Outline ·

[ Standard ] ·

Linear+

EPF - self contribution, need advise

|

BenChiew

|

Sep 19 2024, 10:18 AM Sep 19 2024, 10:18 AM

|

|

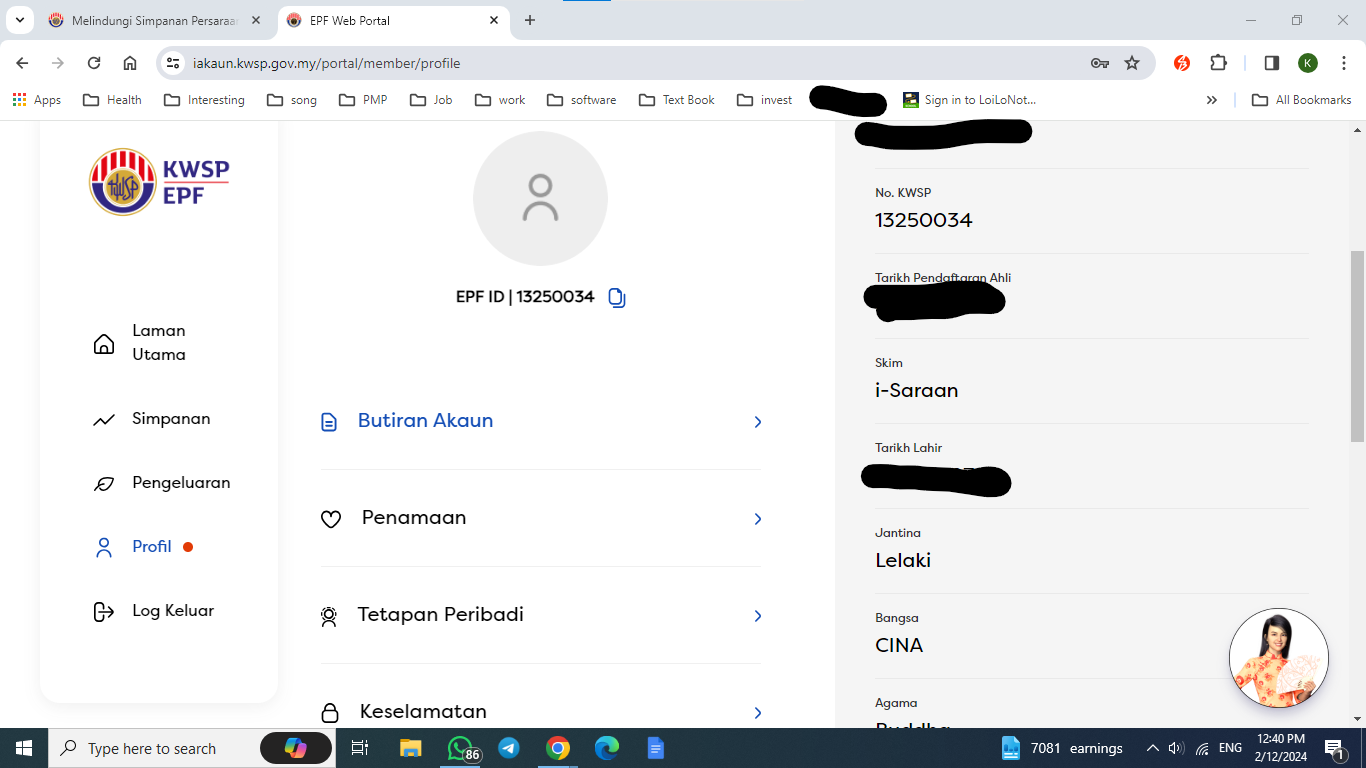

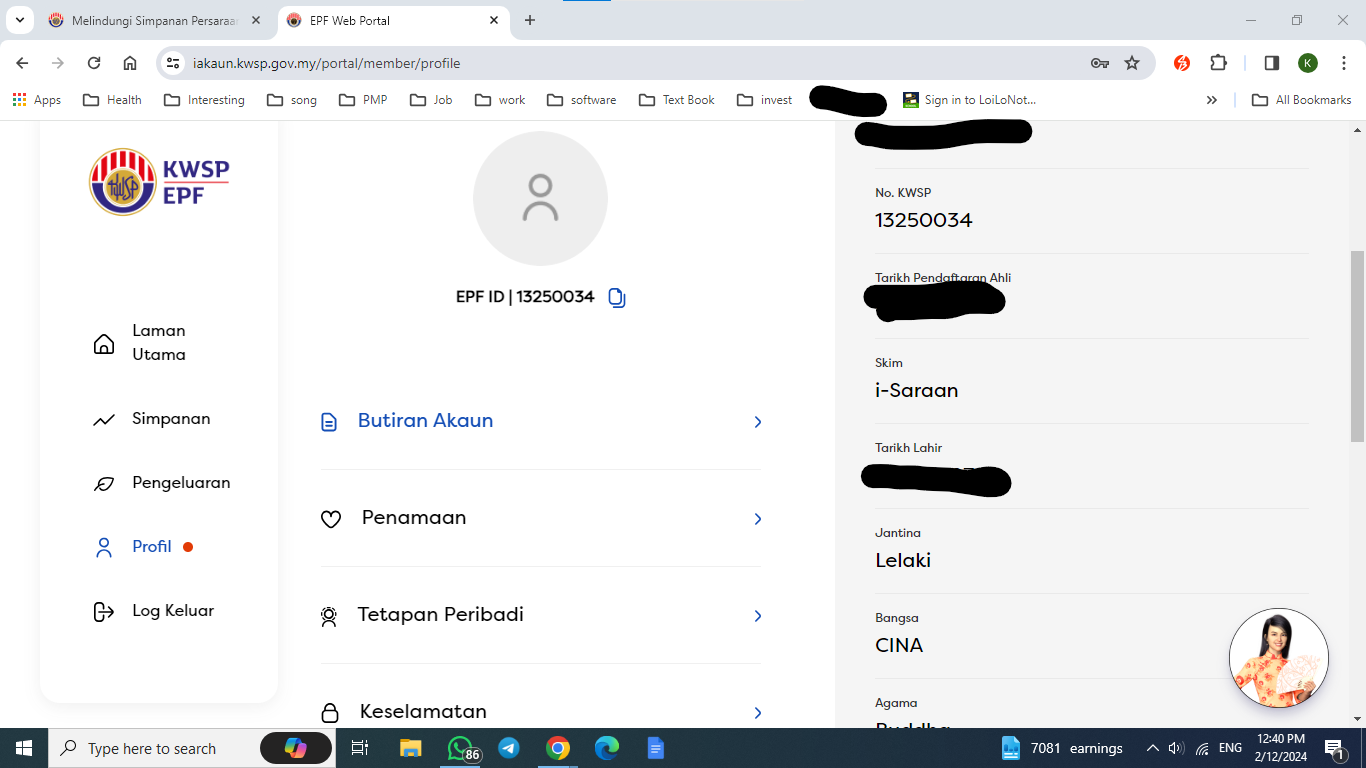

QUOTE(nexona88 @ Sep 19 2024, 09:02 AM) Your profile like this below or not Got written i-saraan  My profile says I-Saraan, last year I made voluntary contribution, but I didn't get the RM500. does the contribution needed to be via a certain manner? ================ Sorry. moot question. Just read that there must not be any employer contribution for the year. This post has been edited by BenChiew: Sep 19 2024, 10:20 AM |

|

|

|

|

|

BenChiew

|

Nov 8 2024, 03:27 PM Nov 8 2024, 03:27 PM

|

|

QUOTE(ronnie @ Nov 7 2024, 10:03 PM) 14 years old can open an EPF account to start earning i-Saraan actually. Wow. Never thought of that. So I just need to deposit RM3500 per year to get the RM500? is there a cutoff date for the year? |

|

|

|

|

|

BenChiew

|

Nov 8 2024, 04:14 PM Nov 8 2024, 04:14 PM

|

|

QUOTE(nexona88 @ Nov 8 2024, 04:08 PM) Jan - June July - Dec The contribution is based on 6 month basis... If you already contribution on first half, then just waiting $$$ around September 😁 Thanks for the heads up. I am just about to get my kids to register for I-saraan. they already have an epf account. So upon seeing the I-saraan product, just deposit RM3.5k? Via the Rm100k yearly allocation? Then wait for the RM500 March 2025? ------------ oops, half yearly means RM1750 for RM250? This post has been edited by BenChiew: Nov 8 2024, 04:15 PM |

|

|

|

|

|

BenChiew

|

Nov 10 2024, 11:49 AM Nov 10 2024, 11:49 AM

|

|

QUOTE(nexona88 @ Nov 8 2024, 05:22 PM) Yes. Just self contribute... Just pick i-saraan option in your banking platform.. If you deposit 3.5k in January to June period, then straight get rm500... In September... If you deposit parts by part... Or monthly basis... Then your 500 split into 2... For 6 month deposit, then balance 6 month on the next year Feb or March So if i deposit RM3500 this month, next year should get the RM500. Thanks a lot guys. |

|

|

|

|

|

BenChiew

|

Nov 11 2024, 10:01 AM Nov 11 2024, 10:01 AM

|

|

QUOTE(Ivictus @ Nov 10 2024, 06:09 PM) Hi Sifus, would like to ask on the 100k self contribution. As I'm in commission based employee and not salary earner. If I want to deposit 100k to EPF is there any cap on the % of earnings or its totally allowed. Ie say I earn 160k annual, i want to deposit 100k to EPF: 1. is it allowed and any issues ? 2. if allowed meaning for income tax do i declare as 60k income end of the day (160k - 100k) 3. one shot or monthly also can? Whatever income you get, clear that with the tax man. There are allowable deductions there for epf in arriving at your taxable income. Once you have done that, you are free to do whatever you want with your taxed income. Rm100k deposits into epf is one of your options. |

|

|

|

|

|

BenChiew

|

Jan 7 2025, 12:32 AM Jan 7 2025, 12:32 AM

|

|

QUOTE(romuluz777 @ Jan 4 2025, 08:29 PM) If I got spare cash lying around, I'll just dump into epf, never bothered counting days whether its end of the month or not. A few lesser bucks gained is negligible lah. Same here. Keep it longer than I need to, it may end up somewhere else other than epf. 😂 |

|

|

|

|

|

BenChiew

|

Jan 8 2025, 01:26 AM Jan 8 2025, 01:26 AM

|

|

QUOTE(nexona88 @ Jan 7 2025, 07:56 AM) Spend the money?? Then it's good lorh Help stimulate the economy of Malaysia The account 3 flexible actually from positive side is good attempt.... Give option actually to people... You want withdrawal asap.. or keep for emergency purposes later... Now with i-akaun secure... Even easier 😁 I have access to akaun 55. The voluntary i put in is incase i live to 99 years Old.  This post has been edited by BenChiew: Jan 8 2025, 01:26 AM This post has been edited by BenChiew: Jan 8 2025, 01:26 AM |

|

|

|

|

|

BenChiew

|

Feb 5 2025, 11:27 AM Feb 5 2025, 11:27 AM

|

|

For the RM500 incentive, let's say my last employer contribution is Oct 2024, will I be entitled this year?

|

|

|

|

|

|

BenChiew

|

Feb 5 2025, 12:04 PM Feb 5 2025, 12:04 PM

|

|

QUOTE(nexona88 @ Feb 5 2025, 11:45 AM) Rule of thumb... Within the period of January to June... Need to make sure No employers contribution comes in... To be extra careful, add July & August too... By then your name already cleared & in the process of crediting rm500.... Meaning if I deposit the RM2500 today, it will likely be captured during Sep 2025 payout? |

|

|

|

|

|

BenChiew

|

Feb 9 2025, 12:37 PM Feb 9 2025, 12:37 PM

|

|

QUOTE(propriete @ Feb 8 2025, 08:48 PM) Hi, what is max % for self elect employee EPF contribution above 11%? Or is there a maximum extra amount? Note: I already max out 100k per year. Not sure whether this matter. you can comfortably do 40% if you are on the 28% tax band. |

|

|

|

|

|

BenChiew

|

Feb 9 2025, 12:40 PM Feb 9 2025, 12:40 PM

|

|

QUOTE(nexona88 @ Feb 8 2025, 09:00 PM) Someone mentioned until 80% of salary.... That 100k self contribution is not included in the quota limit. So no worries... you can only do that if your taxable income is below RM100k per annum. A ringgit after that attracts 25% tax. |

|

|

|

|

|

BenChiew

|

Feb 9 2025, 03:27 PM Feb 9 2025, 03:27 PM

|

|

QUOTE(nexona88 @ Feb 9 2025, 02:58 PM) But realistically Not many people willing to go such high percentage... Not sustainable.... Around 30% probably got... Here there.... Higher than that, very slim... I agree with you. only a small fraction have that luxury. probably the older higher income people that have pretty much paid up everything and not having to pay loans. and maintain a modest lifestyle. |

|

|

|

|

|

BenChiew

|

Feb 9 2025, 04:21 PM Feb 9 2025, 04:21 PM

|

|

QUOTE(jasontoh @ Feb 9 2025, 04:14 PM) It should not impact the tax bracket whether it is 11% or more right? It does not affect your income tax. But since the discussion was about how high can one go. I am trying to point out that it really depends on the individual income too. Let's say you make RM100k a month. The majority of your taxable income is at 28%. you can't choose to do 80% employee contribution as you would only have 72% balance after deducting income tax. Without taking into consideration any other deduction or expenses. in contrast, if you earned RM3k a month, single and lived in your parents home. you can choose to do 80% since there is no income tax pcb and would be able to get by with RM600 a month on transport and small purchases. This post has been edited by BenChiew: Feb 9 2025, 04:22 PM |

|

|

|

|

|

BenChiew

|

Feb 12 2025, 03:42 PM Feb 12 2025, 03:42 PM

|

|

QUOTE(nexona88 @ Feb 11 2025, 05:19 PM) Needs more information on CC application using EPF as collateral.... So far I know... No bank uses them... Only as reference for your monthly contribution.... To cross check with your monthly salary.... Standard Chartered accepts EPF statements to process credit card applications. Not so much as a collateral, but it's conclusive evidence of income every month. Hope this helps. https://www.sc.com/my/credit-cards/#:~:text...20second%20yearThis post has been edited by BenChiew: Feb 12 2025, 03:51 PM |

|

|

|

|

|

BenChiew

|

Feb 12 2025, 04:08 PM Feb 12 2025, 04:08 PM

|

|

QUOTE(Wedchar2912 @ Feb 12 2025, 03:58 PM) oh really? Thanks for sharing... would you know if this applies also to those such as myself who basically have zero taxable income? Just EPF statements will do? tq Please dont quote me but I think the epf statement serves as a very reliable source document to decipher the applicant's income. It has one benefit compared to salary slip and bank statement, the epf statement can reveal how much dividend income from a reliable source. Having zero taxable income does not mean you dont have income. Just that the income has not surpassed the threshold to start paying taxes. |

|

|

|

|

|

BenChiew

|

Feb 12 2025, 04:58 PM Feb 12 2025, 04:58 PM

|

|

QUOTE(fuzzy @ Feb 12 2025, 04:51 PM) They can consider, but no guarantees. EPF is just generally used to cross check the salary slip one submits. If you claim you earn 100k a month, your EPF will reflect it given its mandated, so you can't simply go fake a payslip and get a credit card. But whether then only allow EPF, is case to case basis. Standard Chartered recently made some changes. they no longer want mediocre customers. Bank account opening is RM5k. All credit card application is a minimum of RM8k per month, even for their base products. Adopting epf statements as their source documents. |

|

|

|

|

|

BenChiew

|

Feb 13 2025, 12:12 PM Feb 13 2025, 12:12 PM

|

|

QUOTE(nexona88 @ Feb 12 2025, 05:24 PM) Just as I know too... But the other guy says can use EPF as collateral... That's why I want to know more... Logically it is impossible for EPF to serve as a collateral. Even bankruptcy or court order can't touch it, let alone a commercial arrangement. To me the integrity of the epf statement is better than a salary slip. |

|

|

|

|

|

BenChiew

|

Feb 28 2025, 06:37 PM Feb 28 2025, 06:37 PM

|

|

QUOTE(BboyDora @ Feb 27 2025, 09:48 AM) also the same. my clients children, some havent grad yet, age 19-21, got millions in bank account. not RM 1 million...RM 2 millions ya..., 8 figures.. so how they got so much money? you know, i know. sound absurd? not surprise, we also even read the news that MACC raid someone house with RM 100 millions cash. cash....... How does one get a million into kwsp in 3-4 years? |

|

|

|

|

|

BenChiew

|

Mar 1 2025, 09:16 AM Mar 1 2025, 09:16 AM

|

|

QUOTE(nexona88 @ Mar 1 2025, 08:06 AM) Even one have millions in hand... Still cannot deposit all... Because 100k limit yearly imposed... Another way is increase to max your employees mandatory contribution to like 70% of salary.... Then you could probably achieve the target The earlier poster narrated that the account holder is 18-21 years old and not even working. Even daddykasi, one can’t get all in within 3 years. Unless daddy put the child as an employee in their company. I highly doubt that they will do that because the amount of tax will be huge. And it’s not a million. He said many millions. ——————- I stand corrected. He said bank account. I misread it as epf account. Sorry. This post has been edited by BenChiew: Mar 1 2025, 09:19 AM |

|

|

|

|

|

BenChiew

|

Mar 5 2025, 12:08 PM Mar 5 2025, 12:08 PM

|

|

QUOTE(nexona88 @ Mar 5 2025, 10:37 AM) Got mine dated 4 March 2025 for this year. Quite efficient. Last employer contribution was Oct 2024. Deposited RM2500 in Feb 2025. wonder if they take it back if I go back to employment this year. |

|

|

|

|

Sep 19 2024, 10:18 AM

Sep 19 2024, 10:18 AM

Quote

Quote 0.1600sec

0.1600sec

0.76

0.76

7 queries

7 queries

GZIP Disabled

GZIP Disabled