QUOTE(Hansel @ Nov 12 2022, 04:34 PM)

Ohh,.... all US stocks, then if it's me,... I would transfer all my stocks in to DBS Vickers, But that's me, because I have most of my hldgs in DBS. But be careful of the charges,...

If you are putting most of your holding in DBS, I am curious why you think the risk of this bank-affiliated broker-dealer like DBS Vicker is low?

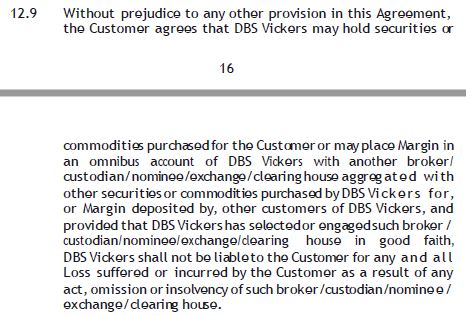

DBS Vicker ask customer to indemnify their counter party risks.

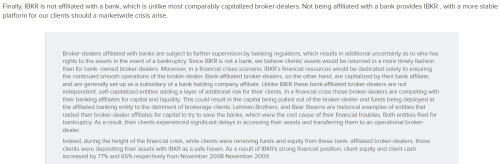

In contrast, it seems IBKR has customer protection in mind more than DBS Vicker.

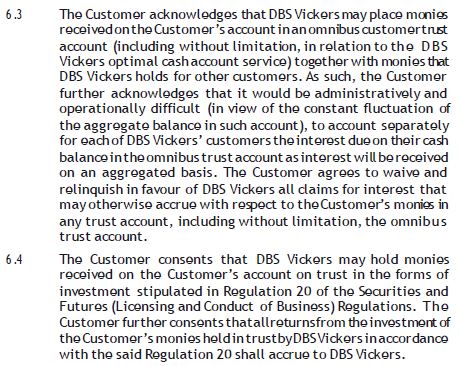

Also regarding customer asset segregation from the other assets:

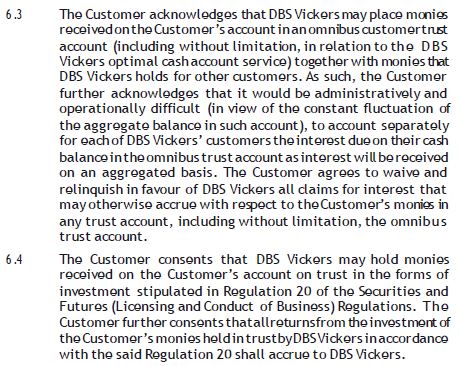

It seems that DBS do not segregate their customer assets, furthermore, they ask customer to waive the investment return of the customer money DBS Vicker temporary make?! Is this a joke?

IBKR has customer assets segregation.

Not trying to tarnish the bank affiliated broker but so far all my questions about customer protection were not able to be answered by bank affiliated broker. Can't find those info on any website too. I still not able to find any bank affiliated broker to have on-par customer protection like IBKR. Hope to be able to find a good bank affiliated broker for long term.

Apr 22 2022, 04:07 PM

Apr 22 2022, 04:07 PM

Quote

Quote

0.2857sec

0.2857sec

1.33

1.33

7 queries

7 queries

GZIP Disabled

GZIP Disabled