QUOTE(GrumpyNooby @ Apr 27 2020, 07:39 PM)

Indeed it is.

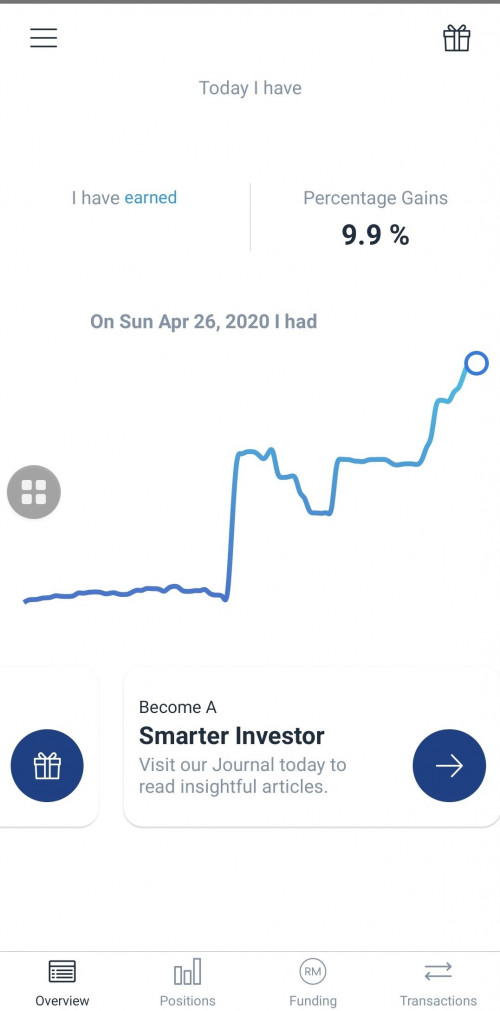

The graph on the app already describes fairly well.

My very aggressive portfolio is earning 9.9% since I had dumped very big amount few weeks back.

I was told by everyone in here that underlying details like ETF price, NAV, low volume, closeness to the US market, its associating ETFs in US and concern of the local ETF manager (Valuecap) are not important at all.

What matters in the end is the number displayed by the app.

Compared to SAMY, I'm still in negative region even though had been DCA since the slump back in March 2020.

Please stop with the misleading statements The graph on the app already describes fairly well.

My very aggressive portfolio is earning 9.9% since I had dumped very big amount few weeks back.

I was told by everyone in here that underlying details like ETF price, NAV, low volume, closeness to the US market, its associating ETFs in US and concern of the local ETF manager (Valuecap) are not important at all.

What matters in the end is the number displayed by the app.

Compared to SAMY, I'm still in negative region even though had been DCA since the slump back in March 2020.

The finance industry already has a bad rep

People need to know the risk that is ahead right now

Currently you are paying nearly 16% more than what the ETF is worth

If you feel that is great then by all means go ahead

Also just because the app shows the price doesn't even mean you can sell it close to that price.

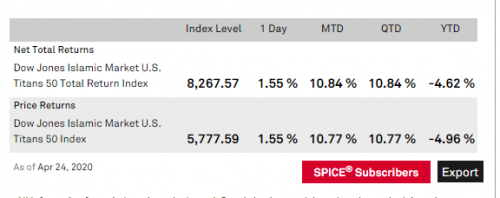

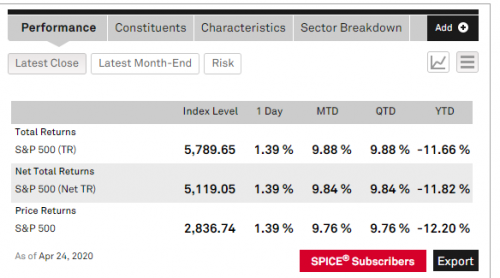

For those investing recently and the comparison with S&P 500 for the past quarter or month

Dow Jones Islamic Market U.S. Titans 50 Index that the ETF is based on

S&P 500

Apr 27 2020, 08:34 PM

Apr 27 2020, 08:34 PM

Quote

Quote

0.0181sec

0.0181sec

0.76

0.76

6 queries

6 queries

GZIP Disabled

GZIP Disabled