[deleted replica]

This post has been edited by HolyAssasin4444: Nov 4 2020, 02:51 PM

Interactive Brokers (IBKR), IBKR users, welcome!

Interactive Brokers (IBKR), IBKR users, welcome!

|

|

Nov 4 2020, 02:50 PM Nov 4 2020, 02:50 PM

Return to original view | IPv6 | Post

#41

|

Junior Member

153 posts Joined: Feb 2015 |

[deleted replica]

This post has been edited by HolyAssasin4444: Nov 4 2020, 02:51 PM |

|

|

|

|

|

Jan 12 2021, 02:23 AM Jan 12 2021, 02:23 AM

Return to original view | IPv6 | Post

#42

|

Junior Member

153 posts Joined: Feb 2015 |

Hi sifus, niche question here not sure if anyone has tried it.

My family members want me to help manage investments for them. Is there a way to create separate IB accounts under their name ONLY, but I can login to do transactions with? |

|

|

Jan 12 2021, 02:19 PM Jan 12 2021, 02:19 PM

Return to original view | IPv6 | Post

#43

|

Junior Member

153 posts Joined: Feb 2015 |

QUOTE(dwRK @ Jan 12 2021, 07:00 AM) yes...check types of account & fees, see if qualify Not worried about login ip etc as I intend to manage the accounts the proper way (ie not having their passwords, and having a separate manager account to login instead)not sure if they track login ip...if not then easy... Was looking at the family offices account / friends and family account. Anyone have experience with this? This post has been edited by HolyAssasin4444: Jan 12 2021, 02:36 PM dwRK liked this post

|

|

|

Jan 23 2021, 11:42 AM Jan 23 2021, 11:42 AM

Return to original view | IPv6 | Post

#44

|

Junior Member

153 posts Joined: Feb 2015 |

QUOTE(eddie2020 @ Jan 23 2021, 04:18 AM) hi bro, opra is sufficient of option trade rite? haha.. stock live i use level2stock/investing so i just need to know for option live as i dont think i able to find the information easily. Depends on your trading style.. For me OPRA is enough (Live stream of bid/ask/bid&ask size/volume), $1.5/monthIf you need depth of book then go for L2 option feeds but they can get rather expensive if you're subscribing to all the exchanges. I'm not a daytrader so I don't find it useful. They basically give the same data for OPRA, but for different prices. Let's say current bid/ask for option A is 1.00/1.01. OPRA gives you data for those prices but L2 feeds give you additional data for 0.99,0.98,0.97..... and 1.02,1.03,1.04... You can find free live stock data easily from other sources online but option prices, just go for the subscription. PM me if you need help with which data package to sub as IBKR makes it really confusing for common investor This post has been edited by HolyAssasin4444: Jan 23 2021, 11:43 AM |

|

|

Jan 23 2021, 11:47 AM Jan 23 2021, 11:47 AM

Return to original view | IPv6 | Post

#45

|

Junior Member

153 posts Joined: Feb 2015 |

QUOTE(belfong @ Jan 22 2021, 10:43 PM) New to IBKR. I wonder why the Watchlist is showing delay data. I think I probably need to subscribe to the market data but I cannot understand the pricing page. How much does it cost to get real time data? Iirc Yahoo Finance is also delayed data. For live data on stocks I use Tradingview, good enough for me but if you want live data on IBKR, subscribe to these packages:I end up looking at Yahoo Finance for a more updated date, lol NYSE (Network A) - 1.5/month NYSE American......... (Network B) - 1.5/month NASDAQ (Network C) - 1.5/month For options, OPRA - 1.5/month This post has been edited by HolyAssasin4444: Jan 23 2021, 11:48 AM belfong liked this post

|

|

|

Jan 23 2021, 03:21 PM Jan 23 2021, 03:21 PM

Return to original view | IPv6 | Post

#46

|

Junior Member

153 posts Joined: Feb 2015 |

QUOTE(jas029 @ Jan 23 2021, 03:06 PM) yes u're right.. only set up in ibkr.. u'll need to provide the TW bank details into it Is this only applicable for their multi-currency account? Cuz I think that feature no longer applicable for Malaysianseven deposit and withdrawal are also initiated in ibkr.. just maintain sufficient USD balance in ur TW account to do ur transactions.. eg. initiate a deposit in ibkr, it'll auto deduct from ur TW account.. obviously initiating a withdrawal in ibkr will transfer the fund to ur TW account |

|

|

|

|

|

Jan 24 2021, 01:39 PM Jan 24 2021, 01:39 PM

Return to original view | IPv6 | Post

#47

|

Junior Member

153 posts Joined: Feb 2015 |

QUOTE(eddie2020 @ Jan 23 2021, 11:44 PM) yes agree,. I saw below as well.. - Yep Nasdaq and NYSE mostly but those ETFs (ie SPY AGG etc) they list on ARCA. If you want to save money let's say you trade mainly stocks on nasdaq then can just subscribe to Network C and forego the others.NYSE (Network A/CTA) Real time market data for NYSE listed stocks. Provides top of book bid/ask/last quotes. Examples - CYS, TEL and LLY. NYSE American, BATS, ARCA, IEX, and Regional Exchanges (Network B) This kinda confuse actually, i thought normally we trade US is either Nasdaq for tech normally or NYSE for other. Provides real-time quotes for stocks listed outside of NYSE and NASDAQ. Exchange listings include (but not limited to) those on NYSE American (formerly known as AMEX), ARCA, BATS, and IEX. Examples include IBKR, SPY, and VXX. NASDAQ (Network C/UTP) Provides real-time data bid/ask (top of book) quotes for NASDAQ listed securities. Examples - MSFT, CSCO and TSLA. OPRA (US Options Exchanges) Provides option data from AMEX, ARCA, BATS, BOX, BSE, CBOE2, CBOE, ISE NASDAQ AND PHLX. I just wonder lets say my acc commission for this month over 20usd 1jan to 24jan. if i subscribe this on 25 jan, will they waive it or they will calculate my commission from 25-31jan must hit 20usd normally you put in usd and transfer to TW? sorry for outtopic, do TW easily to reg an USD acc? currently i use ib convert back to sgd n transfer to sg bank lol - Not sure about the fee waive. But fwiw, my fees for the data are normally charged on the next month (charged in Feb for Jan data) so maybe they waive |

|

|

Jul 9 2021, 01:29 AM Jul 9 2021, 01:29 AM

Return to original view | IPv6 | Post

#48

|

Junior Member

153 posts Joined: Feb 2015 |

QUOTE(Gwynbleidd @ Jul 8 2021, 05:24 PM) QUOTE(solstice818 @ Jul 8 2021, 05:36 PM) IBKR sent us an email. The change seems to be permanent. Applies to friends&family accounts and family offices too This post has been edited by HolyAssasin4444: Jul 9 2021, 01:31 AM solstice818, Takudan, and 3 others liked this post

|

|

|

Jul 9 2021, 01:44 AM Jul 9 2021, 01:44 AM

Return to original view | IPv6 | Post

#49

|

Junior Member

153 posts Joined: Feb 2015 |

QUOTE(polarzbearz @ Jul 9 2021, 01:35 AM) Always been on IBKR. The email was received an hour ago QUOTE(cucumber @ Jul 9 2021, 01:36 AM) This is good news. So if we sign up with the normal ibkr, we can buy fractional shares without having to pay the $10 monthly fee yea? Yep. Just pay the normal commission fee (35c/100 share) plus minimal exchange fee cucumber liked this post

|

|

|

Sep 20 2021, 11:33 AM Sep 20 2021, 11:33 AM

Return to original view | IPv6 | Post

#50

|

Junior Member

153 posts Joined: Feb 2015 |

QUOTE(TOS @ Sep 18 2021, 10:46 PM) Thanks. I did a quick search on Google, it seems like the WHT for Malaysian investors is only 12.5%, very nice compared to other jurisdictions. For you and for anyone else that invests in other countries besides Malaysia, can check up PWC's website regarding everything about taxes. Reviewed and updated frequently by professionals. https://law.moj.gov.tw/ENG/LawClass/LawAll....?pcode=Y0040226 https://investtaiwan.nat.gov.tw/faqQContent...g=eng&search=77 https://taxsummaries.pwc.com/quick-charts/w...-rates#anchor-M langstrasse and TOS liked this post

|

|

|

Oct 7 2021, 05:42 PM Oct 7 2021, 05:42 PM

Return to original view | Post

#51

|

Junior Member

153 posts Joined: Feb 2015 |

QUOTE(Yggdrasil @ Oct 7 2021, 04:48 PM) Want to ask if anyone knows for Margin account (not PM). If buying power is $100k, it means I can day trade $100k worth of stocks but can only hold $50k worth of stocks overnight correct? QUOTE(dwRK @ Oct 7 2021, 05:25 PM) for stocks you can hold $100k forever...until you sell or gets liquidated if falls below maintenance margin You guys overcomplicating it... Buying Power is just Available Funds *4 ie how big of a position you can open right nowmostly derivatives have day & overnight margins... the % between day & overnight margin is also different between derivatives... I forgot how ibkr manages this... Reg T regs margins securities at 50%, which is used in SMA calculation. Intraday margins securities at 25%. So beware that holding 100k with 25k ELV will almost certainly get you margin called with a small downtick Only need to care about 2 crucial numbers. ExLiq > 0 at all times, and SMA > 0 during closing. Options have constant margin requirements. Futures usually have higher overnight margin requirements. Just check it here https://investors.interactivebrokers.com/en...004100808080101 Futures are typicaly risk margined ie the requirements change as volatility changes. For some CME futures, cross margining may be applied to reduce your total margin reqs Extra info: I had quite a concentrated portfolio before I applied for PM, and they would margin my account using risk instead of rules. Having a few concentrated positions will increase your margin more than you expect with typical rules calculation This post has been edited by HolyAssasin4444: Oct 7 2021, 05:47 PM |

|

|

Oct 7 2021, 07:37 PM Oct 7 2021, 07:37 PM

Return to original view | Post

#52

|

Junior Member

153 posts Joined: Feb 2015 |

QUOTE(Yggdrasil @ Oct 7 2021, 07:03 PM) I thought you need huge buying power to be assigned? Like if Buying Power is $100k, you cannot be assigned $200k worth of stock although ELV and SMA>0? There's 3 different type of margins, Initial Margin (IM), Maintenance Margin (MM) and RegT Margin (RegT).Initially I thought Buying Power for overnight positions is usually 50%. I.e. if BP is $100k, can only day trade $100k but hold $50k overnight. This is why people say try to avoid assignment by wheeling the put until you cannot because the put is deep in the money (very low theta decay). Opening any position requires a certain amount of IM and MM. For most US stocks, it's 25% (buying 10k stocks will require 2.5k IM & MM) 100k worth of stock = 25k IM MM. 200k worth of stock = 50k IM MM. Available funds is ELV - IM. Available funds can be thought of how much remaining IM you're allowed to use before not being allowed to open another position. Buying Power (BP) is just a fancy number calculated by Available Funds * 4 (ie a quick and easy way to know how big of a position you're allowed to open) Example, For someone with 25k ELV and no positions, your available funds is 25k, that's why your buying power will display 100k (25k*4). The reason why you're not allowed to buy 200k worth of stock is because that requires 50k of IM, which is more than your current ELV of 25k. Pretty much why I ignore looking at BP because it's just a secondary calculation of your available funds, which itself is a secondary calculation of IM. Overnight positions (for stocks, ignore futures) have the same IM MM requirements, 25%. Only difference is that for normal margin accounts, you're regulated by RegT rules. RegT states that all stocks may only be margined by 50% instead. This is where your RegT margin comes in. However, RegT margin requirements are only checked once a day at market close. Which means that for any overnight positions, they'll be checked for RegT margin requirements. That's why normally people say that you can only have half the amount of stock for overnight positions. Not because different requirements, but because there's an extra layer of margin requirement for you to obey. Once you upgrade to PM, this RegT rule will be removed, and you can just maintain the same amount for both intraday and overnight positions. As someone that majored in derivatives, I hate how people simplify wheeling into such rigid rules and thinking it's easy money because it's not, and there are massive tradeoffs for having so much of theta decay. Won't get into it unless you're interested, but basically very low theta decay is not a problem, it's a feature. The real problem is that rolling any ITM options becomes really costly for you simply because of the bid/ask spread. For the situation you mentioned (rolling the ITM put), I would recommend you to instead take assignment and sell calls. Due to put call parity, this is exactly the same thing but OTM calls have much tighter spreads, especially if they are near the money. Example, I've got XYZ $100 Put, getting assigned cuz XYZ is $95 now. Plan A: You want to roll to XYZ $100 Put for next month instead. Plan B: Take assignment on XYZ, and immediately sell XYZ $100 Call for next month. Both Plan A and B is synthetically the same thing, and there's no difference in doing either theoretically, but irl Plan B will be my choice because of the tighter bid/ask Edit: I can provide you a basic excel worksheet I used in the past to find out how leveraged you can get, and how big of a drawdown till you get to RegT > ELV This post has been edited by HolyAssasin4444: Oct 7 2021, 07:53 PM |

|

|

Oct 7 2021, 08:32 PM Oct 7 2021, 08:32 PM

Return to original view | Post

#53

|

Junior Member

153 posts Joined: Feb 2015 |

|

|

|

|

|

|

Oct 8 2021, 03:17 AM Oct 8 2021, 03:17 AM

Return to original view | Post

#54

|

Junior Member

153 posts Joined: Feb 2015 |

QUOTE(Yggdrasil @ Oct 7 2021, 09:35 PM) I mean I only have one simple question. What do I look at to see how much I can hold ETFs on margin overnight? I attached the Excel file, ugly but I think it does the job. Change the yellow cells, by adding how much ELV you have right now and how much percentage margin you intend to use. (50% = 1.5x your money worth of stock)I.e. how do I know how much stock (in dollar value) I can be assigned? If your Excel file has it, that would be great. Then you can check the chart for the 'min(SMA)' line when it hits the x-axis. That would be how big of a loss you can take till you possibly kena margin call. For example, if you use 1.33x margin, max loss is 50% of your portfolio before in danger of kena call. If 1.66x margin then max loss 20% kena called. https://ufile.io/3q5xw81l |

|

|

Oct 8 2021, 02:13 PM Oct 8 2021, 02:13 PM

Return to original view | Post

#55

|

Junior Member

153 posts Joined: Feb 2015 |

QUOTE(a16791 @ Oct 8 2021, 09:24 AM) Thanks so much . Your excel sheet is exactly what I need . Never understand all the jargons in IBKR Leverage ratio is pretty much Gross Position Value/Net Liq.By the way in IBKR under the margin there's a leverage column. Mine show 0.83 . What does that mean ? Example, I long 100k SPY, with net liq = 80k. My leverage = 1.25 I long 100k SPY, short 60k QQQ, net liq = 80k. Leverage = (100+60)/80 = 2 |

|

|

Oct 8 2021, 02:56 PM Oct 8 2021, 02:56 PM

Return to original view | Post

#56

|

Junior Member

153 posts Joined: Feb 2015 |

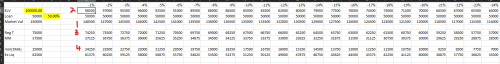

QUOTE(TOS @ Oct 8 2021, 02:18 PM) The link you post is blocked by my Malwarebytes Browser Guard, which flags it as a "riskware". I presume it is just "false positive" of some sort? Hmm not sure about that. My file I'm confident it's safe, but the website I just clicked on the first google results for file hosting service.You file should be safe right?  If you still want the file can just pm me I email to you, but I can just put the formulas here for ppl to make their own. Market Val (left side) = ELV + Loan 1) Formula for the row labelled 1 is 'MarkVal'-('MarkVal'*-'losspercentage'). 2) Formula for row labelled 2 is just row labelled 1 - loan value which is constant (eg in pic 148500 - 50000 = 98500) 3) Formula for row labelled 3 is the regT row, or just row labelled 1*0.5 4) Formula for row labelled 4 is min(SMA) row, row labelled 2 - row labelled 3  |

|

|

Oct 9 2021, 04:34 AM Oct 9 2021, 04:34 AM

Return to original view | Post

#57

|

Junior Member

153 posts Joined: Feb 2015 |

QUOTE(esyap @ Oct 8 2021, 03:01 PM) Boss wat does 'PM' means? ELV = Current Excess Liquidity? I only make sure Excess Liq & SMA not zero. PM = Portfolio Margin. Can leverage more if got diversified portfolio. Can apply if you have >110k USD iirc.How these margin things works is still Russian to me especially wen trading Option. I just close Option position tat is in profit wen Curr Ex Liq in 'Danger' zone. Current volatility makes my CEL figure changes a lot by the day. ELV = Equity with Loan Value. You got the right idea, most important thing is to make sure your ExLiq and SMA >0 you'll be fine. The stuff I mentioned just to show how IBKR calculates your ExLiq and SMA Assuming your option positions are short, it's probably due to the option value itself changing by alot, causing ExLiq to change along with it. If ExLiq constantly in danger zone, might wanna tone down your leverage abit. In fast moving markets you might not even have time to adjust positions before getting margin called QUOTE(a16791 @ Oct 8 2021, 03:16 PM) Looking back at your excel ie 1.66x margin and max loss 20% would have margin call. Why is it so when there's still excess liquidity of 33333.33 ? IBKR got 2 margin rules to obey, the Excess Liq that margins securities at 25%. This must be kept >0 at all times.RegT rules margins securities at 50%, half the amount of ExLiq. This is why the ExLiq will always be higher than the 'min(SMA)'. But your SMA will be checked at every market close. If SMA <0 then you'll kena margin called. That's why in my excel sheet I define margin called when the min(SMA) line <0. Even if ExLiq still positive, your SMA must be positive too if you're holding it thru market close (aka overnight) I haven't fully mentioned how IBKR calculates SMA, because there's also a different method where they use your previous SMA to calculate today's SMA taking into account profits and cash movement. But that's hard for me to define mathematically and keep track in a simple excel sheet. But not to worry because IBKR will take the bigger sum of that calculation, or ELV - RegT margin (this is the one the excel sheet calculates) You'll almost always be positive SMA in your TWS at max loss 20%, as my excel sheet calculates the worst possible SMA. But to play it safe, I generally just follow the sheet's calculation. QUOTE(Yggdrasil @ Oct 8 2021, 07:30 PM) Thanks. Which cell do I need to amend? ELV and loan is it? Yup, ELV and Loan amount percentage. The ones in yellow.I had this warning too when I tried to download. I uploaded the file to VirusTotal and seems safe. |

|

|

Dec 16 2021, 10:23 PM Dec 16 2021, 10:23 PM

Return to original view | IPv6 | Post

#58

|

Junior Member

153 posts Joined: Feb 2015 |

Some of you may realize that Wise has added Multi Currency account for us Malaysians again (finally..)

I've experimented with deposits, here's what I have confirmed, and what I recommend to do for the cheapest route: 1) USD ACH is allowed. No need to go thru wire. Confirmed with transactions made yesterday and went thru. 2) If you need USD in IB, convert directly to USD in TW and send via ACH. For other currencies needed to buy stuff in IBKR, refer below for cheapest: - EUR, AUD, GBP, SEK, DKK, CAD, NZD, SGD, CZK - convert MYR in TW and send directly to IBKR - HUF - (>28.2K RM) convert MYR to EUR in TW, send to IBKR, convert to wanted currency in IBKR (else) convert MYR in TW and send direct - NOK - (>27.1K RM) convert MYR to EUR in TW, send to IBKR, convert to wanted currency in IBKR (else) convert MYR in TW and send direct - CHF - (>19.1K RM) convert MYR to EUR in TW, send to IBKR, convert to wanted currency in IBKR (else) convert MYR in TW and send direct - PLN - (>18.7K RM) convert MYR to EUR in TW, send to IBKR, convert to wanted currency in IBKR (else) convert MYR in TW and send direct - HKD - (>17.3K RM) convert MYR to EUR in TW, send to IBKR, convert to wanted currency in IBKR (else) convert MYR in TW and send direct - JPY - (>2.8K RM) convert MYR to EUR in TW, send to IBKR, convert to wanted currency in IBKR (else) convert MYR in TW and send direct - MXN - (>2K RM) convert MYR to EUR in TW, send to IBKR, convert to wanted currency in IBKR (else) convert MYR in TW and send direct - TRY, CNY, RUB, ZAR - convert MYR to EUR in TW, send to IBKR, convert to wanted currency in IBKR (converting directly if below 1k for TRY CNY and RUB is cheaper but I don't think it's useful info) 3) To spend MYR locally buy rice, convert into GBP in IBKR and send to TW. Then convert into MYR within TW, and withdraw to local bank account (not tested, but should work). Total fee is 2USD(IBKR) + 0.44% (TW) + 1RM (local account withdraw). This is the cheapest route as far as I'm aware of Numbers above is based on Wise fees as of 16th Dec 2021, and USDMYR of 4.2 To compare the fees, if you should convert in TW and send directly, or convert to EUR in TW and then exchange to wanted currency in IBKR, you can compare using: TW fees (wanted currency) vs TW fees (EUR) + 8.4 OR amount threshold = (9.93- fixed fee of wanted currency in TW)/(variable fee of wanted currency in TW - 0.0045) This post has been edited by HolyAssasin4444: Dec 16 2021, 10:28 PM |

|

|

Dec 17 2021, 12:02 AM Dec 17 2021, 12:02 AM

Return to original view | IPv6 | Post

#59

|

Junior Member

153 posts Joined: Feb 2015 |

QUOTE(Davidtcf @ Dec 16 2021, 10:56 PM) Have you tried withdraw directly from IBKR (convert to MYR in IBKR) to Wise, then to local bank account? Can't convert to MYR in IBKR. Ringgit is not traded there. If you want to convert to SGD and withdraw, can directly transfer to Wise SGD balance instead then convert to MYR. No need for CIMB anymore. Only reason why I suggested GBP is because the conversion fees is slightly lower than SGD (.44% vs .53%)Curious if its rate will beat transferring from IBKR (convert to SGD) to SG CIMB, then using wise (convert to MYR here) transfer to MY Cimb account. Troublesome part here is need to purposely go open a cimb MY and SG account and maintain both. This post has been edited by HolyAssasin4444: Dec 17 2021, 12:03 AM |

|

|

Jan 16 2023, 08:52 AM Jan 16 2023, 08:52 AM

Return to original view | IPv6 | Post

#60

|

Junior Member

153 posts Joined: Feb 2015 |

QUOTE(TOS @ Jan 13 2023, 01:12 PM) I found something interesting though. Temasek has a slightly lower curve over SG government in the mid-term. (See the red highlighted curve in the screenshot, it's slightly below the yellow SG gov curve between 2-10 year tenure) I'm just salivating at all those CDS data charts » Click to show Spoiler - click again to hide... « Temasek bonds are safer than SGS bonds... ---------------------- This is all that is for SG-related issuers CDS in Bloomberg. » Click to show Spoiler - click again to hide... « Sifu, can ask where you got your source from for these data? Used to have access to Bloomberg Term in uni but can't justify paying 25kUSD when I'm being paid peanuts in MY. Trying to build a data stream directly into IBKR with CDS data but not much luck with reliable data sources for it This post has been edited by HolyAssasin4444: Jan 16 2023, 08:53 AM |

| Change to: |  0.2557sec 0.2557sec

0.57 0.57

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 1st December 2025 - 05:53 PM |