Someone PMed me and asked how to transfer from IBKR UK to IBKR US. For the benefit of everyone else, I will just post the steps here.

1. First you need to create a new IBKR account using the same login credentials (with your Malaysian address) and link it to your old/current IB account.

Proceed to settings page and open a new account from there.

You will get a new account number "UXXXXXXX", where X is a digit from 0 to 9 in addition to your existing account number. The application process is pretty straightforward and you will find that most of the account particulars fields are prefilled for you. Double check the trading permissions and source of wealth and make sure they are up to date.

» Click to show Spoiler - click again to hide... «

At the end of the application process, you will need to upload your MY passport and MY IC, just like what you did back then when you open your account with TSG. IBKR has a automatic document verification system. But my uploaded documents failed to be verified automatically. So I went for manual verification, which took a longer time for review and approval. If you are lucky enough to hve your documents verified automatically, your account will be approved withint minutes. Otherwise, for manual application, it might take longer. In my case, within 2-3 hours the same day (applied 8 am-9am GMT +8 on a working day, approved by 11am to 12pm GMT +8).

Also, they will ask you for a reason why you need to open a new individual account. You mention to them that you want to "enjoy better investor protection under SIPC", so you switch from IBKR UK to IBKR US LLC. They approve my account with the above reason, for your reference.

From this moment onwards, you will receive notification to fund your new account. Obviously you can just ignore those emails since your new account will soon have the money and stock/bonds etc. holdings transferred in from your old IB UK account.

----------------------

2. Now your new IBKR account is approved and is ready for transfer from the old IBK account. But before you go any further, make sure you verify your new account is indeed under IBKR US LLC and NOT IBKR UK. To do so, head over to the new account's "Other Reports" page. Select your new IBKR account and view the "Account Confirmation Letter".

» Click to show Spoiler - click again to hide... «

*Make sure you select the new IBKR account by clicking on the "Add/Edit" button near your account number display to switch from old to new account.

» Click to show Spoiler - click again to hide... «

You can select with or without liquidation value. It does not matter.

» Click to show Spoiler - click again to hide... «

Now you will see the letter. Check the lower right corner. It should display "Interactive Brokers LLC" with a US address: One Pickwick Plaza Greenwich, CT 06830 USA. This means this account is opened under IB LLC.

» Click to show Spoiler - click again to hide... «

However, if you see "Interactive Brokers (U.K.) Ltd." instead, with UK address: Level 20 Heron Tower 110 Bishopgate London EC2N 4AY. Do not panic. Check if you have produced the account confirmation letter from the old account. Switch over to the new account (click "Add/Edit" near the account number in the earlier page) and reproduce the letter.

» Click to show Spoiler - click again to hide... «

-------------------------

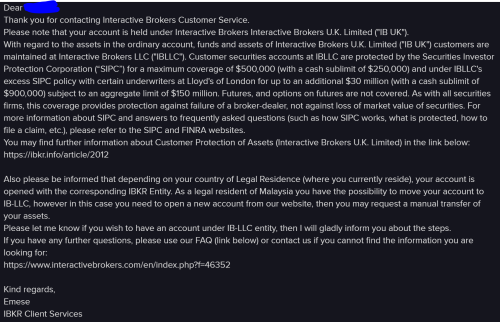

3. Now you have verified your new IB account is under IB LLC. Proceed to the "Secure Message Center" and create a new ticket with IBKR's customer service representative to request for transfer from your old IBKR UK account to the newly opened IBKR LLC account. My conversation with IB's customer service representative is reproduced below for your reference:

» Click to show Spoiler - click again to hide... «

Inquiry #T573395 - UXXXXXXX [My old IB account number]

Summary: Request to Transfer Account from IBKR UK to IBKR LLC

[My IBKR user ID] 2022/11/05 22:47:00

Dear Sir/Madam,

I am [My name] (IBKR account ID: UXXXXXXX) who would like to request to transfer my IBKR account from IB UK (the UK subsidiary) to IBKR LLC (the US subsidiary) to enjoy better investor protection under the SIPC.

Could you kindly advise on the steps necessary to transfer my account from IB UK to IBKR LLC?

Thank you.

Best regards,

[My Name]

IBCS 2022/11/09 13:08:58

Dear Mr. [My Name],

Please provide us both the source and destination account.

Regards,

Faisal C

IBKR Client Services

[My IBKR user ID] 2022/11/09 22:41:58

Dear Sir/Madam,

Thanks for the reply. I have opened a new IBKR account today and the account application has been approved.

The source account is my current account: UXXXXXXX [My old IB account number]

The destination account is my newly-opened account: UYYYYYYY [My new IB account number] (Kindly check if it's opened under IBKR LLC, just to double-confirm.)

Once the funds are transferred over to the new account, kindly delete the old account (UXXXXXXX).

Thanks.

Regards,

[My Name]

IBCS 2022/11/13 08:11:49

Dear Mr. [My Name],

This will be processed as a Manual transfer. Please note that manual transfers from Individual accounts UXXXXXXX [My old IB account number] to Individual account UYYYYYYY [My new IB account number] is subjected to the following:

1) Manual Transfer is subject to review and approval.

2) After the initial review is complete, you will be required to submit additional items.

3) Once all required documentation has been returned, transfers typically take 2 to 3 weeks to receive approval and processing.

Your request has been forwarded to the dedicated team. We will get back to you as soon we have a response.

Regards,

Faisal C

IBKR Client Services

[My IBKR user ID] 2022/11/13 08:21:11

Dear Sir/Madam,

Thanks for the update.

Regards,

[My Name]

As this is still an ongoing process, I will update you guys from time to time.

This post has been edited by TOS: Nov 15 2022, 09:20 PM

Nov 6 2022, 08:24 PM

Nov 6 2022, 08:24 PM

Quote

Quote

0.7686sec

0.7686sec

0.49

0.49

7 queries

7 queries

GZIP Disabled

GZIP Disabled