Outline ·

[ Standard ] ·

Linear+

Interactive Brokers (IBKR), IBKR users, welcome!

|

SUSTOS

|

Jul 3 2024, 12:24 PM Jul 3 2024, 12:24 PM

|

|

FT Opinion | Technology sector Forget radical honesty — Big Tech revisits its corporate culture As the sector ages, markers of traditional hierarchy are creeping in by ELAINE MOORE https://archive.ph/ghQqo |

|

|

|

|

|

SUSTOS

|

Jul 4 2024, 12:20 AM Jul 4 2024, 12:20 AM

|

|

Reuters Breakingviews Guest view: Blame poor audits on absent investors By Natasha Landell-Mills https://www.reuters.com/breakingviews/guest...ors-2024-07-03/ |

|

|

|

|

|

SUSTOS

|

Jul 4 2024, 02:42 PM Jul 4 2024, 02:42 PM

|

|

FT Opinion | Lex Amazon should not join Shein and Temu’s race to the bottom With the US group facing antitrust lawsuits on both sides of the Atlantic, better to let challengers flame out in a bid for market share https://archive.ph/yryiF-------------------------- FT Opinion | Equities AI glitter is flattering markets The story of stocks this year is unambiguously sparkly but the mood is fragile by KATIE MARTIN https://archive.ph/18OqgThis post has been edited by TOS: Jul 4 2024, 02:43 PM |

|

|

|

|

|

SUSTOS

|

Jul 6 2024, 10:54 PM Jul 6 2024, 10:54 PM

|

|

QUOTE(MrBaba @ Jul 6 2024, 08:35 PM) How to convert SGD to USD in ibkr account ? Hi, do you convert for the sake of buying shares/bonds etc. in IBKR? If so you may just make use of IBKR's auto FX conversion feature and save 2 USD for each manual conversion (ala Medufsad's post above). |

|

|

|

|

|

SUSTOS

|

Jul 8 2024, 12:23 PM Jul 8 2024, 12:23 PM

|

|

Big news, ladies and gentlemen! Big news. I don't understand why but I managed to transfer 4721.28 USD from IBKR to my DBS SG USD FD account without paying a single cent of correspondence bank fee to JP Morgan.Money moved out on 3rd July 2024, received at DBS SG bank just after noon today. The value date at DBS side is 8th July though IBKR side says it's 5th of July.   ---------------------------------------- My last wire transfer to DBS SG USD FD account was in December 2022, back then JP Morgan charged a 10 USD correspondent bank fee... This time no more!  This post has been edited by TOS: Jul 8 2024, 12:25 PM This post has been edited by TOS: Jul 8 2024, 12:25 PM |

|

|

|

|

|

SUSTOS

|

Jul 8 2024, 05:38 PM Jul 8 2024, 05:38 PM

|

|

QUOTE(harmonics3 @ Jul 8 2024, 05:13 PM) You transferred to DBS USD fixed deposit account? Have you tried DBS multi currency My Account? Yo bro. Long time no see.  Yes I transferred to DBS Fixed Deposit account. I don't transfer to DBS MCA My account. That will surely kena charged 10 SGD by DBS. https://www.dbs.com.sg/personal/support/ban...nd-charges.htmlThey call it "Handling Commission Fee" which is waived for Treasures Customers (and I am not one of their Treasures Customers). Anyway, I intend to place a USD FD with the proceeds from IBKR, so I am glad that the back office at DBS SG automatically open a 1-month USD FD for my entrance fund. The auto 1-month FD tenure selection has not changed from last deposit in Dec 2022, so this is expected. The only thing you need to change is the maturity instructions (the default instruction is auto-renew principal + interests and you can change it to withdraw principal + interests or renew principal + withdraw interests). This post has been edited by TOS: Jul 8 2024, 08:03 PM |

|

|

|

|

|

SUSTOS

|

Jul 8 2024, 08:13 PM Jul 8 2024, 08:13 PM

|

|

Finished 700 pages in 48 hours! This book documents the rise of index funds and ETFs, detailing how Vanguard and Blackrock iShares came into being. https://buzzgenius2.medium.com/summary-of-t...ed-70c8e0fb4644https://blogs.lse.ac.uk/lsereviewofbooks/20...n-wigglesworth/--------------------------- Old classic I found the famous July 2nd, 2015 article by WSJ which stunned the whole Malaysia back then: https://www.wsj.com/articles/malaysian-inve...share_permalinkAnd some interesting diagrams: https://www.wsj.com/graphics/1mdb-money-flow/-------------------------------------- Hint: You can find both books online (for free...  ) This post has been edited by TOS: Jul 8 2024, 08:33 PM |

|

|

|

|

|

SUSTOS

|

Jul 8 2024, 09:39 PM Jul 8 2024, 09:39 PM

|

|

QUOTE(langstrasse @ Jul 8 2024, 09:34 PM) » Click to show Spoiler - click again to hide... «

Thanks for sharing so much material, do you read on mobile/tablet/laptop? I borrowed the hardcopies from the Seberang Jaya library in Penang. Still have 1000 pages more to go   |

|

|

|

|

|

SUSTOS

|

Jul 9 2024, 07:27 PM Jul 9 2024, 07:27 PM

|

|

QUOTE(jas029 @ Jul 9 2024, 04:29 PM) trillions - got the softcopy? hehe  Free ebooks can be found on shadow libraries like Libgen, Anna's Archive, and zlibrary. Research papers can be found on Sci-Hub. This should be open secret for most people by now... |

|

|

|

|

|

SUSTOS

|

Jul 10 2024, 01:17 PM Jul 10 2024, 01:17 PM

|

|

FT Private credit A borrower’s struggles highlight risk lurking in a surging corner of finance Investors face a wide-ranging estimate of losses on loans to Pluralsight after demand for its training videos fell by Eric Platt and Amelia Pollard in New York (AN HOUR AGO) https://www.ft.com/content/b10dbb08-c745-40...fc-9b4024f1fd10https://archive.ph/9WI7D (no paywall) ----------------------- FT UBS Group AG How UBS fell out with Switzerland’s establishment after rescuing Credit Suisse Bank’s leaders and financial officials clashed over issues from capital requirements to Sergio Ermotti’s pay by Owen Walker, European Banking Correspondent (AN HOUR AGO) https://www.ft.com/content/a2ff49db-6c3f-4a...89-386c7159fcc9https://archive.ph/6nxdz (no paywall) This post has been edited by TOS: Jul 10 2024, 01:20 PM |

|

|

|

|

|

SUSTOS

|

Jul 10 2024, 05:18 PM Jul 10 2024, 05:18 PM

|

|

Business Korea: Samsung Electronics Faces Yield Challenges with Exynos 2500, Considers MediaTek for Galaxy S25 https://www.businesskorea.co.kr/news/articl...ml?idxno=220859 |

|

|

|

|

|

SUSTOS

|

Jul 12 2024, 05:51 PM Jul 12 2024, 05:51 PM

|

|

FT Opinion | Lex Private assets create an information void where mischief can thrive Pluralsight lender group marked debts at seemingly implausible highs https://www.ft.com/content/070df4bb-b7b3-4b...c0-914111fd397ahttps://archive.ph/XkYY5The said paper can be found on SSRN preprint server here: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4879742This post has been edited by TOS: Jul 12 2024, 05:53 PM |

|

|

|

|

|

SUSTOS

|

Jul 14 2024, 08:19 AM Jul 14 2024, 08:19 AM

|

|

FT Opinion: On Wall Street Excesses of cheap money era are provoking ‘creditor-on-creditor violence’ Investors pay the price for flocking to so-called cov-lite leveraged loans with reckless abandon by WILLIAM COHAN (The writer is a former investment banker and author of ‘Power Failure: The Rise and Fall of an American Icon’) https://archive.ph/Vse9X |

|

|

|

|

|

SUSTOS

|

Jul 18 2024, 01:32 PM Jul 18 2024, 01:32 PM

|

|

|

|

|

|

|

|

SUSTOS

|

Jul 18 2024, 02:37 PM Jul 18 2024, 02:37 PM

|

|

Novartis results: https://www.novartis.com/investorsRoche and Nestle reporting next Thursday (25th July) around 2pm GMT/UTC +8. This post has been edited by TOS: Jul 18 2024, 02:47 PM |

|

|

|

|

|

SUSTOS

|

Jul 19 2024, 01:21 PM Jul 19 2024, 01:21 PM

|

|

Time to ask your kid to study law (in the UK lol ) FT The Big Read | Legal services How US law firms shook up the UK’s ‘magic circle’ On the coat-tails of a private equity boom, American partnerships are bringing a long-hours, high-pay culture to the City https://archive.ph/xfd2Z |

|

|

|

|

|

SUSTOS

|

Jul 19 2024, 07:46 PM Jul 19 2024, 07:46 PM

|

|

QUOTE(Eugenet @ Jul 19 2024, 05:57 PM) Error: The min cashOrderQty for money market fund is 10000I store idle USD at a money market fund. Returns should be similar to ETFs like BILL, SGOV or IB01. The benefit is you don't have to deal with transaction costs when buying/selling. Also, there are no withholding tax. I have made additional unit purchases as little as US$37 (yes, just thirty seven dollars). But today I found that IBKR has imposed a purchase minimum of US$10,000. Here's a Reddit discussion on this subject. https://www.reddit.com/r/interactivebrokers...market_fund_is/Cash management is an important tool at a brokerage and IBKR has been weak at it. Today they have just made themselves that much worse. You can still use BIL ETF for parking temporary funds no? You don't need to buy/sell every month, the 30% WHT will be refunded to you the February of the subsequent year. |

|

|

|

|

|

SUSTOS

|

Jul 20 2024, 02:31 PM Jul 20 2024, 02:31 PM

|

|

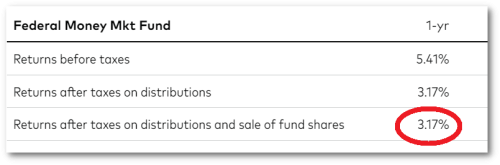

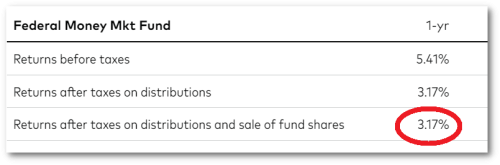

QUOTE(Eugenet @ Jul 20 2024, 02:06 PM) This week I have $139 left after a trade. I can probably buy 1 share of BIL but it'll incur $0.35. Previously I can just buy $139 of my money market fund. No taxes and no transaction cost. If I receive $30 dividends, I can just add $30 to the fund. But now I can't because of the $10,000 minimum. VMFXX appears to incur taxes. It doesn't look pretty after tax. See below. Anyway, IBKR now requires $10,000 for any money market buy transaction so it won't work.  I see. Thanks for the clarifications. Maybe they wanna bully retail investors... |

|

|

|

|

|

SUSTOS

|

Jul 23 2024, 09:13 PM Jul 23 2024, 09:13 PM

|

|

QUOTE(cweng93 @ Jul 23 2024, 08:49 PM) Did you all get requested for Proof of Source of Wealth-Individual-Income while opening account in IBKR? Asking to provide either bank statement or pay slip in last 6 months. Yep, just submit your bank documents, EPF and ASNB account statements together with other proof of wealth that you have. Explain to them what EPF and ASNB are since they may not be familiar with Malaysia's pension system and the "unique" fixed price unit trusts. |

|

|

|

|

|

SUSTOS

|

Jul 23 2024, 09:44 PM Jul 23 2024, 09:44 PM

|

|

QUOTE(john123x @ Jul 23 2024, 09:16 PM) my experience. i submitted my epf and asw statement, and they rejected me Uhm I opened my account just after the pandemic started... somewhere like March-April 2020... I told them I will just buy blue chip stocks and stick to good quality companies and told them those battered down stock prices on SGX and NYSE are eye-watering  Maybe you lack a sweet mouth.  This time you can tell them, uhmm I bet US election results will make market more volatile... if stock prices tank, can generate some alpha  |

|

|

|

|

Jul 3 2024, 12:24 PM

Jul 3 2024, 12:24 PM

Quote

Quote

0.0412sec

0.0412sec

0.77

0.77

7 queries

7 queries

GZIP Disabled

GZIP Disabled