Investment StashAway Malaysia, Multi-Region ETF at your fingertips!

|

|

May 8 2019, 10:37 AM May 8 2019, 10:37 AM

Return to original view | Post

#1

|

Junior Member

90 posts Joined: Jul 2007 |

|

|

|

|

|

|

May 8 2019, 10:46 AM May 8 2019, 10:46 AM

Return to original view | Post

#2

|

Junior Member

90 posts Joined: Jul 2007 |

|

|

|

May 8 2019, 10:48 AM May 8 2019, 10:48 AM

Return to original view | Post

#3

|

Junior Member

90 posts Joined: Jul 2007 |

|

|

|

May 14 2019, 09:54 AM May 14 2019, 09:54 AM

Return to original view | Post

#4

|

Junior Member

90 posts Joined: Jul 2007 |

I changed risk index from 20% to 6.5%, i found no point to involve with this political agenda that caused global market dropped, dumped all the stocks better

This post has been edited by swc881: May 14 2019, 09:54 AM |

|

|

May 14 2019, 10:33 AM May 14 2019, 10:33 AM

Return to original view | Post

#5

|

Junior Member

90 posts Joined: Jul 2007 |

QUOTE(honsiong @ May 14 2019, 10:16 AM) 6.5% still got 35% stocks. You need both stocks and bonds to balance each other out, it’s not like bonds are very stable, they are just inversely correlated with equities. I suffered major losses from US / Japan equities with 20% risk index. You're right even changing to 6.5% i still hold these stocks.... at least it only 10% from my allocated funds. |

|

|

May 14 2019, 11:25 AM May 14 2019, 11:25 AM

Return to original view | Post

#6

|

Junior Member

90 posts Joined: Jul 2007 |

|

|

|

|

|

|

May 14 2019, 11:31 AM May 14 2019, 11:31 AM

Return to original view | Post

#7

|

Junior Member

90 posts Joined: Jul 2007 |

|

|

|

May 14 2019, 11:33 AM May 14 2019, 11:33 AM

Return to original view | Post

#8

|

Junior Member

90 posts Joined: Jul 2007 |

|

|

|

May 14 2019, 12:46 PM May 14 2019, 12:46 PM

Return to original view | Post

#9

|

Junior Member

90 posts Joined: Jul 2007 |

QUOTE(honsiong @ May 14 2019, 12:08 PM) Please. I was -23% last year christmas. I am indeed looking for long term investment, but i don't really see the value of holding these stocks where the value keep depreciating day by day.6.5% is too low TBH, your long term return will be lot lower too. So i am thinking why not i lower down the damage by invested to bonds now (at 6.5%) When market stable, i can always changing back to 20% risk index... |

|

|

May 24 2019, 02:23 PM May 24 2019, 02:23 PM

Return to original view | Post

#10

|

Junior Member

90 posts Joined: Jul 2007 |

QUOTE(snoozet @ May 24 2019, 11:34 AM) Stashaway replied me that their system had error on last friday, therefore no conversion and buy order for Wed deposit. This is weird, if your deposit happened last Friday. Usually it will get processed within Monday and buy order to be happened before US market open, then next Tuesday your buy order should be completed. How come it delayed until Thursday? The effect did not stop there, my last friday deposit should convert and buy yesterday(Thu) but did not happene due to the last friday system glitch and my last friday deposit did not reach on time. A bit disappointed with a high-tech company. The worst part is, it skip buying the day that fall, and the accumulated backlog fund flush out to buy on the rebound day. |

|

|

May 24 2019, 03:05 PM May 24 2019, 03:05 PM

Return to original view | Post

#11

|

Junior Member

90 posts Joined: Jul 2007 |

QUOTE(snoozet @ May 24 2019, 02:36 PM) For Malaysia situation: I not sure if SA work differently between SG and MY, below how my very last transaction work so far for new portfolio, you can sort the transaction view for your portfolio name to see the exact time your buy order being completed. Deposit on early morning of the day: Mon - Buy on Wed night (US wed) Tue - Buy on Thu night Wed -Buy on Fri night Thu - Buy on Mon night Fri - Buy on Tue night This week Mon and Wed is public holiday, so last friday deposit should buy Thu. - Deposit happened at 27 April (Sat) - Buy order showed pending at 29 April (Mon) under SA apps before US market open, it showed completed at next Tuesday morning but already incurred loss under my portfolio from the US stock market happened at 29 April. So i assuming the buy order successfully went through and already started trading on the same day itself. My account is SG FYI. This post has been edited by swc881: May 24 2019, 03:43 PM |

|

|

Jun 19 2019, 03:26 PM Jun 19 2019, 03:26 PM

Return to original view | Post

#12

|

Junior Member

90 posts Joined: Jul 2007 |

|

|

|

Jun 20 2019, 09:17 AM Jun 20 2019, 09:17 AM

Return to original view | Post

#13

|

Junior Member

90 posts Joined: Jul 2007 |

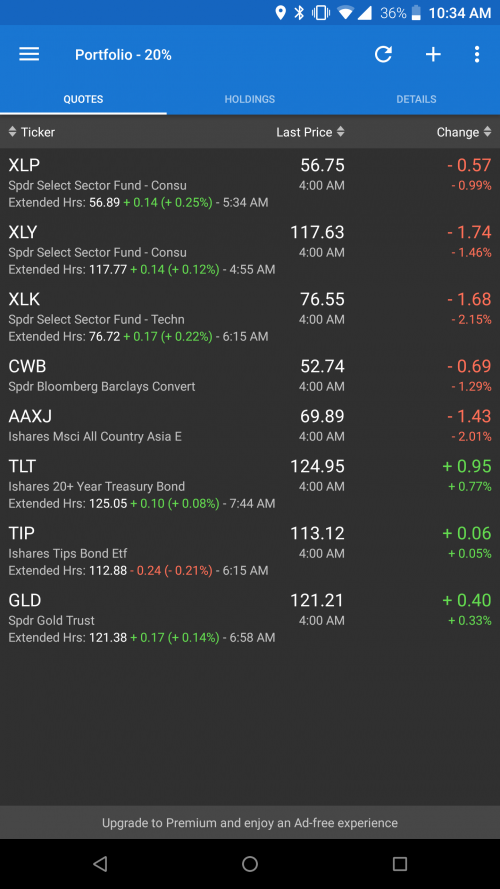

QUOTE(snoozet @ Jun 19 2019, 08:12 PM) stashaway lacks consistency or SOP, even the small matters, always leave ppl guessing. This need improvement urgently, if stashaway is a bank and run in this way, do u still have confidence? SA do not provide any real time dashboard, it only show daily update after US market closed that required intensive calculation for our portfolio returns. If you actually need one real time dashboard, you can download an apps called "My Stocks Portfolio & Widget" for Android, where you can input shares unit, price per shares based on SA allocations, then you get to see the return updated in real time. However, the returns isn't 100% match with SA (after it updated) but it close to 90% accuracy, so you can get the quick view for your returns in real time. |

|

|

|

|

|

Jul 23 2019, 11:44 AM Jul 23 2019, 11:44 AM

Return to original view | Post

#14

|

Junior Member

90 posts Joined: Jul 2007 |

Hi guys, i hoping to get some simple lay man explanation here.

I have no clue how SA actually split the allocation when the fresh funds went through. If i simply see the performance, SA do not really allocate to performing ETF, but rather invest to the lower performing ETF Example 1 - XLK were performing very well, but SA bought the XLP and XLY from my fresh funds without any allocation into XLK. Current performance XLK : +8.24% XLP : +5.89% XLY : +5.37% Example 2 - TLT were performing very well, but SA mainly bought TIP from my fresh fund without any allocation into TLF. Current performance TLT : +5.84% TLF : +2.37% |

|

|

Aug 15 2019, 09:37 AM Aug 15 2019, 09:37 AM

Return to original view | Post

#15

|

Junior Member

90 posts Joined: Jul 2007 |

QUOTE(woonsc @ Aug 14 2019, 10:32 PM) Hi guys, moved to SG. Yes, i using SA SG because i base here just like you. There are various robo advisor here - https://dollarsandsense.sg/complete-cost-gu...pore-investors/Any one investing in SG? Stashaway SG or MY? Got better platform then Stashaway in SG? Idk where got forums like this for sg |

|

|

Aug 15 2019, 11:04 AM Aug 15 2019, 11:04 AM

Return to original view | Post

#16

|

Junior Member

90 posts Joined: Jul 2007 |

Major optimisation into below ETF, changed mine risk index to 22% and see how it goes...

XLV IJR XLY TIP EMLC IVV VGK GLD |

|

|

Aug 15 2019, 11:12 AM Aug 15 2019, 11:12 AM

Return to original view | Post

#17

|

Junior Member

90 posts Joined: Jul 2007 |

|

|

|

Nov 6 2019, 04:24 PM Nov 6 2019, 04:24 PM

Return to original view | Post

#18

|

Junior Member

90 posts Joined: Jul 2007 |

QUOTE(whycanot323 @ Nov 5 2019, 02:54 PM) thanks lot, i got some ques Based on the question you asked, i can determine SA isn't the right platform you looking for. The SA mainly invested into ETF, with each different risk index percentage already pre-set with the custom portfolio internally, thus SA considered none active trading but bought into highly potential ETF researched by SA. 1) whats the time on the day they perform trading? i find that somewhere afternoon they made changes for once only when i login 2) i switching money from portfolio A to B, and C to D. both of the switching done on different day. why ? 3) if one day, i see the return is good , lets say earning 10% showing in app, if i sell, will it only earn 5%, because of the delay of 2-3days for selling. for example , risk index 36% portfolio. From the day SA launched, they only did re-optimisation once, FYI. (corrected) This post has been edited by swc881: Nov 7 2019, 10:20 AM |

|

|

Nov 18 2019, 01:17 PM Nov 18 2019, 01:17 PM

Return to original view | Post

#19

|

Junior Member

90 posts Joined: Jul 2007 |

QUOTE(honsiong @ Nov 18 2019, 12:51 PM) StashAway Singapore got new Simple. Saw this update this morning but 1.9% is way too low, not attractive at all. I don't see how this is better than normal conditional bank accountts in SG. OCBC pays out 1.2% when you credit salary regularly into it. Simple has also risk of 1.7%, and it will take time for money to be withdrawn. Their previous income portfolio not doing any good too, with SGD 50 earnings for past 2 months |

| Change to: |  0.6522sec 0.6522sec

0.43 0.43

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 5th December 2025 - 11:20 PM |