QUOTE(Level 60 Wizard @ Aug 9 2019, 11:15 AM)

Wait I go find back my excel fileCar Loan: 6 years or 9 years?, Which will you pick?

Car Loan: 6 years or 9 years?, Which will you pick?

|

|

Aug 9 2019, 11:21 AM Aug 9 2019, 11:21 AM

|

All Stars

28,075 posts Joined: Aug 2009 |

|

|

|

|

|

|

Aug 9 2019, 12:19 PM Aug 9 2019, 12:19 PM

|

All Stars

28,075 posts Joined: Aug 2009 |

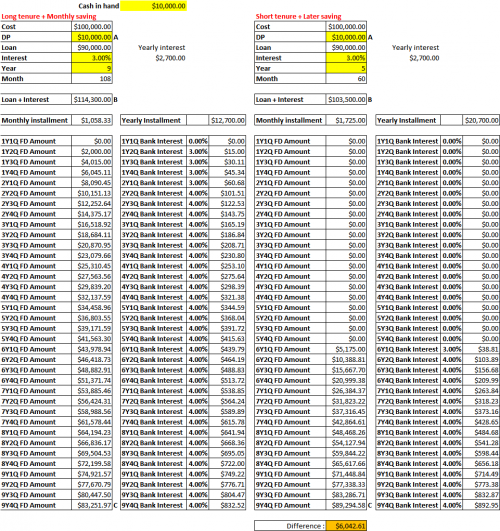

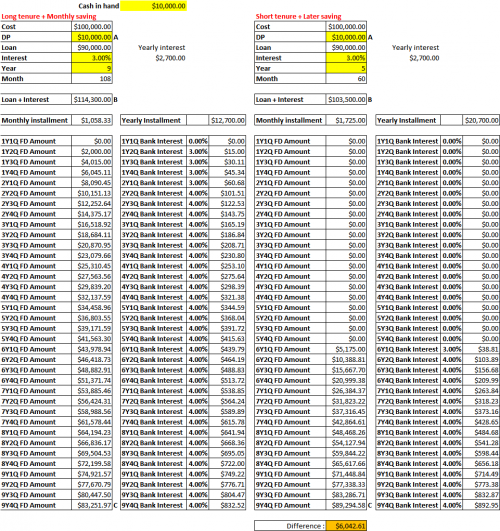

Following the link for the car price, DP, interest rate, I make a comparison between 9 years vs 5 years loan. The difference of money will be put into FD. Click the picture to see it more clearly

After 9 years the difference is you will have less six thousand ringgit if you were to take 9 years loan. Spread out by 9 years that is RM671 per year. If you put it to other type of fund/investment that give higher rate then the difference will be smaller. Usually for shorter term the interest rate is higher than longer term. The pros that I can think of for 5 years loan is you have extra 6k, if you were to trade in your car at 6th year, you will have the car value at that time as your DP + 5k cash whereas if 9 years loan after deduct all your saving you might need to top up 3k to 4k to clear your loan. The pros for 9 years loan is like you mentioned, inflation. Also as the link mention if you want to buy property. Additionally during the first 5 years you will have more extra money in your saving for emergency or opportunity use. You will less likely want to change car because still serving the loan. |

|

|

Aug 9 2019, 03:09 PM Aug 9 2019, 03:09 PM

|

Junior Member

136 posts Joined: Jul 2019 |

QUOTE(nuvi @ Aug 9 2019, 12:19 PM) Following the link for the car price, DP, interest rate, I make a comparison between 9 years vs 5 years loan. The difference of money will be put into FD. Click the picture to see it more clearly Wow  After 9 years the difference is you will have less six thousand ringgit if you were to take 9 years loan. Spread out by 9 years that is RM671 per year. If you put it to other type of fund/investment that give higher rate then the difference will be smaller. Usually for shorter term the interest rate is higher than longer term. The pros that I can think of for 5 years loan is you have extra 6k, if you were to trade in your car at 6th year, you will have the car value at that time as your DP + 5k cash whereas if 9 years loan after deduct all your saving you might need to top up 3k to 4k to clear your loan. The pros for 9 years loan is like you mentioned, inflation. Also as the link mention if you want to buy property. Additionally during the first 5 years you will have more extra money in your saving for emergency or opportunity use. You will less likely want to change car because still serving the loan. |

|

|

Aug 10 2019, 12:41 AM Aug 10 2019, 12:41 AM

|

Senior Member

6,462 posts Joined: Nov 2004 From: [Latitude-N3°9'25"] [Longitude-E101°42'45"] |

QUOTE(Level 60 Wizard @ Aug 9 2019, 11:14 AM) the monthly money saved between 6yrs and 9 is very very small sum Not sure small sum or not, I'm paying close to 1.9k/month for 5 years. Car is 8 years now, so I've been saving 36 months x 1.9k = 68.4kit probably cant even be enough for you to go travel europe there's a thread in /k that compared between those 2, with the additional money from high/low DP put into bank for interest and see which one yields better/more return Except regular maintenance, the only major service I spent is 4k recently only, rather than changing a new car and keep paying installment. BTW, just back from europe » Click to show Spoiler - click again to hide... « Lucky didn't die like king of random » Click to show Spoiler - click again to hide... « Kucing kata jangan » Click to show Spoiler - click again to hide... « This post has been edited by cute_boboi: Aug 10 2019, 12:50 AM |

|

|

Aug 10 2019, 08:53 AM Aug 10 2019, 08:53 AM

Show posts by this member only | IPv6 | Post

#45

|

Senior Member

4,482 posts Joined: Jul 2005 |

Already decided when i need a car I'll go for the Renault captur subscription. Hassle free.

|

|

|

Aug 10 2019, 12:48 PM Aug 10 2019, 12:48 PM

|

Junior Member

532 posts Joined: Jan 2019 |

I would always go for 9 years.

It does not matter if i use the car for 3 or 5 years. What i save from the monthly payment I put into investments that have returns higher than the car loan effective interest rate. |

|

|

|

|

|

Aug 11 2019, 12:07 AM Aug 11 2019, 12:07 AM

Show posts by this member only | IPv6 | Post

#47

|

Junior Member

804 posts Joined: May 2010 |

I prefer 7 years. The monthly instalment is not too much like 5 years, while the time it takes to settle the loan is not too long like 9 years. If I wanna change car after 5 years, it is very likely that the sale price will be slightly more than the outstanding amount of the loan, so I don’t have to touch my savings to pay the DP of next car.

|

|

|

Aug 11 2019, 08:30 AM Aug 11 2019, 08:30 AM

|

Senior Member

2,275 posts Joined: Jun 2010 |

If can, drag 11 years. Janji YOLO

|

|

|

Aug 11 2019, 08:40 AM Aug 11 2019, 08:40 AM

|

Senior Member

5,909 posts Joined: Jan 2006 From: 06.02.58.44.23.08.03 |

9 years is not bad what. Put higher downpayment. At 5th yeara if you are comfortable with the car snd decide to keep driving or you want to sell, settle the loan and get some rebates.

Isnt extra downpayment + get rebate = means total interest rate and monthly payment pretty much more or less like 5 years loan. Maybe somebody can share the spreadsheet to compare This post has been edited by maxizanc: Aug 11 2019, 08:41 AM |

|

|

Aug 11 2019, 07:00 PM Aug 11 2019, 07:00 PM

Show posts by this member only | IPv6 | Post

#50

|

Senior Member

2,065 posts Joined: Oct 2014 From: Ipoh,Perak |

QUOTE(cute_boboi @ Aug 10 2019, 12:41 AM) Not sure small sum or not, I'm paying close to 1.9k/month for 5 years. Car is 8 years now, so I've been saving 36 months x 1.9k = 68.4k 1.9k interest a month r? You only save on interest. You took a 5 or 7 or 9 year loan your principal loan remains the same. |

|

|

Aug 11 2019, 07:05 PM Aug 11 2019, 07:05 PM

|

Senior Member

6,639 posts Joined: Jan 2003 From: "New Castle" |

Buy lightly used car? Or just 3 year old used car? Save a lot actually

|

|

|

Aug 11 2019, 07:05 PM Aug 11 2019, 07:05 PM

|

Senior Member

6,462 posts Joined: Nov 2004 From: [Latitude-N3°9'25"] [Longitude-E101°42'45"] |

QUOTE(rapple @ Aug 11 2019, 07:00 PM) 1.9k interest a month r? You only save on interest. You took a 5 or 7 or 9 year loan your principal loan remains the same. |

|

|

Aug 11 2019, 07:25 PM Aug 11 2019, 07:25 PM

Show posts by this member only | IPv6 | Post

#53

|

Senior Member

2,065 posts Joined: Oct 2014 From: Ipoh,Perak |

QUOTE(cute_boboi @ Aug 11 2019, 07:05 PM) But from year 6 onwards, I don't need to pay installment anymore and that's the monthly amount I'm saving, for a Europe trip as someone suggested above Your savings calculation is still not right. You still pay 100k over 5 years for that car vs the guy who is still paying the 9 year loan + more interest. At the end of the day, you only save the extra 4 year loan interest.You only have more cash flow after 5 years whether you save or not is your issue. Your income will not increase in the 6th year because you have finish paying off your 5 year car loan. This post has been edited by rapple: Aug 11 2019, 07:27 PM |

|

|

|

|

|

Aug 11 2019, 07:48 PM Aug 11 2019, 07:48 PM

Show posts by this member only | IPv6 | Post

#54

|

Senior Member

2,065 posts Joined: Oct 2014 From: Ipoh,Perak |

QUOTE(maxizanc @ Aug 11 2019, 08:40 AM) 9 years is not bad what. Put higher downpayment. At 5th yeara if you are comfortable with the car snd decide to keep driving or you want to sell, settle the loan and get some rebates. Interest is calculated based on rule of 78. You pay more interest early on and lesser towards end of loan tenure.Isnt extra downpayment + get rebate = means total interest rate and monthly payment pretty much more or less like 5 years loan. Maybe somebody can share the spreadsheet to compare Lazy to upload file but with a 9 year loan tenure for 15k total interest to be paid. At the end of the 5th year, the interest remain to be paid is only around 1.6k+ but principal loan balance still around 25k left to be paid. For me I will put the 25k put in ASNB. |

|

|

Aug 11 2019, 07:57 PM Aug 11 2019, 07:57 PM

|

Senior Member

6,462 posts Joined: Nov 2004 From: [Latitude-N3°9'25"] [Longitude-E101°42'45"] |

QUOTE Most new cars nowadays got a lot of engine issues after 5 years. So its better take 5 years or lower loan. Incase u have to dump the car after the warranty period ends QUOTE(rapple @ Aug 11 2019, 07:25 PM) Your savings calculation is still not right. You still pay 100k over 5 years for that car vs the guy who is still paying the 9 year loan + more interest. At the end of the day, you only save the extra 4 year loan interest. The initial question is to choose shorter or longer loan tenure, in case to dump car after warranty. Not about the interest paid.You only have more cash flow after 5 years whether you save or not is your issue. Your income will not increase in the 6th year because you have finish paying off your 5 year car loan. So imagine if dump the car at 5th year after warranty. I do not need to top up, but I'm getting back money for selling the car. Imagine if you loan 9 years, dump at 5th year, what is the calculation ? It's a trap to twist the presentation by car salesman for someone who may not be financially sound. A more proper advise is to choose a cheaper car that can pay in 5 years loan, rather than max it out for a more expensive car at 9 years loan. My income did not increase (assuming I'm not getting increment or business profit), but my saving/spending power increases for other things in life. I'm not tied down in car loan continuously, that's an expense. |

|

|

Aug 11 2019, 09:03 PM Aug 11 2019, 09:03 PM

Show posts by this member only | IPv6 | Post

#56

|

Senior Member

2,065 posts Joined: Oct 2014 From: Ipoh,Perak |

QUOTE(cute_boboi @ Aug 11 2019, 07:57 PM) The initial question is to choose shorter or longer loan tenure, in case to dump car after warranty. Not about the interest paid. Dump at 6th year and loan again? How much is the maintenance of the car after warranty is over to justify to buy a new car again? How would you know the guy with a 9 year loan need to top up to settle loan? So imagine if dump the car at 5th year after warranty. I do not need to top up, but I'm getting back money for selling the car. Imagine if you loan 9 years, dump at 5th year, what is the calculation ? It's a trap to twist the presentation by car salesman for someone who may not be financially sound. A more proper advise is to choose a cheaper car that can pay in 5 years loan, rather than max it out for a more expensive car at 9 years loan. My income did not increase (assuming I'm not getting increment or business profit), but my saving/spending power increases for other things in life. I'm not tied down in car loan continuously, that's an expense. How is that financially sound to you to sell and buy car again? You might as well pay upfront cash and tell me it's a ONE off car expenses. Travelling to Europe, bank interest and maintenance of the car is an expense. Car loan for me is not because car it's an asset to me. Car enables me to meet or work with people in different places to generates more income. People who spend beyond their means its destined to doom financially be it for car loan or any credit facility because they didnt have a plan regardless it's a short or long loan tenure. |

|

|

Aug 11 2019, 09:11 PM Aug 11 2019, 09:11 PM

|

Senior Member

6,462 posts Joined: Nov 2004 From: [Latitude-N3°9'25"] [Longitude-E101°42'45"] |

QUOTE(rapple @ Aug 11 2019, 09:03 PM) Dump at 6th year and loan again? How much is the maintenance of the car after warranty is over to justify to buy a new car again? How would you know the guy with a 9 year loan need to top up to settle loan? Can't answer your question though, I didn't dump at 5th year. It's not financially sound to me to do that, nor is it financially sound to me for a car loan >5 years. How is that financially sound to you to sell and buy car again? You might as well pay upfront cash and tell me it's a ONE off car expenses. Travelling to Europe, bank interest and maintenance of the car is an expense. Car loan for me is not because car it's an asset to me. Car enables me to meet or work with people in different places to generates more income. People who spend beyond their means its destined to doom financially be it for car loan or any credit facility because they didnt have a plan regardless it's a short or long loan tenure. |

|

|

Aug 12 2019, 05:11 PM Aug 12 2019, 05:11 PM

Show posts by this member only | IPv6 | Post

#58

|

Senior Member

2,706 posts Joined: Jan 2009 From: Malaysia. |

QUOTE(rapple @ Aug 11 2019, 07:48 PM) Interest is calculated based on rule of 78. You pay more interest early on and lesser towards end of loan tenure. Is this rule of 78 applied generally across all bankers in Malaysia? If the rule of 78 applies, meaning you will opt for shorter duration if loan period?Lazy to upload file but with a 9 year loan tenure for 15k total interest to be paid. At the end of the 5th year, the interest remain to be paid is only around 1.6k+ but principal loan balance still around 25k left to be paid. For me I will put the 25k put in ASNB. |

|

|

Aug 12 2019, 09:57 PM Aug 12 2019, 09:57 PM

Show posts by this member only | IPv6 | Post

#59

|

Senior Member

2,065 posts Joined: Oct 2014 From: Ipoh,Perak |

QUOTE(crazycrazyman @ Aug 12 2019, 05:11 PM) Is this rule of 78 applied generally across all bankers in Malaysia? If the rule of 78 applies, meaning you will opt for shorter duration if loan period? Personal loan and car loan uses this method.Whatever loan you take of course the shorter the tenure the less interest you need to pay. |

|

|

Aug 13 2019, 02:08 PM Aug 13 2019, 02:08 PM

|

Junior Member

73 posts Joined: Jan 2016 |

As Car Dealer i suggest 9 years.

U could have better cash flow means u could save more money for emergency, investment and other purpose. Nevertheless you could always do full settlement earlier, the bank will gv you discount for that |

| Change to: |  0.0208sec 0.0208sec

0.69 0.69

5 queries 5 queries

GZIP Disabled GZIP Disabled

Time is now: 19th December 2025 - 12:57 AM |