QUOTE(rocketm @ Apr 15 2020, 11:31 PM)

Thanks for your explanation.

I hope you can guide me how they calculate the percentage gains of -11.8%

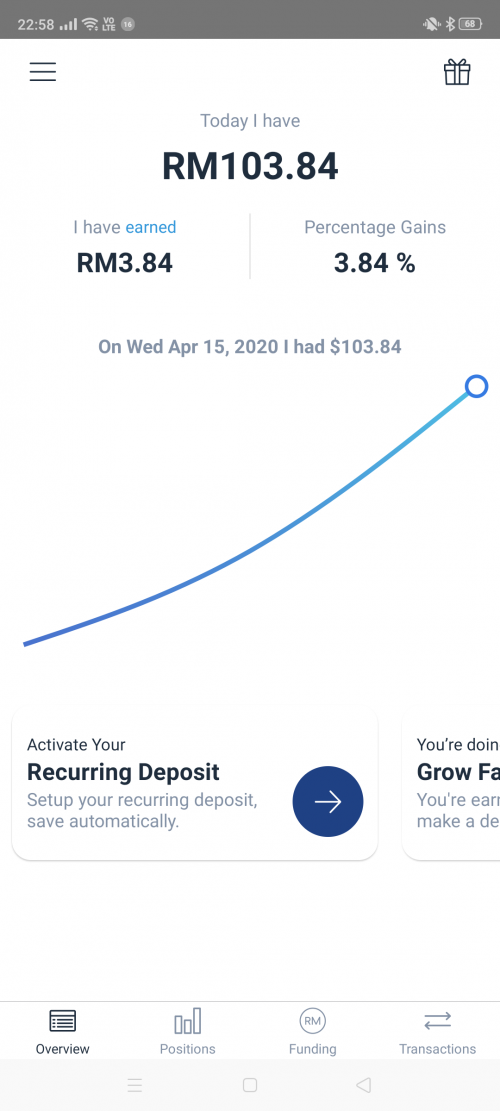

I press on the earned blue words, it display

Total balance RM 122.71

Total earnings RM-17.12

Wahed fee RM0.17

Cash bonuses RM40

I have earned RM-17.29

What I know is that the RM-17.89 is from RM140 - RM122.71

I have calculated the loss is RM12.35 [(122.71-140)/140]

The percentage return is using time-weighted return. It's a bit hard to calculate it exactly since we need the daily gains/loss info to calculate it, which you can only get on the monthly statement (you can access by clicking the top left triple line button > Account Details > Under "My investment account" click Regular > Monthly statements). Each month statement is released after the end of the month.

https://www.oldschoolvalue.com/tutorial/tim...io-performance/» Click to show Spoiler - click again to hide... «

QUOTE(rocketm @ Apr 15 2020, 11:31 PM)

I know that invest in long term will perform better especially if we CDA it. But, will it be the same positive result, when we want to cash out this investment at the time we are having serious disease when we are old?

I personally don't think Wahed is a good vehicle for long-term investment as it doesn't have a solid reputation like EPF/ASB. I would maybe keep my money at Wahed for 1-2 years, then cash out and transfer the money somewhere safer. If I'm happy with the returns I get from Wahed, then I will restart from 0 and put my money little by little all over again.

And you definitely shouldn't expect to always get positive return with Wahed as all of its investment portfolio (stock, bond, gold) all have history of going down in prices, unlike EPF/ASB returns which have never went negative.

QUOTE(rocketm @ Apr 15 2020, 11:31 PM)

Coincidentally, the market is not well perform, does our investment will not give us a positive result? Because the amount of money we have invested, we need to make sure it will generate some result to us.

That's why it's important that you only invest in the market with money that you are prepared to lose. If you want to have an investment with better returns than EPF/ASB, then you have to take risk.

If you lose your money, learn what mistake you made and try again with the hopes that you can earn back your losses in the future. If you gain money, then set a reasonable expectation on how much gain you are happy with and cash out when you reach that gain. Don't get too greedy by dreaming for a better return in the future as you can never know when the market will turn. Even if the market does end up higher, be happy that you reach your goal for that investment.

This post has been edited by Assassin's: Apr 16 2020, 01:50 AM  but im wondering what happen if the current etf close with a discount to the NAV though. Eg. if the share price is USD 1 but the NAV is USD 1.2. Will we get USD 1.2?

but im wondering what happen if the current etf close with a discount to the NAV though. Eg. if the share price is USD 1 but the NAV is USD 1.2. Will we get USD 1.2?

Apr 15 2020, 06:30 PM

Apr 15 2020, 06:30 PM

Quote

Quote

0.0281sec

0.0281sec

0.61

0.61

6 queries

6 queries

GZIP Disabled

GZIP Disabled