QUOTE(ikanbilis @ Nov 24 2023, 11:28 AM)

This 2k and 300 incentive is capped or i put more will get more incentive?EPF - self contribution, need advise

EPF - self contribution, need advise

|

|

Nov 26 2023, 10:06 PM Nov 26 2023, 10:06 PM

Return to original view | Post

#1

|

Junior Member

331 posts Joined: Mar 2017 |

|

|

|

|

|

|

Jan 24 2024, 11:21 AM Jan 24 2024, 11:21 AM

Return to original view | Post

#2

|

Junior Member

331 posts Joined: Mar 2017 |

|

|

|

Jan 24 2024, 11:33 AM Jan 24 2024, 11:33 AM

Return to original view | Post

#3

|

Junior Member

331 posts Joined: Mar 2017 |

|

|

|

Mar 9 2024, 06:03 PM Mar 9 2024, 06:03 PM

Return to original view | IPv6 | Post

#4

|

Junior Member

331 posts Joined: Mar 2017 |

|

|

|

Mar 11 2024, 08:19 PM Mar 11 2024, 08:19 PM

Return to original view | Post

#5

|

Junior Member

331 posts Joined: Mar 2017 |

|

|

|

Mar 20 2024, 12:14 AM Mar 20 2024, 12:14 AM

Return to original view | Post

#6

|

Junior Member

331 posts Joined: Mar 2017 |

If i put in 10k in December, then withdraw at july. Will the 10k still enjoy the annual dividend for period of 6 month by prorated basis?

|

|

|

|

|

|

Mar 26 2024, 08:25 PM Mar 26 2024, 08:25 PM

Return to original view | Post

#7

|

Junior Member

331 posts Joined: Mar 2017 |

|

|

|

Apr 26 2024, 12:20 PM Apr 26 2024, 12:20 PM

Return to original view | IPv6 | Post

#8

|

Junior Member

331 posts Joined: Mar 2017 |

QUOTE(nexona88 @ Apr 26 2024, 12:01 PM) If you withdraw before dividend is declared after calender year normally period Jan- Feb, it would include min interim dividend of 2.5% even for full account closure withdrawal. Mean will lose the dividend of that year if withdraw on December for example although the money sit inside for 11 month?Withdrawal on 31 Dec or before will not be entitle for dividend on that same calender year. |

|

|

Apr 26 2024, 05:57 PM Apr 26 2024, 05:57 PM

Return to original view | IPv6 | Post

#9

|

Junior Member

331 posts Joined: Mar 2017 |

|

|

|

May 26 2024, 07:58 PM May 26 2024, 07:58 PM

Return to original view | Post

#10

|

Junior Member

331 posts Joined: Mar 2017 |

|

|

|

Nov 2 2024, 08:13 PM Nov 2 2024, 08:13 PM

Return to original view | Post

#11

|

Junior Member

331 posts Joined: Mar 2017 |

QUOTE(nexona88 @ Nov 2 2024, 11:53 AM) Already being discussed previously... Got 500k as inheritance, ok then probably make sense.She got like 500k inheritance $$$ Maximum 100k self contribution + max employee contribution (around 70% of salary)... Since she got 500k $$$, don't really needed the monthly salary for few years... nexona88 liked this post

|

|

|

Nov 3 2024, 10:25 AM Nov 3 2024, 10:25 AM

Return to original view | Post

#12

|

Junior Member

331 posts Joined: Mar 2017 |

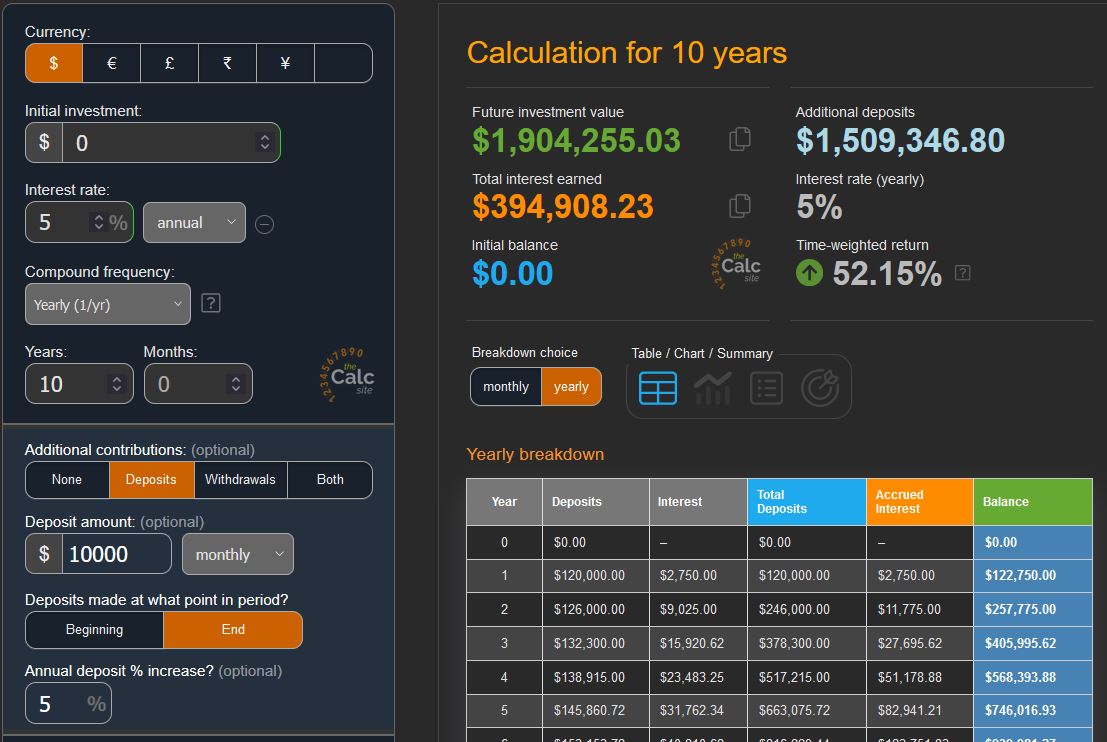

QUOTE(Lembu Goreng @ Nov 3 2024, 09:12 AM) She could do that, but the point here is that the 500k inheritance isnt the real difference in her EPF. If the inheritance received since 15 YO, then with compound interest effect in EPF, there will be big differenceIf anything, for her salary and years of working, her current EPF is low. At 50k salary, her standard & employee EPF contribution is already 12k/month. Plus the 100k bonus she self contribute, so she's already contributing ~20k/month on average into EPF. Say 10 years ago she only started out contributing 10k/month for EPF. At a 5% yearly salary increase, and 5% average EPF returns - she still would make almost RM2mil in EPF.  That's why I said the 500k inheritance is insignificant to her EPF balance. It made her richer a bit more, but no real affect to her EPF. She's doing well on her own without 500k tongkat. What job can made a 25YO able to contribute 10k per month in EPF? This post has been edited by Ayambetul: Nov 3 2024, 10:27 AM |

|

|

Nov 3 2024, 10:29 AM Nov 3 2024, 10:29 AM

Return to original view | Post

#13

|

Junior Member

331 posts Joined: Mar 2017 |

|

|

|

|

|

|

Nov 28 2024, 02:09 PM Nov 28 2024, 02:09 PM

Return to original view | Post

#14

|

Junior Member

331 posts Joined: Mar 2017 |

|

|

|

Nov 30 2024, 01:55 PM Nov 30 2024, 01:55 PM

Return to original view | Post

#15

|

Junior Member

331 posts Joined: Mar 2017 |

|

|

|

Dec 3 2024, 11:16 AM Dec 3 2024, 11:16 AM

Return to original view | Post

#16

|

Junior Member

331 posts Joined: Mar 2017 |

QUOTE(gashout @ Dec 3 2024, 07:23 AM) yes, i also know of doctors join the femes tfx scam The irony is there are ppl believing it.most withdraw epf, then go invest in some 60% annual return fund... kek Might as well go genting bet. gashout liked this post

|

|

|

Dec 18 2024, 01:18 PM Dec 18 2024, 01:18 PM

Return to original view | Post

#17

|

Junior Member

331 posts Joined: Mar 2017 |

QUOTE(KIP21 @ Dec 17 2024, 06:44 PM) Starting 2025 onwards, no longer 55yo as retirement age where I can withdraw all from EPF and now revised to 60? Chill bruh, no news on this.They only want to increase 100k (on top of 1M) for those oredi hit 1M and can freely withdraw the excess. nexona88 liked this post

|

|

|

Dec 20 2024, 10:27 PM Dec 20 2024, 10:27 PM

Return to original view | Post

#18

|

Junior Member

331 posts Joined: Mar 2017 |

QUOTE(lee82gx @ Dec 20 2024, 10:22 PM) They say they say 2031 will review again… don’t count on 2M being the limit. Could be unlimited until you properly retire and then some. This will make more people choose not to self contribute. sg8989 liked this post

|

|

|

Dec 29 2024, 09:47 PM Dec 29 2024, 09:47 PM

Return to original view | Post

#19

|

Junior Member

331 posts Joined: Mar 2017 |

|

|

|

Jan 3 2025, 05:07 PM Jan 3 2025, 05:07 PM

Return to original view | Post

#20

|

Junior Member

331 posts Joined: Mar 2017 |

QUOTE(MUM @ Jan 3 2025, 01:56 PM) Kwsp, ... 1 day of the month of deposit We can always bank in last minute - T1If you deposit 26 or 27 of Jan get same 1 day interest. If you moved earlier your money 100k from other daily 4% pa interest bearing vehicle, ... 1 day costed you to earn RM11 less. 1 day kwsp interest at 6% pa is RM15 for that 100k. If you like to play play last minute then move to kwsp, if you missed the transaction date, ...you will lose abt RM480 of interest for that month 2 day returns at 4% daily interest from mmf is abt RM22 1 day kwsp is abt RM15. Will you bet saving RM7 against earning RM480? |

| Change to: |  0.1212sec 0.1212sec

0.50 0.50

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 6th December 2025 - 02:06 AM |