QUOTE(ableze_joepardy @ Jun 17 2019, 04:31 PM)

i just boost in recent few weeks. so far havnt found any merchant that can accept boost but not cc at my place (or maybe got but the merchant wasnt in my regular expenditure).

basically i tried boost coz read in mbb2card thread that boost accept amex. so its really good news coz my amex cb always cant hit ceiling. but now since amex "dont accept boost" so its going back to normal.

the least reason for me to use boost

-if they can maintain min rm1 reward for rm50 payment n above.

-if they have some promo like spend 100 at tesco get rm10.

-when i maxxed out all of my cc cb quota

for sure uninstall straight away. if use boost = use cash i prefer use cash. unless 100% daily transaction can be made in boost then maybe shift to boost.

even using CC also due to CB offer. otherwise i dont bother. cashless is secondary reason.

care to explain a bit on the bold part?

if without any benefit from e-wallet and card..... i would rather go for cash which at least all my transaction would not be recorded and traceable by any bank or advertiser

QUOTE(zenquix @ Jun 17 2019, 04:39 PM)

Personally I have always expected the banks to turn the tap off (just that it is alot sooner than expected)

No. 1 issue is the cycle of funds to earn rewards / cashback as it does not make good business sense to anyone in the chain but the customer.

CC > ewallet > withdraw to bank account > CC

I don't think even BNM wants this loophole to exist. Now there are 2 options - removed withdrawal or remove benefit. Whichone is easier?

even with remove of benefit, the allow for withdrawal still bring some benefit (for those small amount spender).

QUOTE(imap.cc @ Jun 17 2019, 05:36 PM)

Ahhhhh, too bad i cleared all ptptn for myself and wife last year to get 20% off, now cannot enjoy boosting debts anymore

the 20% is worth more than the Boost shake reward itself.

QUOTE(propusers @ Jun 17 2019, 05:46 PM)

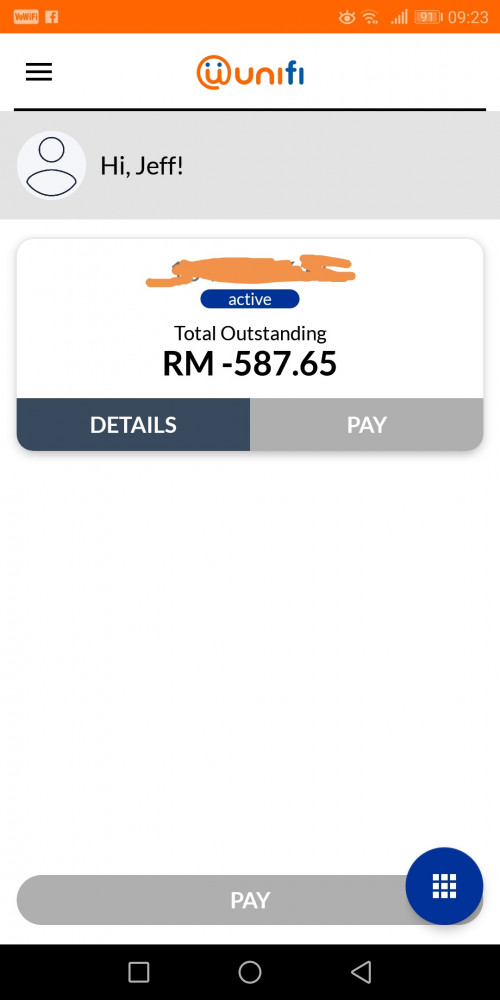

past 2 or 3 months use amex -> Boost -> Unifi / Astro / Syabas

next month should be amex -> Unifi / Astro via m2u portal bill payment

only concern is Syabas, which is under utilities category... 0% cash back...

for me the usage of AMEX mainly for electric and internet bill payment. the revision of the Maybank card benefit almost remove all the category i would use the card

Jun 14 2019, 10:16 PM

Jun 14 2019, 10:16 PM

Quote

Quote

0.0547sec

0.0547sec

0.46

0.46

7 queries

7 queries

GZIP Disabled

GZIP Disabled