QUOTE(MGM @ Feb 7 2023, 09:40 PM)

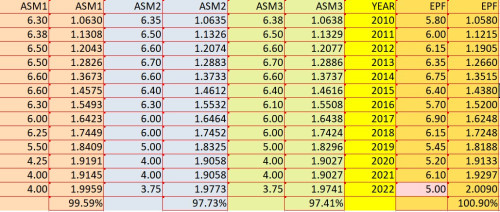

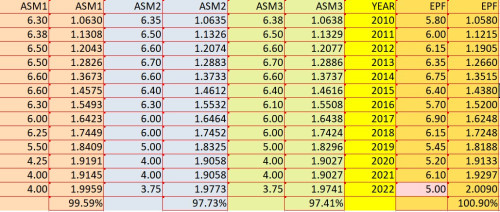

Sorry there were some wrong calculation previously. Hope the updated one below is accurate.

QUOTE(MGM @ Mar 8 2023, 03:37 PM)

Ai ya over the last 13 years diff of 2% only.

Luckily i didnt listen to the naysayers and dumped all fd into AS1M when few people wanted it.

QUOTE(df569 @ Apr 12 2023, 02:50 AM)

My goodness, I just tried fishing for a bit and the app is not responsive, feels like server struggling to keep up with demand.

Manage to get some ASM3, wondering what's the difference between the 3 ASMs?

Assuming that the ave fd rate of 3.0% for the same 13 years, FD would have generated a compounded returns of 47%.

Assuming that the ave fd rate of 3.5% for the same 13 years, FD would have generated a compounded returns of 57%.

Assuming that the ave fd rate of 4.0% for the same 13 years, FD would have generated a compounded returns of 67%.

Luckily i didnt listen to the naysayers and dumped all fd into AS1M when few people wanted it.

To me no significant diff btw all 3 ASMx, n thankfully to some who think that ASM3/AS1m is linked to 1MDB.

This post has been edited by MGM: Apr 12 2023, 06:51 AM

Mar 31 2023, 11:41 AM

Mar 31 2023, 11:41 AM

Quote

Quote

0.0382sec

0.0382sec

0.48

0.48

7 queries

7 queries

GZIP Disabled

GZIP Disabled