Outline ·

[ Standard ] ·

Linear+

Investment StashAway Malaysia, Multi-Region ETF at your fingertips!

|

woonsc

|

Sep 12 2019, 06:10 PM Sep 12 2019, 06:10 PM

|

|

QUOTE(-CoupeFanatic- @ Sep 12 2019, 02:08 PM) US withholding tax we all kena, but since u invest in SGD, are you subjected to any withholding tax by MAS or SASG on the profits made since u are a malaysian? I am soon becoming Sg tax resident. So capital gains aren't taxed. |

|

|

|

|

|

woonsc

|

Sep 12 2019, 07:51 PM Sep 12 2019, 07:51 PM

|

|

QUOTE(Ramjade @ Sep 12 2019, 07:12 PM) No tax by Singapore government. If so, any advantage to take out from MY and put into SG? |

|

|

|

|

|

woonsc

|

Sep 17 2019, 04:50 PM Sep 17 2019, 04:50 PM

|

|

I am curious how much do you guys invest a week? DCA?

I was doing around 200 ringgit weekly.

don't know if it is ok to up it. I was keeping 20% as a buffer, so any crash, can buy

|

|

|

|

|

|

woonsc

|

Sep 17 2019, 06:07 PM Sep 17 2019, 06:07 PM

|

|

QUOTE(frostfrench @ Sep 17 2019, 05:42 PM) I have been putting in money (RM1000) weekly since April. SA is part of my diversification and gonna ride it for at least 3 years lor  wao.. working in SG or Earning 100k as per /k salary |

|

|

|

|

|

woonsc

|

Sep 17 2019, 07:37 PM Sep 17 2019, 07:37 PM

|

|

QUOTE(coolguy99 @ Sep 17 2019, 07:15 PM) /k celery only 20k la. where got 100k haha  ahhh 4 k a month into stashaway.. 16 k spare   Jokes aside, Stashaway is currently my only investment vehicle.   I hope this is a good way to accumulate, then can move to SReit   |

|

|

|

|

|

woonsc

|

Sep 17 2019, 09:02 PM Sep 17 2019, 09:02 PM

|

|

QUOTE(coolguy99 @ Sep 17 2019, 08:31 PM) You have both Stashaway MY and SG? I am slowly moving some funds into Stashaway, currently my biggest investment vehicle is ASNB. QUOTE(Ramjade @ Sep 17 2019, 08:36 PM) Just pick either Stashaway MY or SG. No need for both. I maintain my holdings in SA MY and started topping up at SA SG. If there is big changes in Forex, then I move from MY to SG.. |

|

|

|

|

|

woonsc

|

Sep 17 2019, 09:26 PM Sep 17 2019, 09:26 PM

|

|

QUOTE(MNet @ Sep 17 2019, 09:09 PM) 20%? Do u mean by right full force u able to invest RM240 per week? Since u keep 20% buffer, mean 200*20%=40  kinda.. but that's the past.. I am investing in SA SG now.. So I allocated a certain percentage like a "Market Crash Fund"  |

|

|

|

|

|

woonsc

|

Sep 17 2019, 09:28 PM Sep 17 2019, 09:28 PM

|

|

QUOTE(Ramjade @ Sep 17 2019, 09:19 PM) Is basically the same thing. If is me, I will pick SASG. 1. Faster transaction Money put into SAMY can be used to divert to SASG. Yes, same day money received from SA SG.. I will see.. since the underlying asset is USD hedge..  No difference, just hassle to have two accounts.. Plus the 30% witholdiong tax refund at the end of the year.,  |

|

|

|

|

|

woonsc

|

Sep 29 2019, 10:44 AM Sep 29 2019, 10:44 AM

|

|

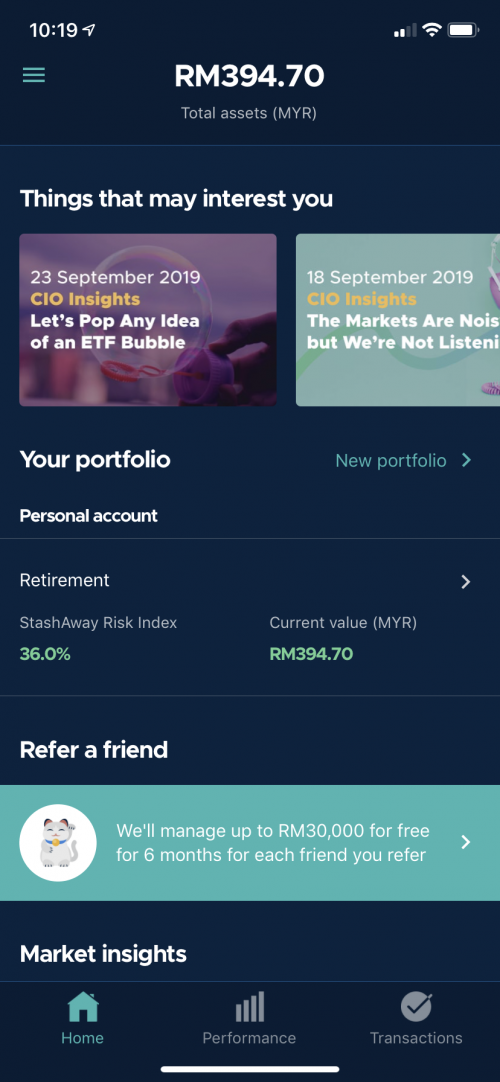

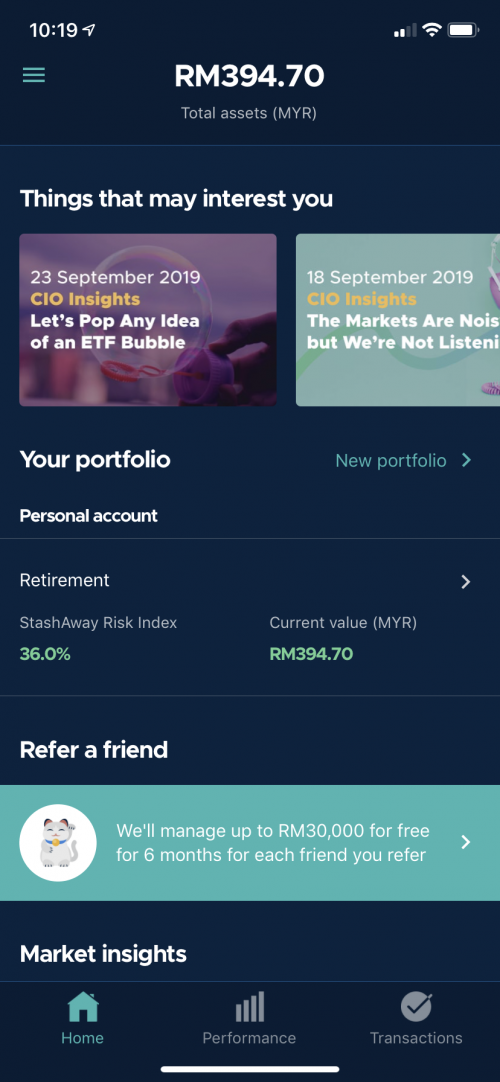

QUOTE(taiping... @ Sep 29 2019, 10:20 AM) I invested rm400 Been on negative region for past 1 week 36% risk Am I doing something Wrong here  I also just started early this month, 500 starting and 150 weekly at 36%. 950 so I am now at 938. 1.3% down. But I like it. Haha SA MY down before. I am also starting a crash fund at the side. Every drop in my portfolio of 5%, I top up 1/10 of this crash fund. So if market down 10% I put 1/9 Down 20% 1/7 If down 50% I put in 1/1 So you keep buying at the dips. |

|

|

|

|

|

woonsc

|

Oct 3 2019, 12:44 PM Oct 3 2019, 12:44 PM

|

|

Anyone adding money in?

|

|

|

|

|

|

woonsc

|

Oct 21 2019, 06:10 PM Oct 21 2019, 06:10 PM

|

|

SG is the fastest.

Afternoon in, evening reflected

|

|

|

|

|

|

woonsc

|

Nov 19 2019, 02:07 PM Nov 19 2019, 02:07 PM

|

|

QUOTE(-CoupeFanatic- @ Nov 19 2019, 02:06 PM) imo nothing can be as liquid as liquid cash, period. It will take at least a couple working hours, if not days, for SA to send the money to you upon withdrawal. If >2.2% I'll put inside. |

|

|

|

|

|

woonsc

|

Nov 19 2019, 03:18 PM Nov 19 2019, 03:18 PM

|

|

QUOTE(-CoupeFanatic- @ Nov 19 2019, 02:09 PM) for SGD account, 2.2% p.a. is considered high already, maybe its worth it after all? depends on individual. I'm lucky to be able to get 2% on my savings account on SC jumpstart account. So either give me more % or when I reached my SC limit. |

|

|

|

|

|

woonsc

|

Nov 20 2019, 10:25 PM Nov 20 2019, 10:25 PM

|

|

QUOTE(UsernameCopied @ Nov 20 2019, 09:32 PM) How often do you guys use recurring deposit? Is it better to do once a month at RM500 or once ever 2 weeks at RM 250? What's the pros and cons of these two options? Btw I just started stashaway about a month ago, deposited RM500 on 16 October then another RM500 on 4th November at 36% risk index... so far only getting RM18.7 total returns (2.52% money weighted return/2.66 time weighted return) which seems kinda low. Is it better to lower my risk index to get consistent higher returns or just stay at 36%? Still new to stashaway and any tips or advice is appreciated. Bro. Two months 2.5% is considered low? What do u expect. Casino, crypto returns? With that amount, you can consistently top up. For me, if I see the week is bad, I top up a bit more, good week, top up minimum amount. |

|

|

|

|

|

woonsc

|

Jan 28 2020, 07:27 AM Jan 28 2020, 07:27 AM

|

|

QUOTE(neverfap @ Jan 27 2020, 11:30 PM) Just a heads up Market is tanking hard because of coronavirus. Top up right now! |

|

|

|

|

|

woonsc

|

Mar 1 2020, 06:36 PM Mar 1 2020, 06:36 PM

|

|

QUOTE(cucumber @ Mar 1 2020, 04:01 PM) My 6% portfolio is at 1% return since last year. Probably better off putting it in FD. Nothing is safe at the moment, even gold is crashing. I'm going to hold on to my cash & wait for a while. If this turns into a bear like it did in 2008, then it's going to keep crashing for many months. Plenty of time to get in. Really? Only 1%? How? Is should be safe. Is it better to get into SA simple |

|

|

|

|

|

woonsc

|

Mar 1 2020, 07:13 PM Mar 1 2020, 07:13 PM

|

|

QUOTE(cucumber @ Mar 1 2020, 07:00 PM) Bonds were not doing that great last year. And it was affected by last week's drop as well. Hmmm.. I am putting extra on my normal dca. Around 40% More. . |

|

|

|

|

|

woonsc

|

Mar 13 2020, 07:38 AM Mar 13 2020, 07:38 AM

|

|

I feel it's really cheap now.

At 36% risk, I am down 19% MWR.

Topping up 500 ringgit. Haha.

War chest not much, but cutting back on spending and invest!

|

|

|

|

|

|

woonsc

|

Mar 13 2020, 06:44 PM Mar 13 2020, 06:44 PM

|

|

Hehehehe I just lost a month salary wage.

|

|

|

|

|

|

woonsc

|

Mar 13 2020, 08:01 PM Mar 13 2020, 08:01 PM

|

|

QUOTE(CoronaV @ Mar 13 2020, 06:59 PM) I know it's best time to enter. You can do VCA |

|

|

|

|

Sep 12 2019, 06:10 PM

Sep 12 2019, 06:10 PM

Quote

Quote

0.2042sec

0.2042sec

0.34

0.34

7 queries

7 queries

GZIP Disabled

GZIP Disabled