QUOTE(scriptkiddie44 @ Apr 1 2019, 05:34 PM)

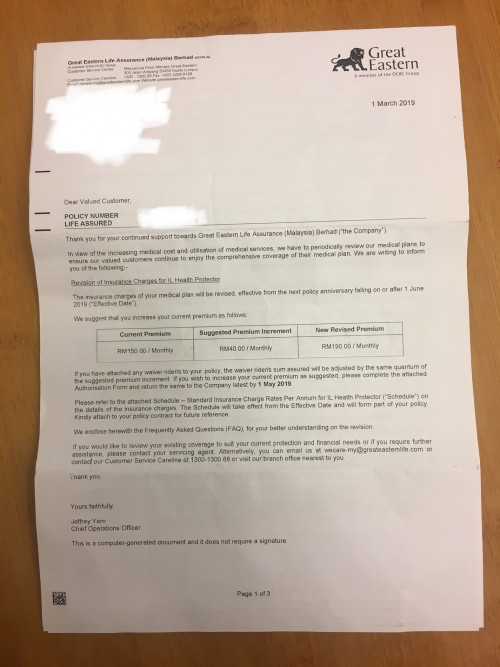

Look at the premium difference, in 6 years, she lost almost RM6k on the cash value. It looks like I can sustain much more longer in the long run (I'm not an insurance expert, I'm just doing some simple calculation).

If I saved up that difference in premium paid, when the time the premium increased, I can just top up using the saving right. Some more, I can use that amount if in any emergency need of money.

So I explain the whole situation to my friend, ask her to consult with her agent, and do the math again to her agent. Guess what her agent said?

"If you insists to pay less and have more coverage, dont blame me if your premium increase in the future."

Then my friend tell the agent that if the premium increased, can just use the difference in premium paid to top up back right? Then the agent did not reply.

This looks like some con job if you ask me. Not saying that insurance is a con job, but I'm just doing some math.

So my point is, what's the point of putting so much portion in cash value if saving in FD can yield more return? I know the high risk high reward thingy, but look at the performance of the fund. 6 years ald losing 6k. Even if it doubles in 5 years, still not making any profit with the fund. How to sustain long?

Expert here can educate me if I'm wrong, as I'm not an insurance expert.

haha the agent just not happy you didn't sign up a bigger plan with him/her.

But ya the truth is, you just top up the difference in the near future if not enough money.

As I said to many ppl who has better yield of investment return out there, if got money, just park into those investment vehicle, however insurance plan nowadays are engineered in such a way that you will still get some sort of cash value after paying x amount of years, I won't say investing into insurance will make you rich, but it's just a financial vehicle to conserve your money in.

If you're the type of person that can't stand to see money laying around in low yielding / safe financial vehicle like FD, then investing into insurance is definitely not for you.

However if you're looking into insurance as a way to conserve your wealth, then it's a viable option.

Apr 1 2019, 02:55 PM

Apr 1 2019, 02:55 PM

Quote

Quote

0.1066sec

0.1066sec

0.48

0.48

7 queries

7 queries

GZIP Disabled

GZIP Disabled