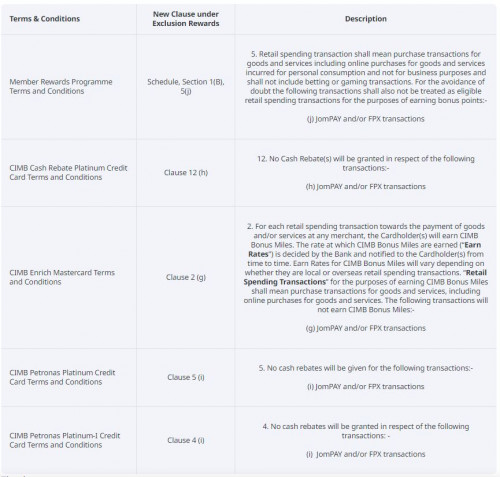

Jompay and FPX are quite similar, both provided by Paynet (formerly known as MEPS), a service provider set up by Bank Negara and commercial banks.

Jompay - initialed at bank website/App

FPX - initialed at merchant's website/App

https://www.paynet.my/personal-fpx.htmlhttps://www.paynet.my/fpx/FPX-CCA-Merchant.pdfEg at Shopee,

If you want to use a

credit card or debit card to pay, provide your card number, expiry date and CVV, the transaction will be settled at Visa/Mastercard network.

You can choose FPX to pay as well, no need your card details, it will be directed to bank's website, you choose Savings account or

credit card account (not all merchants) to pay, settled immediately at Paynet, not related to Visa/Mastercard network.

Notes: (1) Credit card =/= credit card account (a bank account), (2) There is no Debit card account, Debit card is not a bank account, you can't use a Debit card for Jompay or FPX, You must use the bank account which the debit card is linked to.

Thanks for the explanation! So in layman terms, if I have to enter my credit card number and CVC, that means those transactions are still qualified for CIMB cash rebate or points.

Oct 10 2019, 11:42 AM

Oct 10 2019, 11:42 AM

Quote

Quote

0.1393sec

0.1393sec

0.35

0.35

7 queries

7 queries

GZIP Disabled

GZIP Disabled