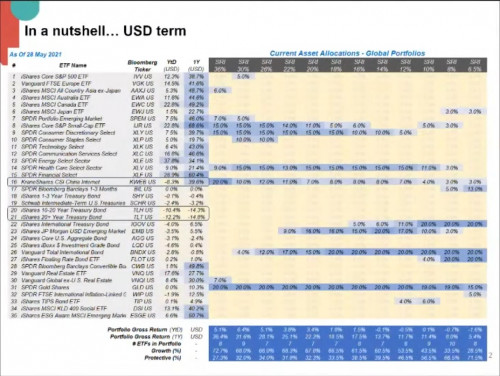

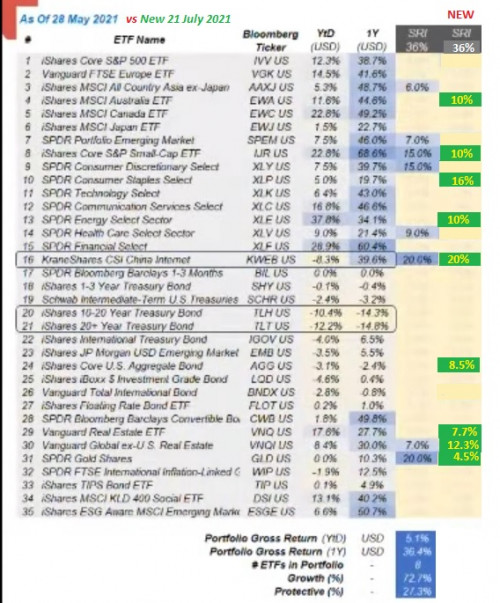

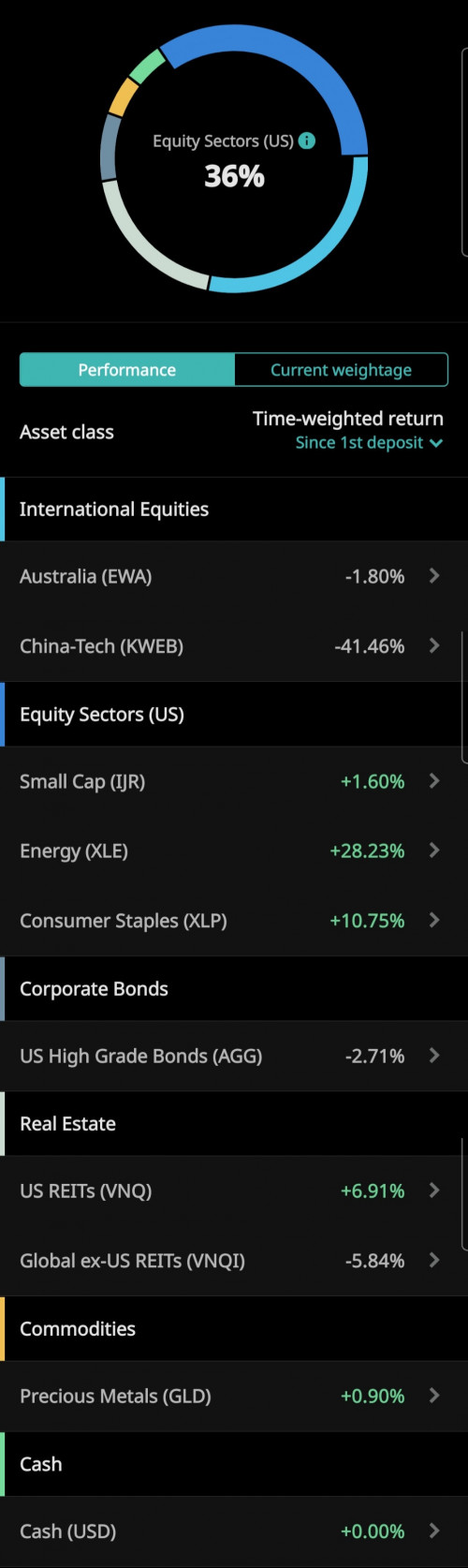

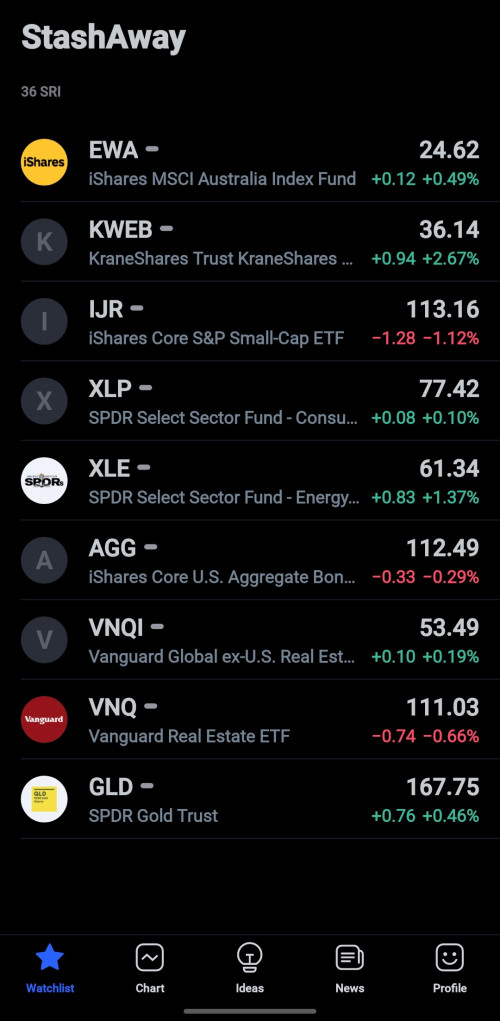

I watched the AMA video, at this point we dont know (for sure) if Stash Away's reoptimization in the removal of KWEB from the portfolio was a mistake. Because looking at the KWEB graph, its growth is not stable. Its volatility can be compared to crypto

If they did continue with this no human can guarantee whether the losses will be far worse or the price will rebound back.

But I understand that the decision to remove KWEB is not just one man's decision, it was a collective decision by a board probably led by Freddie. So Im pretty sure that this decision was not taken lightly since they are a business oriented company. If they are indeed qualified fund managers they must have evaluated all the risks and potential losses in removing KWEB as well as the opportunity costs as well.

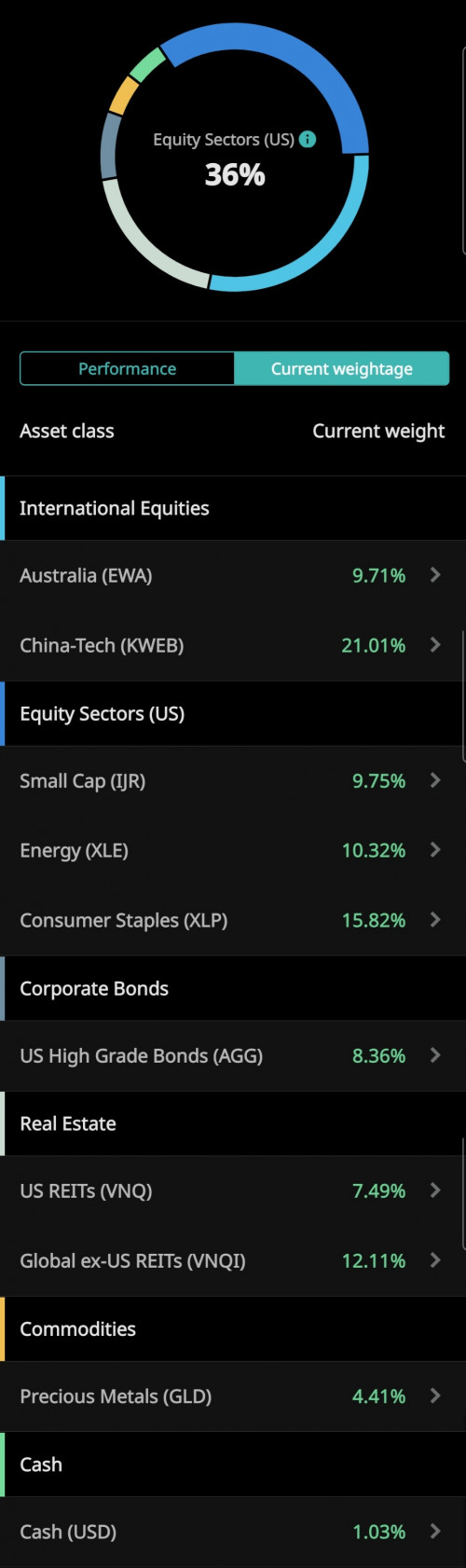

But I still have doubts how this current portfolio selection will perform if the market enters into recession. Is it already geared up for growth or hedge against a recession environment?

Can anyone here share your knowledge on this area, because I definitely will not be investing into the same SRI risk if another major reoptimization kicks in when the US market enters into recession which will secure more losses on top of KWEB sell off.

My Doubts:

- the GLD ETF price is close to ATH, investing more will be purchasing at high price

- will technology sector perform in recession? (XLK is also expensive 154USD)

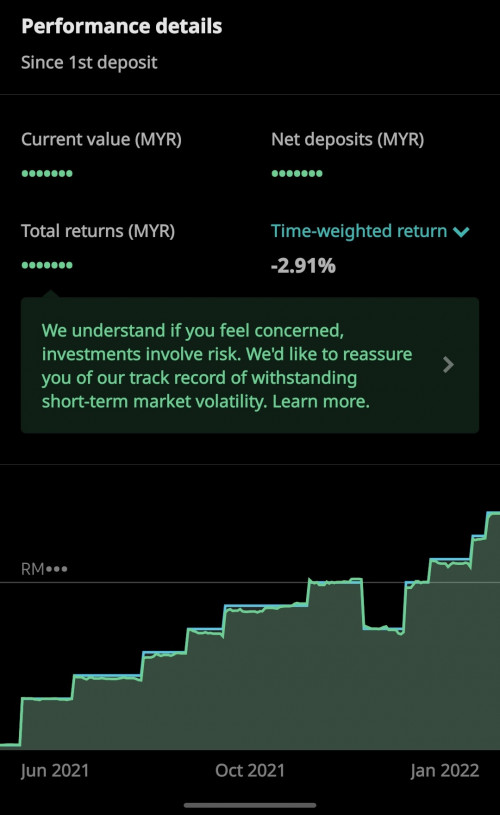

Personally I think General Portfolio of 36SRI has stabilized since the KWEB complete sell-off (albeit extremely bad timing). Like a lot of us here have been saying, KWEB is more volatile than crypto these days.

I would view StashAway as more of a defensive investment platform (even the most aggressive one), with it's relatively low fee & periodic ETF dividends pay-out. It is still a good platform to stack up some funds and let them do the investment works. Furthermore, they're quite transparent and up-front with re-opt of portfolios.

Jun 23 2021, 02:13 AM

Jun 23 2021, 02:13 AM

Quote

Quote

0.0446sec

0.0446sec

0.57

0.57

7 queries

7 queries

GZIP Disabled

GZIP Disabled