Outline ·

[ Standard ] ·

Linear+

Credit Cards CIMB Bank Credit Cards V7, Cash Rebate Platinum, up to 5%

|

kclamtarc

|

Sep 22 2018, 11:25 AM Sep 22 2018, 11:25 AM

|

|

QUOTE(David83 @ Sep 22 2018, 11:23 AM) CIMB Petronas Mastercard is only better for spending at Petronas. The rest is the same as Cash Rebate Platinum (0.2% for others) I see. I only want cash back for petrol and groceries. so Cash Rebate Platinum is still a better one for me i guess. |

|

|

|

|

|

kclamtarc

|

Sep 22 2018, 01:19 PM Sep 22 2018, 01:19 PM

|

|

QUOTE(David83 @ Sep 22 2018, 11:26 AM) First question to ask your ownself is are you a Petronas pumper? If yes, then CIMB Petronas Mastercard is offering 1% more. If no, then Cash Rebate Platinum is better as it covers more category. yes, that's what i am thinking too. i think i will just stick to Platinum because even though I pump Petronas, my Viva does not need to be fuelled too regularly. at the same time i buy groceries more often then i pump hehehe. thanks bro ! |

|

|

|

|

|

kclamtarc

|

Sep 23 2018, 11:44 AM Sep 23 2018, 11:44 AM

|

|

QUOTE(LostAndFound @ Sep 23 2018, 06:09 AM) If wanna help better pass the card to a CIMB branch. Unlikely the person check lowyat to find his missing card. your username makes you the best person to reply this post  |

|

|

|

|

|

kclamtarc

|

Nov 6 2018, 07:52 PM Nov 6 2018, 07:52 PM

|

|

cimb cash rebate CC will let me have 0.2% cash rebate on taobao

but if pay using online banking, i can get 1.5% service charge off

so cimb credit card is losing out

|

|

|

|

|

|

kclamtarc

|

Nov 24 2018, 09:42 PM Nov 24 2018, 09:42 PM

|

|

guys, do you know if cancel credit card, how long will it take effect? just call to customer service and no need go to bank counter is it?

|

|

|

|

|

|

kclamtarc

|

Nov 24 2018, 10:51 PM Nov 24 2018, 10:51 PM

|

|

QUOTE(fruitie @ Nov 24 2018, 09:55 PM) Should be immediately. Mine disappeared from my CIMB Click on the next day if I can recall. Yes, call CS will do, no need to walk-in to bank. oh, okay. much appreciated.  |

|

|

|

|

|

kclamtarc

|

Nov 25 2018, 05:32 PM Nov 25 2018, 05:32 PM

|

|

QUOTE(DarReNz @ Nov 25 2018, 12:57 PM) oh you still thinking of cancelling your only cc ? haha. still undecided. i am just curious to know so i asked. |

|

|

|

|

|

kclamtarc

|

Nov 12 2019, 05:52 PM Nov 12 2019, 05:52 PM

|

|

can we request to reduce our credit limit?

|

|

|

|

|

|

kclamtarc

|

Nov 13 2019, 10:31 AM Nov 13 2019, 10:31 AM

|

|

QUOTE(coolguy99 @ Nov 12 2019, 05:59 PM) Of course you can. Just call them. alright, thank you coolguy99  |

|

|

|

|

|

kclamtarc

|

Apr 20 2020, 07:31 PM Apr 20 2020, 07:31 PM

|

|

Can I know how to set my CIMB credit card as Pay wave enabled? Does it have any limit?

This post has been edited by kclamtarc: Apr 20 2020, 07:32 PM

|

|

|

|

|

|

kclamtarc

|

Apr 21 2020, 09:48 AM Apr 21 2020, 09:48 AM

|

|

QUOTE(kclamtarc @ Apr 20 2020, 07:31 PM) Can I know how to set my CIMB credit card as Pay wave enabled? Does it have any limit? just an update, I tried calling CIMB customer service and it went through, relief.. Pay wave function can only be de/activated by calling customer service. RM 250 limit per day. Just sharing. Sorry for my ignorance. |

|

|

|

|

|

kclamtarc

|

May 29 2020, 06:36 PM May 29 2020, 06:36 PM

|

|

QUOTE(GrumpyNooby @ May 29 2020, 06:30 PM) 12% Cash Rebate¹ on Weekend DiningDine like a true weekend warrior at your favourite restaurants and earn cash back with no minimum spend. ¹Weekend Dining refers to dining spend transacted on Saturday and Sunday with predefined merchant category codes. Weekend Dining Cash Rebate is capped at RM30 per card holder per statement cycle. Campaign period is from 1 June 2020 - 30 June 2020. For full terms and conditions, click (below) . Card info link: https://www.cimb.com.my/en/personal/day-to-...redit-card.htmlT&C link: https://www.cimb.com.my/content/dam/cimb/pe...tnc-jun2020.pdf if i remember correctly first cycle no maximum cap right? |

|

|

|

|

|

kclamtarc

|

May 29 2020, 06:47 PM May 29 2020, 06:47 PM

|

|

QUOTE(GrumpyNooby @ May 29 2020, 06:40 PM) From Page 1 said Yes:  oh thanks. I have not been able to use it for weekend dining since 18 March until now. so sayang |

|

|

|

|

|

kclamtarc

|

Jun 22 2020, 09:56 PM Jun 22 2020, 09:56 PM

|

|

QUOTE(coolguy99 @ Jun 22 2020, 09:03 PM) To me the cash back platinum is still the best considering that they have the 12% weekend cash back which I use a lot. But sadly it will end this month. hopefully they will announce sth like "we heard you out there! so our weekend dining promo will extend 1 more year! "  |

|

|

|

|

|

kclamtarc

|

Jun 27 2020, 01:18 PM Jun 27 2020, 01:18 PM

|

|

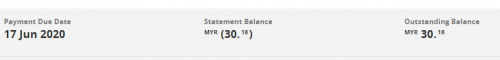

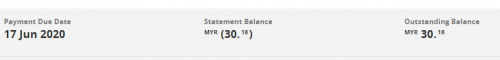

Hi friends. I always get confused between statement balance and outstanding balance. For example the screenshot above, one have bracket the other one no bracket. Does it mean I still need to pay 30.18? Or I actually have extra 30.18 in my account and no need to do anything? |

|

|

|

|

|

kclamtarc

|

Jun 29 2020, 06:07 PM Jun 29 2020, 06:07 PM

|

|

QUOTE(rickyro @ Jun 29 2020, 04:08 PM) Statement Balance = Last Month's Printed Statement Final Figure Outstanding Balance = Last Month's Printed Statement Final Figure + Whatever Spendings Incurred to Date after receiving the statement So it means that if you didn't make any payment for ur credit card since receiving the statement, you had spent RM60.36 Thanks very much for helping to explain to me!  So with the two brackets enclosing RM 30.18, can I interpret it as last month I extra paid RM 30.18; this month I swiped my credit card with the amount RM 30.18, so by right I should pay bank RM 30.18 for swiping my card, but since I already extra paid RM 30.18 last month, so now I do not need to do anything because the two RM 30.18 will counter themselves? |

|

|

|

|

|

kclamtarc

|

Jun 29 2020, 08:42 PM Jun 29 2020, 08:42 PM

|

|

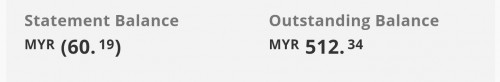

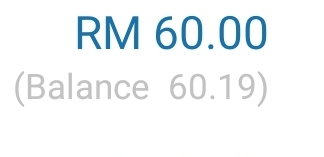

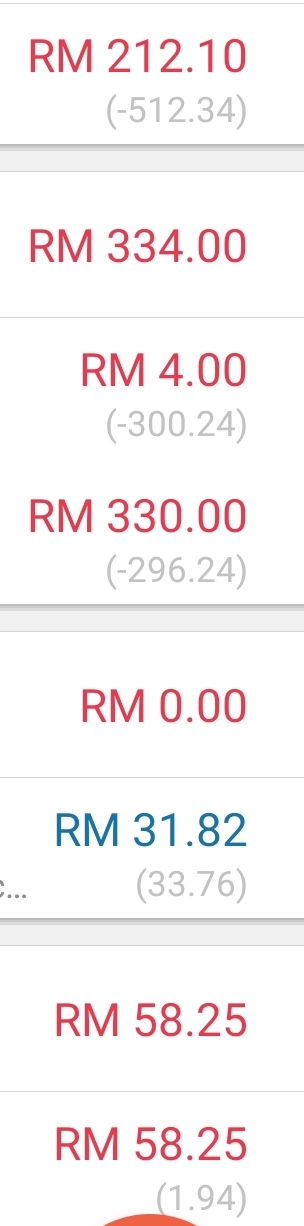

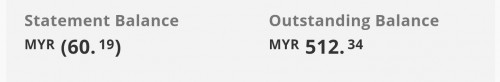

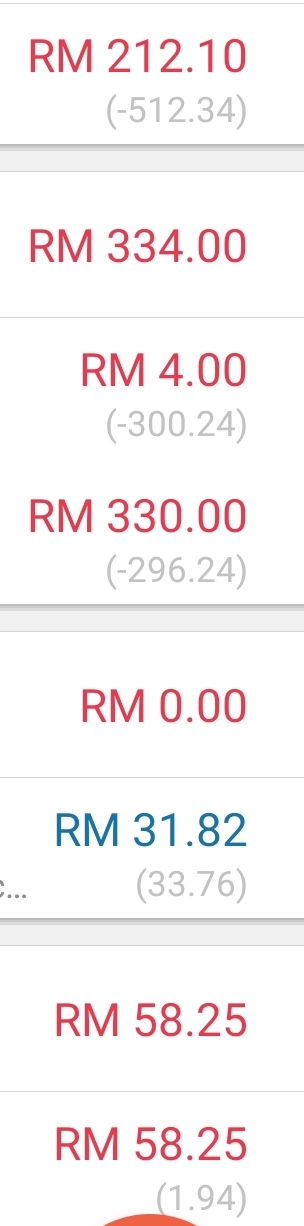

QUOTE(rickyro @ Jun 29 2020, 06:39 PM)  Here is my one though, and i got track my spendings on my credit card, it means, Outstanding Balance = Last Month's Printed Statement Final Figure + Whatever Spendings Incurred to Date after receiving the statement Say, if i pay rm300 today before my cc cutoff date, this outstanding balance will drop to rm212.34... But you are not saying that you had spent rm60.36 to date from your statement date 🤔 🤔 So, is it correct to say the actual amount you should pay to credit card = 512.34-60.19 = 452.15? |

|

|

|

|

|

kclamtarc

|

Jun 30 2020, 02:35 PM Jun 30 2020, 02:35 PM

|

|

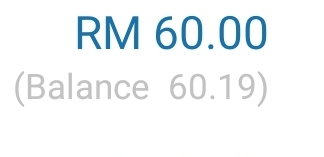

QUOTE(rickyro @ Jun 29 2020, 09:08 PM) Nope.. I owe my card 512.34 to-date Means i spent 512.34 + 60.19... And i gotta pay 512.34  Last transaction before statement issuance, i transferred rm60  Spendings + cashback, this is how i arrived to 512.34.. Note that top number is latest 512.34 is all the confirmed transaction yeah, for those unconfirmed transaction, it will further add/deduct on this 512.34 I think I should ask this question: does the bracket carry any meaning? I mean, is 60.19 = (60.19)? I learnt previously that figures in bracket means negative, but I got confused now when I see your screenshot that shows negative inside bracket eg (-512.34) LOL |

|

|

|

|

|

kclamtarc

|

Jun 30 2020, 05:40 PM Jun 30 2020, 05:40 PM

|

|

QUOTE(rickyro @ Jun 30 2020, 04:44 PM) PS: i got this breakdown from my spending tracker app.. So yes, 60.19 = (60.19)as per the spending tracker app display Red means what I spent Blue means cashback and/or payment Grey means nett outstanding balance.. alright, thank you so much for your patience in explaing to me me yah  |

|

|

|

|

|

kclamtarc

|

Sep 20 2020, 03:20 PM Sep 20 2020, 03:20 PM

|

|

i think depends on what you want.

for me, I think cash rebate card is better because I mainly use for petrol and buying groceries.

if you buy online a lot, then you go for cc that rewards you for online purchase.

|

|

|

|

|

Sep 22 2018, 11:25 AM

Sep 22 2018, 11:25 AM

Quote

Quote

0.0256sec

0.0256sec

0.60

0.60

7 queries

7 queries

GZIP Disabled

GZIP Disabled