Stashaway said the costs of expense ratio/bid spread may outweigh the benefit of lower Withholding Tax.

True or false?

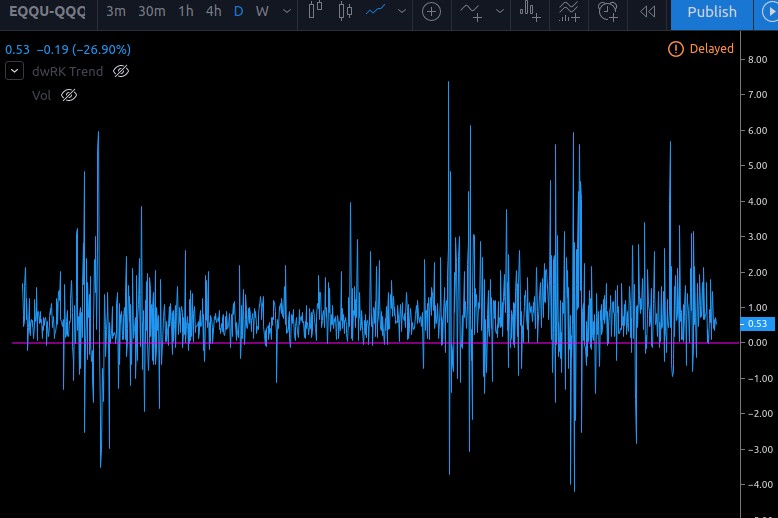

Data:

https://finance.yahoo.com/quote/VOO/history?p=VOO

https://finance.yahoo.com/quote/CSPX.L/history?p=CSPX.L

https://finance.yahoo.com/quote/QQQ/history?p=QQQ

https://finance.yahoo.com/quote/CNDX.L/history?p=CNDX.L

Methodology:

Same as previous thread using harmonic mean and geometric return.

But, I noticed something interesting. There were additional and missing data from both the US domiciled ETF and the ones listed at London Stock Exchange.

I suspect it's due to public holidays but let's find out using Google.

NOTE: 25 April 2011 is public holiday in London not in US.

NOTE: 25 Nov 2010 is public holiday in US not in London.

Total list of data removed:

IMPORTANT: Yahoo Finance does not give daily bid/ask spread data. I can only calculate which ETF gives better return. Since both track the same thing, their returns should be the same. Furthermore, bid/ask spread does not matter as everything will be 'equalled' out eventually as your transactions get higher and higher (i.e. n is very huge).

This is why I use harmonic mean. It's the same reason why there is little to low exchange rate risk when buying foreign ETFs because let's say MYR is weak and you buy less of USD ETF (1USD:MYR4.5). Some years, MYR grew stronger than USD (1USD:MYR3.5). Eventually your transactions will converge towards the harmonic mean. Possibly near 1 USD:MYR 4 depending on scenarios.

You may argue that you lose 'return' when you sell the ETF because you sell at a lower price compared to US domiciled ETF due to the wider bid/ask spread gap. This is bullshit because another person may argue that he/she has to buy at a higher price compared to US domiciled ETF due to bid/ask spread. Furthermore, some days you may queue at buy instead of buy from the seller. Some days you may buy immediately. Eventually everything will be evened out. Also, assuming efficient markets, there is unlikely to be mispricings in ETFs because the NAV can be calculated almost instantly every second and a lower priced ETF than its NAV (undervalued) will be bought up immediately until it equals the fair value.

Thus, the argument that bid/ask spread causes lower returns is untrue and any difference between the returns from US domiciled vs non-US domiciled ETFs is solely due to other factors including expense ratio/tracking error. High possibility it is the effect of higher expense ratios that is compounded for years especially since the non-US domiciled ETF is measured based on NAV. Higher expenses -> Lower NAV -> Less money that gets reinvested.

Results:

Note: I suppose the dividends have already been accounted for in the price of the ETFs on the LSE. Hence, the NAV increases as dividends are taxed, reinvested immediately and should reflect the price.

Conclusion:

What Stashaway said is true. You have an advantage buying US domiciled ETFs which have lower expense ratios. However, the gap is very small at 0.13%~0.15% in the long run.

This post has been edited by Yggdrasil: Oct 26 2019, 09:11 PM

Oct 26 2019, 09:04 PM, updated 7y ago

Oct 26 2019, 09:04 PM, updated 7y ago

Quote

Quote

0.0181sec

0.0181sec

1.04

1.04

5 queries

5 queries

GZIP Disabled

GZIP Disabled