Outline ·

[ Standard ] ·

Linear+

Ultimate Discussions of ASNB Fixed Price UT, Magical UT only in Malaysia

Ultimate Discussions of ASNB Fixed Price UT, Magical UT only in Malaysia

|

veera77

|

Jan 10 2019, 12:53 PM Jan 10 2019, 12:53 PM

|

|

QUOTE(vanitas @ Jan 10 2019, 11:50 AM) Or smile if foreign currency went down against ringgit. Risk and opportunity always cross related. And I think our boss veera is someone who would like to take some risk. So, up to him to decide. Forex risk veera77 still can consider but thinking about jail in foreign country..takut !!! |

|

|

|

|

|

veera77

|

Jan 12 2019, 02:49 PM Jan 12 2019, 02:49 PM

|

|

Whatapps group will reveal your mobile number...privacy issue  This ASNB forum is perfect enough to serve our main objective to share lastest ASNB information and updates..  furthermore this website is mobile-friendly...would be better if LowYat.net come out with mobile apps like I3investor. My 2sen only.. |

|

|

|

|

|

veera77

|

Jan 15 2019, 12:36 PM Jan 15 2019, 12:36 PM

|

|

QUOTE(coca^cola @ Jan 15 2019, 12:13 PM) Advice needed. Those who invest for their children you still open bank account for them? Yes opened bank account for kids before...but now transferred all fund into ASNB Akaun Bijak.. If u already hv Akaun Bijak for kids regular saving...then seriously bank account Not required.. |

|

|

|

|

|

veera77

|

Jan 15 2019, 11:09 PM Jan 15 2019, 11:09 PM

|

|

KUALA LUMPUR: Employees Provident Fund (EPF) chairman Samsudin Osman is tight-lipped on payment of dividend to its 14 million contributors this year. This followed reports that EPF could declare a lower dividend rate for 2018 compared to 2017, due to subdued local and regional equities markets. “You can imagine the market condition, at what level. I cannot say… but I can’t give the answer. We have to look what happened last year to know whether it is good or bad,” he told reporters today. https://www.freemalaysiatoday.com/category/...ividend-payout/This post has been edited by veera77: Jan 16 2019, 01:14 AM Attached thumbnail(s)

|

|

|

|

|

|

veera77

|

Jan 16 2019, 12:35 PM Jan 16 2019, 12:35 PM

|

|

QUOTE(nexona88 @ Jan 16 2019, 08:43 AM) Hmm like I said many time... This round its below 6%... 5.5 to 5.8 😴 ASM first... Then ASM 2 & 3.. Lastly ASB  This year if can get dividen 1% higher than mortgage interest rate pun cantek  |

|

|

|

|

|

veera77

|

Jan 16 2019, 09:33 PM Jan 16 2019, 09:33 PM

|

|

QUOTE(saitong09 @ Jan 16 2019, 08:09 PM) lol maybe another wave of mass withdrawing coming Apr if the dividend is not good mass withdrawal might happen if dividend below 4.5%...as average mortgage interest rate is 4.5%.. I believe ASx dividend wont go down below 5.5%...  |

|

|

|

|

|

veera77

|

Jan 16 2019, 10:15 PM Jan 16 2019, 10:15 PM

|

|

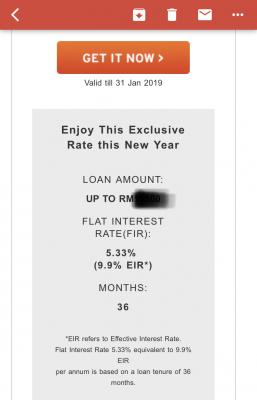

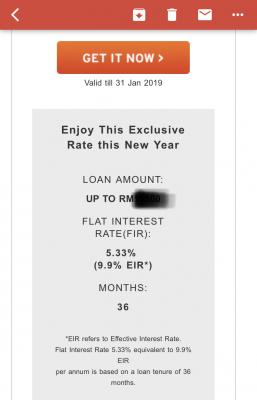

QUOTE(yklooi @ Jan 16 2019, 09:36 PM)  what is the borrowing cost (interest rate?) of the ASNB funds?oops...found.....about 4.85~5.8%  https://loanstreet.com.my/asb-loan https://loanstreet.com.my/asb-loanNow Citibank Malaysia Credit Card promo giving ‘Quick Cash’ from CC limit at the rate of 5.33% flat rate.. Thought take that with 6 months repayment option an invest in ASNB...but now have to think twice... Attached thumbnail(s)

|

|

|

|

|

|

veera77

|

Jan 16 2019, 10:37 PM Jan 16 2019, 10:37 PM

|

|

QUOTE(alexanderclz @ Jan 16 2019, 10:18 PM) the better way is to do 0% balance transfer, then withdraw the extra money (either via transfer to savings or indirectly via e-wallets). then you don't have to pay any interest. Good idea also...problem i only one CC only..anyway should explore this BT opportunity also..  |

|

|

|

|

|

veera77

|

Jan 16 2019, 10:56 PM Jan 16 2019, 10:56 PM

|

|

QUOTE(nexona88 @ Jan 16 2019, 10:48 PM) same feeling here... like I said... around 5.5 to 5.8  if lower than 5.5 really GG   the gap between ASx vs FD is too close call.. better dump into FD  One day Malaysia might follow Japan...negative interest for FD...huh huh  |

|

|

|

|

|

veera77

|

Jan 16 2019, 11:01 PM Jan 16 2019, 11:01 PM

|

|

QUOTE(nexona88 @ Jan 16 2019, 11:00 PM) possible... since back to look east policy with focus on Japan   Oops..wrong policy seems..he he |

|

|

|

|

|

veera77

|

Jan 17 2019, 05:39 PM Jan 17 2019, 05:39 PM

|

|

QUOTE(fun_feng @ Jan 17 2019, 11:06 AM) 5.33 % convert to effective interest rate is 9.7% is shockingly high... Even if your ASX returns 8% also u lose money... ASNB loan is effective interest 4.X ~ 5.X still can earn a little ASNB dividend calc is based flat rate not APR. |

|

|

|

|

|

veera77

|

Jan 29 2019, 09:09 PM Jan 29 2019, 09:09 PM

|

|

Esok target 10k ASW2 one shot....hopefully M2U no issue tomolo...

|

|

|

|

|

|

veera77

|

Jan 29 2019, 11:01 PM Jan 29 2019, 11:01 PM

|

|

QUOTE(coolguy99 @ Jan 29 2019, 09:27 PM) Wow gotten year end bonus yeah  Ha ha...yes...  |

|

|

|

|

|

veera77

|

Jan 29 2019, 11:04 PM Jan 29 2019, 11:04 PM

|

|

Even SSPN is giving 4.5% for 2018.... So don’t worry, ASNB mesti bagi at least 5.5%  otherwise SSPN will bully ASNB..lol Attached thumbnail(s)

|

|

|

|

|

|

veera77

|

Jan 30 2019, 11:13 AM Jan 30 2019, 11:13 AM

|

|

QUOTE(nexona88 @ Jan 30 2019, 09:08 AM) That 0.5 is new... Maybe this year ASM got bonus 😏😬 Reward those managed to buy 😑 and because it's the fund never given out bonus before (ASW has previously, 1 time) Yes...hopefully ada bonus this year in ASM.. For SSPN, the 0.5% is for those opened account before 2016, and top-up at least RM500 between 2016-2018, and never made any withdrawal in same period . Good news my kid account eligible for this bonus...as i top up RM500 last year to claim RM500 geran sepadan bonus for 7-12 yrs old kid.. This post has been edited by veera77: Jan 30 2019, 11:14 AM |

|

|

|

|

|

veera77

|

Jan 30 2019, 11:23 AM Jan 30 2019, 11:23 AM

|

|

QUOTE(DBHILUHDAQWISRTNJ @ Jan 30 2019, 11:19 AM) Wah u guy so greedy , mau bonus . For me if maintain 6% , I already open champagne . 5.9% boleh juga . For me 5.5% pun cantek...ha ha Anyway, the main benchmark for 2018 dividends is EPF dividend which is due for announcements in two weeks time.,, |

|

|

|

|

|

veera77

|

Feb 4 2019, 11:24 AM Feb 4 2019, 11:24 AM

|

|

Happy CNY to all who celebrate:)

|

|

|

|

|

|

veera77

|

Feb 13 2019, 02:38 PM Feb 13 2019, 02:38 PM

|

|

QUOTE(nexona88 @ Feb 12 2019, 10:36 PM) willing buyer willing seller basis  that's what direct deal  Willing seller is here  Any willing buyer? |

|

|

|

|

|

veera77

|

Feb 13 2019, 03:12 PM Feb 13 2019, 03:12 PM

|

|

Balik kampung July-August only..(summer break)..till then can’t touch my ASNB...

Anyway, ASM3 is always my ‘saving account’ during my stay in Malaysia..

No heart to touch ASW and ASM..

This post has been edited by veera77: Feb 13 2019, 03:13 PM

|

|

|

|

|

Jan 10 2019, 12:53 PM

Jan 10 2019, 12:53 PM

Quote

Quote

0.3994sec

0.3994sec

0.50

0.50

7 queries

7 queries

GZIP Disabled

GZIP Disabled