Outline ·

[ Standard ] ·

Linear+

Investment StashAway Malaysia, Multi-Region ETF at your fingertips!

|

tsutsugami86

|

Jul 29 2020, 12:02 AM Jul 29 2020, 12:02 AM

|

|

If next time got one banker accidentally transfer money wrongly to my account, will I need go to jail due to I stole someone money?

If just a human error did by curlec, SA already do their best to refund all the money. Those 2nd or 3rd batch auto debit may be just because key in wrongly by curlec and the system automaticly follow the instruction to process, SA should not able to stop it.

|

|

|

|

|

|

tsutsugami86

|

Jul 29 2020, 12:25 AM Jul 29 2020, 12:25 AM

|

|

QUOTE(vanitas @ Jul 29 2020, 12:14 AM) If next time got one banker accidentally transfer your money wrongly to my account, will you still believe the banker? Some will forgive, some won't, as simple as that. Ya I won't forgive the banker, in this scenario the banker (Curlex) transfer my money (investor) to your account (SA). |

|

|

|

|

|

tsutsugami86

|

Jul 29 2020, 12:38 AM Jul 29 2020, 12:38 AM

|

|

QUOTE(vanitas @ Jul 29 2020, 12:27 AM) The backend involved two parties bro. Are you really sure is Curlec problem solely? Not sure. BTW, is the whole process of auto debit like this way : 1) SA - request 2) Curlec - process 3) Bank - Allow Anyone know? |

|

|

|

|

|

tsutsugami86

|

Jul 29 2020, 02:33 PM Jul 29 2020, 02:33 PM

|

|

QUOTE(JLJQ @ Jul 29 2020, 02:22 PM) Hey guys, how long does it usually take for JomPay funds to reach our SA account? First time using JomPay since they have suspended direct debit feature for now. Reach their account consider fast, just take time to convert to USD and invest. |

|

|

|

|

|

tsutsugami86

|

Jul 29 2020, 04:03 PM Jul 29 2020, 04:03 PM

|

|

QUOTE(chichabom @ Jul 29 2020, 03:48 PM) this is very bad i feel. Time taken is just too long. Maybe jompay on monday morning, the transaction may faster, hopefully can complete before weekend |

|

|

|

|

|

tsutsugami86

|

Jul 30 2020, 09:27 AM Jul 30 2020, 09:27 AM

|

|

QUOTE(zstan @ Jul 30 2020, 09:24 AM) SA should request compensation from Curlec instead. Maybe ask them to provide free auto debit service for 6 months as well  not sure whose problem yet.  |

|

|

|

|

|

tsutsugami86

|

Aug 3 2020, 08:55 PM Aug 3 2020, 08:55 PM

|

|

QUOTE(joshtlk1 @ Aug 3 2020, 08:52 PM) My deposit has been in 'progress' since the 29th July. Anyone deposited recently and have the same problem? I use jompay on 01/08 to deposit RM 300 to SA portfolio, today showed fund received, converted to usd and now buy unit (in progress). |

|

|

|

|

|

tsutsugami86

|

Aug 3 2020, 08:57 PM Aug 3 2020, 08:57 PM

|

|

QUOTE(joshtlk1 @ Aug 3 2020, 08:56 PM) dam, mine must be lost somewhere in transition. Do you have more than 1 portfolio? Got, 36% & 26% |

|

|

|

|

|

tsutsugami86

|

Aug 4 2020, 12:10 PM Aug 4 2020, 12:10 PM

|

|

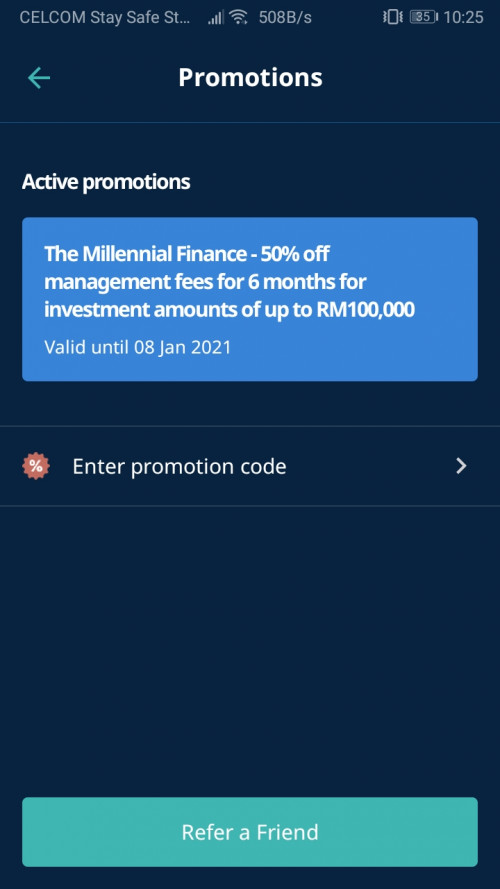

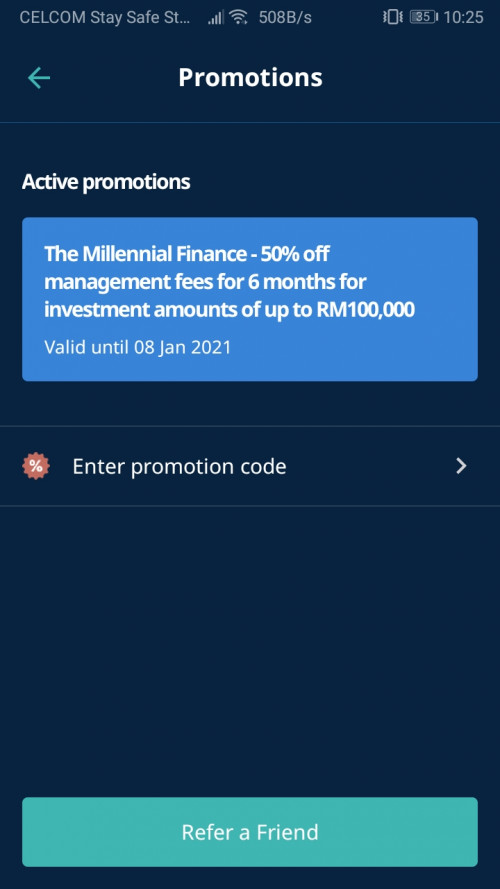

QUOTE(4eyeco @ Aug 4 2020, 10:37 AM) Thanks for your reply. Dunno why mine is 50% off instead of free. Just dropped a whatsapp to SA on this.  your promote code get from the blogger who help SA to promote, therefore got 50% discount on fee for investment up to RM 100K (good for huge amount investor) While our referral code is 100% free for investment up to RM 30k only. |

|

|

|

|

|

tsutsugami86

|

Aug 4 2020, 12:47 PM Aug 4 2020, 12:47 PM

|

|

I registered SA since Mar 2020 but didn't use any promo code.

I lose few month of fee, but luckily my investment amount not huge.

|

|

|

|

|

|

tsutsugami86

|

Aug 5 2020, 01:27 PM Aug 5 2020, 01:27 PM

|

|

QUOTE(Xenopher @ Aug 5 2020, 01:23 PM) One thing I loves about SA is their CFO constantly sharing his views on current market and they have valid reasons for the assets they chose. Although it's marketed as 'Robo-Advisor' but it has human overseeing the investment direction. For me it has the advantage of 'passive investing' of a roboadvisor, but also has the advantage of 'market optimization' of a unit trust. SA still has human overseeing the investment direction, Wahed seem like really 'Robo-Advisor', we just bank in and no need to do anything (actually nothing can do with their app). |

|

|

|

|

|

tsutsugami86

|

Aug 5 2020, 02:28 PM Aug 5 2020, 02:28 PM

|

|

QUOTE(honsiong @ Aug 5 2020, 02:21 PM) Wait, these two arent mutually exclusive. What's ur point here? Just to complaint Wahed's app so simple and cannot see the detail (except you review the monthly statement) |

|

|

|

|

|

tsutsugami86

|

Aug 5 2020, 08:55 PM Aug 5 2020, 08:55 PM

|

|

QUOTE(ben3003 @ Aug 5 2020, 07:47 PM) It took like nearly 1 week to receive the money, cashed out on monday evening, money came in on monday. If u ask me to park money, i think opus income plus fund is reallt worth to look at. No sales charge, the miney u bank in before 4pm will show tomorrow, u wan take out also before 4pm u withdraw tomorrow also out already. Ya, opus really fast, if performance of Simple almost same with opus mpf, I may think to move there. |

|

|

|

|

|

tsutsugami86

|

Aug 7 2020, 11:27 PM Aug 7 2020, 11:27 PM

|

|

QUOTE(majorarmstrong @ Aug 7 2020, 09:19 PM) agree to this but weight on gold is not that high 36% portfolio got 20% portion for gold, quite high. |

|

|

|

|

|

tsutsugami86

|

Aug 10 2020, 01:48 PM Aug 10 2020, 01:48 PM

|

|

QUOTE(ShinG3e @ Aug 10 2020, 12:26 PM) can try, however the amount of headache dealing with foreign regulator just isn't worth it (unless millions, then get local lawyer to attend the case on your behalf). i'm unsure if you'll receive the full capital back (if hacked), but i do know that your funds with luno is kept with a trustee account (Amtrust) as per SC's requirement to operate a local cryptoexchange here. However, it's an interesting question, maybe i'll ask around on this as crypto isn't like fiat where u have PIDM up to RM250k Agree, in order to chase back money may need spent a lot of time & money to deal with foreign regulator. Need to consider worth or not. Until today i still not start using etoro to invest. Another issue, when money transfer back from etoro to local bank account, bank negera may "kacau". So many risk & problem need to face. |

|

|

|

|

|

tsutsugami86

|

Aug 11 2020, 09:45 AM Aug 11 2020, 09:45 AM

|

|

My SA Simple had received 2 times dividend total RM 3.63, is it amount too small and they don't use to re-invest ?

|

|

|

|

|

|

tsutsugami86

|

Aug 11 2020, 02:21 PM Aug 11 2020, 02:21 PM

|

|

QUOTE(gundamsp01 @ Aug 11 2020, 02:13 PM) does Simple really help much in terms of giving more value to your cash? In your case, car insurance payments. What i am saying is, does the interest/dividend generated able to cover your car insurance? It is impossible to cover car insurance, the interest generate not much (Eg : i put RM 1500 only RM 2 - 3 dividend per month). But Simple can treat as another tool to replace saving account, i just part some fund inside Simple as emergency use. |

|

|

|

|

|

tsutsugami86

|

Aug 11 2020, 04:25 PM Aug 11 2020, 04:25 PM

|

|

QUOTE(XHunTerx123 @ Aug 11 2020, 03:05 PM) I suggest you put in RHB Smart account better bro, they have 1.5%+0.5% based can earn each months 1.5%+0.5% per annum ? but overall very little difference compare to Simple  |

|

|

|

|

|

tsutsugami86

|

Aug 11 2020, 05:04 PM Aug 11 2020, 05:04 PM

|

|

QUOTE(Gabriel03 @ Aug 11 2020, 04:48 PM) Stashaway Simple projected 2.4% pa is subjected to OPR rate. With latest drop, the return is less than 2.4% pa. Another issue with Simple is the longer duration to process buy and sell order. Besides that, there other money market funds which give competitive rate against Simple but with less processing time like Philips Money Market Fund, etc. still feel that not much difference since the amount i want to park in Simple not a huge amount. If park at Philip MMF, need monitor another account, very lazy to do this. |

|

|

|

|

|

tsutsugami86

|

Aug 14 2020, 12:55 PM Aug 14 2020, 12:55 PM

|

|

QUOTE(tehoice @ Aug 14 2020, 12:29 PM) consistent DCA? then you do VCA? when is the best time to check your portfolio? when your mood feels like it? checking at different time will yield drastic difference? best is just DCA and don't need to open it. open it after a year would give you bigger surprise too. Write down the jompay code, uninstall the apps and do dca. After 1 year install back the apps and see the result. |

|

|

|

|

Jul 29 2020, 12:02 AM

Jul 29 2020, 12:02 AM

Quote

Quote

0.0419sec

0.0419sec

0.48

0.48

7 queries

7 queries

GZIP Disabled

GZIP Disabled