Outline ·

[ Standard ] ·

Linear+

EPF - self contribution, need advise

|

gamenoob

|

Feb 14 2025, 03:02 PM Feb 14 2025, 03:02 PM

|

|

QUOTE(fuzzy @ Feb 13 2025, 08:53 PM) I can't remember so i googled a bit. Correction - you basically take a loan that you still need to pay monthly. But, if you default on it, the bank can get EPF to pay the arrears from your Acc2 when you reach 55. This was also specific during 2023 due to covid and the hardship. It was to be a temporary measure, which from the loan mechanism now evolve into Acc3. I also want to know if these facilities available for those with acct 55/ acct emas? |

|

|

|

|

|

gamenoob

|

Mar 2 2025, 09:41 AM Mar 2 2025, 09:41 AM

|

|

QUOTE(doremon @ Mar 1 2025, 10:00 PM) Congratulations to those getting RM126k. Yup, it’s not much, but it’s still okay better than nothing, right? You know who you are. Still trying to hit my first RM1m in KWSP. God, how pathetic am I =`( How old are you and how far off from RM1m? Generally as one aged, their earning capacity will peaked few years before 60 retirement, I'm sure you will hit it and beyond. |

|

|

|

|

|

gamenoob

|

Mar 13 2025, 09:41 PM Mar 13 2025, 09:41 PM

|

|

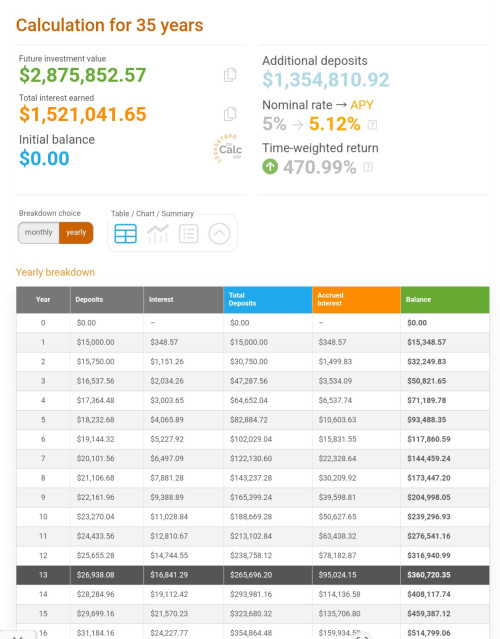

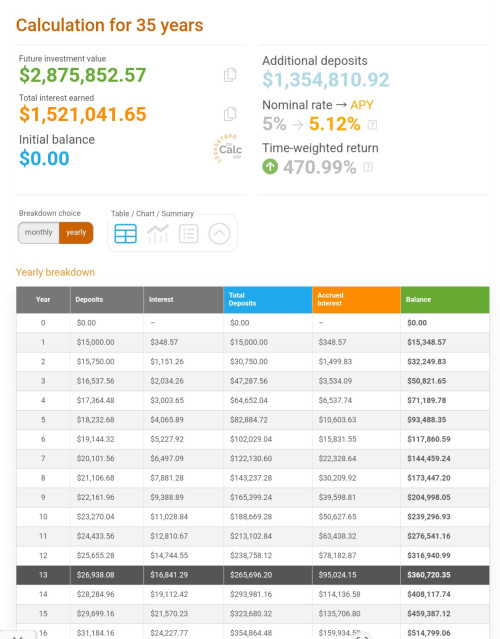

To hit 3M in 35 years assuming one start working at 25 earning 5k with 5% annual increment with EPF dividends at 5% annually, one will have about RM2.9M. Last drawn salary at 60 is RM28k per monthly with above model. https://www.thecalculatorsite.com/finance/c...calculators.php This post has been edited by gamenoob: Mar 13 2025, 09:45 PM This post has been edited by gamenoob: Mar 13 2025, 09:45 PM |

|

|

|

|

|

gamenoob

|

Mar 13 2025, 10:11 PM Mar 13 2025, 10:11 PM

|

|

QUOTE(Sihambodoh @ Mar 13 2025, 10:07 PM) Nowadays don't assume can be employed for 35 years. 40 years old either your company will push you out or your body will tell you to get out. Indeed.... Hence the challenges of attaining that RM3M numbers..... unless one have another mean to max out self topping 100k which was 60k few years back... Those that say needed RM5m in epf to retire is in different realm altogether... beyond ability of the masses....obviously not solely with EPF... This post has been edited by gamenoob: Mar 13 2025, 10:29 PM |

|

|

|

|

|

gamenoob

|

Mar 14 2025, 08:11 AM Mar 14 2025, 08:11 AM

|

|

Actually I'm at this stage. Joined work force around 23 and now 56. Hope to survive the rat race till 60 as the last 10 years of corporate career is where the peak earning capacity lies. So next 4 years is where I'm pushing to have my cake and eat it too.

As some say, you will face many headwind where you also considered high cost to company and they will find way to rid you while enriching the top C and shareholders. It's a never ending game... that a topic for another day.

Health wise, I can tell you, 45 is first big one. There was an article mention where there are 2 age stage that sudden seems hit a turbo button on aging...45 and 60. I can attest to that personally. Suddenly, you can't be as crazy as agile as physically as you want it to be. Mentally still good but one never know so I'm trying to make up for lost time... for next 3 decades. It actually terrifying to know what lies ahead where it's not about work, it's how to get age gracefully in terms of health, wealth, relationship, etc as these age where one attending funeral and wedding dinner become routine, empty nester etc

Anyway back to EPF planning, I have seen it.. it can be done. I did some financial assessment and comparisons for friends on their numbers. They are making above 30k monthly for MNC and they are only early 40s. Not even C level. The only bad habits for them, was minimal retirement planning because their income are good and comfortable that they spend thrift ... they felt invisible. Money is good and retail therapy also equally good...watches, wine, michelin rated restaurant, etc...they will have EPF 3M, if they sustained until 55 provided they don't get cut. Cash flow or emergency funds is horrid for them.

'm doing fine at the hawker center..sipping my teh gelas than fancy rm20 latte... lol..my kid education is done, insurance balances being built that I hope enough to self paid from 65onward, mortgage done, etc. Just need to keep up the health and mental well being...stepping into the unknown,... it's almost like a fresh grad clueless day on what come next ... it's all over again..

This post has been edited by gamenoob: Mar 14 2025, 08:20 AM

|

|

|

|

|

|

gamenoob

|

Mar 14 2025, 11:27 AM Mar 14 2025, 11:27 AM

|

|

QUOTE(Cubalagi @ Mar 14 2025, 10:51 AM) I should hit RM3m in EPF next year, age 52. Minimal voluntary contribution. Congrats. If you stay on course to 60, your EPF should be no less than 5M. |

|

|

|

|

|

gamenoob

|

Mar 14 2025, 11:33 AM Mar 14 2025, 11:33 AM

|

|

QUOTE(confusedway @ Mar 14 2025, 11:26 AM) Dear sifus, when i read through the comment you guys keep mentioning the 1.3m dividend payout is not enough to survive thing... what about the capital of 1.3m going??? u r not using it in any condition or keeping it for grave yard??? how can u just spend what dividend u have when u retired??? after you have gone the 1.3 contribute to government??? your kids cannot start their own life and accumulate their 1.3 or 13m in future??? sorry ya just thinking out loud... The best outcome is of course not touching the capital, just withdraw below the dividend rate so the capital remain flat or even growing. When kaput, that goes to the beneficiaries. Why we aim for such is because inflation are getting higher and future health cost is even steeper. Just being conservative .. that’s all. This post has been edited by gamenoob: Mar 14 2025, 11:35 AM |

|

|

|

|

|

gamenoob

|

Mar 14 2025, 01:25 PM Mar 14 2025, 01:25 PM

|

|

There are no right numbers... there are only inadequate numbers hence everyone numbers are different. Even the most brilliant planned numbers is not for everyone... only if life that simple.

This post has been edited by gamenoob: Mar 14 2025, 01:51 PM

|

|

|

|

|

|

gamenoob

|

Jun 29 2025, 09:49 AM Jun 29 2025, 09:49 AM

|

|

QUOTE(thesnake @ Jun 27 2025, 04:19 PM) my EPF is around 60% of my total net worth now. Same for me on fluid funds ratio. Actually as I aged and last few years before retired, the EPF ratio is getting higher vs my fluid funds. The dividends and annual contribution from employment exceeds the annual saving and investment. Plus paying off kid college funds which also reduce the personal portfolios, while EPF remain untouched, the overall numbers grew faster despite some early years withdrawal decade ago to settle house loans. Now is trying to catch up to replenish what withdrawn. Essentially not really extra contribution as I only max out last 3 years self contribution to top it back to what it supposed to be with interest lost from early withdrawal. I expect the EPF vs cash/funds ratio will climb higher as I progressively withdraw both pools for next 40-50 years. Will withdraw more on personal side as per plan since I used a very conservative 2% return only while 4% for EPF. Anything more is upside. Say current low risk bonds and safe FD is already at 5+% and 3.5-4% respectively. If EPF drop below 4%, then I will need to re adjust the ratio mix. Will shift more to bonds etc. Partly also when you hit 55 onward, you have full access to it (barring acct emas) and get treated as pseudo FD/saving acct. I'm sure there are other way to skin the cat but this suited to my current needs and risk profile. This post has been edited by gamenoob: Jun 30 2025, 01:02 PM |

|

|

|

|

|

gamenoob

|

Sep 12 2025, 04:20 PM Sep 12 2025, 04:20 PM

|

|

QUOTE(CommodoreAmiga @ Sep 12 2025, 09:41 AM) Thanks ...means still can contribute next year.... My birthday far away at end of the year...lol. Change to 100 later, using Mahathir as an example. Gov hope you die before you can retire. Once you hit 55 birthday, they will merge all acct into acct 55 and acct emas. They will prorate accordingly for that 55th birthday month contribution. But do give them few days to sort out. Mine was disrupted right when they doing the 3 acct splitting period last year so numbers was some inflated which I went to counter to sort it out with their officer and internal IT. Week later all correctly reflected. |

|

|

|

|

|

gamenoob

|

Sep 30 2025, 07:02 AM Sep 30 2025, 07:02 AM

|

|

QUOTE(virtualgay @ Sep 30 2025, 12:27 AM) now they kena game unker dah 52 so no impact even it increase to 2.0M the only thing that scare me is account 55 jadi account 60 then really GG this gov introduce RIA Framework to help rakyat better manage retirement next gov maybe introduce something else to help rakyat save till 60 I doubt they will do that... The consequences are massive ie street reaction ..but you never know... If they are to do it, it's likely a staggered on age group. Say those 50 and above will not be affected, those 45 onward maybe have some transition ie can touch up to certain % but not full access like acct 55. But those below 45 or 40, it's immaterial. They will announce that maybe 2-3 years ahead etc... again policy are never fair, it's biggest effect to be achieved..some bound to be unhappy |

|

|

|

|

|

gamenoob

|

Nov 4 2025, 01:30 PM Nov 4 2025, 01:30 PM

|

|

QUOTE(ornehx @ Nov 2 2025, 04:29 PM) After the news of World Bank 70 years old recommendation, are you guys spooked out of doing out monthly self contribution? Nope…. Not at all. Infact, Topping up 100k come Jan 2026. This post has been edited by gamenoob: Nov 4 2025, 01:31 PM |

|

|

|

|

Feb 14 2025, 03:02 PM

Feb 14 2025, 03:02 PM

Quote

Quote

0.0250sec

0.0250sec

0.72

0.72

7 queries

7 queries

GZIP Disabled

GZIP Disabled