QUOTE(MUM @ Feb 2 2022, 11:40 PM)

Both portfolios have similar-ish risk....how does one knows that they are "similar-ish"?

other than that,...does they have they the same start date of entries?

i kind of think,...when and if they are both similar......then ETFs should have "better" roi...for its entry cost & holding cost is lower than unit trusts...

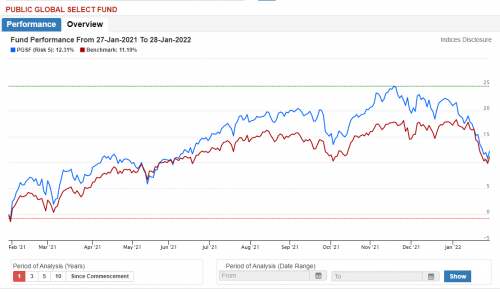

Yeah kind of similar I guess, I have a 90:10 UT portfolio between equities and fixed income, and I have 2 portfolios in my SA (36 sri & 22 sri). I have mainly been observing the 2 (UTs and SA) for about 2 years now, not long enough to observe a significant pattern yet tho. I suppose the impact of the difference in fees would only be noticeable several years down the road.

QUOTE(coolguy99 @ Feb 3 2022, 08:34 AM)

I like how they are hassle free, so far the returns are okay. I started investing 4 years back and now my portfolio is around +30%. But of course as some shared it has to do with the timings of my deposit as well. Nonetheless I am just happy to let it run on its own without checking frequently.

Yes the hassle free part is really quite the selling point here. Yea the timing thing is a stronger factor when the period considered is shorter. 30+ in 4 years seems decent enough regardless.

QUOTE(Medufsaid @ Feb 3 2022, 09:55 AM)

oooh which funds did you pick for UT? anyway if you had pick a UT that tracks HK (you can say KWEB is a part of Hang Seng Index) then it'll be negative

compare against a fund that buys global stocks

I have 10% in Amanahraya unit trust, 40% in developed markets; Principal global titans, and 50% in APAC markets; Affin select apac ex jp dividend and Principal apac dynamic growth (25% each). Yea its mostly down currently, as is everything else I suppose.

QUOTE(sgh @ Feb 3 2022, 10:13 AM)

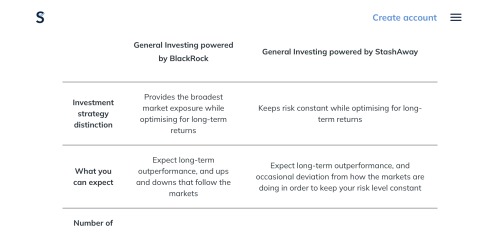

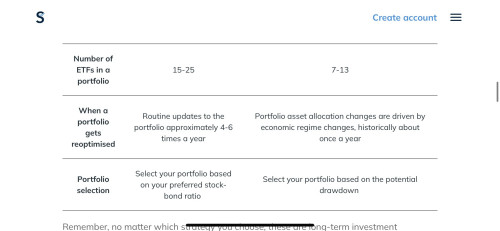

It is precisely in a bear market that you know which investment vehicle is performing the best. Ironic but true. Some UT has a benchmark like an index to beat. So unlike ETF which just buy most of the stocks in the index (aka passively managed ETF), UT fund manager need to do extra in order to beat that. This is where a lot of arguments have been going on for years. The ETF supporters are saying basically a passively managed ETF will beat the UT in the long run as most fund manager have lousy skills. So in a bear market we see how the UT perform. Note there are UT that explicitly state that they are not performing against any index at all. For such UT how you compare to it's ETF equivalent (if any) ?

In this bear market, I have observed UT with a heavy duplication of stocks in the index suffer the same fate as the ETF this is only logical. For UT that have lesser stocks in the index and have stocks that are OUTSIDE of the index it perform better (as in drop the least and climb up fastest). UT has this edge over ETF with the assumption the fund manger really are skillful and for this I will say pay the extra UT expense ratio for them to do their job. Of cuz vice versa is also true as in some UT just duplicate the stocks in the index and charge high expense ratio such kind of fund manager really earn monies for nothing so we should not invest in those.

Right that makes sense. So essentially UTs would have better downside protection as opposed to robo advisors? Wonder if that means robos would be good for growth for younger investors and then may slowly increase UTs in later years as a retiree or when reaching retirement.

Oct 5 2021, 02:17 PM

Oct 5 2021, 02:17 PM

Quote

Quote

0.0733sec

0.0733sec

0.73

0.73

7 queries

7 queries

GZIP Disabled

GZIP Disabled