medical insurance cost sudden increase 29%, normal !?

|

|

Mar 16 2019, 05:15 PM, updated 7y ago Mar 16 2019, 05:15 PM, updated 7y ago

Show posts by this member only | Post

#1

|

Junior Member

59 posts Joined: Mar 2017 |

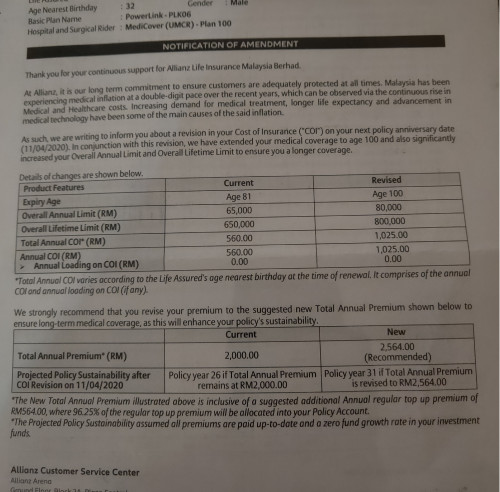

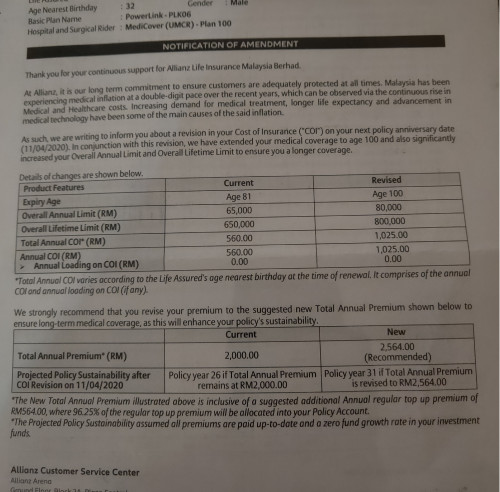

just received a letter from allianz today (2 weewks before payment due!) that my medical insurance cost had increased this year from previously rm2000 annually to rm2590 annually (29% rise!??) my policy 1st started age 26, and this year im 32. the cost only start increase this year. they can increase sesuka hati? then what's the motto of 'buy young so that cost less" is that normal? im only looking for 36 protection. how come so costly. what's my option here, can i switch to other ins company? im really fed up with allianz, my another saving plan from them also riddled with many issues. thanks for advice |

|

|

|

|

|

Mar 16 2019, 05:27 PM Mar 16 2019, 05:27 PM

Show posts by this member only | Post

#2

|

All Stars

15,192 posts Joined: Oct 2004 |

They claimed medical cost increase, so increase you lo...

|

|

|

Mar 16 2019, 05:28 PM Mar 16 2019, 05:28 PM

Show posts by this member only | Post

#3

|

Senior Member

2,223 posts Joined: Aug 2008 From: Port Klang, Selangor |

now im waiting the reply on my brother's claim on the medical.

see what's their reply now. kinda upset now. |

|

|

Mar 16 2019, 05:39 PM Mar 16 2019, 05:39 PM

Show posts by this member only | Post

#4

|

|

Staff

25,802 posts Joined: Jan 2003 From: Penang |

QUOTE(leelazens @ Mar 16 2019, 05:15 PM) my policy 1st started age 26, and this year im 32. the cost only start increase this year. Cost of insurance always rise together with age one, no such thing you buy at 26, and then when 50 time, premium is cheaper. they can increase sesuka hati? then what's the motto of 'buy young so that cost less" is that normal? im only looking for 36 protection. how come so costly. thanks for advice The more correct motto is insurance cost you less when you are young. Not when you buy or start at young, then premium will stay the same , or will cost less when you are old, this is never the case. It is a trend worldwide throughout, as more and more people getting sick due to modern life style, not so good life-style etc, that resulted people are getting sick more often. Insurance works basically like a pool of fund, everyone pay premium to be in the pool of the fund, which is used to compensate those needed one (or you can call it unfortunate one). When more and more people claims, then the pool of fund becomes not self sufficient, then insurance premium needed to be raised. Insurance industry is regulated by BNM , they also cannot simply raise the premium become extra-ordinary high and making fat profit. |

|

|

Mar 16 2019, 05:41 PM Mar 16 2019, 05:41 PM

Show posts by this member only | IPv6 | Post

#5

|

|

Elite

5,626 posts Joined: Nov 2004 From: Klang, Selangor |

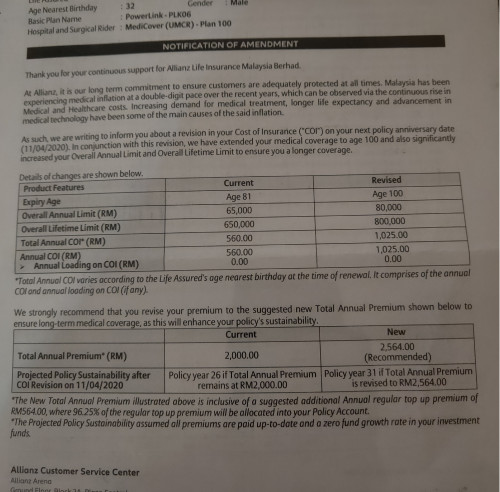

QUOTE(leelazens @ Mar 16 2019, 05:15 PM) just received a letter from allianz today (2 weewks before payment due!) that my medical insurance cost had increased this year I received the same letter as well. From my understanding, it is not forcing you to increase your premium. They are "recommending" you to increase your premium (but you need to sign a form and return it to them). If you do not opt for the increase in premium, your existing policy will still be in-force. The only benefit if you choose to increase your premium, then you will get higher annual coverage and total coverage. I believe if you policy is the same as mine, then the coverage age will be increased from the current 80 to 100.from previously rm2000 annually to rm2590 annually (29% rise!??) my policy 1st started age 26, and this year im 32. the cost only start increase this year. they can increase sesuka hati? then what's the motto of 'buy young so that cost less" is that normal? im only looking for 36 protection. how come so costly. what's my option here, can i switch to other ins company? im really fed up with allianz, my another saving plan from them also riddled with many issues. thanks for advice You can read from the comparison table that they are merely "recommending" you to opt for the increased premium. Not forcing. |

|

|

Mar 16 2019, 05:56 PM Mar 16 2019, 05:56 PM

Show posts by this member only | Post

#6

|

All Stars

11,954 posts Joined: May 2007 |

QUOTE(leelazens @ Mar 16 2019, 05:15 PM) just received a letter from allianz today (2 weewks before payment due!) that my medical insurance cost had increased this year May I know what is the plan name?from previously rm2000 annually to rm2590 annually (29% rise!??) my policy 1st started age 26, and this year im 32. the cost only start increase this year. they can increase sesuka hati? then what's the motto of 'buy young so that cost less" is that normal? im only looking for 36 protection. how come so costly. what's my option here, can i switch to other ins company? im really fed up with allianz, my another saving plan from them also riddled with many issues. thanks for advice |

|

|

|

|

|

Mar 16 2019, 05:58 PM Mar 16 2019, 05:58 PM

Show posts by this member only | Post

#7

|

Junior Member

882 posts Joined: Nov 2004 |

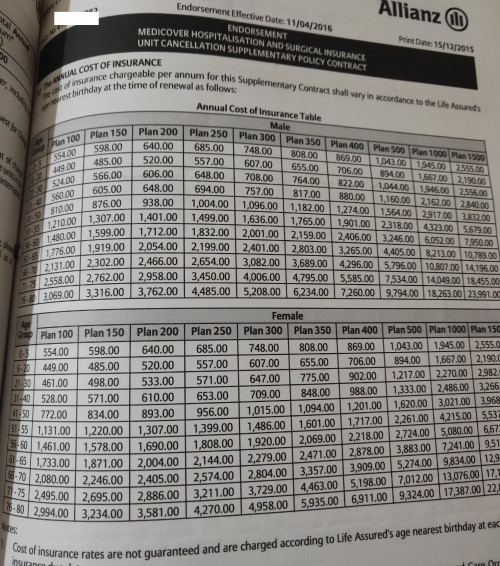

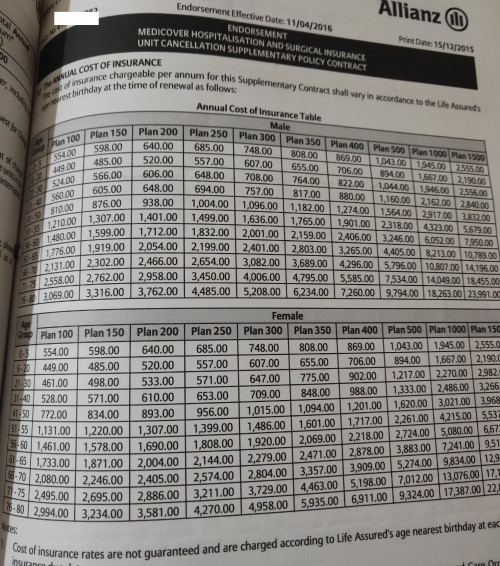

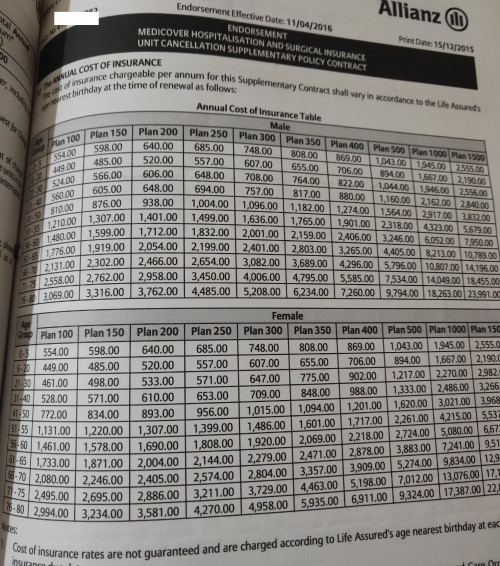

QUOTE(leelazens @ Mar 16 2019, 05:15 PM) just received a letter from allianz today (2 weewks before payment due!) that my medical insurance cost had increased this year There is a table in your policy stating the increase by age. I think you just hit a certain road map in your age.from previously rm2000 annually to rm2590 annually (29% rise!??) my policy 1st started age 26, and this year im 32. the cost only start increase this year. they can increase sesuka hati? then what's the motto of 'buy young so that cost less" is that normal? im only looking for 36 protection. how come so costly. what's my option here, can i switch to other ins company? im really fed up with allianz, my another saving plan from them also riddled with many issues. thanks for advice |

|

|

Mar 16 2019, 06:00 PM Mar 16 2019, 06:00 PM

Show posts by this member only | Post

#8

|

|

Staff

25,802 posts Joined: Jan 2003 From: Penang |

QUOTE(Jordy @ Mar 16 2019, 05:41 PM) I received the same letter as well. From my understanding, it is not forcing you to increase your premium. They are "recommending" you to increase your premium (but you need to sign a form and return it to them). If you do not opt for the increase in premium, your existing policy will still be in-force. The only benefit if you choose to increase your premium, then you will get higher annual coverage and total coverage. I believe if you policy is the same as mine, then the coverage age will be increased from the current 80 to 100. Not the same insurance company as yours.You can read from the comparison table that they are merely "recommending" you to opt for the increased premium. Not forcing. I received a letter from Gxxxx insurance company recently, that notify my medical insurance is going to increase a couple of hundreds next year. |

|

|

Mar 16 2019, 06:02 PM Mar 16 2019, 06:02 PM

Show posts by this member only | IPv6 | Post

#9

|

Junior Member

316 posts Joined: May 2015 |

It's not just Allianz, another company (Great Eastern) is also increasing premium, up about 44%, but for older plans. Seems like the cost increases could be seen industry wide. See which other companies increase.

|

|

|

Mar 16 2019, 06:05 PM Mar 16 2019, 06:05 PM

|

All Stars

48,418 posts Joined: Sep 2014 From: REality |

QUOTE(Jordy @ Mar 16 2019, 05:41 PM) I received the same letter as well. From my understanding, it is not forcing you to increase your premium. They are "recommending" you to increase your premium (but you need to sign a form and return it to them). If you do not opt for the increase in premium, your existing policy will still be in-force. The only benefit if you choose to increase your premium, then you will get higher annual coverage and total coverage. I believe if you policy is the same as mine, then the coverage age will be increased from the current 80 to 100. oh so good..You can read from the comparison table that they are merely "recommending" you to opt for the increased premium. Not forcing. just "recommending" only Mine No such thing. Straight increased.. saying that medical cost have increased... seems like Industry wide increase.. |

|

|

Mar 16 2019, 09:12 PM Mar 16 2019, 09:12 PM

|

Junior Member

59 posts Joined: Mar 2017 |

QUOTE(Jordy @ Mar 16 2019, 05:41 PM) I received the same letter as well. From my understanding, it is not forcing you to increase your premium. They are "recommending" you to increase your premium (but you need to sign a form and return it to them). If you do not opt for the increase in premium, your existing policy will still be in-force. The only benefit if you choose to increase your premium, then you will get higher annual coverage and total coverage. I believe if you policy is the same as mine, then the coverage age will be increased from the current 80 to 100. i believe ur letter and mine probably the same, but i suggest u also go 1 round allianz and ask them calculate,You can read from the comparison table that they are merely "recommending" you to opt for the increased premium. Not forcing. and note on the faq section that, if u opt not to increase the premium, your policy sustainability may have problem. for my plan, every year my premium add into some 'rider', and it keep decrease until nex year i pay again, if i dont pay the require amount, it will not have enough amount to support and hence the policy eventually will gone in some times. |

|

|

Mar 16 2019, 09:21 PM Mar 16 2019, 09:21 PM

|

Junior Member

59 posts Joined: Mar 2017 |

|

|

|

Mar 16 2019, 09:40 PM Mar 16 2019, 09:40 PM

|

All Stars

15,192 posts Joined: Oct 2004 |

QUOTE(leelazens @ Mar 16 2019, 09:12 PM) i believe ur letter and mine probably the same, but i suggest u also go 1 round allianz and ask them calculate, I think the insurance also tipu orang One.and note on the faq section that, if u opt not to increase the premium, your policy sustainability may have problem. for my plan, every year my premium add into some 'rider', and it keep decrease until nex year i pay again, if i dont pay the require amount, it will not have enough amount to support and hence the policy eventually will gone in some times. The agents earn over 30% of the premium for few years which are part of our premium |

|

|

|

|

|

Mar 16 2019, 10:24 PM Mar 16 2019, 10:24 PM

Show posts by this member only | IPv6 | Post

#14

|

Senior Member

5,586 posts Joined: Apr 2011 From: Kuala Lumpur |

QUOTE(Jordy @ Mar 16 2019, 05:41 PM) I received the same letter as well. From my understanding, it is not forcing you to increase your premium. They are "recommending" you to increase your premium (but you need to sign a form and return it to them). If you do not opt for the increase in premium, your existing policy will still be in-force. The only benefit if you choose to increase your premium, then you will get higher annual coverage and total coverage. I believe if you policy is the same as mine, then the coverage age will be increased from the current 80 to 100. Correct, medical plan repricing does not force you to increase your premium, but if you don’t your cash value will finish up quickerYou can read from the comparison table that they are merely "recommending" you to opt for the increased premium. Not forcing. QUOTE(leelazens @ Mar 16 2019, 09:21 PM) Can I know the medical card name ? Power link is the basic plan QUOTE(jack2 @ Mar 16 2019, 09:40 PM) I think the insurance also tipu orang One. Not tipu la, it’s widely known edi agents will take 6 years commissions from premium because they’ll have to service their customers The agents earn over 30% of the premium for few years which are part of our premium |

|

|

Mar 16 2019, 10:34 PM Mar 16 2019, 10:34 PM

Show posts by this member only | IPv6 | Post

#15

|

Senior Member

1,181 posts Joined: May 2005 |

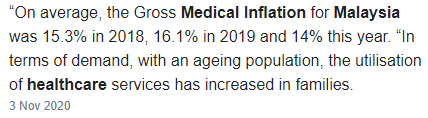

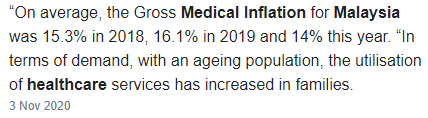

That’s why I hate ILP because the contract never address medical cost increase. My friend who is an actuarial scientist for an insurance company says they only can assume 15% cost increase for the first 3-6 years, and from there they work out the premium charge. Which mean they are assuming zero increase from 6th year onwards, which is not going to happen. But what’s certain is that the projection schedule that your lovely insurance agent shows you is fundamentally flawed and does take into consideration of a massive medical cost review. The selling point of buy young to be safe is completely flawed. contagiouseddie and Michael_Light liked this post

|

|

|

Mar 17 2019, 12:24 AM Mar 17 2019, 12:24 AM

Show posts by this member only | IPv6 | Post

#16

|

Newbie

21 posts Joined: Sep 2016 |

QUOTE(victorian @ Mar 16 2019, 10:24 PM) Correct, medical plan repricing does not force you to increase your premium, but if you don’t your cash value will finish up quicker Can I know the medical card name ? Power link is the basic plan Not tipu la, it’s widely known edi agents will take 6 years commissions from premium because they’ll have to service their customers Some insurance agent before 6 years...already quit the industry or change to another insurance company..let's say quit/changed on 3rd year....and you get referred to someone else..I assume the new guy don't get.the remaining of the commission, so face black black as they are they doing charity servicing you... My assumptions true? |

|

|

Mar 17 2019, 12:58 AM Mar 17 2019, 12:58 AM

Show posts by this member only | IPv6 | Post

#17

|

Junior Member

316 posts Joined: May 2015 |

QUOTE(peterpan888 @ Mar 17 2019, 12:24 AM) Some insurance agent before 6 years...already quit the industry or change to another insurance company..let's say quit/changed on 3rd year....and you get referred to someone else..I assume the new guy don't get.the remaining of the commission, so face black black as they are they doing charity servicing you... Unless the agent who took over is the manager of the previous/terminated agent. If is a very new agent, normally don't get commission, but insurance company can't force a new agent to take over (it's usually the upline who will get the commission of the terminated agent's cases), so face black black shouldn't happen unless is assigned by new agent's manager or customer problem.My assumptions true? |

|

|

Mar 17 2019, 07:07 AM Mar 17 2019, 07:07 AM

|

Senior Member

945 posts Joined: Jun 2012 |

Drop me a PM if you need any clarification with your insurance as I represent Allianz.

Best, Jiansheng |

|

|

Mar 17 2019, 07:40 AM Mar 17 2019, 07:40 AM

|

All Stars

11,954 posts Joined: May 2007 |

|

|

|

Mar 17 2019, 08:10 AM Mar 17 2019, 08:10 AM

|

Senior Member

1,590 posts Joined: Nov 2006 |

I got a standalone medical card from zu****

Got a letter from them stated they are going to increase the premium around 60% starting next year This post has been edited by epie: Mar 17 2019, 08:11 AM |

|

|

Mar 17 2019, 08:42 AM Mar 17 2019, 08:42 AM

|

Senior Member

5,586 posts Joined: Apr 2011 From: Kuala Lumpur |

Medical inflation is around 15% every year. So of course your insurance COI will go up as well. Insurance company will do repricing to reflect that medical inflation.

|

|

|

Mar 17 2019, 09:20 AM Mar 17 2019, 09:20 AM

|

Senior Member

785 posts Joined: Mar 2012 |

QUOTE(peterpan888 @ Mar 17 2019, 12:24 AM) Some insurance agent before 6 years...already quit the industry or change to another insurance company..let's say quit/changed on 3rd year....and you get referred to someone else..I assume the new guy don't get.the remaining of the commission, so face black black as they are they doing charity servicing you... So who will take the remain 4th to 6th year commission? No one but still being "charged" in the policy?My assumptions true? |

|

|

Mar 17 2019, 10:27 AM Mar 17 2019, 10:27 AM

|

Senior Member

5,586 posts Joined: Apr 2011 From: Kuala Lumpur |

|

|

|

Mar 17 2019, 05:32 PM Mar 17 2019, 05:32 PM

Show posts by this member only | IPv6 | Post

#24

|

|

Elite

5,626 posts Joined: Nov 2004 From: Klang, Selangor |

QUOTE(cherroy @ Mar 16 2019, 06:00 PM) Not the same insurance company as yours. A couple of hundreds? OMG! That is a hell of an increase!I received a letter from Gxxxx insurance company recently, that notify my medical insurance is going to increase a couple of hundreds next year. Is this the first time your premium is increased by them? How many years have you held this policy? QUOTE(leelazens @ Mar 16 2019, 09:12 PM) i believe ur letter and mine probably the same, but i suggest u also go 1 round allianz and ask them calculate, Yup so we have the same plan. I did not delve further as it is not that important to me anymore now.and note on the faq section that, if u opt not to increase the premium, your policy sustainability may have problem. for my plan, every year my premium add into some 'rider', and it keep decrease until nex year i pay again, if i dont pay the require amount, it will not have enough amount to support and hence the policy eventually will gone in some times. If the policy lapses once the cost overruns the premium, then so be it. I have been paying the premium for nothing as I don't use the medical anyways. QUOTE(kbandito @ Mar 16 2019, 10:34 PM) That’s why I hate ILP because the contract never address medical cost increase. This is so true. What is the point of buying early when we have low risk?My friend who is an actuarial scientist for an insurance company says they only can assume 15% cost increase for the first 3-6 years, and from there they work out the premium charge. Which mean they are assuming zero increase from 6th year onwards, which is not going to happen. But what’s certain is that the projection schedule that your lovely insurance agent shows you is fundamentally flawed and does take into consideration of a massive medical cost review. The selling point of buy young to be safe is completely flawed. Wait until high risk age baru buy more worth it, save on all thee increments |

|

|

Mar 17 2019, 06:46 PM Mar 17 2019, 06:46 PM

|

Senior Member

785 posts Joined: Mar 2012 |

|

|

|

Mar 17 2019, 06:50 PM Mar 17 2019, 06:50 PM

Show posts by this member only | IPv6 | Post

#26

|

Junior Member

375 posts Joined: Nov 2017 |

QUOTE(Jordy @ Mar 16 2019, 05:41 PM) I received the same letter as well. From my understanding, it is not forcing you to increase your premium. They are "recommending" you to increase your premium (but you need to sign a form and return it to them). If you do not opt for the increase in premium, your existing policy will still be in-force. The only benefit if you choose to increase your premium, then you will get higher annual coverage and total coverage. I believe if you policy is the same as mine, then the coverage age will be increased from the current 80 to 100. Yay it is more like a top up and coverage will increase too when sum insured increased.You can read from the comparison table that they are merely "recommending" you to opt for the increased premium. Not forcing. |

|

|

Mar 17 2019, 08:13 PM Mar 17 2019, 08:13 PM

|

All Stars

48,418 posts Joined: Sep 2014 From: REality |

|

|

|

Mar 17 2019, 09:25 PM Mar 17 2019, 09:25 PM

Show posts by this member only | IPv6 | Post

#28

|

Senior Member

1,590 posts Joined: Nov 2006 |

|

|

|

Mar 17 2019, 09:28 PM Mar 17 2019, 09:28 PM

Show posts by this member only | IPv6 | Post

#29

|

Senior Member

1,181 posts Joined: May 2005 |

|

|

|

Mar 17 2019, 11:06 PM Mar 17 2019, 11:06 PM

|

All Stars

48,418 posts Joined: Sep 2014 From: REality |

|

|

|

Mar 18 2019, 01:56 PM Mar 18 2019, 01:56 PM

|

Senior Member

1,590 posts Joined: Nov 2006 |

|

|

|

Mar 18 2019, 02:21 PM Mar 18 2019, 02:21 PM

|

All Stars

48,418 posts Joined: Sep 2014 From: REality |

|

|

|

Mar 18 2019, 02:41 PM Mar 18 2019, 02:41 PM

|

|

Staff

25,802 posts Joined: Jan 2003 From: Penang |

QUOTE(Jordy @ Mar 17 2019, 05:32 PM) A couple of hundreds? OMG! That is a hell of an increase! Has been with the policy for decade+Is this the first time your premium is increased by them? How many years have you held this policy? : Not the first time already. Compared with first sign up, the premium next year will be nearly 3x the origin when the policy started time, this is inevitable as getting older. |

|

|

Mar 18 2019, 02:45 PM Mar 18 2019, 02:45 PM

Show posts by this member only | IPv6 | Post

#34

|

All Stars

21,454 posts Joined: Jul 2012 |

QUOTE(Jordy @ Mar 17 2019, 05:32 PM) I have been paying the premium for nothing as I don't use the medical anyways. Insurance company is a not charity or welfare organization.This is so true. What is the point of buying early when we have low risk? Wait until high risk age baru buy more worth it, save on all thee increments insurance agents commission is from buyers. |

|

|

Mar 18 2019, 03:07 PM Mar 18 2019, 03:07 PM

|

Senior Member

1,972 posts Joined: Jan 2008 |

Lol issue is when you sign up they promise you the sun and moon...later when you try to claim macam2 alasan cant claim...end up refer to GH also. Rather not buy which is rare...anyone no insurance here?

|

|

|

Mar 19 2019, 12:55 PM Mar 19 2019, 12:55 PM

|

Junior Member

685 posts Joined: Jul 2012 From: Kuala Lumpur |

QUOTE(epie @ Mar 17 2019, 08:10 AM) I got a standalone medical card from zu**** Standalone medical cardGot a letter from them stated they are going to increase the premium around 60% starting next year 1 possibility:- 1. jump into the new age bracket 40-45=XX 46-50=XX from 45 to 46 can lead to 60% increase |

|

|

Mar 19 2019, 03:57 PM Mar 19 2019, 03:57 PM

Show posts by this member only | IPv6 | Post

#37

|

Senior Member

1,590 posts Joined: Nov 2006 |

|

|

|

Mar 19 2019, 04:01 PM Mar 19 2019, 04:01 PM

|

All Stars

10,162 posts Joined: Nov 2014 |

|

|

|

Mar 19 2019, 05:43 PM Mar 19 2019, 05:43 PM

Show posts by this member only | IPv6 | Post

#39

|

Junior Member

808 posts Joined: May 2008 |

I am with HLA and they increased twice in the last 4 years by 20% each time (if my mind recalls correctly). But I take it as inflation, if you buy stuff in other currencies you'll know RM is bad at the moment.

|

|

|

Mar 19 2019, 05:46 PM Mar 19 2019, 05:46 PM

|

Senior Member

8,188 posts Joined: Apr 2013 |

QUOTE(kuci_mayong @ Mar 19 2019, 05:43 PM) I am with HLA and they increased twice in the last 4 years by 20% each time (if my mind recalls correctly). But I take it as inflation, if you buy stuff in other currencies you'll know RM is bad at the moment. increased twice in the last 4 yrs at 20% each time.... MYR currency got drop so much meh? |

|

|

Mar 19 2019, 05:49 PM Mar 19 2019, 05:49 PM

Show posts by this member only | IPv6 | Post

#41

|

Junior Member

808 posts Joined: May 2008 |

QUOTE(yklooi @ Mar 19 2019, 05:46 PM) Well use to be I can get mcd breakfast for rm4 with coffee, Now cheapest also close to rm9-10. I'm not sure why they increase it so much but I remember they sent me letter twice informing me of the increase. |

|

|

Mar 19 2019, 05:57 PM Mar 19 2019, 05:57 PM

|

Senior Member

8,188 posts Joined: Apr 2013 |

|

|

|

Mar 19 2019, 06:44 PM Mar 19 2019, 06:44 PM

|

Senior Member

785 posts Joined: Mar 2012 |

|

|

|

Mar 19 2019, 07:00 PM Mar 19 2019, 07:00 PM

Show posts by this member only | IPv6 | Post

#44

|

Senior Member

1,363 posts Joined: Jan 2010 |

I just received the letter today. I am suppose to pay about rm850 a year until I am 35, currently 33 yo then only will increase to the next age group price.

But today letter came this year instead of paying rm850 I have to pay rm1050. That is a wooping rm200 increase. Guys this is outrages, how can they just simply increase SO MUCH like that? Is there a platform to let our voice be heard or everyone just diam diam and pay? At least increase rm50 la, straight away rm200 from out the sky??? |

|

|

Mar 19 2019, 08:03 PM Mar 19 2019, 08:03 PM

|

Senior Member

785 posts Joined: Mar 2012 |

QUOTE(JustcallmeLarry @ Mar 19 2019, 07:00 PM) I just received the letter today. I am suppose to pay about rm850 a year until I am 35, currently 33 yo then only will increase to the next age group price. You are relatively new to insurance perhaps, it had been like that for many years, unless it is a traditional plan with fixed price to pay. And yeah, it is kind of hidden price / terms & conditions if you ask me, but your policy doesn't said the price won't rise, so by law it is still right, just how the agent deliver to you.But today letter came this year instead of paying rm850 I have to pay rm1050. That is a wooping rm200 increase. Guys this is outrages, how can they just simply increase SO MUCH like that? Is there a platform to let our voice be heard or everyone just diam diam and pay? At least increase rm50 la, straight away rm200 from out the sky??? What you can do.. Rethink do you really need insurance given this fact... This post has been edited by vanitas: Mar 19 2019, 08:05 PM |

|

|

Mar 19 2019, 08:08 PM Mar 19 2019, 08:08 PM

Show posts by this member only | IPv6 | Post

#46

|

Junior Member

192 posts Joined: Jan 2018 |

QUOTE(vanitas @ Mar 19 2019, 08:03 PM) You are relatively new to insurance perhaps, it had been like that for many years, unless it is a traditional plan with fixed price to pay. And yeah, it is kind of hidden price / terms & conditions if you ask me, but your policy doesn't said the price won't rise, so by law it is still right, just how the agent deliver to you. Im new too...is there still any traditional plan ins with fixed premium in the market?What you can do.. Rethink do you really need insurance given this fact... What are the cons |

|

|

Mar 19 2019, 08:10 PM Mar 19 2019, 08:10 PM

|

Senior Member

785 posts Joined: Mar 2012 |

|

|

|

Mar 19 2019, 08:50 PM Mar 19 2019, 08:50 PM

Show posts by this member only | IPv6 | Post

#48

|

Senior Member

2,980 posts Joined: Jan 2007 From: Mount Chiliad |

COI or COT is normal la to increase....

just that u didn't use the medical service, then u wont get the idea... if u don't want to pay the suggested premium, be prepared for policy lapsed after the fund exhausted (for ILP). if u plan to change to other company, the waiting period will restart and bare in mind that your future claim with new company might fall under pay & claim. |

|

|

Mar 19 2019, 09:00 PM Mar 19 2019, 09:00 PM

|

Senior Member

785 posts Joined: Mar 2012 |

QUOTE(hafiez @ Mar 19 2019, 08:50 PM) COI or COT is normal la to increase.... No one claim COI is abnormal to increase, it is the percentage of increase. just that u didn't use the medical service, then u wont get the idea... if u don't want to pay the suggested premium, be prepared for policy lapsed after the fund exhausted (for ILP). if u plan to change to other company, the waiting period will restart and bare in mind that your future claim with new company might fall under pay & claim. And yeah most of us didn't use medical service (much / frequently), if you got the idea, can you tell us how does it justify for 29% to 60% increase for just one year? |

|

|

Mar 19 2019, 09:47 PM Mar 19 2019, 09:47 PM

|

All Stars

48,418 posts Joined: Sep 2014 From: REality |

|

|

|

Mar 20 2019, 12:11 AM Mar 20 2019, 12:11 AM

Show posts by this member only | IPv6 | Post

#51

|

Senior Member

1,363 posts Joined: Jan 2010 |

QUOTE(vanitas @ Mar 19 2019, 08:03 PM) You are relatively new to insurance perhaps, it had been like that for many years, unless it is a traditional plan with fixed price to pay. And yeah, it is kind of hidden price / terms & conditions if you ask me, but your policy doesn't said the price won't rise, so by law it is still right, just how the agent deliver to you. Before sign up the broucher came with the cart how much I need to pay all the way till 70 years old. I had this plan for about six years now and now out of the blue it says price increase by rm200.What you can do.. Rethink do you really need insurance given this fact... My worry is if they can simply do this, how many more times can they simply increase the price from out of the blue in future?? I sign up for a plan to suit my budget, increasing the price by 200 is outrages to me and this is the only thread I could find online where a few people are disappointed. |

|

|

Mar 20 2019, 12:24 AM Mar 20 2019, 12:24 AM

|

Senior Member

785 posts Joined: Mar 2012 |

QUOTE(JustcallmeLarry @ Mar 20 2019, 12:11 AM) Before sign up the broucher came with the cart how much I need to pay all the way till 70 years old. I had this plan for about six years now and now out of the blue it says price increase by rm200. Yeah, you got a big table, with ages and premium to be paid, but for sure there is a small tnc under how much you need to paid in your policy wrote something similar to the following:My worry is if they can simply do this, how many more times can they simply increase the price from out of the blue in future?? I sign up for a plan to suit my budget, increasing the price by 200 is outrages to me and this is the only thread I could find online where a few people are disappointed. The renewal of premium rate for Your Policy is not guaranteed and We reserve the right to revise the premium rates applicable at the time of renewal. Edit: Agent normally won't tell you the price could increase so much, they want commissions. Only trust those who get nothing on replying you.. At least you get the fact right now, to continue or not, it is up to you... Off topic: Until now I still don't understand why there must be an agent attached to the insurance with hefty commissions fee, but not self service... When everything agent know / want to tell can be found online, and those info from official web is much more trustworthy than from agent... This post has been edited by vanitas: Mar 20 2019, 12:34 AM il0ve51 liked this post

|

|

|

Mar 20 2019, 01:05 AM Mar 20 2019, 01:05 AM

Show posts by this member only | IPv6 | Post

#53

|

Senior Member

2,980 posts Joined: Jan 2007 From: Mount Chiliad |

QUOTE(vanitas @ Mar 19 2019, 09:00 PM) No one claim COI is abnormal to increase, it is the percentage of increase. amount of contributions, amount of participants, amount of claims, amounts of coverage, and lots more.And yeah most of us didn't use medical service (much / frequently), if you got the idea, can you tell us how does it justify for 29% to 60% increase for just one year? |

|

|

Mar 20 2019, 01:17 AM Mar 20 2019, 01:17 AM

|

Senior Member

1,985 posts Joined: Jun 2010 |

If you want to save money on your medical insurance, go for a coinsurance policy. Only disadvantage is that you cannot claim 100%.

|

|

|

Mar 20 2019, 09:31 AM Mar 20 2019, 09:31 AM

|

All Stars

10,162 posts Joined: Nov 2014 |

yea I would suggest to get deductible for your medical insurance, pay a small fee but save 10 - 20% on your yearly premiums

|

|

|

Mar 20 2019, 03:22 PM Mar 20 2019, 03:22 PM

|

All Stars

48,418 posts Joined: Sep 2014 From: REality |

QUOTE(Artus @ Mar 20 2019, 01:17 AM) If you want to save money on your medical insurance, go for a coinsurance policy. Only disadvantage is that you cannot claim 100%. Coinsurance policy?Meaning joined type? With another person? Like husband wife? This post has been edited by nexona88: Mar 20 2019, 03:23 PM zhixie liked this post

|

|

|

Mar 20 2019, 03:31 PM Mar 20 2019, 03:31 PM

|

Senior Member

785 posts Joined: Mar 2012 |

QUOTE(nexona88 @ Mar 20 2019, 03:22 PM) With insurance company, for example, insurance company paid 80%, you paid 20% of medical fee, after deductible (from zero to five digits or even more) which is 100% paid by yourself. zhixie liked this post

|

|

|

Mar 20 2019, 03:45 PM Mar 20 2019, 03:45 PM

|

All Stars

48,418 posts Joined: Sep 2014 From: REality |

|

|

|

Mar 20 2019, 03:50 PM Mar 20 2019, 03:50 PM

|

Senior Member

1,730 posts Joined: Jul 2016 From: tomato land |

|

|

|

Mar 20 2019, 03:52 PM Mar 20 2019, 03:52 PM

|

Junior Member

59 posts Joined: Mar 2017 |

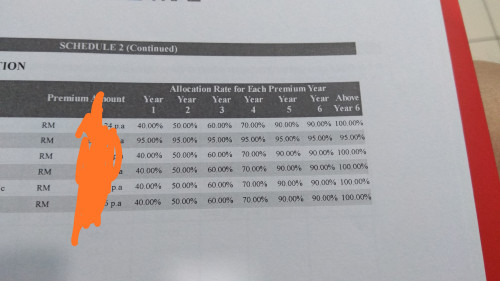

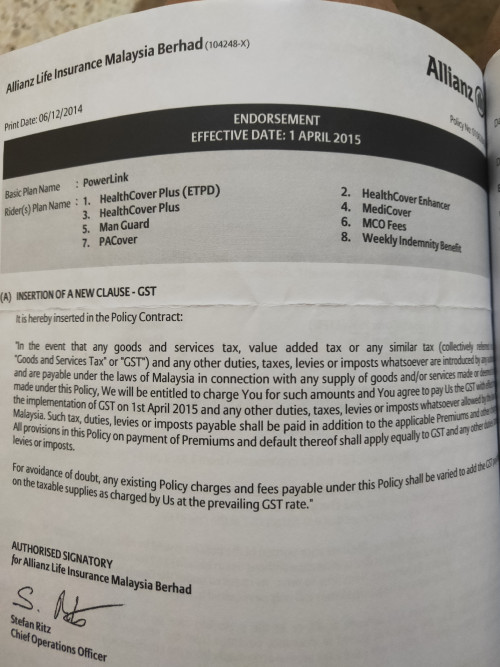

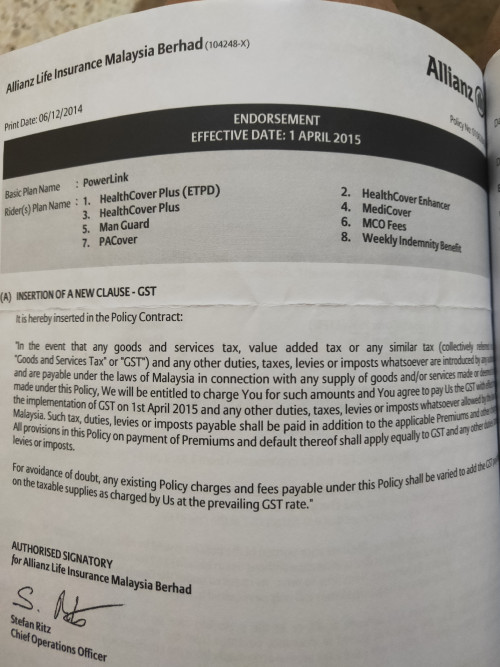

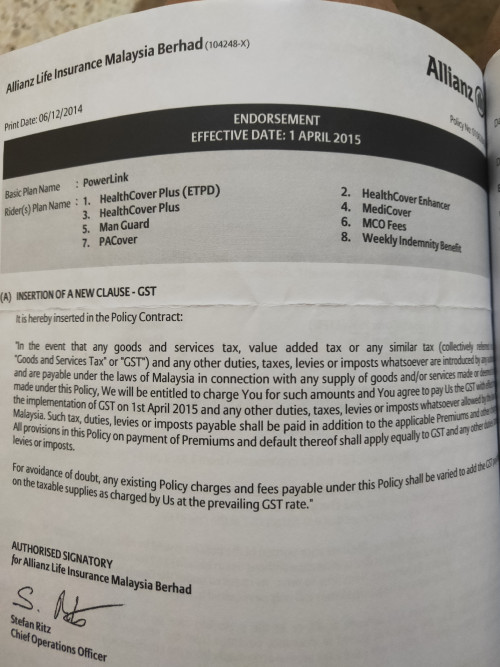

QUOTE(Holocene @ Mar 17 2019, 07:07 AM) Drop me a PM if you need any clarification with your insurance as I represent Allianz. Best, Jiansheng QUOTE(MNet @ Mar 17 2019, 07:40 AM) hi, Jiansheng,can u help me take a look at my plan, i just found out actually my medical plan is THE CHEAPEST 1, medisave 100, supposed rm667 annually but how come my annual premium rm2000 (and now hike to rm2590!?) did i just get conned or what? 1st pic, revise letter receive 2nd pic, policy originally cost table 3rd pic, policy full plan, (actually just found this, i dont understand existence of these plans at all!)    |

|

|

Mar 20 2019, 04:20 PM Mar 20 2019, 04:20 PM

|

|

Staff

25,802 posts Joined: Jan 2003 From: Penang |

QUOTE(nexona88 @ Mar 20 2019, 03:22 PM) Actually, Co-insurance is a good thing to have, as it may reduce the abuse of insurance, that may lead to overall increase of premium. (when someone abuse the insurance claim, then the whole pool of policy owner need to bare aka premium increase) Eg. No-coinsurance, (cashless or everything paid by insurance), the policy owner doesn't care how much the medical cost or room rate is, just max out the best room, even may undergo unnecessary medical check etc. (which I had seen before on a friend cited already bought insurance, must utilise it kaw kaw. Co-insurance, policy owner needs to pay out a portion, so may be a bit cost minded. |

|

|

Mar 20 2019, 04:27 PM Mar 20 2019, 04:27 PM

|

|

Elite

5,626 posts Joined: Nov 2004 From: Klang, Selangor |

QUOTE(cherroy @ Mar 18 2019, 02:41 PM) Has been with the policy for decade+ Well, looks like it is time to relook at these costs then. If it keeps increasing like this while I have never used the medical card before, I think it is time to cut down on the expenses.Not the first time already. Compared with first sign up, the premium next year will be nearly 3x the origin when the policy started time, this is inevitable as getting older. From the savings of the annual premium, I think I could manage to pay for my own medical services when the time comes. QUOTE(kuci_mayong @ Mar 19 2019, 05:43 PM) I am with HLA and they increased twice in the last 4 years by 20% each time (if my mind recalls correctly). But I take it as inflation, if you buy stuff in other currencies you'll know RM is bad at the moment. Care to explain how does the depreciation of MYR affect the cost of our medical insurance? |

|

|

Mar 20 2019, 04:28 PM Mar 20 2019, 04:28 PM

|

Senior Member

785 posts Joined: Mar 2012 |

QUOTE(cherroy @ Mar 20 2019, 04:20 PM) Actually, Co-insurance is a good thing to have, as it may reduce the abuse of insurance, that may lead to overall increase of premium. Policy owners with coinsurance is in different pool (on how actuary calculate risk, or even how company manage the fund) with non coinsurance? (when someone abuse the insurance claim, then the whole pool of policy owner need to bare aka premium increase) Eg. No-coinsurance, (cashless or everything paid by insurance), the policy owner doesn't care how much the medical cost or room rate is, just max out the best room, even may undergo unnecessary medical check etc. (which I had seen before on a friend cited already bought insurance, must utilise it kaw kaw. Co-insurance, policy owner needs to pay out a portion, so may be a bit cost minded. If it is same pool, those in non-co abuse, the co still need to paid for them... |

|

|

Mar 20 2019, 04:54 PM Mar 20 2019, 04:54 PM

|

|

Staff

25,802 posts Joined: Jan 2003 From: Penang |

QUOTE(Jordy @ Mar 20 2019, 04:27 PM) Well, looks like it is time to relook at these costs then. If it keeps increasing like this while I have never used the medical card before, I think it is time to cut down on the expenses. It is good that one needs not to use medical insurance, best is until we died. From the savings of the annual premium, I think I could manage to pay for my own medical services when the time comes. Care to explain how does the depreciation of MYR affect the cost of our medical insurance? If one has ability of self-insured (aka one has enough money to pay for it), eg ABC medical insurance has annual limit of 100K and overall 500K, and one has more than 500K at his/her disposal easily, then the medical insurance doesn't seem too important already, especially for older age people, whereby the premium can easily near 5 digit. While for not so wealthy one, then the high premium at older age may be a big burden to swallow, or not economically to do so. |

|

|

Mar 20 2019, 05:54 PM Mar 20 2019, 05:54 PM

|

Senior Member

945 posts Joined: Jun 2012 |

QUOTE(leelazens @ Mar 20 2019, 03:52 PM) hi, Jiansheng, The simple answer is that the premium increase is due to the extended coverage.can u help me take a look at my plan, i just found out actually my medical plan is THE CHEAPEST 1, medisave 100, supposed rm667 annually but how come my annual premium rm2000 (and now hike to rm2590!?) did i just get conned or what? 1st pic, revise letter receive 2nd pic, policy originally cost table 3rd pic, policy full plan, (actually just found this, i dont understand existence of these plans at all!)    Also, let me know: - at what age did you convert to PowerLink (start paying RM2000/year) - what's the sum assured for healthcover+, PA, and manguard How technical do you want my explanation to get? Best, Jiansheng This post has been edited by Holocene: Mar 20 2019, 05:56 PM |

|

|

Mar 20 2019, 06:00 PM Mar 20 2019, 06:00 PM

|

Junior Member

83 posts Joined: Jan 2018 |

QUOTE(Jordy @ Mar 20 2019, 04:27 PM) Well, looks like it is time to relook at these costs then. If it keeps increasing like this while I have never used the medical card before, I think it is time to cut down on the expenses. Personally feel some basic insurance is still needed, eg for critical illness. Don't need to get the most "comprehensive" packages that some agents may recommend, but something is better than nothing.From the savings of the annual premium, I think I could manage to pay for my own medical services when the time comes. Care to explain how does the depreciation of MYR affect the cost of our medical insurance? Depreciation of MYR affects cost of medical insurance because cost of medical procedures increase? Medicines and equipment may be imported. |

|

|

Mar 20 2019, 06:05 PM Mar 20 2019, 06:05 PM

|

All Stars

10,162 posts Joined: Nov 2014 |

QUOTE(leelazens @ Mar 20 2019, 03:52 PM) hi, Jiansheng, your snapshot doesn't show other riders, seems like there might be other insurance coverage that you're getting which impact the premium that is payable.can u help me take a look at my plan, i just found out actually my medical plan is THE CHEAPEST 1, medisave 100, supposed rm667 annually but how come my annual premium rm2000 (and now hike to rm2590!?) did i just get conned or what? 1st pic, revise letter receive 2nd pic, policy originally cost table 3rd pic, policy full plan, (actually just found this, i dont understand existence of these plans at all!)    |

|

|

Mar 20 2019, 06:46 PM Mar 20 2019, 06:46 PM

|

Senior Member

785 posts Joined: Mar 2012 |

I just realised you can online buy medical card now... Price is quite cheap compared with those with agent.. those who are interested can take a look... As low as RM 37 per month..

Axa https://www.axa.com.my/buy/online-medical-c...aysia/purchase/ Quick link to count cost for Axa https://www.imoney.my/medical-insurance/axa...dic-online-plan Manulife https://www.manulifenow.com.my/ManuEZMed.aspx This post has been edited by vanitas: Mar 20 2019, 06:54 PM |

|

|

Mar 20 2019, 09:16 PM Mar 20 2019, 09:16 PM

|

All Stars

15,192 posts Joined: Oct 2004 |

QUOTE(vanitas @ Mar 20 2019, 06:46 PM) I just realised you can online buy medical card now... Price is quite cheap compared with those with agent.. those who are interested can take a look... As low as RM 37 per month.. wow... which one is better?Axa https://www.axa.com.my/buy/online-medical-c...aysia/purchase/ Quick link to count cost for Axa https://www.imoney.my/medical-insurance/axa...dic-online-plan Manulife https://www.manulifenow.com.my/ManuEZMed.aspx |

|

|

Mar 20 2019, 09:33 PM Mar 20 2019, 09:33 PM

|

Senior Member

785 posts Joined: Mar 2012 |

|

|

|

Mar 20 2019, 09:42 PM Mar 20 2019, 09:42 PM

Show posts by this member only | IPv6 | Post

#71

|

Senior Member

2,866 posts Joined: Sep 2008 From: Wangsa Maju, KL |

QUOTE(leelazens @ Mar 16 2019, 05:15 PM) » Click to show Spoiler - click again to hide... « QUOTE(leelazens @ Mar 20 2019, 03:52 PM) » Click to show Spoiler - click again to hide... « QUOTE(kbandito @ Mar 16 2019, 10:34 PM) » Click to show Spoiler - click again to hide... « QUOTE(kbandito @ Mar 17 2019, 09:28 PM) didnt know about the actuarial part, thanks for sharing that! something to take note then. the point of buying young... i will rephrase it as "buying it while your health is still eligible". cost of insurance wise, it is not guaranteed and also not up to agent to determine how much will the increase be in the future. so if from financial planning perspective, managing personal cash flow first then only look into all these (in the case of if premium is increased somewhere in the future, or increasing coverage due the need of it, etc.) |

|

|

Mar 20 2019, 09:43 PM Mar 20 2019, 09:43 PM

Show posts by this member only | IPv6 | Post

#72

|

Senior Member

2,866 posts Joined: Sep 2008 From: Wangsa Maju, KL |

QUOTE(vanitas @ Mar 17 2019, 09:20 AM) So who will take the remain 4th to 6th year commission? No one but still being "charged" in the policy? the manager of the agent.QUOTE(vanitas @ Mar 17 2019, 06:46 PM) Standalone medical card also will suddenly increase price due to medical cost increase right? Correct me if I am wrong. yea you are right.QUOTE(vanitas @ Mar 20 2019, 06:46 PM) » Click to show Spoiler - click again to hide... « |

|

|

Mar 20 2019, 09:44 PM Mar 20 2019, 09:44 PM

Show posts by this member only | IPv6 | Post

#73

|

Senior Member

2,866 posts Joined: Sep 2008 From: Wangsa Maju, KL |

QUOTE(epie @ Mar 19 2019, 03:57 PM) yea, still the premium shown in the table is subject to change and not guaranteed.QUOTE(j0nn @ Mar 20 2019, 06:00 PM) Personally feel some basic insurance is still needed, eg for critical illness. Don't need to get the most "comprehensive" packages that some agents may recommend, but something is better than nothing. depending on individual needs and concerns.Depreciation of MYR affects cost of medical insurance because cost of medical procedures increase? Medicines and equipment may be imported. QUOTE(tsg_7 @ Mar 16 2019, 05:28 PM) now im waiting the reply on my brother's claim on the medical. what's the situation?see what's their reply now. kinda upset now. QUOTE(jack2 @ Mar 16 2019, 09:40 PM) » Click to show Spoiler - click again to hide... « QUOTE(peterpan888 @ Mar 17 2019, 12:24 AM) Some insurance agent before 6 years...already quit the industry or change to another insurance company..let's say quit/changed on 3rd year....and you get referred to someone else..I assume the new guy don't get.the remaining of the commission, so face black black as they are they doing charity servicing you... depends on the agent that serves you. very subjective.My assumptions true? This post has been edited by ckdenion: Mar 20 2019, 09:45 PM |

|

|

Mar 20 2019, 10:52 PM Mar 20 2019, 10:52 PM

|

Junior Member

59 posts Joined: Mar 2017 |

QUOTE(Holocene @ Mar 20 2019, 05:54 PM) The simple answer is that the premium increase is due to the extended coverage. i start paying at age 26, 1st year straight rm2000 already, never know what the rest of those coverage, i just wanted good medical protection, did the agent just quietly force all that on my plan ?Also, let me know: - at what age did you convert to PowerLink (start paying RM2000/year) - what's the sum assured for healthcover+, PA, and manguard How technical do you want my explanation to get? Best, Jiansheng are those other plan life insurance? what can i do now if found some part of it are not wanted by me. thanks |

|

|

Mar 20 2019, 11:01 PM Mar 20 2019, 11:01 PM

|

Senior Member

945 posts Joined: Jun 2012 |

QUOTE(leelazens @ Mar 20 2019, 10:52 PM) i start paying at age 26, 1st year straight rm2000 already, never know what the rest of those coverage, i just wanted good medical protection, did the agent just quietly force all that on my plan ? Well technically you would have sign off, before the company would have offered you the coverage. So check out your policy if there is actually such cover.are those other plan life insurance? what can i do now if found some part of it are not wanted by me. thanks They are critical illness riders. If they are really not what you wanted, you can fill up a form to request it's removal. Alternatively, you can buy me Starbucks or Chinese tea and I'll review your policy in detail. Best, Jiansheng |

|

|

Mar 21 2019, 12:36 AM Mar 21 2019, 12:36 AM

Show posts by this member only | IPv6 | Post

#76

|

Junior Member

808 posts Joined: May 2008 |

QUOTE(Jordy @ Mar 20 2019, 04:27 PM) Cost of living has gone up and as one commentator also posted: your coverage has been revise to new coverage rates which only means that medical cost has also gone up.In other words, your ringgit worth less than before. |

|

|

Mar 21 2019, 02:17 AM Mar 21 2019, 02:17 AM

|

Senior Member

1,985 posts Joined: Jun 2010 |

QUOTE(nexona88 @ Mar 20 2019, 03:22 PM) The higher the deductible (the portion that you pay to the hospital), the lower the premiums.Deductibles can be something like RM5,000, RM10,000, RM15,000 etc. Maybe also in percentages in some cases. Those who consider coinsurance are mainly worried about the big bills. It is far more affordable. If one day, especially when one becomes very old and the premiums gets too high, one can apply to increase the deductible to lower the premiums. Not sure if all insurance companies would allow the change though. |

|

|

Mar 21 2019, 09:25 AM Mar 21 2019, 09:25 AM

|

All Stars

48,418 posts Joined: Sep 2014 From: REality |

QUOTE(Artus @ Mar 21 2019, 02:17 AM) The higher the deductible (the portion that you pay to the hospital), the lower the premiums. Thanks..Deductibles can be something like RM5,000, RM10,000, RM15,000 etc. Maybe also in percentages in some cases. Those who consider coinsurance are mainly worried about the big bills. It is far more affordable. If one day, especially when one becomes very old and the premiums gets too high, one can apply to increase the deductible to lower the premiums. Not sure if all insurance companies would allow the change though. Understand it now... Its quite good... At least for us.. |

|

|

Mar 21 2019, 02:35 PM Mar 21 2019, 02:35 PM

Show posts by this member only | IPv6 | Post

#79

|

Senior Member

2,223 posts Joined: Aug 2008 From: Port Klang, Selangor |

|

|

|

Mar 21 2019, 03:52 PM Mar 21 2019, 03:52 PM

|

Junior Member

59 posts Joined: Mar 2017 |

QUOTE(Holocene @ Mar 20 2019, 11:01 PM) Well technically you would have sign off, before the company would have offered you the coverage. So check out your policy if there is actually such cover. yes, no problem.They are critical illness riders. If they are really not what you wanted, you can fill up a form to request it's removal. Alternatively, you can buy me Starbucks or Chinese tea and I'll review your policy in detail. Best, Jiansheng thank for your help, contacted u through whatsapp |

|

|

Mar 22 2019, 09:59 AM Mar 22 2019, 09:59 AM

|

Senior Member

4,949 posts Joined: Jul 2010 |

To those who think it's better to wait and buy only when you reach high-risk age, do reconsider. This is a risky move.

Once you are diagnosed with high blood pressure or diabetes, good luck finding a company that is willing to cover you, let alone getting cheap premium. Those who think they don't need insurance because they can afford the medical fees, do ensure you have easy and fast access to the cash. You will be dead if you think you can refinance or sell one of your properties to pay for medical fee. And do ensure you have enough balance to cover your living expenses after paying for the med fees. |

|

|

Mar 22 2019, 11:42 AM Mar 22 2019, 11:42 AM

|

|

Staff

25,802 posts Joined: Jan 2003 From: Penang |

QUOTE(mushigen @ Mar 22 2019, 09:59 AM) This statement is good and it is the same across whether one has medical insurance or not or whatever kind of insurance.Insurance is just one off compensation to help out based on circumstance happened within the insurance coverage, insurance is not a charity. So even one has millions medical insurance coverage, one still needs to prepare some cash for post medication and living expenses needed. |

|

|

Mar 22 2019, 12:33 PM Mar 22 2019, 12:33 PM

|

Senior Member

945 posts Joined: Apr 2016 From: Shah Alam |

|

|

|

Mar 22 2019, 12:54 PM Mar 22 2019, 12:54 PM

|

All Stars

48,418 posts Joined: Sep 2014 From: REality |

|

|

|

Mar 22 2019, 01:05 PM Mar 22 2019, 01:05 PM

|

Senior Member

4,949 posts Joined: Jul 2010 |

QUOTE(Mr.Weezy @ Mar 22 2019, 12:33 PM) That's when the upgrading suggestions start to come.QUOTE(nexona88 @ Mar 22 2019, 12:54 PM) Iinm, it's up to 60% for the first year. |

|

|

Mar 22 2019, 06:09 PM Mar 22 2019, 06:09 PM

|

|

Elite

5,626 posts Joined: Nov 2004 From: Klang, Selangor |

QUOTE(mushigen @ Mar 22 2019, 09:59 AM) To those who think it's better to wait and buy only when you reach high-risk age, do reconsider. This is a risky move. I believe that with diligent savings and investing wisely, we will have enough to cover for medical expenses when the time comes. I think that the most common insurance policies would cover up to RM100k annually? If yes then I don't see a problem for one to come up with that money. After all, what are the odds that require one to come up with such an amount for medical services?Once you are diagnosed with high blood pressure or diabetes, good luck finding a company that is willing to cover you, let alone getting cheap premium. Those who think they don't need insurance because they can afford the medical fees, do ensure you have easy and fast access to the cash. You will be dead if you think you can refinance or sell one of your properties to pay for medical fee. And do ensure you have enough balance to cover your living expenses after paying for the med fees. |

|

|

Mar 22 2019, 07:12 PM Mar 22 2019, 07:12 PM

Show posts by this member only | IPv6 | Post

#87

|

Senior Member

4,949 posts Joined: Jul 2010 |

QUOTE(Jordy @ Mar 22 2019, 06:09 PM) I believe that with diligent savings and investing wisely, we will have enough to cover for medical expenses when the time comes. I think that the most common insurance policies would cover up to RM100k annually? If yes then I don't see a problem for one to come up with that money. After all, what are the odds that require one to come up with such an amount for medical services? Question is, when will this "time" come? Before or after you are ready to cover the medical fees, with excess money to live on?Insurance is a form of gambling, so to speak. Whether someone needs it or not is entirely his choice. You are betting against your own misfortune. |

|

|

Mar 22 2019, 07:12 PM Mar 22 2019, 07:12 PM

Show posts by this member only | IPv6 | Post

#88

|

Senior Member

4,949 posts Joined: Jul 2010 |

QUOTE(Jordy @ Mar 22 2019, 06:09 PM) I believe that with diligent savings and investing wisely, we will have enough to cover for medical expenses when the time comes. I think that the most common insurance policies would cover up to RM100k annually? If yes then I don't see a problem for one to come up with that money. After all, what are the odds that require one to come up with such an amount for medical services? Question is, when will this "time" come? Before or after you are ready to cover the medical fees, with excess money to live on?Insurance is a form of gambling, so to speak. Whether someone needs it or not is entirely his choice. You are betting against your own misfortune. |

|

|

Mar 22 2019, 07:16 PM Mar 22 2019, 07:16 PM

|

Senior Member

945 posts Joined: Apr 2016 From: Shah Alam |

|

|

|

Mar 22 2019, 07:21 PM Mar 22 2019, 07:21 PM

|

Senior Member

4,949 posts Joined: Jul 2010 |

|

|

|

Mar 22 2019, 08:30 PM Mar 22 2019, 08:30 PM

|

Senior Member

945 posts Joined: Apr 2016 From: Shah Alam |

|

|

|

Mar 22 2019, 09:36 PM Mar 22 2019, 09:36 PM

|

Senior Member

4,949 posts Joined: Jul 2010 |

|

|

|

Mar 23 2019, 12:52 PM Mar 23 2019, 12:52 PM

|

|

Elite

5,626 posts Joined: Nov 2004 From: Klang, Selangor |

QUOTE(mushigen @ Mar 22 2019, 07:12 PM) Question is, when will this "time" come? Before or after you are ready to cover the medical fees, with excess money to live on? I agree, we are only "gambling" with the money. Therefore education is very important.Insurance is a form of gambling, so to speak. Whether someone needs it or not is entirely his choice. You are betting against your own misfortune. 1. Buy insurance is just like gambling in casino, it is a make or break scenario. If you do not face any big issue in your life, then your money is gone. 2. Start young by contributing regularly to a "insurance fund" where you won't have easy access to. Invest wisely over 20-30 years. If there is no problem in life, at least this money can be used during retirement. Nothing is lost in this. We can create our own "insurance pool" by contributing into the fund under various names (husband and wife, children, parents). If you are getting insurance coverage for every individual in the family, just imagine how many insurance policies you have to buy, and how much money you are gambling on? By creating our own pool, anyone of the family member can have access to the combined pool without restrictions. |

|

|

Mar 23 2019, 04:38 PM Mar 23 2019, 04:38 PM

|

All Stars

21,454 posts Joined: Jul 2012 |

QUOTE(Jordy @ Mar 23 2019, 12:52 PM) I agree, we are only "gambling" with the money. Therefore education is very important. Insurance is for financial illterate.1. Buy insurance is just like gambling in casino, it is a make or break scenario. If you do not face any big issue in your life, then your money is gone. 2. Start young by contributing regularly to a "insurance fund" where you won't have easy access to. Invest wisely over 20-30 years. If there is no problem in life, at least this money can be used during retirement. Nothing is lost in this. We can create our own "insurance pool" by contributing into the fund under various names (husband and wife, children, parents). If you are getting insurance coverage for every individual in the family, just imagine how many insurance policies you have to buy, and how much money you are gambling on? By creating our own pool, anyone of the family member can have access to the combined pool without restrictions. |

|

|

Mar 24 2019, 06:24 PM Mar 24 2019, 06:24 PM

Show posts by this member only | IPv6 | Post

#95

|

|

Elite

5,626 posts Joined: Nov 2004 From: Klang, Selangor |

QUOTE(icemanfx @ Mar 23 2019, 04:38 PM) Yup, so is unit trust though. I believe that if a financial illiterate could pick the right UT and continuously top up diligently, the return over the long term will be more superior than what the insurance could cover. The only catch is to start early and do it diligently. |

|

|

Mar 24 2019, 08:13 PM Mar 24 2019, 08:13 PM

|

Senior Member

8,188 posts Joined: Apr 2013 |

insurance is insurance...

hopefully if , if only there is nothing wrong during the wealth accumulation stage to set up own "insurance" coverage fund either for self or other members of the family.... during the initial stages of accumulation,...most likely not enough to cover the cost of one. after the accumulation stage....maybe not enough for the needs of the other members of the families, for the collected pool of monies maybe be not enough or partially used for some other "deemed" emergencies too. |

|

|

Mar 25 2019, 09:55 AM Mar 25 2019, 09:55 AM

|

Senior Member

4,949 posts Joined: Jul 2010 |

QUOTE(Jordy @ Mar 23 2019, 12:52 PM) I agree, we are only "gambling" with the money. Therefore education is very important. The reply below echos what I was going to write. Too many people think critical illnesses wait until you are financially ready before striking.1. Buy insurance is just like gambling in casino, it is a make or break scenario. If you do not face any big issue in your life, then your money is gone. 2. Start young by contributing regularly to a "insurance fund" where you won't have easy access to. Invest wisely over 20-30 years. If there is no problem in life, at least this money can be used during retirement. Nothing is lost in this. We can create our own "insurance pool" by contributing into the fund under various names (husband and wife, children, parents). If you are getting insurance coverage for every individual in the family, just imagine how many insurance policies you have to buy, and how much money you are gambling on? By creating our own pool, anyone of the family member can have access to the combined pool without restrictions. Even then, it will blow a big hole in your bank balance. QUOTE(yklooi @ Mar 24 2019, 08:13 PM) insurance is insurance... I really don't mind "wasting" my money paying for med insurance and not claiming anything.hopefully if , if only there is nothing wrong during the wealth accumulation stage to set up own "insurance" coverage fund either for self or other members of the family.... during the initial stages of accumulation,...most likely not enough to cover the cost of one. after the accumulation stage....maybe not enough for the needs of the other members of the families, for the collected pool of monies maybe be not enough or partially used for some other "deemed" emergencies too. Just like I've never regretted purchasing comprehensive coverage for my car over 3rd party coverage even though I did not claim anything that year. |

|

|

Mar 25 2019, 10:53 AM Mar 25 2019, 10:53 AM

|

|

Elite

5,626 posts Joined: Nov 2004 From: Klang, Selangor |

QUOTE(yklooi @ Mar 24 2019, 08:13 PM) insurance is insurance... If one puts aside RM500 a month for single person's "insurance" purpose, then there will be RM6000 a year. Do it right over 5 years and the pool will quickly gather to around RM35k.hopefully if , if only there is nothing wrong during the wealth accumulation stage to set up own "insurance" coverage fund either for self or other members of the family.... during the initial stages of accumulation,...most likely not enough to cover the cost of one. after the accumulation stage....maybe not enough for the needs of the other members of the families, for the collected pool of monies maybe be not enough or partially used for some other "deemed" emergencies too. I am not saying that RM35k is a lot of money to cover one's medical cost, but again this has to be done as early as possible. The earlier one starts practicing this, the lower the risk of having insufficient funds when one needs it. If we have the financial strength to build up this pool of fund, then by all means this would be the best way out. Otherwise then insurance is the next best alternative. QUOTE(mushigen @ Mar 25 2019, 09:55 AM) The reply below echos what I was going to write. Too many people think critical illnesses wait until you are financially ready before striking. I agree with the statements by yourself and yklooi, but what chances does critical illness really strike that early in life? We are talking about those below 35 in this context as I am an advocate of early financial planning.Even then, it will blow a big hole in your bank balance. I really don't mind "wasting" my money paying for med insurance and not claiming anything. Just like I've never regretted purchasing comprehensive coverage for my car over 3rd party coverage even though I did not claim anything that year. But let's make it clear before any misunderstanding escalates from this discussion. I am not totally condemning insurance for critical illness. Through this discussion, I am just opening up our minds to a possible better alternative to "insure" against critical illness or other medical complications. |

|

|

Mar 25 2019, 10:59 AM Mar 25 2019, 10:59 AM

|

Senior Member

8,188 posts Joined: Apr 2013 |

i think there is this legacy protection needs consideration too...

like creditors can chase your saved assets, not insurances money |

|

|

Mar 25 2019, 02:03 PM Mar 25 2019, 02:03 PM

|

Senior Member

4,949 posts Joined: Jul 2010 |

QUOTE(Jordy @ Mar 25 2019, 10:53 AM) I agree with the statements by yourself and yklooi, but what chances does critical illness really strike that early in life? We are talking about those below 35 in this context as I am an advocate of early financial planning. I understand where you're coming from. As you pointed out, what are the chances of one contracting critical illness before 35? Nobody can answer that. But let's make it clear before any misunderstanding escalates from this discussion. I am not totally condemning insurance for critical illness. Through this discussion, I am just opening up our minds to a possible better alternative to "insure" against critical illness or other medical complications. And how sure are you that you will be able to afford a lump sump payment for medical procedures if critical illness strikes at, say, 40 years old? And the lump sum compensation will come in handy too. My wife's cousin was diagnosed with cancer at age 30-plus. And I'm sure, given our modern lifestyle, the median age when the proverbial shit hits the fan is trending downwards. I can agree with you that if you can afford it, you don't need to buy medical and life insurance. Question is, how many cannot afford their medical fees now and yet think that when major illness strikes, they will have saved up sufficient monies to afford treatment. |

|

|

Mar 25 2019, 02:58 PM Mar 25 2019, 02:58 PM

|

|

Staff

25,802 posts Joined: Jan 2003 From: Penang |

QUOTE(mushigen @ Mar 25 2019, 02:03 PM) I understand where you're coming from. As you pointed out, what are the chances of one contracting critical illness before 35? Nobody can answer that. The discussion between yours and Jordy, just sums up that life is cruel and never perfect.And how sure are you that you will be able to afford a lump sump payment for medical procedures if critical illness strikes at, say, 40 years old? And the lump sum compensation will come in handy too. My wife's cousin was diagnosed with cancer at age 30-plus. And I'm sure, given our modern lifestyle, the median age when the proverbial shit hits the fan is trending downwards. I can agree with you that if you can afford it, you don't need to buy medical and life insurance. Question is, how many cannot afford their medical fees now and yet think that when major illness strikes, they will have saved up sufficient monies to afford treatment. It is some risk, choice and chance one needs to take. Get insured early, burned 35K premium, (could easily more than 50K if taking account of compounded interest/return that can serve as self insured/wealth building) vs No insured, take risk in between. There is no right or wrong nor which is wiser, just a choice and risk one needs to take, especially when one is just coming into society/working life and in the process of building career and wealth and disposal income is constraint. |

|

|

Mar 25 2019, 06:37 PM Mar 25 2019, 06:37 PM

|

Senior Member

4,949 posts Joined: Jul 2010 |

QUOTE(cherroy @ Mar 25 2019, 02:58 PM) The discussion between yours and Jordy, just sums up that life is cruel and never perfect. Agree. There is also a need to factor in the peace of mind from knowing you have done your best securing the best coverage for your medical needs at a given income level.It is some risk, choice and chance one needs to take. Get insured early, burned 35K premium, (could easily more than 50K if taking account of compounded interest/return that can serve as self insured/wealth building) vs No insured, take risk in between. There is no right or wrong nor which is wiser, just a choice and risk one needs to take, especially when one is just coming into society/working life and in the process of building career and wealth and disposal income is constraint. Indeed it's about risk taking, and the negative outcome from not buying insurance is something I am not willing to bear because it comes at the expense of my loved ones. |

|

|

Mar 25 2019, 06:38 PM Mar 25 2019, 06:38 PM

Show posts by this member only | IPv6 | Post

#103

|

Senior Member

3,165 posts Joined: Feb 2015 |

QUOTE(Jordy @ Mar 25 2019, 10:53 AM) If one puts aside RM500 a month for single person's "insurance" purpose, then there will be RM6000 a year. Do it right over 5 years and the pool will quickly gather to around RM35k. I am not a strong advocate of "too much" insurance. But I recommend buying at least some insurance while you are building your own funds. Why? Illness can strike anytime....at least have some form of protection when illness strikes.I am not saying that RM35k is a lot of money to cover one's medical cost, but again this has to be done as early as possible. The earlier one starts practicing this, the lower the risk of having insufficient funds when one needs it. If we have the financial strength to build up this pool of fund, then by all means this would be the best way out. Otherwise then insurance is the next best alternative. I agree with the statements by yourself and yklooi, but what chances does critical illness really strike that early in life? We are talking about those below 35 in this context as I am an advocate of early financial planning. But let's make it clear before any misunderstanding escalates from this discussion. I am not totally condemning insurance for critical illness. Through this discussion, I am just opening up our minds to a possible better alternative to "insure" against critical illness or other medical complications. And, dun underestimate the factor of psychology when it comes to money. Sure, you can build your 35k or whatever amount and use it as self insurance BUT your mind will be screwed up if you had to use it. This is because you have treated the 35k as your money already, part of your funds...and when you part with this fund..your net worth take a hit...psychologically, you might even want to "save" some costs while you pay everything yourself... Contrast this to...everything covered under insurance....you don't come out with your own money(eventhough it is your own money if you have paid through the years).....your mind will be more at ease when battling major illness my 2 cents |

|

|

Mar 26 2019, 09:11 AM Mar 26 2019, 09:11 AM

|

|

Staff

25,802 posts Joined: Jan 2003 From: Penang |

QUOTE(aspartame @ Mar 25 2019, 06:38 PM) I am not a strong advocate of "too much" insurance. But I recommend buying at least some insurance while you are building your own funds. Why? Illness can strike anytime....at least have some form of protection when illness strikes. It is never the case (bolded part), a medical insurance never cover everything. It has its own coverage and limitation as well. And, dun underestimate the factor of psychology when it comes to money. Sure, you can build your 35k or whatever amount and use it as self insurance BUT your mind will be screwed up if you had to use it. This is because you have treated the 35k as your money already, part of your funds...and when you part with this fund..your net worth take a hit...psychologically, you might even want to "save" some costs while you pay everything yourself... Contrast this to...everything covered under insurance....you don't come out with your own money(eventhough it is your own money if you have paid through the years).....your mind will be more at ease when battling major illness my 2 cents One still needs to have own saving to cover those area that is not covered by insurance. A balance act needs to consider between saving and insurance, as said life is not perfect and a lot of time is cruel. |

|

|

Mar 26 2019, 10:11 AM Mar 26 2019, 10:11 AM

|

Senior Member

3,165 posts Joined: Feb 2015 |

QUOTE(cherroy @ Mar 26 2019, 09:11 AM) It is never the case (bolded part), a medical insurance never cover everything. It has its own coverage and limitation as well. Dun take it too literally lah.. of course insurance does not cover everything ....One still needs to have own saving to cover those area that is not covered by insurance. A balance act needs to consider between saving and insurance, as said life is not perfect and a lot of time is cruel. |

|

|

Mar 26 2019, 10:40 AM Mar 26 2019, 10:40 AM

|

|

Staff

25,802 posts Joined: Jan 2003 From: Penang |

QUOTE(aspartame @ Mar 26 2019, 10:11 AM) When it doesn't cover everything, then there is no 100% peace of mind and one still needs own saving to mitigate those risk as well. Don't underestimate this statement, often "insurance cover everything" is the statement that start off many dispute and some client may claim agent cheating them (by saying this word to them), especially when they can't claim those compensation. Also, "insurance cover everything" may have implication towards one's financial planning approach and forget the importance to have own saving to mitigate those risk. |

|

|

Mar 27 2019, 11:21 AM Mar 27 2019, 11:21 AM

|

|

Elite

5,626 posts Joined: Nov 2004 From: Klang, Selangor |

QUOTE(mushigen @ Mar 25 2019, 02:03 PM) I understand where you're coming from. As you pointed out, what are the chances of one contracting critical illness before 35? Nobody can answer that. I am sorry to hear about the misfortune of your wife's cousin. And I hope that he/she bought insurance to cover against the cancer.And how sure are you that you will be able to afford a lump sump payment for medical procedures if critical illness strikes at, say, 40 years old? And the lump sum compensation will come in handy too. My wife's cousin was diagnosed with cancer at age 30-plus. And I'm sure, given our modern lifestyle, the median age when the proverbial shit hits the fan is trending downwards. I can agree with you that if you can afford it, you don't need to buy medical and life insurance. Question is, how many cannot afford their medical fees now and yet think that when major illness strikes, they will have saved up sufficient monies to afford treatment. I could consider myself more fortunate that nothing untoward affected my health during my wealth accumulation stage (*touch wood* x 3). Well I am still below 35 and as of now I have amassed enough cash buffer to cover many years of the most common insurance annual coverage. I started my wealth accumulation a little later in life (not exactly at 23 as most would have due to the problems I faced over 10 years ago) but rather just a few years ago. So imagine how much would one be able to amass if they started between the ages of 23-25. We need to instill this into the young minds that "cash is king" (no pun intended). QUOTE(cherroy @ Mar 25 2019, 02:58 PM) s Woah, sifu Cherroy summed it up in a very wise post.The discussion between yours and Jordy, just sums up that life is cruel and never perfect. It is some risk, choice and chance one needs to take. Get insured early, burned 35K premium, (could easily more than 50K if taking account of compounded interest/return that can serve as self insured/wealth building) vs No insured, take risk in between. There is no right or wrong nor which is wiser, just a choice and risk one needs to take, especially when one is just coming into society/working life and in the process of building career and wealth and disposal income is constraint. I agree that there is no right or wrong (never ever in life) in all the decisions that we take, but those who knew me well would know that I am quite a risk taker. This time around I took the correct bet in saving everything I had towards my financial independence roadmap. It is just the sacrifices that one has to make in order to make this work. Once one made it, the money will keep on snowballing until a time when one really needs it for emergency. Of course luck plays a big role in this too as we cannot predict our health conditions. So it is a good practice to always go for a full medical check up once every year to make sure there are no signs of major health implication. QUOTE(aspartame @ Mar 25 2019, 06:38 PM) I am not a strong advocate of "too much" insurance. But I recommend buying at least some insurance while you are building your own funds. Why? Illness can strike anytime....at least have some form of protection when illness strikes. I could understand that psychological part there and could partly agree with you that some people do feel overwhelmed when they need to part with the money. But I am of the opposite. I will feel the pinch whenever I have to pay for the insurance policy renewal (which happens every year until the day I die) And, dun underestimate the factor of psychology when it comes to money. Sure, you can build your 35k or whatever amount and use it as self insurance BUT your mind will be screwed up if you had to use it. This is because you have treated the 35k as your money already, part of your funds...and when you part with this fund..your net worth take a hit...psychologically, you might even want to "save" some costs while you pay everything yourself... Contrast this to...everything covered under insurance....you don't come out with your own money(eventhough it is your own money if you have paid through the years).....your mind will be more at ease when battling major illness my 2 cents The more my cash flows out on big ticket payments such as insurance, the more heartbreaking I get and psychologically I would keep thinking to myself that I might need to postpone my plan for early retirement. This will cause me uneasiness over the years that comes. The earlier one starts it, the higher the chances of one being able to accumulate enough cash buffer for critical illnesses and having the ease of mind just like I did. |

|

|

Mar 27 2019, 11:40 AM Mar 27 2019, 11:40 AM

|

Senior Member

4,949 posts Joined: Jul 2010 |