QUOTE(tadashi987 @ Apr 20 2019, 12:36 AM)

Hi guys, i saw from Ringgitplus there are two types of premium types, i tried to search around but to no avail cant figure what is it in details.

Any one can clarify?

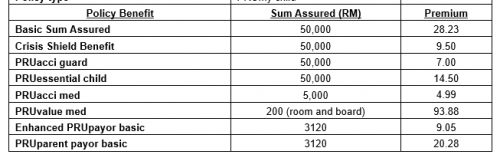

[attachmentid=10229894]

What this meant is the premium payable will be on a same amount for the whole period, which is normally an ILP policy.

However, do take into consideration that not all ILP are built the same, the premium may increase in the future if there is insufficient cash value.

QUOTE(tadashi987 @ Apr 20 2019, 12:46 AM)

Any pros and cons for both?

As in the case of this, I would assume for sure Flat type is better than Progressive, as I saw a lot person is not aware of this and suddenly they got increase in premium price to pay.

ILP will have a more riders that you can add on in the long run with a lower overall cost and having more benefits for yourself than just a standalone by itself

QUOTE(tadashi987 @ Apr 20 2019, 01:09 AM)

The reason is because i am comparing Prudential PRUwithyou with GE Smart Legacy in the moment, I am 26yo this year

Prudential PRUwithyoGE Smart Legacythou from the surface, it seems that I would go for GE because GE has

1) RM500k Minimum Sum Assured (PRUwithyou is RM100k)

2) Loyalty Bonus: Up to 1% increase of the Basic Sum Assured every year up to a maximum of 30%

3) Flat rate. Stays the same throughout coverage term. (which I assume Flat > Progressive, as I wouldn't want to increase my commitment as I aging?)

which GE looks more appealing

thou GE Smart Legacy doesn't show including critical illness, but I researched and see critical illness should be included in their Smart Legacy MAX premium

If overall the benefit with GE is better, take GE

QUOTE(Ilnov @ Apr 20 2019, 10:00 AM)

Dear sifus, wanna ask. Medical card with co insurance vs medical card without co insurance, which one better?

I seeing GE medical card with high annual limit but lifetime unlimited and no co insurance.

And I having pruvalue med with MVP RM1mil with med saver RM300, this is consider limitation of my this medical card? My agent told me my medical card does not have annual limit, I actually don’t quite understand what he meant by no annual limit when my this medical card does have a limit of MVP up to RM1mil only.

Any expertise can explain to me?

Basically having a co-insurance vs non co-insurance

You pay lesser premium charges for with co-insurance policies but you’ll always have to fork out RM300 whenever you get admitted to the hospital.

Whereas with no co-insurance, it’s more hassle free not having to fork out additional money every time you get hospitalized.

When your agent says their is no annual limit for the prudential medical card, your RM1 mil is the annual limit, whatever exceeds that amount, you will need to pay for it.

Don’t have to be confused about the “marketing” package by the insurance company

QUOTE(Ilnov @ Apr 20 2019, 10:45 AM)

Still not so understand how does this co insurance work. Assuming my monthly premium quoted from both GE and Pru around RM250 monthly, wouldn’t GE medical card seems stronger because no co insurance?

As per above explanation.

QUOTE(Ilnov @ Apr 20 2019, 11:18 AM)

Yes, it seems everything else is the same except Pru have co insurance.

1. Annual limit: GE - RM1,320,000 and Pru no annual limit when I asked my agent

2. Lifetime limit: GE unlimited and Pru goes by MVP RM1mil, is that my lifetime limit with Pru?

3. Both also same room and board of RM200

How do you state that having full coverage can end up being expensive? Maybe I am zero knowledge about this insurance thing. I seeing both monthly premium of med card is the same amount.

Let’s just say insurance company want you to share the cost of insurance with them, so when you share the cost with them, they are willing to charge you lesser.

Then you will need to do some mathematics on how much co-insurance / deductible do you need to pay every time for hospitalization before the insurance company cover the other balance amount.

Some insurance plan has high deductible e.g 20k - 60k, so which means you will need to pay RM20k - 60k of the hospital bill before the insurance company pays for the rest. But you get to pay super cheap premium for such insurance.

But again is that what you want ? Have an insurance policy but yet have to worry about paying high deductibles for it even though you can say “I have a very cheap insurance”.

Basically you get what you pay for just like everywhere else. Can’t expect pay “Cheap” premium and expect “Superb” insurance coverage without drawbacks.

Apr 10 2019, 09:32 AM

Apr 10 2019, 09:32 AM

Quote

Quote

0.1063sec

0.1063sec

0.28

0.28

7 queries

7 queries

GZIP Disabled

GZIP Disabled