UCITS investors beware.

Mismatches as a result of the US transition to T+1 settlement next year will particularly affect ETFs, observers say

The burden will fall heavily on overseas ETFs that invest in US securities © Getty Images

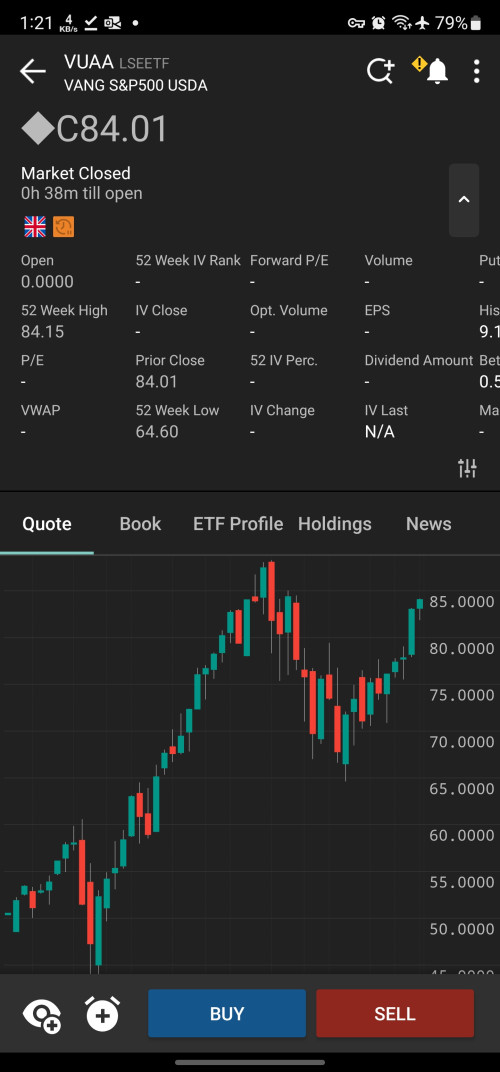

Exchange traded fund industry participants are bracing themselves to take on a costly transfer of risk from US retail brokers, such as Robinhood, when the US unilaterally implements T+1 settlement in May next year.

The move, which will reduce the standard US trade settlement cycle of two business days to just one for all securities (US Treasuries already settle on T+1), would reduce “credit, market and liquidity risks” for market participants, according to the US Securities and Exchange Commission.

But critics said the additional costs this will create for many ETFs, including US ETFs with exposure to overseas markets, will disproportionately be borne by non-US investors because most of the rest of the world will continue to operate on a T+2 basis.

Among those critics is the European Fund and Asset Management Association.

Susan Yavari, senior regulatory policy adviser at Efama, said ETFs were particularly exposed to the coming mismatch because of the way they work and referred to the heavy burden being borne by investors outside the US. Efama’s data suggests 42 per cent of the assets of Ucits equity funds are invested in US equities.

In contrast, just a sixth of the holdings of US equity funds are estimated to be invested overseas.

ETFs rely on a primary market of so-called authorised participants who make their money by looking for arbitrage opportunities between the price of an ETF’s underlying securities and the price of the ETF itself.

Investors in ETFs participate in a secondary market trading of the shares of ETFs that the APs create. When T+1 is implemented, European-listed ETFs, for example, will settle in T+2, but any US-domiciled securities they hold will settle a day earlier.

As Yavari explained, on creation of ETF shares, faced with the coming timing mismatch, the authorised participant will step in and fund the position for a day, passing on the cost to the end investor through wider spreads, or the ETF issuer will rely on an overdraft with a broker to still settle on T+1.

“Either way, the shortage of funding will incur a cost, ultimately borne by the investor,” Yavari said.

The change to shorter settlement has been mooted since the meme stock frenzy in January 2021. Retail brokers scrambled to meet sharply elevated collateral obligations sparking regulatory concerns.

“I understand the rationale for risk reduction and improving margin efficiencies. In the specific case of ETFs, however, I personally don’t believe this will make much difference to overall ETF adoption or liquidity, and the pains may outweigh the benefits for some time,” said Joachim Tigler, who until recently was head of ETF trading at ADG Securities, a specialist ETF market maker.

The pains would also stretch to foreign exchange markets, explained Adam Conn, head of trading at Baillie Gifford.

At present, many managers based outside the US complete trade matching processes and then generate and execute settlement of FX orders on T+1. This process ensures payment can be actually completed by T+2.

To do this, managers tend to use CLS Bank, the primary operator of payment-to-payment platforms.

“The need to execute settlement FX between the close of the North American equity markets [4pm EST] and custodian cut-off times, which can be as early as 4.30pm, dramatically reduces the ability to settle through CLS,” said Conn, adding that this situation was likely to lead to an increase in bilaterally settled trades .

“Trading outside of a payment-versus-payment netting platform carries a greater operating and settlement risk,” Conn added.

On top of the increased trading costs, come operational headaches, the cost of which will also eventually be passed to end investors.

As Yavari explained: “It goes without saying that EU firms will have to extend working hours either through night desks in Europe or expanded operations in US to cater to all the cut-off times happening on T+1.”

For managers based in Asia, trying to settle within US T+1 when they have started their day much earlier — Australia is 14 hours ahead of EST and Hong Kong 12 hours — the challenge might be insurmountable.

“It is likely there will be an increase in failed trades for APAC-based investors transacting in US ETFs following the move to T+1, which is purely a timezone issue,” said Jim Goldie, a regional head of capital markets for ETFs at Invesco.

Goldie played down some of the concerns expressed by his peers. While he agreed that brokers in the EU would have long exposure to an ETF for a day and have to fund that position, or hedge the position to align settlement between primary and secondary market trades, he thought costs would be a “fraction of a basis point per day”, which would be worn by the broker or “baked into the spreads they show investors”.

But he agreed the biggest burden would be felt outside the US. “There is a larger proportion of [European] Ucits AUM invested in US securities, relative to US ETFs tracking international securities,” he said.

For Yavari, the potential fall-out is hard to predict. “There will definitely be an increase in the overall cost of trading for EU funds,” she said. “There may also be an impact on the appeal of US securities, given all the associated issues, from an EU perspective.”

The Investment Association, which represents UK investment managers, said: “The shift to T+1 will see the timelines and ability to settle FX trades become more constrained, particularly for UK and Europe-based firms managing on behalf of investors in the Asia-Pacific region. We are working with our members to explore practical solutions to this challenge.”

thread.

Jul 14 2023, 10:07 AM

Jul 14 2023, 10:07 AM

Quote

Quote

0.0668sec

0.0668sec

1.15

1.15

7 queries

7 queries

GZIP Disabled

GZIP Disabled