QUOTE(virtualgay @ Feb 2 2024, 04:11 PM)

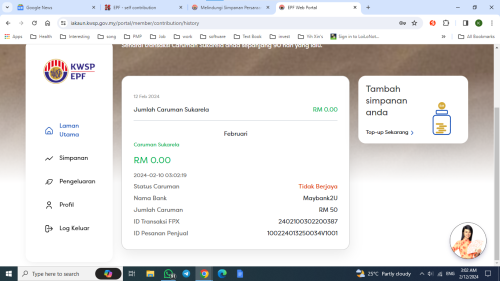

good idea also.. no matter what max 100k is a must for this year and the next 3 years if i need to hit my goal of 1.5Million

my own calculation is 1.3 million right now when i reach 55 years old

anyone here know how is life when stop working? I am a little scare... is just 4 years away...

I will be 55 in next few months.... I'm going to stay employed until 60 unless they kick me out.

It is little unsettling the thought of no longer working but I have been mentally preparing myself for such transition last few years.

Will still do gig job like consulting, corporare oaching/training, etc or contract term with my ex Co etc.

If not working out, Heck I will go back to school and do a master program just to keep brain from senility....

Other than health cost at that age, all major expenses is settled. Collehe funds prepped, no loan etc... just insurance payments until 65.

But I do have vice..... cars... love driving.... so will likely get a drop top MX5 or GR86/BRZ before i lose the borrowing/loan capacity and drive like it's stolen.... until not physically able to...then sell off and buy ah pek lowly city or P2 putt around...or any within old farts physical limit.

And yes keep up the physical movements... friendship Tok kok sing song....

This post has been edited by gamenoob: Feb 3 2024, 06:17 PM

Jun 2 2023, 07:41 PM

Jun 2 2023, 07:41 PM

Quote

Quote

0.0292sec

0.0292sec

0.67

0.67

7 queries

7 queries

GZIP Disabled

GZIP Disabled