide BSA too. thanks for the input |

|

|

|

|

|

chezzcake2

|

Feb 26 2020, 08:53 PM Feb 26 2020, 08:53 PM

|

|

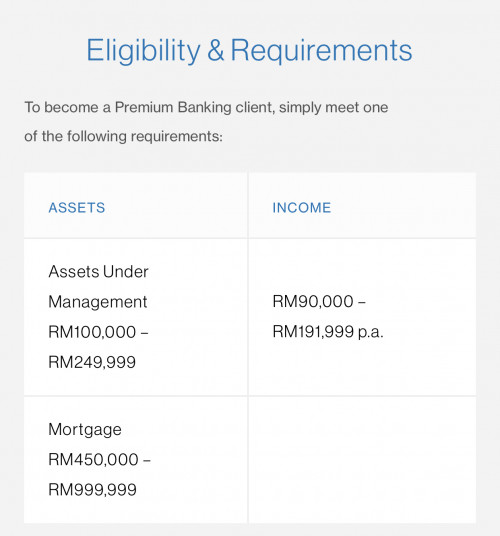

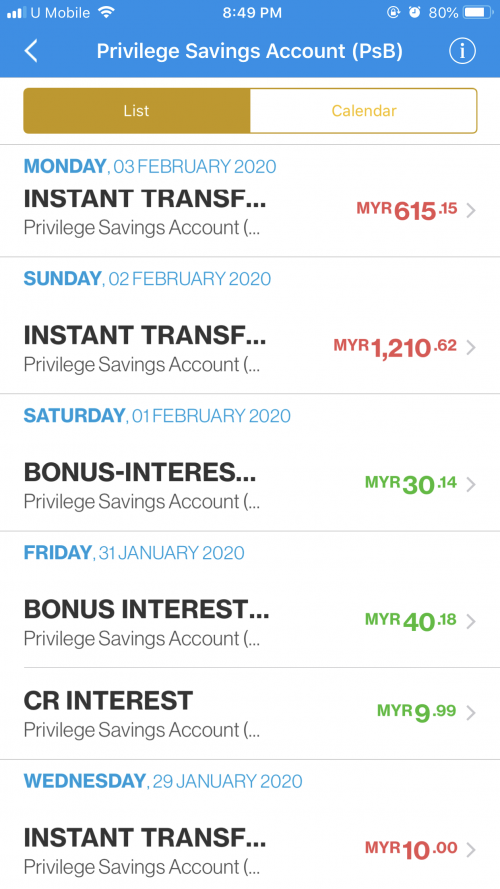

start using since 2017 the interest is paid by monthly and calculated by daily..and it's more than 4% PA if u know what i mean..( without the investment tier ) why put in FD and locked ur money? just join us and take out ur fd from others bank This post has been edited by chezzcake2: Feb 26 2020, 09:00 PM |

|

|

|

|

|

GrumpyNooby

|

Feb 26 2020, 09:23 PM Feb 26 2020, 09:23 PM

|

|

QUOTE(chezzcake2 @ Feb 26 2020, 08:53 PM)  start using since 2017 the interest is paid by monthly and calculated by daily..and it's more than 4% PA if u know what i mean..( without the investment tier ) why put in FD and locked ur money? just join us and take out ur fd from others bank FD for amount greater than RM 100k |

|

|

|

|

|

chezzcake2

|

Feb 26 2020, 09:26 PM Feb 26 2020, 09:26 PM

|

|

QUOTE(GrumpyNooby @ Feb 26 2020, 09:23 PM) FD for amount greater than RM 100k oops...yea..amount > 100k u can stay with others bank   |

|

|

|

|

|

infiniti123

|

Feb 27 2020, 03:02 PM Feb 27 2020, 03:02 PM

|

|

QUOTE(chezzcake2 @ Feb 26 2020, 09:26 PM) oops...yea..amount > 100k u can stay with others bank   if my saving reaches 100k and above what will happen?? |

|

|

|

|

|

chezzcake2

|

Feb 27 2020, 03:10 PM Feb 27 2020, 03:10 PM

|

|

QUOTE(infiniti123 @ Feb 27 2020, 03:02 PM) if my saving reaches 100k and above what will happen?? based 0.5% and fresh fund 2.0 % no capped 1.5% credit card spend capped at 100k if not more than 200k u can get 1 more for spouse lor..😂 |

|

|

|

|

|

jieGeGe

|

Feb 27 2020, 04:39 PM Feb 27 2020, 04:39 PM

|

Getting Started

|

QUOTE(infiniti123 @ Feb 27 2020, 03:02 PM) if my saving reaches 100k and above what will happen?? Join their Premium customer and they have some Promo FD rate. Last year 4.7% FD for 6 month 30% Casa 70% FD |

|

|

|

|

|

GrumpyNooby

|

Feb 27 2020, 04:41 PM Feb 27 2020, 04:41 PM

|

|

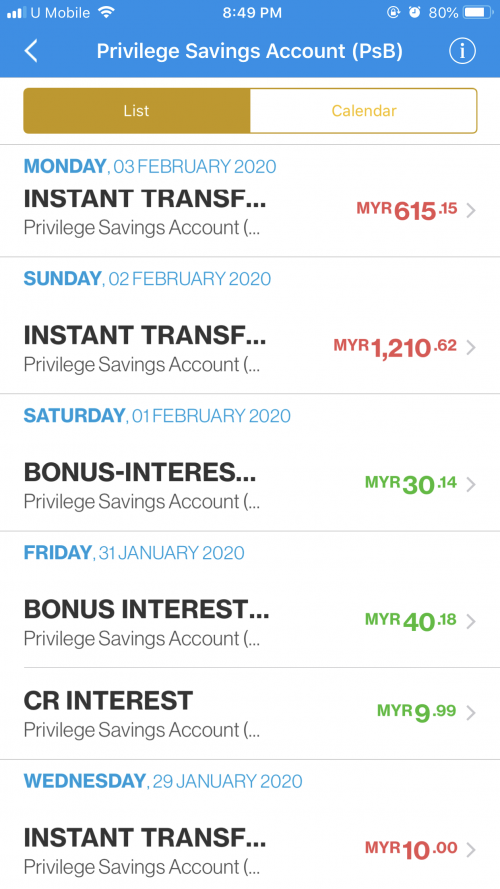

QUOTE(jieGeGe @ Feb 27 2020, 04:39 PM) Join their Premium customer and they have some Promo FD rate. Last year 4.7% FD for 6 month 30% Casa 70% FD What is min AUM for Premiere banking? |

|

|

|

|

|

a.lifehacks

|

Feb 27 2020, 06:44 PM Feb 27 2020, 06:44 PM

|

Getting Started

|

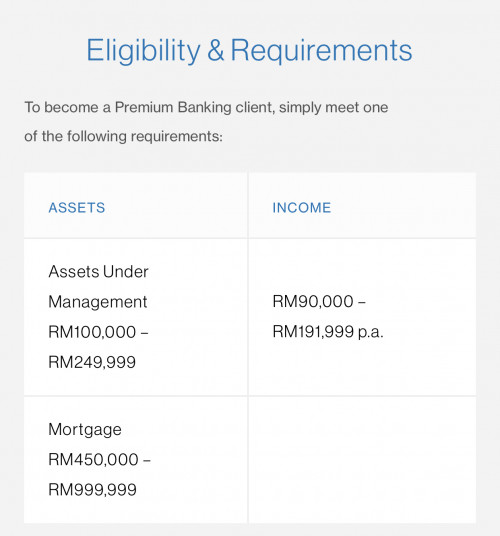

QUOTE(GrumpyNooby @ Feb 27 2020, 04:41 PM) What is min AUM for Premiere banking?  Premium Banking: 100k-249,999 Priority Banking: 250k and above |

|

|

|

|

|

infiniti123

|

Feb 27 2020, 08:34 PM Feb 27 2020, 08:34 PM

|

|

QUOTE(jieGeGe @ Feb 27 2020, 04:39 PM) Join their Premium customer and they have some Promo FD rate. Last year 4.7% FD for 6 month 30% Casa 70% FD Yes I’ve already signed up for that. Maximum was 300k if I’m not wrong... now I just reached 300k so quite panic la.. means I have to withdraw if not will decrease in interest right ? |

|

|

|

|

|

David_Yang

|

Feb 27 2020, 11:00 PM Feb 27 2020, 11:00 PM

|

|

QUOTE(jieGeGe @ Feb 27 2020, 05:39 PM) Join their Premium customer and they have some Promo FD rate. Last year 4.7% FD for 6 month 30% Casa 70% FD now it is 4,2% which still is great. but promo ends FRIDAY I was told |

|

|

|

|

|

roarus

|

Feb 28 2020, 11:27 AM Feb 28 2020, 11:27 AM

|

|

Anyone knows the daily balance cut-off time for interest calculation?

|

|

|

|

|

Feb 23 2020, 06:09 PM

Feb 23 2020, 06:09 PM

Quote

Quote

0.0336sec

0.0336sec

0.84

0.84

6 queries

6 queries

GZIP Disabled

GZIP Disabled