![]() Ultimate Discussions of ASNB Fixed Price UT, Magical UT only in Malaysia

Ultimate Discussions of ASNB Fixed Price UT, Magical UT only in Malaysia

|

|

Oct 30 2018, 08:12 PM Oct 30 2018, 08:12 PM

Return to original view | Post

#21

|

Senior Member

1,229 posts Joined: Jul 2011 |

Today Maybank and UOB were working fine

|

|

|

Oct 31 2018, 04:48 PM Oct 31 2018, 04:48 PM

Return to original view | Post

#22

|

Senior Member

1,229 posts Joined: Jul 2011 |

|

|

|

Oct 31 2018, 07:47 PM Oct 31 2018, 07:47 PM

Return to original view | Post

#23

|

Senior Member

1,229 posts Joined: Jul 2011 |

I think there no need for ASNB to make a big shift to change FP to VP..

Actual accounting of FP, i believe should have taken account of real NAV...the FP accounting should be kind of consolidated accounting... Wawasan’s real NAV should be easily 1.50...while ASM and AS1M real NAV i agree could be below 1.00 based on ASG fund NAV and performances.. in a way, VP is more transparent and dynamic compared to FP.. At least for VP, u could accumulate during bearish market at lower NAV...while FP u don’t have this opportunity...the only major downside is 5% SC... This post has been edited by veera77: Oct 31 2018, 07:49 PM |

|

|

Nov 1 2018, 11:57 AM Nov 1 2018, 11:57 AM

Return to original view | Post

#24

|

Senior Member

1,229 posts Joined: Jul 2011 |

compared to big bunch of immatured and manipulating forumers in i3 investor...hmmm...i would say we here are much matured and responsible...

|

|

|

Nov 1 2018, 11:58 AM Nov 1 2018, 11:58 AM

Return to original view | Post

#25

|

Senior Member

1,229 posts Joined: Jul 2011 |

|

|

|

Nov 1 2018, 12:11 PM Nov 1 2018, 12:11 PM

Return to original view | Post

#26

|

Senior Member

1,229 posts Joined: Jul 2011 |

|

|

|

Nov 1 2018, 12:29 PM Nov 1 2018, 12:29 PM

Return to original view | Post

#27

|

Senior Member

1,229 posts Joined: Jul 2011 |

|

|

|

Nov 1 2018, 12:54 PM Nov 1 2018, 12:54 PM

Return to original view | Post

#28

|

Senior Member

1,229 posts Joined: Jul 2011 |

|

|

|

Nov 1 2018, 02:53 PM Nov 1 2018, 02:53 PM

Return to original view | Post

#29

|

Senior Member

1,229 posts Joined: Jul 2011 |

|

|

|

Nov 1 2018, 02:57 PM Nov 1 2018, 02:57 PM

Return to original view | Post

#30

|

Senior Member

1,229 posts Joined: Jul 2011 |

|

|

|

Nov 1 2018, 03:16 PM Nov 1 2018, 03:16 PM

Return to original view | Post

#31

|

Senior Member

1,229 posts Joined: Jul 2011 |

QUOTE(Exodius @ Nov 1 2018, 03:08 PM) Yes there is 1.5 billion allocation for Indian ASM3 started from Jan 2018Each Indian can top up first 30k without any quota restriction...after 30k as usual based on quota and availability. This post has been edited by veera77: Nov 1 2018, 03:59 PM |

|

|

Nov 1 2018, 03:39 PM Nov 1 2018, 03:39 PM

Return to original view | Post

#32

|

Senior Member

1,229 posts Joined: Jul 2011 |

|

|

|

Nov 1 2018, 04:00 PM Nov 1 2018, 04:00 PM

Return to original view | Post

#33

|

Senior Member

1,229 posts Joined: Jul 2011 |

|

|

|

Nov 1 2018, 04:07 PM Nov 1 2018, 04:07 PM

Return to original view | Post

#34

|

Senior Member

1,229 posts Joined: Jul 2011 |

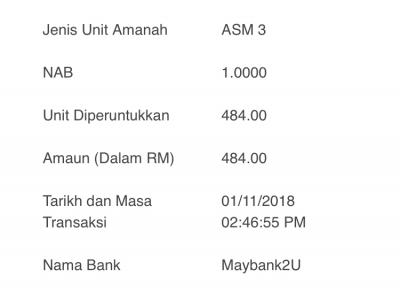

QUOTE(DBHILUHDAQWISRTNJ @ Nov 1 2018, 04:02 PM) Yes...activate the power of magical compunding interest Lucky Malaysia have option for low risk investment which gives compounding return from 4-6%... In Qatar, where i’m working..the highest return u could for low risk investment is 1.5%... 72/1.5 = 48 yrs to double ur investment This post has been edited by veera77: Nov 1 2018, 04:10 PM Attached thumbnail(s)

|

|

|

Nov 1 2018, 04:38 PM Nov 1 2018, 04:38 PM

Return to original view | Post

#35

|

Senior Member

1,229 posts Joined: Jul 2011 |

QUOTE(OPT @ Nov 1 2018, 04:32 PM) don't know about other...but that is my plan....get 1million in ASx and your retirement plan is on...for 1 million @ 6% interest...monthly return is 5k...thats is more than enough...but must make sure to settle all other comitments before retirement eg mortgage, kids education loan etc... if kids want some share from parents wealth...i would nominate them and tell them...enjoy this money only after i die...till then let me enjoy my retirement... |

|

|

Nov 1 2018, 04:45 PM Nov 1 2018, 04:45 PM

Return to original view | Post

#36

|

Senior Member

1,229 posts Joined: Jul 2011 |

|

|

|

Nov 1 2018, 05:00 PM Nov 1 2018, 05:00 PM

Return to original view | Post

#37

|

Senior Member

1,229 posts Joined: Jul 2011 |

|

|

|

Nov 1 2018, 05:22 PM Nov 1 2018, 05:22 PM

Return to original view | Post

#38

|

Senior Member

1,229 posts Joined: Jul 2011 |

QUOTE(DBHILUHDAQWISRTNJ @ Nov 1 2018, 05:06 PM) QUOTE(DBHILUHDAQWISRTNJ @ Nov 1 2018, 05:16 PM) true 20 yrs ago...now i think equity return are lesser and fund size a much bigger due to dividend re-investment... dulu most of bursa counter easily can give 10% dividend...now 3% consider very great |

|

|

Nov 1 2018, 05:37 PM Nov 1 2018, 05:37 PM

Return to original view | Post

#39

|

Senior Member

1,229 posts Joined: Jul 2011 |

|

|

|

Nov 1 2018, 05:39 PM Nov 1 2018, 05:39 PM

Return to original view | Post

#40

|

Senior Member

1,229 posts Joined: Jul 2011 |

QUOTE(DBHILUHDAQWISRTNJ @ Nov 1 2018, 05:32 PM) Don't know my mindset correct or not. Exactly...better decent return in long run...rather than...high return in short term, then kantoi in long run.....eg BAT, MEDIAFor me , if asnb offer higher than 7% , I will feel something bad is coming. So asnb better stay in between 6%~7% , at least everyone can cari makan , no ppl jump from 14 floor . |

| Bump Topic Topic ClosedOptions New Topic |

| Change to: |  0.0222sec 0.0222sec

0.51 0.51

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 5th December 2025 - 11:57 AM |

All Rights Reserved © 2002- 2025 Vijandren Ramadass (~unite against racism~)

Powered by Invision Power Board © 2025 IPS, Inc.

Quote

Quote