Outline ·

[ Standard ] ·

Linear+

EPF - self contribution, need advise

|

BenChiew

|

Mar 5 2025, 02:56 PM Mar 5 2025, 02:56 PM

|

|

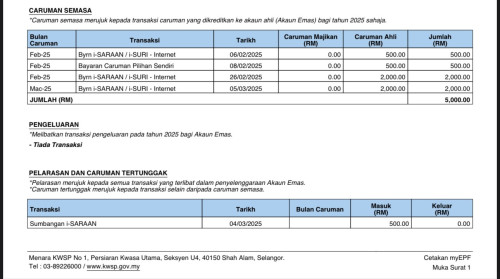

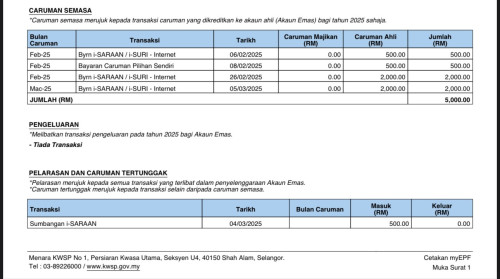

QUOTE(nexona88 @ Mar 5 2025, 01:55 PM) That one you gotten is for 2024... Second payment, which normally paid February or March... Your February 2025 deposit, payment only around August or September 2025... 🙏 It's for 2025, last year I was still employed. Plus the RM2500 only deposited as i-saraan in late February 2025. Only last month. Several days later they paid out the RM500 on 4 Mar 2025. My kids also received theirs but it was for 2024. RM3500 was deposited sometime Oct 2024. For 2025, I have yet to deposit the RM2500.. |

|

|

|

|

|

BenChiew

|

Mar 6 2025, 03:06 PM Mar 6 2025, 03:06 PM

|

|

QUOTE(nexona88 @ Mar 6 2025, 09:02 AM) Take time to process all.. And need to get $$$ from MoF too.. which sure would delay till Q3...  Perhaps coz mine is akaun emas. |

|

|

|

|

|

BenChiew

|

Mar 7 2025, 02:07 PM Mar 7 2025, 02:07 PM

|

|

QUOTE(MGM @ Mar 6 2025, 06:00 PM) Any self contribution during unemployment in late 2024? Yes last quarter of 2024 I did, but for the first 9 months of 2024, there are employer contribution. I assumed I will not be entitled for 2024. So put some in during Feb 2025. Got the RM500 in Mar 2025. |

|

|

|

|

|

BenChiew

|

Mar 7 2025, 04:29 PM Mar 7 2025, 04:29 PM

|

|

QUOTE(nexona88 @ Mar 7 2025, 02:13 PM) Bingo... Now I found my answer 🙏 i-saraan contribution for July - December month period... Even you just pick self contribution.... They would recognize as "i-saraan"... Be prepared for another 500 by September if there's no employers contribution for Jan - June period 👌 I understand where you are coming from. But Jul-Dec 2024, there are employer contributions, mixed with my own contribution. And I thought the RM500 is only for those that dont have the employer contribution the whole year.. I hope you are right, then I can get another RM500 this September. I basically have 4 years to qualify. After that I go past 60.... |

|

|

|

|

|

BenChiew

|

Mar 12 2025, 07:54 PM Mar 12 2025, 07:54 PM

|

|

QUOTE(MGM @ Mar 7 2025, 05:18 PM) Btw July to Dec 2024, which months have self contribution only? When did u register for i-saraan? Last employer contribution was Oct 2024. After that I self contribute for the last months of 2024. My self contribution continued in last week of Feb 2025. Mar 2025 I got the RM500. Hope this helps. |

|

|

|

|

|

BenChiew

|

Mar 12 2025, 08:06 PM Mar 12 2025, 08:06 PM

|

|

QUOTE(nexona88 @ Mar 12 2025, 08:00 PM) November & December 2024 accumulated self contribution amounts rm2500 & above?? If Yes... Then you got rm500 for that 2 month contribution & would get another rm500 around September 2025 🙏 Yes exceed RM3500. Thanks. |

|

|

|

|

|

BenChiew

|

Sep 12 2025, 03:17 AM Sep 12 2025, 03:17 AM

|

|

QUOTE(CommodoreAmiga @ Aug 30 2025, 09:13 AM) Say, self contribution is based on Date right? If say you reach 55 that year, but before birthday, contribution still going to your current accounts and not Akaun Emas right? For sure. Akaun Emas only exist in your account smack on the day you turn 55. A day before that you still have akaun 1,2,3. On your birthday, those 3 accounts gets consolidated into one total amount under Akaun 55. So on that lucky day, you will see Akaun 55 and Akaun Emas. |

|

|

|

|

|

BenChiew

|

Sep 17 2025, 08:59 PM Sep 17 2025, 08:59 PM

|

|

QUOTE(theevilman1909 @ Sep 15 2025, 03:23 PM) i-Saraan incentive payout dates2019: Oct 2019 (not sure the date) 2020: 24/09/2020 2021: 08/09/2021 2022: 19/09/2022 2023: 23/11/2023 2024: 28/08/2024 2025: ??????? 2025 4/3/2025 |

|

|

|

|

|

BenChiew

|

Sep 20 2025, 01:46 AM Sep 20 2025, 01:46 AM

|

|

QUOTE(nexona88 @ Sep 17 2025, 09:39 PM) It's for 2024 payout boss... I meant... It's for July - December 2024 contribution.... Jan - June 2025 contribution one not credited yet..... Probably end of September or October.... That is correct. The date I stated was for contribution I did Jan/Feb 2025. Got the 500 in March. My kids accounts got paid the same month (Mar 2025) but it was for contribution for 2024. Which was deposited in Nov 2024. In June 2025, my kids accounts received contribution for 2025. So now waiting to see if they get the 500 this month. |

|

|

|

|

|

BenChiew

|

Sep 20 2025, 02:24 PM Sep 20 2025, 02:24 PM

|

|

QUOTE(Syok Your Mom @ Sep 20 2025, 01:08 PM) All my relatives both parents sides no hope one. Once you ask them about money, they will block you forever. That's why I rely on crypto to get easy fast cash when I noticed there's going to be a crypto rally. If you are very confident, why don’t take a bank personal loan? |

|

|

|

|

|

BenChiew

|

Sep 20 2025, 09:35 PM Sep 20 2025, 09:35 PM

|

|

QUOTE(Syok Your Mom @ Sep 20 2025, 02:32 PM) Personal loan I asked before, if late payment per day charge 8% interests daily. Really Xiao the terms & conditions of personal loans You mean 8% calculated daily? |

|

|

|

|

|

BenChiew

|

Sep 29 2025, 07:17 PM Sep 29 2025, 07:17 PM

|

|

The million ringgit level was there for many years. A million back then was a lot of money.

They are just updating it. The essence still remains if you have a large sum in EPF, you are allowed to withdraw the remainder. The essence is still the same.

From recent statistics. There are about 16.2 mil contributors.only 0.13% have a million or more.

For those about getting there 650k-1mil is 0.15%.

Add both playing in this realm only 0.28%.

Plus those in the million ringgit club would also have a substantial amount outside the EPF ecosystem. They don’t really need the money.

Keep in mind, dividends alone will add 50-60k to their balance every year.

I think they will not increase anymore after the 3 years.

|

|

|

|

|

|

BenChiew

|

Oct 2 2025, 01:57 AM Oct 2 2025, 01:57 AM

|

|

To each their own. I see this as an adjustment from the perspective of EPF. The 1 mil threshold has been around for a long time. They needed to bring that up to speed in keeping the essence to only allow withdrawal after you have a substantial amount. And they can’t flip that from 1 mil to 1.3mil. So they do that consecutively for 3 years. Makes no sense for them to do beyond that unless something really drastic happens. I don’t see them retroactively take away the 55 years old access to your account too.

50 and above contributors accounts for 46% aum of EPF. And they are 27% of your total contributors. So if you are younger than 50 years old and nearing the 1mil, you are the needle in the haystack. Epf is not trying to thwart your plans.

Be grateful that we have a privileged institution like epf serving the rakyat. Their existence and purpose is similar to cpf of Singapore. Cpf only seeks to anchor their citizens at a subsistent level while we have the privilege of capitalising on EPF.

The epf is still the apex fund for retirement. It also comes along with some special protection.

Younger people will not see it until they enter their final realm of life.

This post has been edited by BenChiew: Oct 2 2025, 02:10 AM

|

|

|

|

|

|

BenChiew

|

Oct 3 2025, 03:49 AM Oct 3 2025, 03:49 AM

|

|

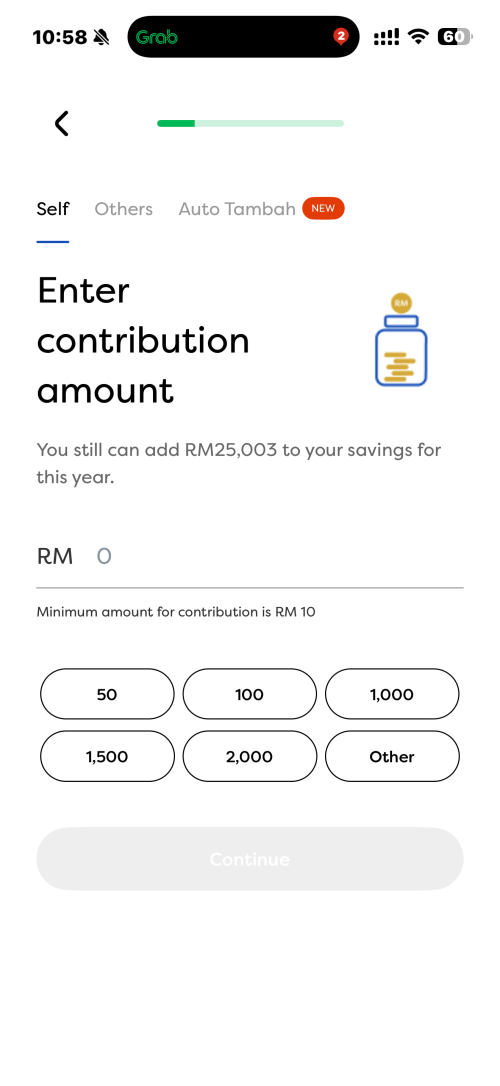

QUOTE(tweakity @ Oct 2 2025, 10:55 AM) How much would one value capital guarantee feature. (in EPF case only value guarantee though, not when-can-take-out guarantee) Example: Fixed value EPF 5% pa Corporate bond 5.7% pa At what point would you rather put the 100k reserved for EPF self contribution into Corporate bond. 5.5%? 5.9%? 6.3%? But while I feel biggest factor is still age. Like young can risk more, but at the same time with time compounding power is only obvious when you save earlier I only wish Tax deductible for EPF could be higher. Current amount is negligible Once I have fully contributed the maximum 100k. Then have to look for others. The amount is not much to the HNWI. |

|

|

|

|

|

BenChiew

|

Oct 8 2025, 02:45 AM Oct 8 2025, 02:45 AM

|

|

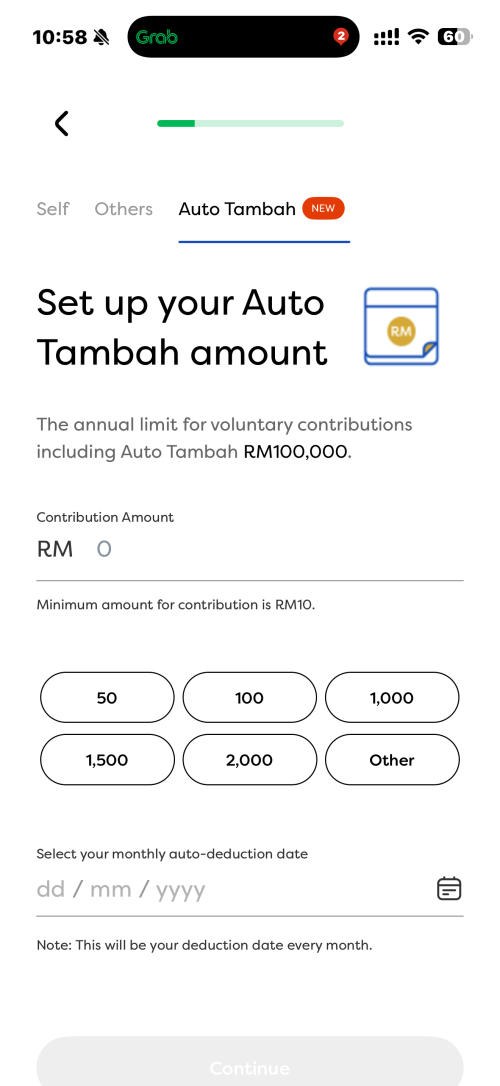

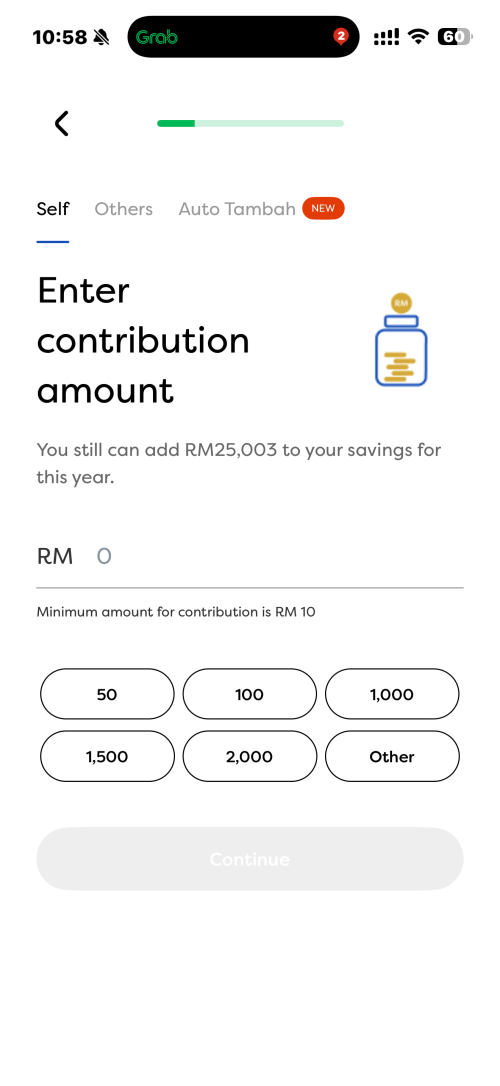

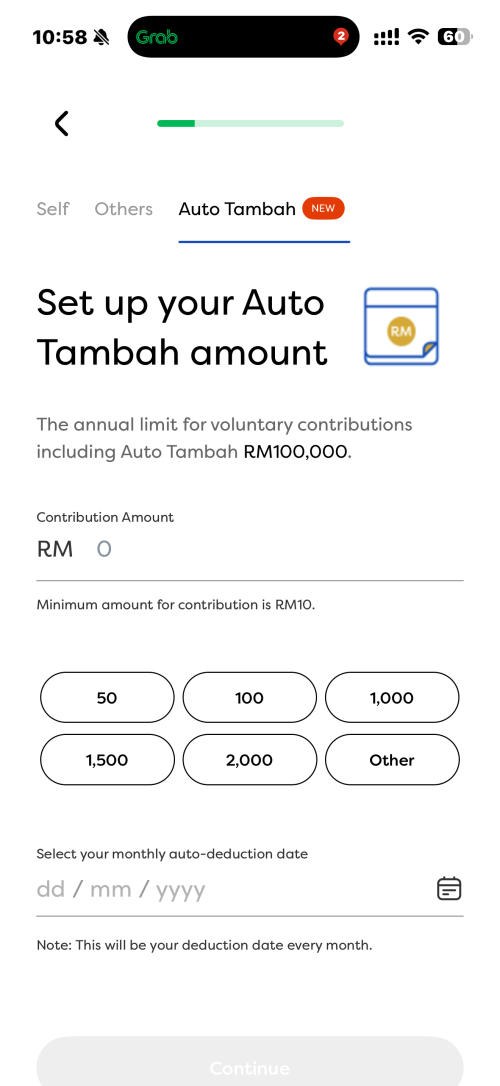

QUOTE(furuku89 @ Oct 7 2025, 11:08 PM)   I’m not sure when the new “Auto Tambah” feature was launched, but I noticed that it doesn’t seem to share the same quota as personal top ups. Can anyone verify this? I’m trying to max out my EPF contributions: - Personal contribution limit: RM100,000 - Auto Tambah limit: RM100,000 So does that mean the total possible contribution is RM200,000? Looks deceiving to show you still have 100k. |

|

|

|

|

|

BenChiew

|

Oct 8 2025, 02:55 AM Oct 8 2025, 02:55 AM

|

|

QUOTE(sweetpea123 @ Oct 7 2025, 12:55 AM) huh, meaning those who contributed AFTER June 2025 will only get next year? Anyway, quite new to this i-saraan thingy cos only collected once although I am already old....hahaha. Anyway, I deposited in Feb 2025 without specifying deposit meant for i-saraan. My account is listed as i-saraan though, so I am trying to see if I can get it. If cannot, I will shed some tears.   Both my kids deposited earlier than June 2025 haven’t gotten theirs yet. This post has been edited by BenChiew: Oct 8 2025, 02:55 AM |

|

|

|

|

|

BenChiew

|

Oct 8 2025, 11:00 PM Oct 8 2025, 11:00 PM

|

|

QUOTE(Wedchar2912 @ Oct 8 2025, 12:16 PM) my nephews and nieces deposited back during CNY also no. guess everyone waiting... Hopefully they will put it in soon. Am using EPF to teach and inculcate a savings habit for my teenage kids. Start them early, make them see the benefits and let the power of compounding effect do its job. Equally important, I am making sure they know EPF is called retirement money. Not let’s buy a house money, not let’s gets a new car money. Or lets go for a holiday money. This post has been edited by BenChiew: Oct 8 2025, 11:01 PM |

|

|

|

|

|

BenChiew

|

Oct 13 2025, 05:40 PM Oct 13 2025, 05:40 PM

|

|

QUOTE(jojolicia @ Oct 13 2025, 02:15 PM) Sorry noob question, who is eligible for i-Saraan? Any age limit, can one with converted account55 participate i-saraan as new? Yes can. All your contributions and the matching gift goes into your akaun emas. |

|

|

|

|

|

BenChiew

|

Oct 13 2025, 05:50 PM Oct 13 2025, 05:50 PM

|

|

QUOTE(torres09 @ Oct 11 2025, 03:42 PM) Want to ask sifus here, so if I open i-saraan account for my 14 year old kid, is it also broken into account 1, 2 and 3? Meaning can withdraw flexibly account 3, and can withdraw account 2 for his higher education purposes later? Yes. All correct. Even if it does not serve your purpose, you should also quickly open an account. The government is considering to change the terms of EPF and it will affect new accounts. |

|

|

|

|

|

BenChiew

|

Oct 28 2025, 07:55 PM Oct 28 2025, 07:55 PM

|

|

QUOTE(nexona88 @ Oct 28 2025, 12:12 PM) You need to download the statement... Then you can see the real thing.... I meant the i-saraan contribution listed... So far, only those deposit in January & February already gotten their $$$.... March to rest of the year is anyone guess... Normally January to June contribution would be getting their $$$ same time.... But this year it's little different.... I concur with your observation. Wonder when will they pay for contributions from March onwards. |

|

|

|

|

Mar 5 2025, 02:56 PM

Mar 5 2025, 02:56 PM

Quote

Quote

0.1127sec

0.1127sec

0.84

0.84

7 queries

7 queries

GZIP Disabled

GZIP Disabled