QUOTE(xerxesbear_1 @ Nov 12 2022, 03:31 PM)

can malaysia's open bank saving accounts in Singapore? my stocks are all US stocks, so they are not SGX.

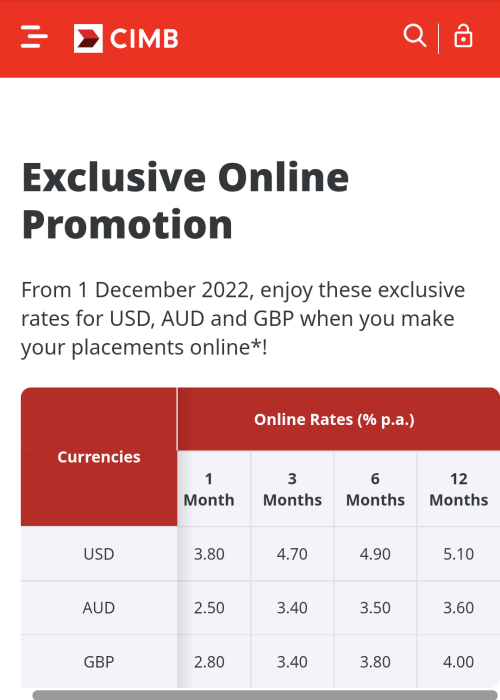

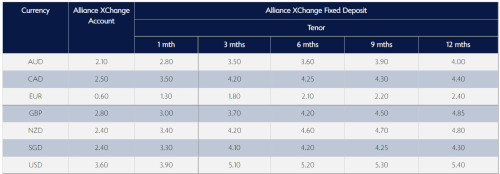

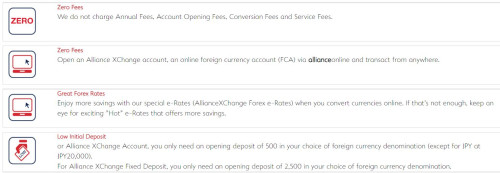

Yes, you can use Maybank SG or CIMB SG or both. Here's a complete guide to opening CIMB SG for Malaysians, without needing the need to travel across the border: https://ringgitfreedom.com/banking/opening-...for-malaysians/For Maybank SG, you can follow the instructions here: https://www.maybank2u.com.sg/iwov-resources...n-Form-mbmy.pdf

CIMB SG is recommended over Maybank SG as:

1. CIMB SG has no minimum balance deposit requirement. Maybank SG has a minimum daily balance requirement of 500 SGD, or else you will be charged with 2 SGD fall-below fees.

2. CIMB SG has good SGD->MYR forex rate for transfers back to MY. Note that the converse is not true. MYR->SGD is best done via Wise/Instarem/Sunway Money/BigPay etc.

3. No inwards remittance TT charges for CIMB SG if you need to send money into your SG bank account via SWIFT, for example.

This post has been edited by TOS: Nov 14 2022, 08:34 AM

Nov 12 2022, 03:48 PM

Nov 12 2022, 03:48 PM

Quote

Quote

[/url

[/url

0.0284sec

0.0284sec

0.33

0.33

6 queries

6 queries

GZIP Disabled

GZIP Disabled