What's the expected return for etf?

I have the choice of either putting more money into my ASNB (6% returns a year) or do something else with it.

I had the same question like you and contact the customer service for more info since Stashaway don't show its yearly return for each risk index. Please bare in mind, I just copied and pasted their reply to my mail. It's probable that the info might be outdated.

It's ok. I have contacted StashAway for more info and received a reply from them. So, i would like to share it with everyone here.

Expected Returns (based on historical data)Core Portfolios:

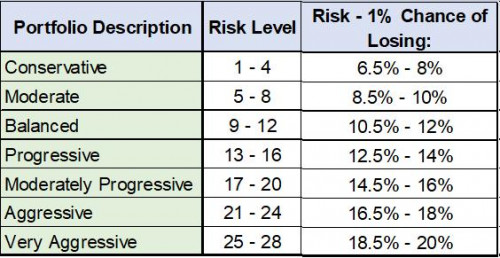

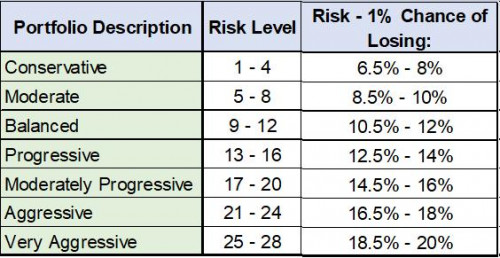

StashAway Risk Index 6.5% - 8%, our projected returns are 5.0% - 5.6%

StashAway Risk Index 8.5% - 10%, our projected returns are 5.7% - 6.2%.

StashAway Risk Index 10.5% - 12%, our projected returns are 6.4% - 6.6%.

StashAway Risk Index 12.5% - 14%, our projected returns are 6.7% - 7.0%.

StashAway Risk Index 14.5% - 16%, our projected returns are 7.2% - 7.4%.

StashAway Risk Index 16.5% - 18%, our projected returns are 7.7% - 8.0%.

StashAway Risk Index 18.5% - 20%, our projected returns are 8.1% - 8.4%.

Higher-Risk Portfolios:

StashAway Risk Index 26% - 36%, our projected returns are 8.5% - 9.3%.

Please note that these projections are based on historical monthly data (from January 1982 to December 2017). We do not endorse that historical returns are reflective of the future. As economic cycles change, returns could be higher or lower than these long-term projections.

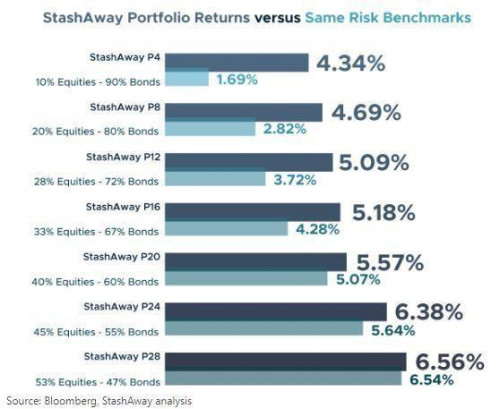

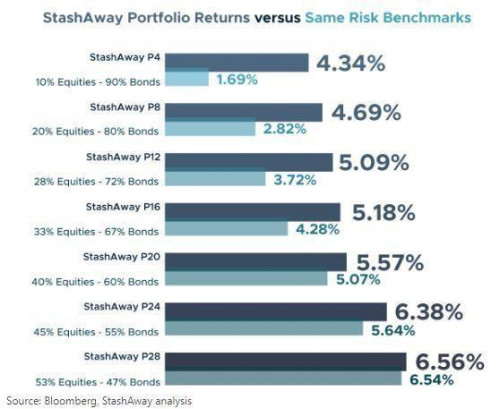

Actual returns (July 2017 - July 2018)Here are 7 anchor portfolios to illustrate the range of risk and returns we earned in the last year. The following chart shows gross returns in SGD of these portfolios, ranked by risk (low to high), compared to the returns of their respective risk-based benchmarks.

Our portfolios have yielded between 4.3% and 6.6% gross returns in SGD over the last year, characterised by a very positive market for the first 7 months (July 2017 to January 2018) and a more turbulent one for the subsequent 5 months (February 2018 - July 2018).

All of StashAway’s 28 portfolios (excl higher risk portfolios) have outperformed their same-risk benchmark. In the same time frame, an investment in the Straits Times Index (STI) would have yielded only 0.8% positive returns. Note that the risk of the STI is approximately 2x the risk of P28 over the last 10 years.

Previously, we have named our portfolios 1 to 28 as P1 to P28. However, we've introduced "StashAway Risk Index" and the portfolios have since been renamed.

Previous Model:

Mar 4 2019, 09:12 AM

Mar 4 2019, 09:12 AM

Quote

Quote

0.0251sec

0.0251sec

0.45

0.45

6 queries

6 queries

GZIP Disabled

GZIP Disabled