why so complicated...my 1st pass simplistic approach...

fees paid on investment, say $10k, assume price/value no change throughout

(a) $10000 * 0.2% = $20

(b) $10000 * 0.3% = $30

underlying dividend yield is the same, say 2%, so dividend taxed

(a) $10000 * 2% * 30% = $60

(b) $10000 * 2% * 15% = $30

so clearly (b) is better than (a), since overall less money taken. what can make this false is dividend yield so low that wht has minimal effect, this is around 0.6-0.7%

next question is distributing or accumulating? if wanna stay invested, distributed funds may be insufficient to buy whole units, therefore have to keep and wait. so imho, if prices are going up then accumulating, if going down then distributing.

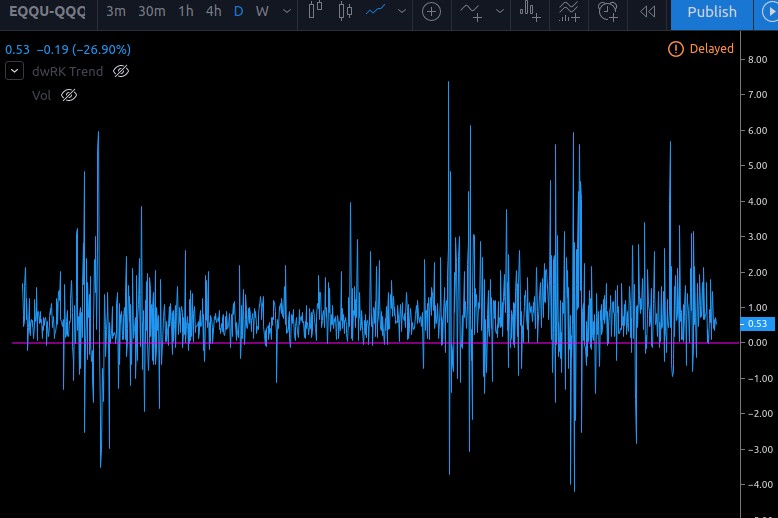

ETF: Irish domiciled ETF vs US, WHT benefit vs expense ratio bid spread

Nov 18 2019, 01:48 PM

Nov 18 2019, 01:48 PM

Quote

Quote

0.0135sec

0.0135sec

0.46

0.46

6 queries

6 queries

GZIP Disabled

GZIP Disabled