Outline ·

[ Standard ] ·

Linear+

Interactive Brokers (IBKR), IBKR users, welcome!

|

Medufsaid

|

Nov 27 2024, 10:37 PM Nov 27 2024, 10:37 PM

|

|

QUOTE(poooky @ Nov 27 2024, 12:30 PM) compare with sunway money also QUOTE(poooky @ Nov 27 2024, 12:30 PM) 2. CIMB SG to IBKR USD - USD 2 to convert - Not sure what is exact rate is, but I'm assuming rate is ~0.748 based on the SGD 10 I have inside - So USD 2,255 (3015 x 0.748) - 2 you can save further with either of these steps - if your IBKR is cash account type (and not margin type), don't need to convert to USD, just buy and IBKR will auto convert from SGD to USD @ a fee of 0.03%. if you are buying something more than USD6,666 then ok, just manually convert it for USD2

- cash & margin type can invest using IBKR recurring investment. IBKR will convert without any charge

QUOTE(poooky @ Nov 27 2024, 12:30 PM) u can compare Moneymatch sending USD, and also Sunwaymoney sending USD. but don't expect it to be cheap |

|

|

|

|

|

Medufsaid

|

Dec 8 2024, 06:39 PM Dec 8 2024, 06:39 PM

|

|

annoymous1234 i don't think so. that's between you and London Stock Exchange. not between you and USA

|

|

|

|

|

|

Medufsaid

|

Dec 16 2024, 07:45 PM Dec 16 2024, 07:45 PM

|

|

james.6831 malaysians cannot buy from IBKR

|

|

|

|

|

|

Medufsaid

|

Dec 17 2024, 12:46 PM Dec 17 2024, 12:46 PM

|

|

Malaysians cannot buy IBIT on ibkr. Use Moomoo

|

|

|

|

|

|

Medufsaid

|

Dec 18 2024, 12:14 AM Dec 18 2024, 12:14 AM

|

|

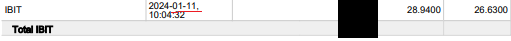

QUOTE(lamode @ Dec 17 2024, 11:58 PM) not true. i bought before. if you are one of the lucky ones who bought IBIT in early Jan 2024, you can still buy it now. but IBKR has shut the door to other malaysians/singaporeans who didn't buy in during that time. i'm one of the lucky ones. the only other one i know was a singaporean on reddit, also bought in early  for malaysians who didn't buy $IBIT before, u can try to buy it now, see if IBKR restricts you. they restricted by March/April i think, and i believe still restricted bcos i know of a sinkie who wanted to buy IBIT options but can't do it on IBRK (IBIT options introduced recently only) This post has been edited by Medufsaid: Dec 18 2024, 08:53 AM |

|

|

|

|

|

Medufsaid

|

Dec 26 2024, 11:09 AM Dec 26 2024, 11:09 AM

|

|

Duckies is your IBKR a cash account or margin account?

|

|

|

|

|

|

Medufsaid

|

Dec 26 2024, 01:28 PM Dec 26 2024, 01:28 PM

|

|

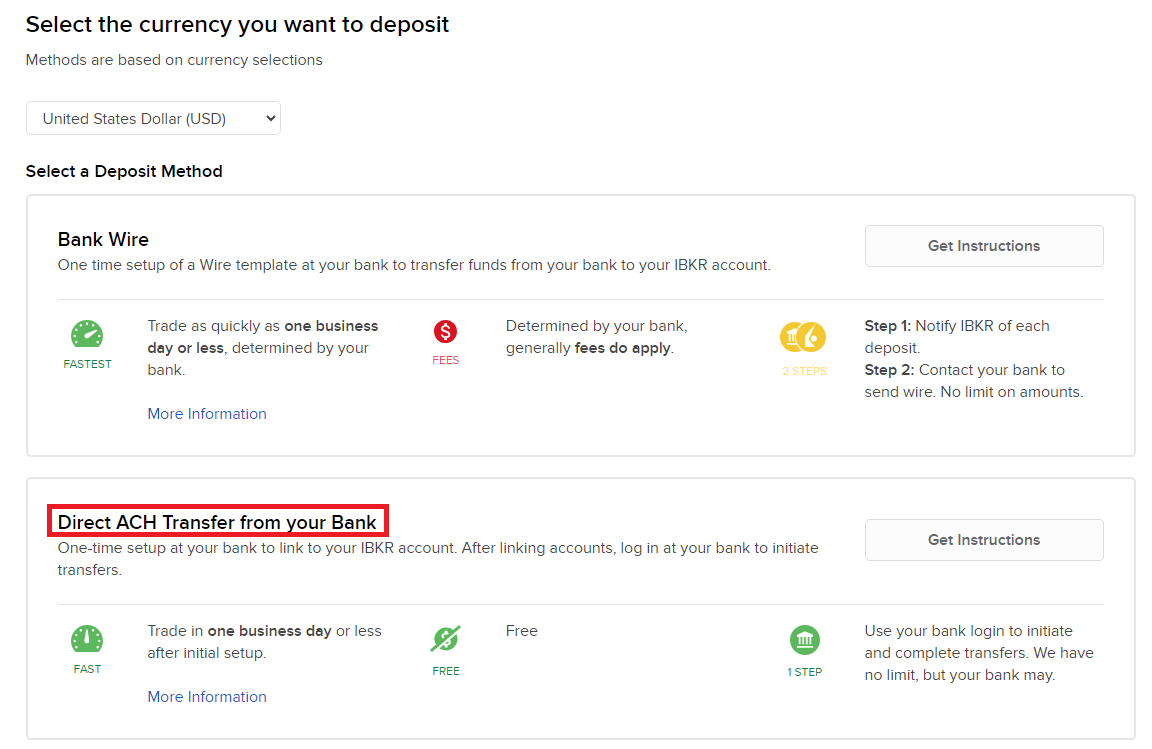

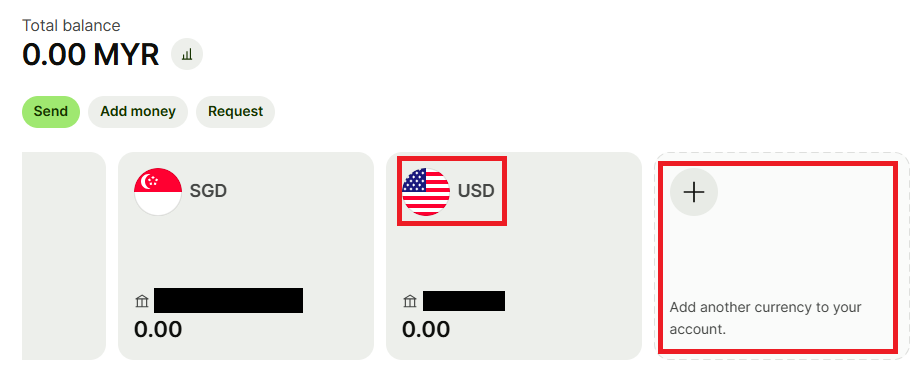

Duckies you can either - open SG bank account to deposit SGD into IBKR, or

- convert to EUR and then send to IBKR. EUR due to these reasons

- (cheaper than converting USD)

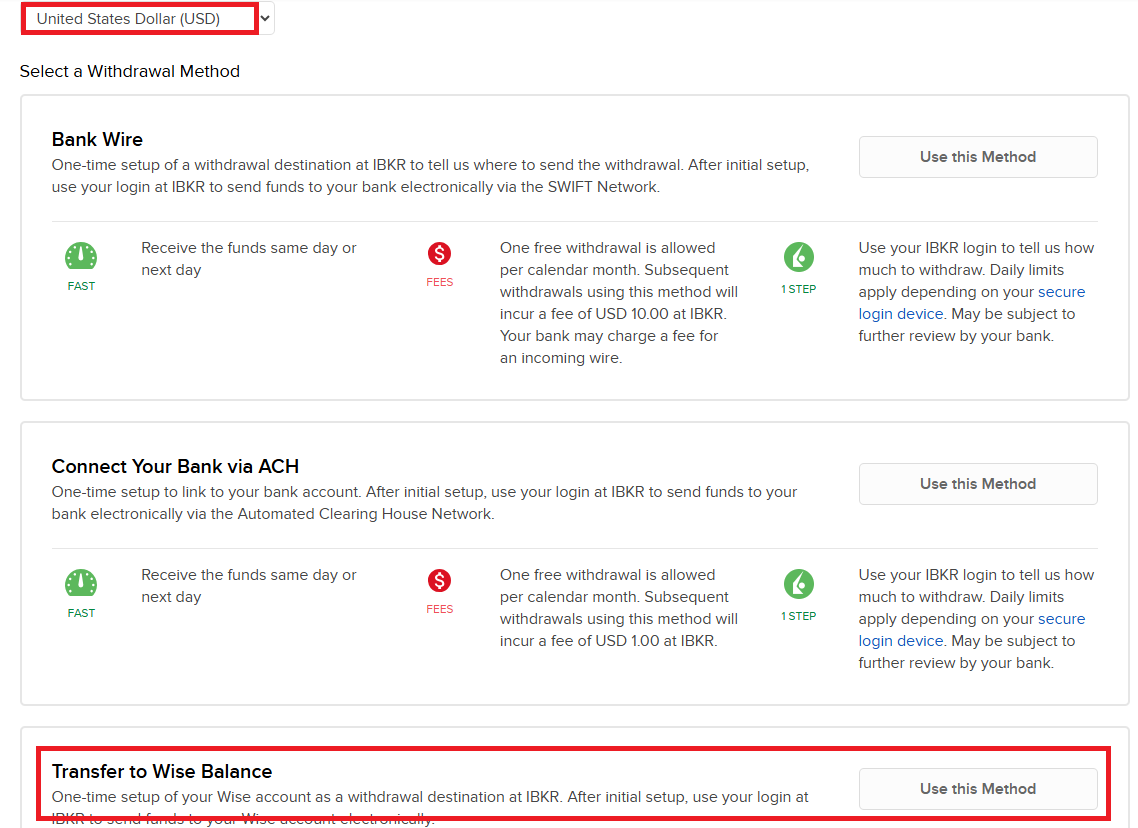

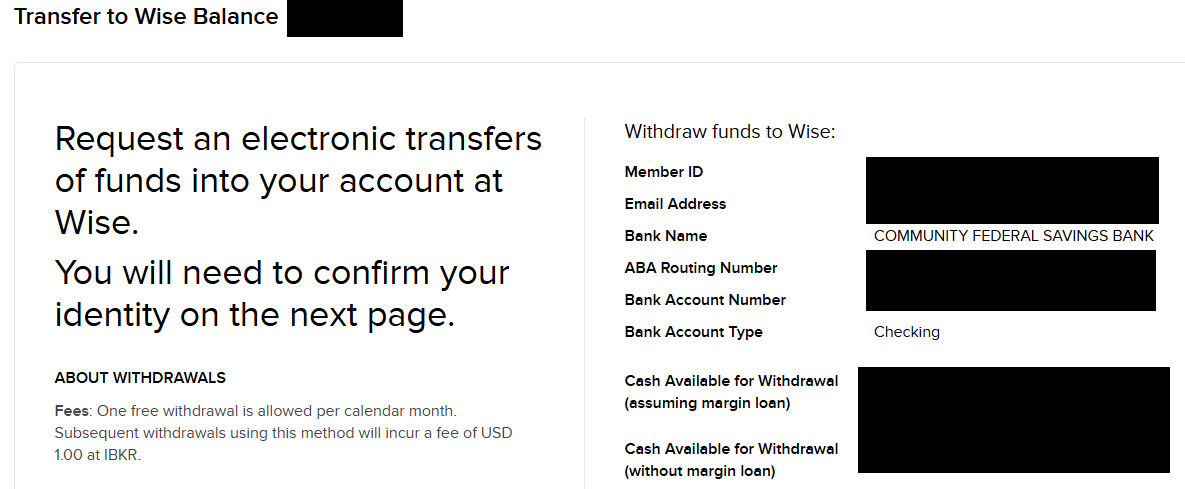

- can send to IBKR directly for free. if you send USD to IBKR, wise charges USD1.13 per trx

as you are on cash account, all EUR/SGD will be automatically converted by IBKR into USD for a fee of 0.03% only any EUR/SGD cash balances less than USD5 will be auto swept by IBKR into your base currency (USD) This post has been edited by Medufsaid: Dec 26 2024, 01:30 PM

|

|

|

|

|

|

Medufsaid

|

Dec 26 2024, 01:35 PM Dec 26 2024, 01:35 PM

|

|

QUOTE(Duckies @ Dec 26 2024, 01:31 PM) USD 1.13 per transaction better or 0.03% better? Hmmm let's say if I plan to invest 1k MYR. that's basic math. USD1.13 is RM5.05 0.03% of RM1,000 is RM0.30 (equivalent in EUR or USD) |

|

|

|

|

|

Medufsaid

|

Dec 26 2024, 02:47 PM Dec 26 2024, 02:47 PM

|

|

QUOTE(Medufsaid @ May 31 2024, 08:23 AM) my strategy is to buy USA etfs using recurring investment, then once a year, liquidate that ETF and buy CSPX | Month | Action | Fees | | Jan | buy USA etf | $0.35 | | Feb | buy USA etf | $0.35 | | Mar | buy USA etf | $0.35 + $0.34 (34 cents because your money in USA etf so additional 15% deduction) | | Apr | buy USA etf | $0.35 | | May | buy USA etf | $0.35 | | Jun | buy USA etf | $0.35 + $0.68 (you have twice as much money now) | | Jul | buy USA etf | $0.35 | | Aug | buy USA etf | $0.35 | | Sep | buy USA etf | $0.35 + $1.02 | | Oct | buy USA etf | $0.35 | | Nov | buy USA etf | $0.35 | | Dec | sell USA etf & buy LSE etf | $0.35 + $1.91 | | | Total fees | $8.15 |

buying purely LSE will cost you $20.40 yearly $VUSD is a distributing ETF. i recommend you just go for VUAA which is accumulating type. i recommend you buy something like $IVV/$VOO (USA based ETF) for 11 months, then sell all and buy $VUAA on the 12th month. fees for LSE etf are as below, make sure to set your pricing to tiered QUOTE(Medufsaid @ May 31 2024, 08:23 AM) use this to calculate in excel | | A | B | C | | 1 | Amount | Tiered | Fixed | | 2 | <<Enter your amount here>> | =min(max(1.7, A2 * 0.0005),39)+max(0.13, A2 * 0.000045)+0.08 | =max(4, A2 * 0.0005) |

|

|

|

|

|

|

Medufsaid

|

Dec 26 2024, 02:57 PM Dec 26 2024, 02:57 PM

|

|

QUOTE(Duckies @ Dec 26 2024, 02:53 PM) VOO is US based right? If not mistaken have to pay for the tax also which is quite high? please refer to my table, assuming you switch all from VOO to VUAA once a year, you only pay $0.34+$0.68+$1.02 aka $2.04 in taxes yearly only. u either pay that, or you can pay $11 in the form of higher transaction fees (LSE etf) to IBKR QUOTE(Duckies @ Dec 26 2024, 02:53 PM) Sorry newbie here, what is the difference between distributing ETF and accumulating ETF? They are different? |

|

|

|

|

|

Medufsaid

|

Dec 26 2024, 03:06 PM Dec 26 2024, 03:06 PM

|

|

VUAA & VUSD same tax.

just that with VUSD, the quarterly dividend will be given back to you as USD cash. then you'll have the hassle of buying back VUSD shares with the dividend cash (0.35% given back to you as cash quarterly)

|

|

|

|

|

|

Medufsaid

|

Dec 30 2024, 09:55 AM Dec 30 2024, 09:55 AM

|

|

Duckies you already know the answer to this QUOTE(Duckies @ Dec 26 2024, 01:31 PM) USD 1.13 per transaction better or 0.03% better? QUOTE(Medufsaid @ Dec 26 2024, 01:35 PM) that's basic math. USD1.13 is RM5.05 0.03% of RM1,000 is RM0.30 (equivalent in EUR or USD)

|

|

|

|

|

|

Medufsaid

|

Dec 30 2024, 10:00 AM Dec 30 2024, 10:00 AM

|

|

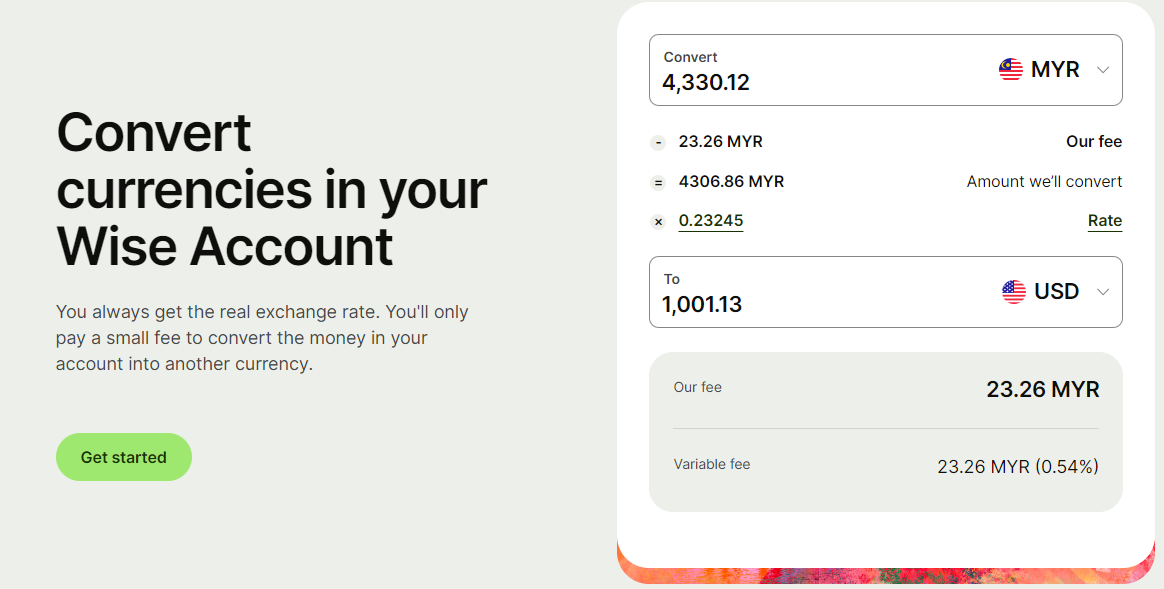

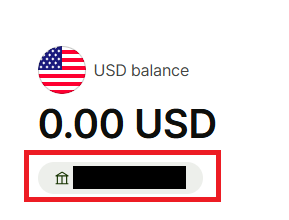

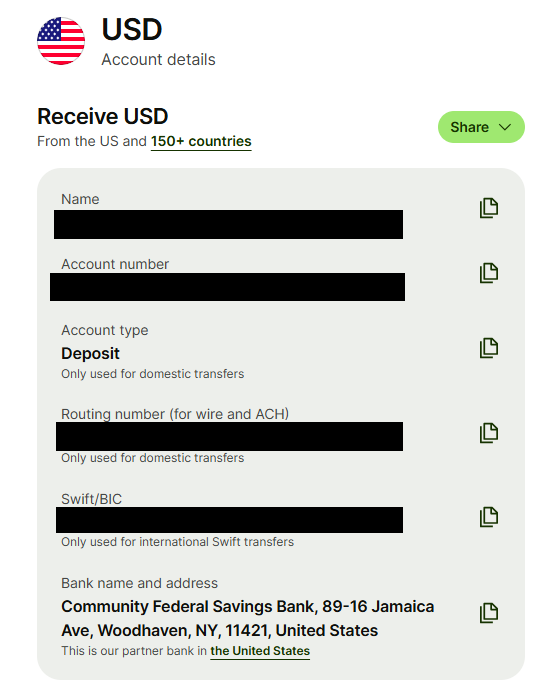

QUOTE(Duckies @ Dec 30 2024, 09:57 AM) EUR in Wise and then deposit as USD in IBKR my method is convert to EUR, send to IBKR as EUR. and use IBKR internal conversion to convert to USD for a fee of 0.03% MYR will be converted to USD within Wise, not IBKR. that's how the USD1.13 fee to enter IBKR comes about |

|

|

|

|

|

Medufsaid

|

Dec 30 2024, 06:06 PM Dec 30 2024, 06:06 PM

|

|

kanasai CIMB Malaysia? Why not open a Wise account? Can withdraw USD, convert to RM inside Wise, then transfer out to TnG ewallet

|

|

|

|

|

|

Medufsaid

|

Dec 31 2024, 12:44 PM Dec 31 2024, 12:44 PM

|

|

kanasai wise very fast to open and validate acct. That's why I suggested that rather than open Cimb sg

If you opened yesterday, can already withdraw yesterday

This post has been edited by Medufsaid: Dec 31 2024, 12:54 PM

|

|

|

|

|

|

Medufsaid

|

Jan 1 2025, 11:23 AM Jan 1 2025, 11:23 AM

|

|

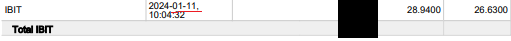

NothinUnusual you'll notice that beside 0.54% fee, there's additional USD1.13 deducted (haven't factor in the 5.5% that IBKR will charge you) https://wise.com/my/pricing/hold-fees?sourc...getCurrency=USD QUOTE(Medufsaid @ Sep 16 2024, 12:49 AM) let me use USD1,000 as an example the cheaper way to send USD from wise to IBKR is via ACH, you'll only need to fork out RM4,330.12 » Click to show Spoiler - click again to hide... « "2 units of VUAA it has USD 1.7" yes it's correct as you are buying LSE stocks where min charge is USD1.70-1.90 to get charged more that that you need to buy more than USD3k worth of stocks This post has been edited by Medufsaid: Jan 1 2025, 11:28 AM

|

|

|

|

|

|

Medufsaid

|

Jan 1 2025, 11:45 AM Jan 1 2025, 11:45 AM

|

|

NothinUnusual you are paying USD1.13 extra bro. that's RM5. USD100 becomes USD101.13, USD1,000 becomes USD1001.13 (you'll still only get USD100 and USD1,000 respectively). if you send EUR, you only need to send EUR1,000. not EUR1,001.13

This post has been edited by Medufsaid: Jan 1 2025, 11:57 AM

|

|

|

|

|

|

Medufsaid

|

Jan 2 2025, 08:27 PM Jan 2 2025, 08:27 PM

|

|

JusticeLeagueMY as long as the account holder name is identical, no issues if withdraw to Singapore bank.

you'll receive a warning if you used IBKR purely to exchange money (i.e., deposit to IBKR, straightaway change currency, straightaway withdraw). if you've been trading for some time, then convert from USD to SGD & withdraw, it's fine

|

|

|

|

|

|

Medufsaid

|

Jan 2 2025, 08:53 PM Jan 2 2025, 08:53 PM

|

|

JusticeLeagueMY deposited via wise, withdraw to SG bank account. no issues, and not direct forex convert+withdraw

|

|

|

|

|

|

Medufsaid

|

Jan 5 2025, 02:25 PM Jan 5 2025, 02:25 PM

|

|

|

|

|

|

|

Nov 27 2024, 10:37 PM

Nov 27 2024, 10:37 PM

Quote

Quote

0.0298sec

0.0298sec

0.86

0.86

7 queries

7 queries

GZIP Disabled

GZIP Disabled