Outline ·

[ Standard ] ·

Linear+

StashAway MY, New instrument for Malaysian?

|

ViktorJ

|

Dec 11 2018, 10:49 PM Dec 11 2018, 10:49 PM

|

|

QUOTE(MNet @ Dec 11 2018, 10:42 PM) I still did not get the process. Let say I topup RM42 which mean after convert to USD is USD10. How can SA buy the ETF using USD 10? Like this  |

|

|

|

|

|

ViktorJ

|

Dec 12 2018, 06:17 PM Dec 12 2018, 06:17 PM

|

|

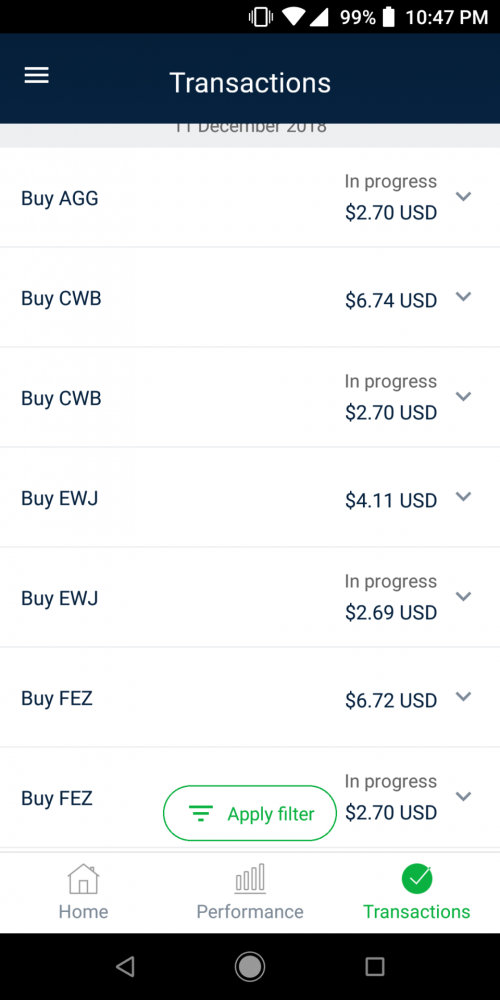

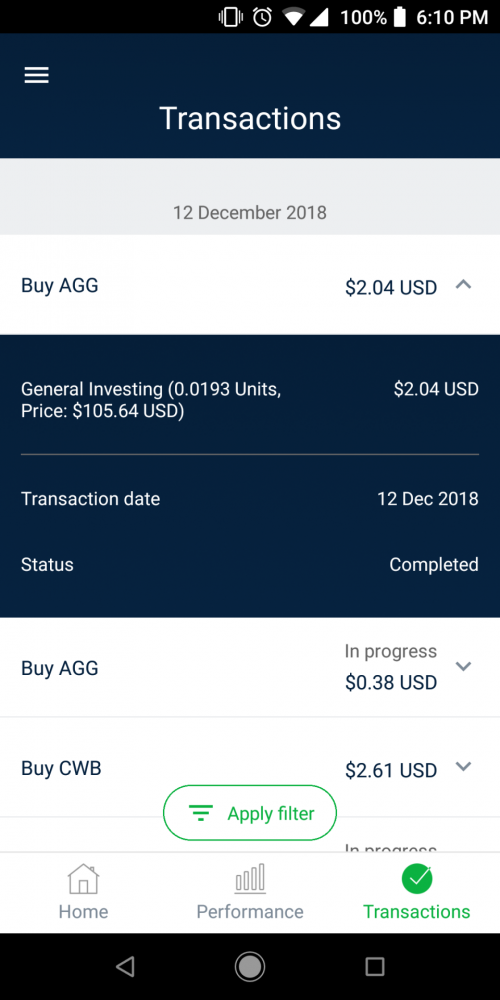

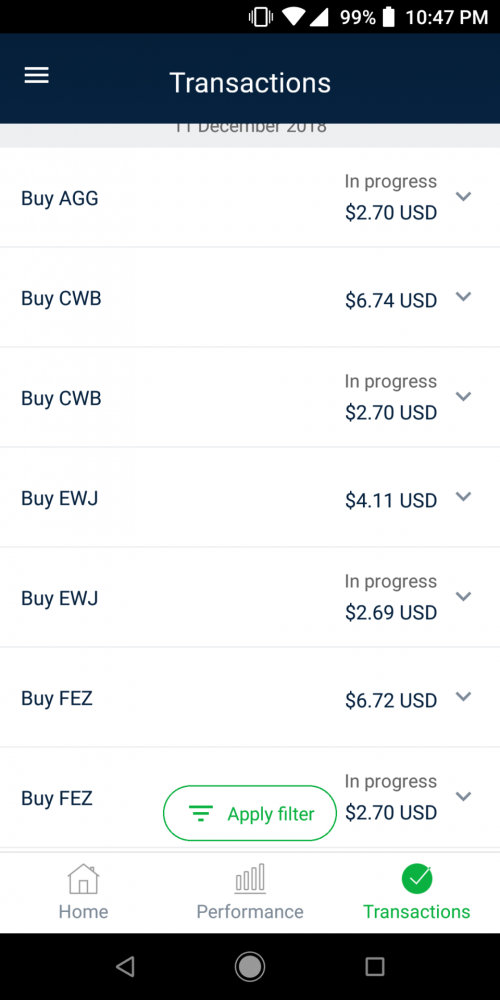

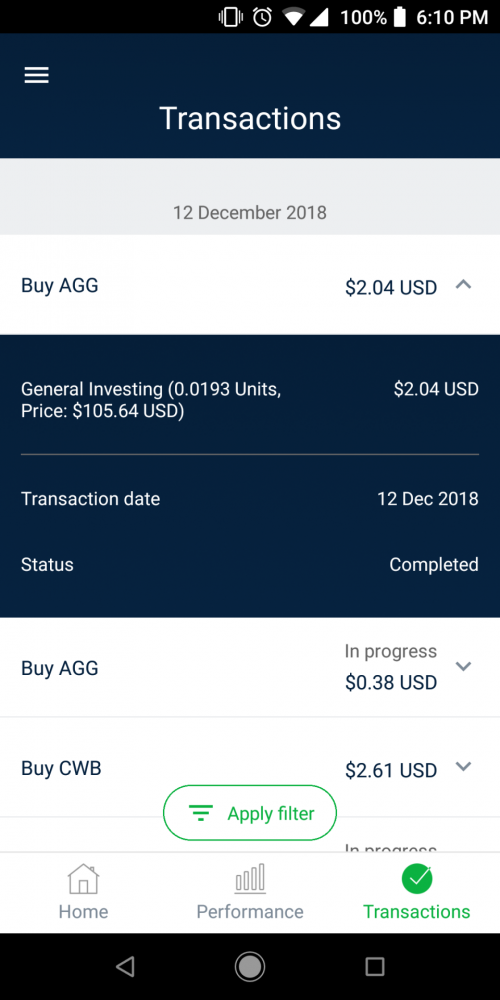

QUOTE(MNet @ Dec 12 2018, 04:47 PM) Since its Fractional shares, can we see how much we got in term of unit for each of the ETF that we buy using USD 10?  |

|

|

|

|

|

ViktorJ

|

Dec 19 2018, 06:22 PM Dec 19 2018, 06:22 PM

|

|

-1% since Nov 29 @ 6.5 risk profile

Still too much exposure in US and JP equities

The 64% allocation to FI wasn't enough apparently

|

|

|

|

|

|

ViktorJ

|

Dec 19 2018, 07:34 PM Dec 19 2018, 07:34 PM

|

|

QUOTE(honsiong @ Dec 19 2018, 06:49 PM) If it goes too much into fixed income it can be more volatile. They probably couldn’t go below 6.5% loss with any portfolio unless all cash. Hmm, maybe hold more cash than 1% in these sort of market conditions? Too bad it won't use inverse ETFs, too volatile as well I suppose. But I dunno, hold more gold? More muni bonds? At least go up to 85% on FI or something? |

|

|

|

|

|

ViktorJ

|

Dec 22 2018, 01:56 PM Dec 22 2018, 01:56 PM

|

|

-1.9% @ 6.5 now

|

|

|

|

|

|

ViktorJ

|

Dec 23 2018, 01:08 AM Dec 23 2018, 01:08 AM

|

|

QUOTE(honsiong @ Dec 23 2018, 01:03 AM) LOL my 6.5 portfoio -4.4% ady. Sekali broke through max 6.5% p.a. loss then funny liao. Excluding FX? aiyoyo |

|

|

|

|

|

ViktorJ

|

Dec 25 2018, 05:54 PM Dec 25 2018, 05:54 PM

|

|

QUOTE(Ancient-XinG- @ Dec 25 2018, 05:38 PM) not to even windows dress can save any ass There will have to be a tiny little bit of it to correct the weightage among the funds, but yeah won't be too surprised that all hell break loose again near CNY. |

|

|

|

|

|

ViktorJ

|

Dec 25 2018, 06:22 PM Dec 25 2018, 06:22 PM

|

|

QUOTE(Ancient-XinG- @ Dec 25 2018, 06:05 PM) I don't think Jan can be a green month.... Yeah, it won't. I meant that there will window dressing for the next few days to balance for the year end, and that's it. No more liao after that. |

|

|

|

|

|

ViktorJ

|

Dec 28 2018, 10:38 AM Dec 28 2018, 10:38 AM

|

|

QUOTE(honsiong @ Dec 28 2018, 10:27 AM) Have to admit, that whatsapp button is annoying af. |

|

|

|

|

|

ViktorJ

|

Jan 1 2019, 06:51 PM Jan 1 2019, 06:51 PM

|

|

It is quite difficult to time the market using SA, isn't it?

So lets say that I am anticipating a market surge today, switching from 6% to 36%, chances are SA is buying the ETFs at the price that is the day after, right? and vice versa etc.

Yeah I know, I am in it for the long haul too, but I am just curious.

|

|

|

|

|

|

ViktorJ

|

Jan 1 2019, 08:46 PM Jan 1 2019, 08:46 PM

|

|

QUOTE(Krv23490 @ Jan 1 2019, 08:43 PM) Indeed, so you have to time the market few days in advance too. I wish it was immediately on the night they receive our deposit also Sad I don't mind that they make the actual transaction later but I was hoping that the price would be based on when we make the transaction, or closing price at least. |

|

|

|

|

|

ViktorJ

|

Jan 2 2019, 02:49 PM Jan 2 2019, 02:49 PM

|

|

QUOTE(cheefai7 @ Jan 2 2019, 02:27 PM) Why time the market if you believed in Stash Away or ETF investment as your choice? JL Collins says: "Time in the market is better than time the market", "Best day to invest was yesterday, second best day is today" Happy New Year QUOTE(honsiong @ Jan 2 2019, 02:36 PM) Timing the market is not good, but it's fun to do I guess. The best "timing the market" thing we do with StashAway is just DCA on every Monday. haha yes, you are right. I am indeed in for the long haul. As you said, it is fun to do. I don't always have the time to look at the market, but when I do, old habits die hard (was a sales trader). |

|

|

|

|

|

ViktorJ

|

Jan 6 2019, 12:26 AM Jan 6 2019, 12:26 AM

|

|

QUOTE(SwarmTroll @ Jan 6 2019, 12:01 AM) The bond portion that Stashaway invests in is subject to US tax correct? iinm not just the bonds, but any dividends from all categories are subject to it. |

|

|

|

|

|

ViktorJ

|

Jan 7 2019, 07:49 PM Jan 7 2019, 07:49 PM

|

|

QUOTE(B500 @ Jan 7 2019, 07:45 PM) Just saw a transaction "Currency Conversion", all seemed normal, until I noticed that this one from Usd to RM.. And for this case, they converted a small amount from usd to RM and I saw my RM balance deducted by that same amount. Anyone faced this before? hmm interesting, my 6.5% doesn't have that transaction. Anyone else with a higher risk profile has this? |

|

|

|

|

|

ViktorJ

|

Jan 7 2019, 08:05 PM Jan 7 2019, 08:05 PM

|

|

QUOTE(honsiong @ Jan 7 2019, 07:58 PM) In SG stashaway, they target 1% in SGD, and target 0% in USD. Then every month, they deduct SGD for management fee. They could be doing same thing in ur account, but I noticed they macam didn’t keep a separate MYR asset, so it may be a design flaw they need to account for. A lot of us are using referral code, so we won’t be seeing management fee for 6 months. I think you are right. I am in my free-management-fee period too, is why I didn't see that transaction too, nor any MYR cash asset. |

|

|

|

|

|

ViktorJ

|

Jan 8 2019, 01:09 PM Jan 8 2019, 01:09 PM

|

|

QUOTE(Ancient-XinG- @ Jan 8 2019, 01:05 PM) bosses sekalian. can share the assets allocation for 36.0? I just create a 2nd profile with nothing inside, then just shift the risk around to see the asset allocation. |

|

|

|

|

|

ViktorJ

|

Jan 8 2019, 01:31 PM Jan 8 2019, 01:31 PM

|

|

QUOTE(Ancient-XinG- @ Jan 8 2019, 01:11 PM) me old liao. cr8 profile very eat my energy. No no, not new account. I mean you can just add a new empty portfolio. Just 1 click away |

|

|

|

|

|

ViktorJ

|

Jan 8 2019, 01:49 PM Jan 8 2019, 01:49 PM

|

|

QUOTE(Ancient-XinG- @ Jan 8 2019, 01:33 PM) eh, woops, I thought only SG was having the restriction for higher risk profiles. my bad! |

|

|

|

|

|

ViktorJ

|

Jan 10 2019, 09:34 PM Jan 10 2019, 09:34 PM

|

|

QUOTE(Ancient-XinG- @ Jan 10 2019, 08:54 PM) no. only the re optimize is on. I check the price tho. it's actually losing. what on earth AGG that frequent. Mine sold a lot of TLH and then bought it back the next day. I wonder if we are affected by some sort of minimum order thing. |

|

|

|

|

|

ViktorJ

|

Jan 19 2019, 10:44 AM Jan 19 2019, 10:44 AM

|

|

QUOTE(nickcct @ Jan 19 2019, 10:08 AM) If not mistaken there is no fee charges for deposit and withdrawal, except for the currency conversion, which is not charge by SA. I bet they get a tiny spread from the conversion |

|

|

|

|

Dec 11 2018, 10:49 PM

Dec 11 2018, 10:49 PM

Quote

Quote

0.0239sec

0.0239sec

0.81

0.81

7 queries

7 queries

GZIP Disabled

GZIP Disabled