QUOTE(mangoes4life @ Feb 12 2022, 02:13 PM)

Hello all, newbie here.

I've just started dipping my toes into the investing world. I have no one irl to refer to on whether my understandings are correct, hope fellow sifus can help with my dumb questions

I am aware that investing in Ireland-domiciled ETF can save 15% tax compared to USA. But US allows to buy in fraction which is ideal for me currently, as I want to start slowly with my extra cash in hand

1. Say I invest in a US ETFs, I will receive dividends back into my account. And this dividend will be charged a 30% tax. Other than that is there any other fees/tax that will be charged later on? And is the situation the same if I buy (fraction) shares from a single company like Tesla?

2. Does accumulating means I will be buying more shares with the dividends? and I profit through selling these shares?

3. What about accumulating ETFs on LSE? As far as I know there's no fractional shares option on LSE? Then where will the accumulation go?

Hi there fellow newbie, welcome! Not a sifu here, but I can share my thoughts:

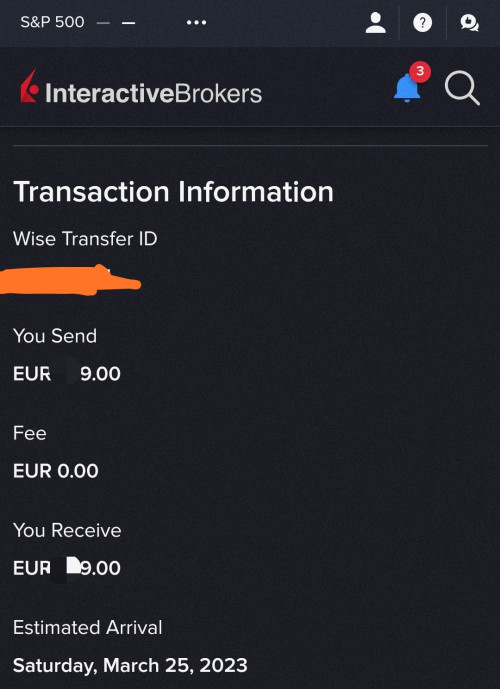

1. It sounds to me your extra cash is a bit too low (like <RM2000?), that you're considering fractional shares for ETF. Not saying it's wrong, just that you should be aware and accept the consequences: there is no extra charge for fractional shares, but understand that it will

1) be less liquid (harder to sell)

2) cost more in the long run, as you trade more often. Each trade costs the same indeed (for retail investors like us), but imagine if you split one big trade to five smaller trades, you will be paying 5x the trading fees. If you are buying at RM100 and get charged RM 2 per trade, your cost is 2%. If you are buying at RM 1000, you also get charged RM 2, but your cost is now relatively smaller i.e. 0.2%.

2. By your "accumulating", you described "dividend reinvestment" in IBKR. To my understanding, it is a way for you to easily keep the value of your holdings, because dividend payout always results in stock value drop, typically proportionate to the dividend payout. Otherwise, you get paid in cash, and it sits there as cash.

In essence, yeah you gain by selling your stock/position that is of higher value than when you bought it (for "long"/the typical stock purchase). If you don't sell, they are only paper profits. There are other ways to play the game like shorting, call/puts and whatnot, unfortunately I am not knowledgeable in those to advise.

3. To my understanding, what they will do to the dividends is they will reinvest them back into their holdings so the dividend value never reaches the investors, but you as an investor, basically carry the same value before and after payouts.

Other sifus, please feel free to correct me

Sep 23 2021, 11:27 PM

Sep 23 2021, 11:27 PM

Quote

Quote

0.2616sec

0.2616sec

0.63

0.63

7 queries

7 queries

GZIP Disabled

GZIP Disabled