QUOTE(zenjiazenjia @ Oct 30 2019, 12:46 PM)

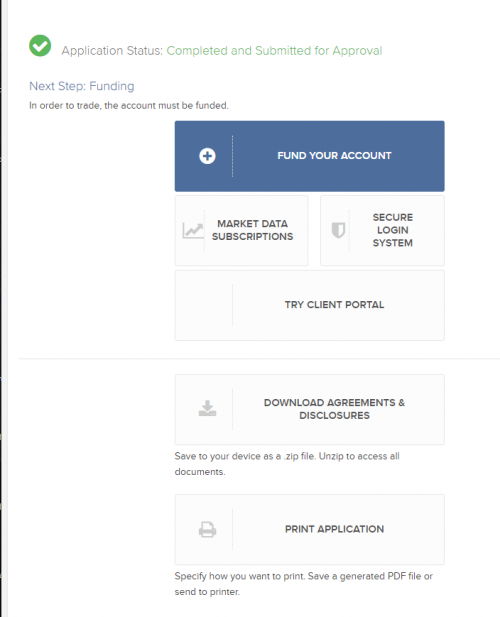

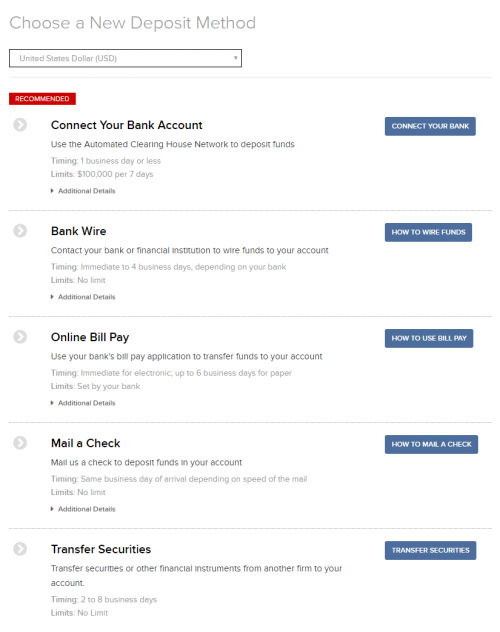

Guys, i wanted try transfer fund to IBKR from my standchart account, see can pass thru or not. i already created a bank wire deposit request in IBKR and have beneficiary and bank details. when i fill i standard chartered international transfer form via online banking, most of it fields input i can find from the info from IBKR, but not sure what to fill for below. need some advise on my 1st international transfer

ID / PASSPORT NO: (is it account number)

CHARGES: (3 options to select), 1) all local & oversea charges borne by applicant, 2) all local & oversea charges borne by beneficiary, 3) local charges borne by applicant, oversea charges borne by beneficiary

by the way, i saw the beneficiary is Interactive Brokers UK Limited, address is UK, but the bank is in new york, US, is this normal?

Don't bother using standard chartered. Final amount which suppose to end up will be lesser say about USD50-100. All kena makan up by standard charted.

But to humour you,

ID should be your unique interactive username usually UTXXXXX.

Charges you pay everything yourself. Pick option 1. Again as mentioned after doing all that, final amount that appear in interactive broker will be lesser. Banks makan your money already (through invisible fees, unfavourable exchange rate)

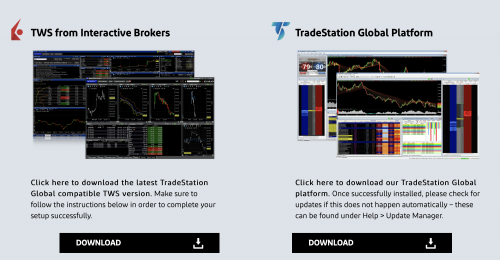

Yes. Normal. Tradestation global is for IB UK. But since you are transferring I assume is USD, of course the bank is in New York.

QUOTE(livina2011 @ Oct 30 2019, 01:18 PM)

i was curious how you guys trade US stocks. do you buy USD at our bank rate and TT to IBKR then trade over there in USD then when you want to use money or take some profit only then you exchange your USD back to malaysia bank. if that's the case does the spot USD makes any difference while you trade over there at IBKR? assuming you don't convert back to MYR everytime you sell your US stocks.

Our local bank that offer US stocks don't have withdrawal fee, inactivity fee, monthly trading platform fee.

We never use Malaysian banks to TT. Well some might. Bloody expensive. What most people do is transfer SGD into interactive broker account via FAST (Singapore version of IBFT). From there, once money available just convert at spot rate into USD. Pay USD2.00 only for spot rate (real time market rates which banks use for themselves).

There's a tutorial over here.

https://forum.lowyat.net/topic/4744515Difference is a lot over time.

I don't know what US stocks you are talking about. Malaysian banks don't let you buy or sell US stocks. You need a stock broker to do that. As far as I know all stock brokers in Malaysia charente a hefty fee for overseas stock purchased from say NYSE and Nasdaq.

Oct 29 2019, 09:24 AM

Oct 29 2019, 09:24 AM

Quote

Quote

0.3169sec

0.3169sec

0.43

0.43

7 queries

7 queries

GZIP Disabled

GZIP Disabled